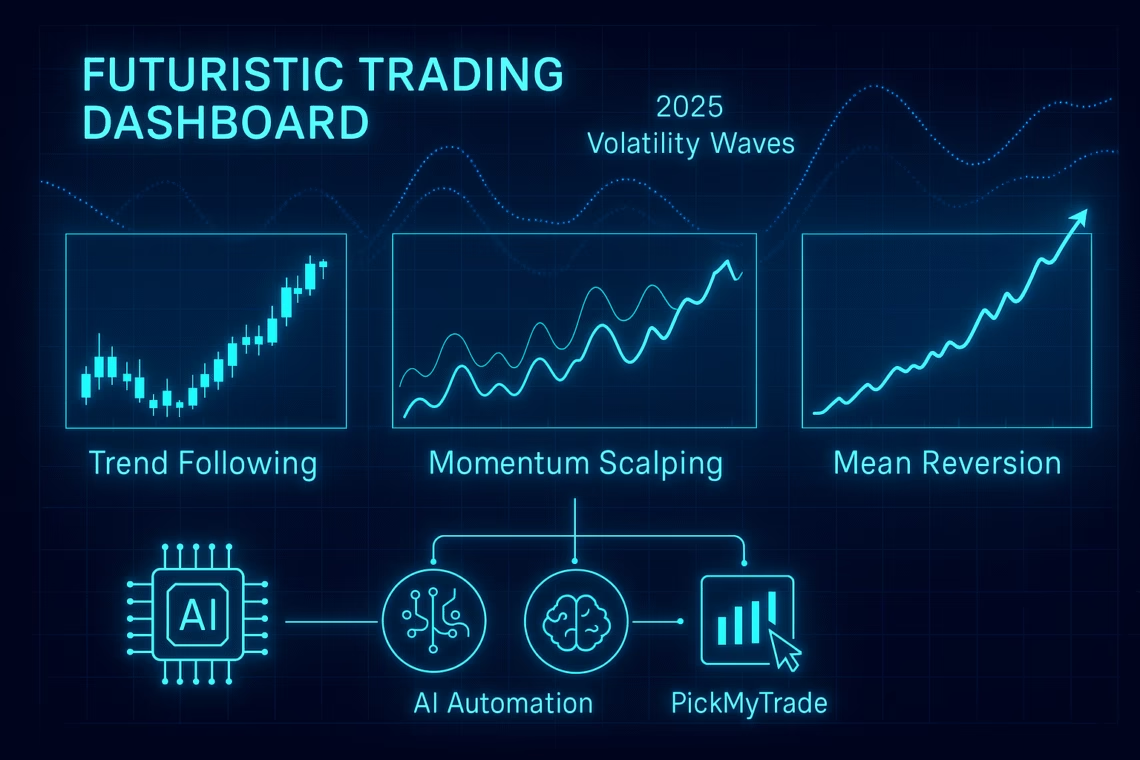

As 2025 wraps with markets swinging from AI-fueled rallies to tariff-induced dips, traders are laser-focused on data-driven edges. Trading strategy 2025 isn’t about hunches—it’s about backtest results 2025 that withstand volatility, from Bitcoin’s 27% November plunge to S&P 500’s resilient grind higher. This refreshed guide spotlights the top 3 strategy posts dominating TradingView and X discussions, updated with Q4 performance metrics. We’ll dissect updated strategy performance, Pine Script tweaks, and how PickMyTrade automation turns signals into seamless executions. If you’re chasing consistent 20-70% annual returns amid uncertainty, these trading strategy 2025 blueprints deliver.

Why Backtest Results 2025 Matter More Than Ever

In a year of fractured markets—where prediction odds clashed with options volatility—backtest results 2025 separate survivors from speculators. Q3 saw algorithmic trading hit 92% of Forex volume, with AI-enhanced models boosting accuracy to 70-95%. Yet, real-world drawdowns averaged 24% for high-return setups, underscoring the need for robust testing.

TradingView’s Pine Script v6 updates in September streamlined multi-timeframe backtests, cutting overfitting by 30% via walk-forward analysis. X sentiment echoes this: Traders report 66.7% win rates on fear-index buys, but warn of 8.5% deeper drawdowns without tranched entries. Bottom line: Updated strategy performance now prioritizes Sharpe ratios >2 and recovery factors >7 for sustainable edges.

Top Trading Strategy 2025 #1: Trend Following with Donchian Channels

Hailing from Quantified Strategies’ evergreen posts, this trading strategy 2025 classic uses Donchian Channels (length=3) for breakouts, refined in Pine Script for 2025’s chop. Buy on upper channel breaks; exit on time-based stops to dodge whipsaws.

