The trading landscape has shifted significantly since Charles Schwab acquired TD Ameritrade in 2020, with full integration completed by 2024. Many retail and algorithmic traders who relied on TD Ameritrade’s robust developer tools now face a common question: does TD Ameritrade have an API today? The short answer is no—the original TD Ameritrade API was permanently discontinued. However, Schwab launched its own Trader API in 2024, offering similar functionality for automated trading. This guide explores the current status, key changes, and practical alternatives to keep your strategies running smoothly.

Understanding the TD Ameritrade API Discontinuation

TD Ameritrade once provided one of the most developer-friendly APIs in retail brokerage, enabling real-time market data, order execution, account management, and streaming quotes. Traders built sophisticated bots and integrations around it.

Following the Schwab acquisition, accounts migrated to the Schwab platform, and the TD Ameritrade API endpoints were shut down after market close on May 10, 2024. As of December 2025, no legacy TD Ameritrade API access remains available.

Schwab has ported much of the original functionality into its Schwab Trader API, which supports equities, options, account inquiries, and order placement. Thinkorswim—the advanced charting platform inherited from TD Ameritrade—remains fully operational under Schwab but lacks direct public API access for automation.

Key takeaway: If you’re searching for “does TD Ameritrade have an API,” recognize that the service no longer exists independently. Migrate to Schwab’s Trader API or third-party automation tools for seamless transitions.

Does TD Ameritrade Have an API? Current Alternatives for Automated Trading

While the original API is gone, traders have strong options. Schwab’s Trader API is now live and accessible to individual accounts via the developer portal (developer.schwab.com). It requires registering an app and linking a brokerage account.

For those preferring no-code solutions—especially TradingView users—platforms like PickMyTrade bridge alerts to supported brokers without direct API coding.

Popular broker alternatives include:

- Interactive Brokers (IBKR): Comprehensive API with global market access, complex orders, and strong developer support.

- Tradovate/Rithmic: Ideal for futures traders, with low-latency execution.

- TradeLocker: Commission-free stocks and options, modern REST API.

These options often pair well with automation tools to replicate (or improve) the old TD Ameritrade experience.