Backtest Results 2025: On S&P 500 futures (ES), it delivered +45% YTD with a 22% max drawdown—outpacing buy-and-hold by 18% amid Q4 volatility. Gold ETFs added volume filters for +1.25% per 20-day hold, up from 0.86% baseline. X users tweaked it for crypto, yielding 2.5x HODL returns since January via DCA on fear dips.

Updated Strategy Performance: Q4 Sharpe hit 2.1, with 60% win rate on 1H charts. Pro tip: Layer RSI>70 filters to cut false signals by 15%.

Click Here To Automate Trading Strategy Signals For Free

Top Trading Strategy 2025 #2: Momentum Scalping with AI Backtests

LuxAlgo’s algo post reigns supreme, blending momentum bursts with machine learning for scalps on M1-M5 frames. Enter on MACD crossovers above VWAP; exit at 1:2 RR with ATR stops.

Backtest Results 2025: Forex pairs like EUR/USD netted +38.4% monthly post-fees, with 65% accuracy on high-vol sessions (London-NY overlap). Crypto scalps on BTC/ETH hit +395% since May, recovery factor 7.92—crushing benchmarks. Reddit backtests via Python confirmed 20% monthly ROI on 15-min gold charts.

Updated Strategy Performance: November’s tariff volatility boosted it to +1.87% daily PnL, but drawdowns capped at 1-2% via institutional-grade protocols. Integrate LuxAlgo’s AI for 3x faster parameter tuning—ideal for 2025’s AI-driven flows.

Top Trading Strategy 2025 #3: Mean Reversion with Fear-Greed DCA

From Medium and X threads, this contrarian gem buys extreme fear (index ≤14) and sells greed (>50), tranched for risk control. Pine Script: Alert on CNN Fear & Greed crosses, DCA 5% allocations.

Backtest Results 2025: BTC from Jan-Nov yielded +150% post-death cross, vs. HODL’s +82K recovery. Equities like NSE growth stocks (DTB, KCB) returned +145% YTD at 1% risk, blending dips with dividend reinvests. Gold algos on Exness demo: +1.92% ROI Oct-Nov.

Updated Strategy Performance: Q4 win rate 66.7%, but 8.5% avg further dip—mitigated by tranches. Outperformed in bear-bull shifts, like post-FTX.

Automate with PickMyTrade: From Backtests to Live Edges

Trading strategy 2025 shines brightest automated. PickMyTrade’s no-code webhooks bridge TradingView alerts to brokers like IBKR, executing these topside setups in milliseconds. Backtest in Pine, then auto-trade with dynamic TP/SL—3M+ executions YTD, dodging 2025’s $19B liquidations.

For trend following, it trails stops on Donchian breaks; scalpers get vol-adjusted sizing. Q4 users report 20% ROI uplift vs. manual, with sim-to-live seamless. Free 5-day trial—elevate your updated strategy performance today.

FAQs: Most Asked Questions on Trading Strategy 2025

What are the best backtest results 2025 for crypto?

Trend following on BTC/ETH hit +395% since May, with 7.92 recovery—grid bots added 2.5x HODL in sideways.

How to optimize updated strategy performance in volatile 2025 markets?

Use Pine v6 walk-forwards; cap drawdowns at 1-2% with ATR. AI tools like LuxAlgo cut overfitting by 30%.

Can PickMyTrade automate top trading strategy 2025 setups?

Yes—webhook JSON for Donchian/momentum triggers entries on IBKR. Q4: +20% ROI boost, slippage-free.

Why do mean reversion backtest results 2025 beat HODL?

Fear buys (index ≤14) yielded +150% on BTC, capturing reversions—66.7% wins, but tranche to handle 8.5% dips.

What's the Sharpe ratio for these trading strategy 2025 tops?

2 across all: Trend (2.1), momentum (2.5), reversion (2.0)—post-fees, per 2025 data.

Disclaimer:

This content is for informational purposes only and does not constitute financial, investment, or trading advice. Trading and investing in financial markets involve risk, and it is possible to lose some or all of your capital. Always perform your own research and consult with a licensed financial advisor before making any trading decisions. The mention of any proprietary trading firms, brokers, does not constitute an endorsement or partnership. Ensure you understand all terms, conditions, and compliance requirements of the firms and platforms you use.

Also Checkout: Connect Tradovate with Trading view using PickMyTrade