How to Automate Trades with PickMyTrade After the TD Ameritrade API Shutdown

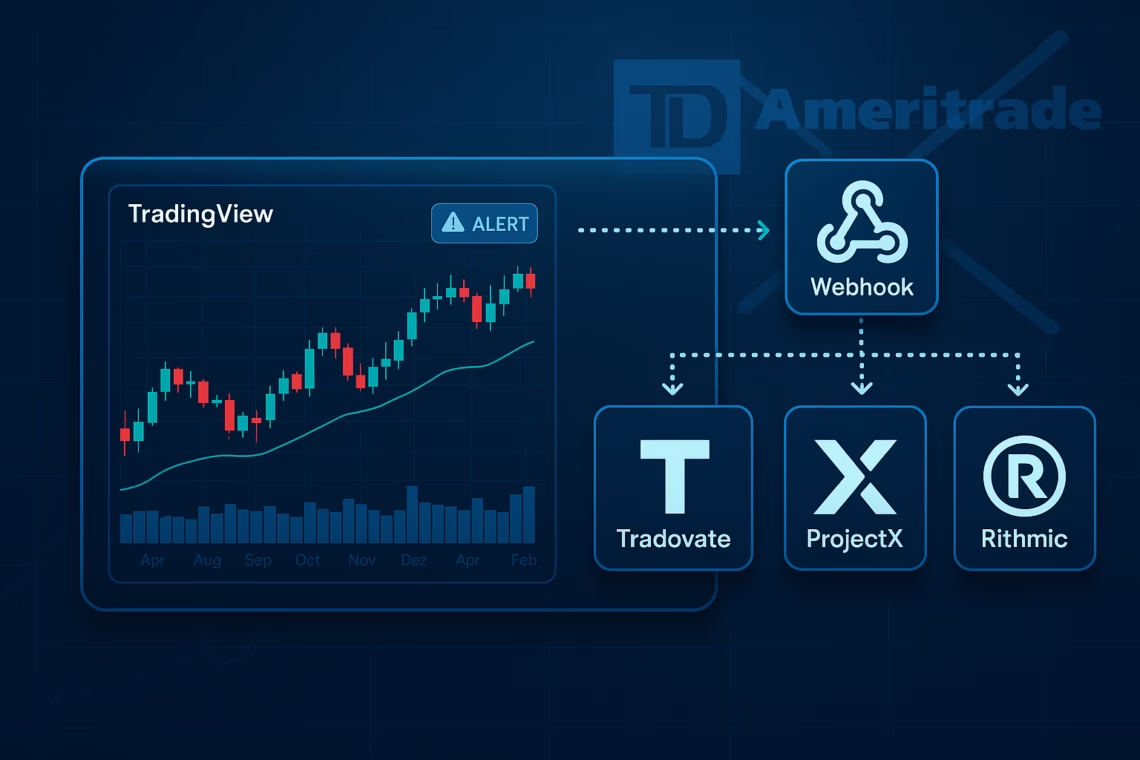

Many traders miss the ease of sending TradingView alerts directly to execution. PickMyTrade fills this gap by routing webhook alerts to brokers like Interactive Brokers, Tradovate (via Rithmic), and others.

This approach requires no custom coding—just strategy setup in TradingView and alert configuration.

Step-by-Step Guide to PickMyTrade Automation

PickMyTrade acts as a secure middleware: TradingView sends JSON alerts via webhook, and PickMyTrade translates them into live orders on your connected broker.

You’ll need a PickMyTrade account, a supported broker, and TradingView Pro (or higher) for reliable alerts.

Click Here To Start Futures Trading Automation For Free

Benefits vs. Limitations of Post-TD Ameritrade API Options

Schwab’s Trader API and no-code tools like PickMyTrade offer powerful paths forward.

Benefits:

- Faster execution and reduced emotional trading through automation.

- Backtesting and live deployment from the same platform (e.g., TradingView).

- Multi-broker support for diversification.

- Paper trading modes for risk-free testing.

- Cost savings on commissions with supported brokers.

Limitations:

- Schwab Trader API requires coding and OAuth management.

- No direct thinkorswim scripting for external bots.

- Webhook delays (typically <1 second, but not zero-latency).

- Broker-specific restrictions on order types or frequency.

Real-World Use Cases: Where PickMyTrade Automation Shines

Automation excels in disciplined, rules-based strategies.

Common Setup Pitfalls

- Incorrect webhook URL: Double-check the exact PickMyTrade endpoint for your strategy—typos cause instant failures.

- Mismatched JSON payload: Missing fields like “action” or “symbol” lead to rejected alerts; always test with paper accounts first.

- Broker connection issues: Forgetting to enable API access in IBKR or Rithmic credentials expiring mid-session.

Advanced Tips

- Use dynamic quantities: Incorporate risk-based sizing in TradingView Pine Script (e.g., {{strategy.order.contracts}}).

- Add redundancy: Set up email/SMS fallback alerts in TradingView for webhook failures.

- Monitor logs: PickMyTrade dashboards show alert history—review daily for patterns in rejections.

Ready to automate your TradingView strategies without coding? Sign up for PickMyTrade today and start with our free trial. Connect your broker in minutes, test in paper mode, and go live with confidence—experience reliable execution that keeps pace with your ideas.

Most-Asked FAQs

Does TD Ameritrade still have an API in 2025?

No, it was discontinued in 2024 after the Schwab merger; use Schwab’s Trader API instead.

Can I automate thinkorswim trades via API?

No direct public API for thinkorswim; use Schwab Trader API or external tools like PickMyTrade.

What's the best no-code alternative for TradingView automation?

PickMyTrade—reliable webhook routing to IBKR, Tradovate, and more.

Does PickMyTrade support futures via Tradovate/Rithmic?

Yes, full integration for low-latency futures execution.

How secure are webhooks in PickMyTrade?

Encrypted endpoints with authentication tokens; no storage of broker credentials on TradingView.

Disclaimer:

This content is for informational purposes only and does not constitute financial, investment, or trading advice. Trading and investing in financial markets involve risk, and it is possible to lose some or all of your capital. Always perform your own research and consult with a licensed financial advisor before making any trading decisions. The mention of any proprietary trading firms, brokers, does not constitute an endorsement or partnership. Ensure you understand all terms, conditions, and compliance requirements of the firms and platforms you use.

Also Checkout: Automate TradingView Indicators with Tradovate Using PickMyTrade

It’s definitely a big shift for traders who relied on TD Ameritrade’s APIBlog comment ideas. Schwab’s Trader API seems to offer a lot of the same features, but it’s disappointing that Thinkorswim doesn’t have public API access anymore. It’ll be interesting to see if they add that back in the future.