Welcome to an in-depth exploration of how to automate your trading strategies using PickMyTrade and TradingView. This guide will provide you with a comprehensive understanding of the features available on the PickMyTrade platform, how to set up alerts, and the various order types you can use to streamline your trading process.

Understanding PickMyTrade

PickMyTrade is a powerful platform designed to help traders automate their trades based on TradingView indicators and strategies. With this integration, users can leverage various trading strategies to enhance their trading efficiency. The platform allows for the generation of alerts based on specific conditions, enabling automated trading actions without the need for constant monitoring.

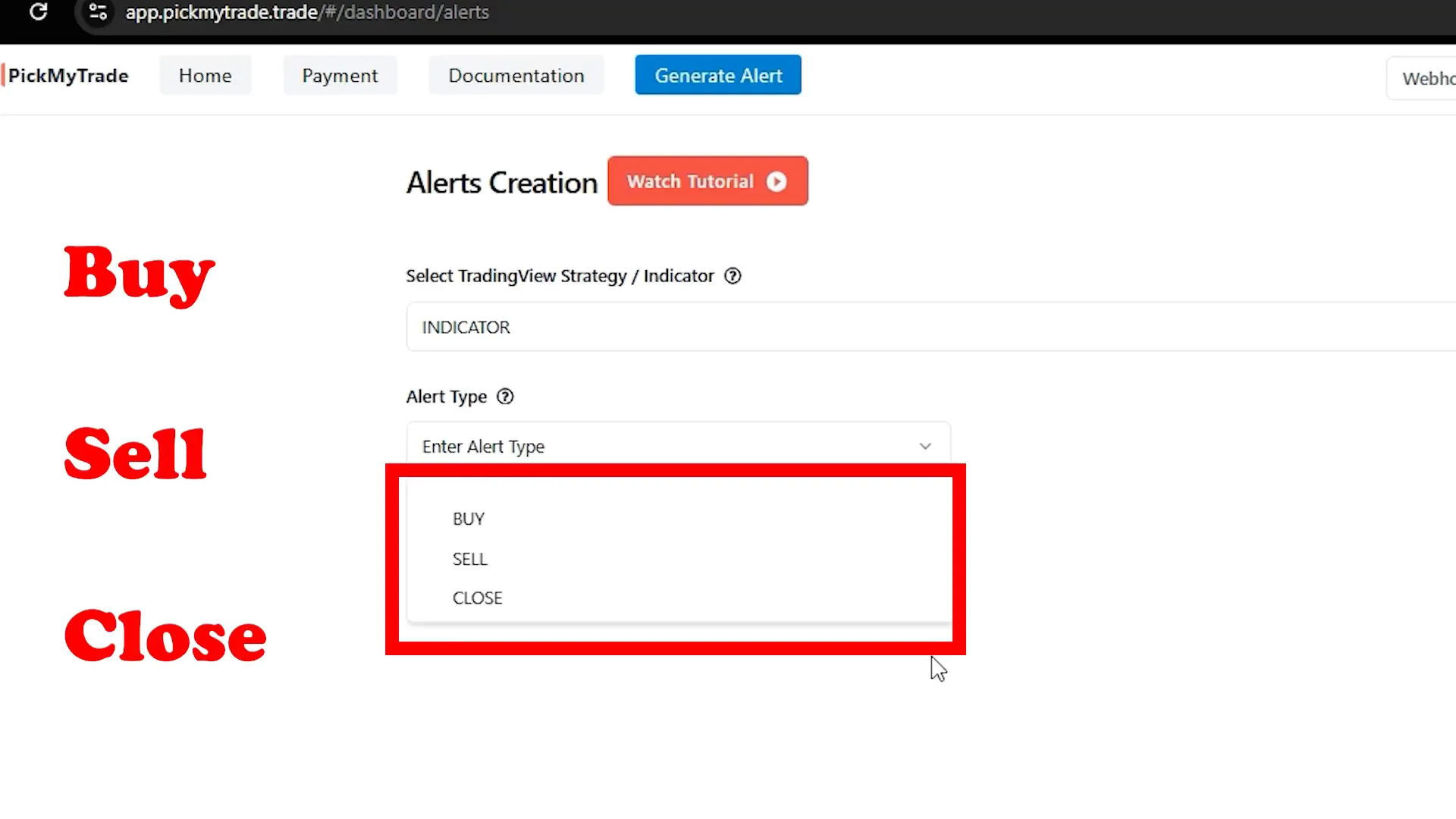

Types of Alerts

There are three main types of alerts you can set up on PickMyTrade:

- Buy Alerts: These alerts trigger a buy trade. If there are any existing sell positions or open orders, they will be closed or canceled before the new buy trade is initiated.

- Sell Alerts: Similar to buy alerts, these will initiate a sell trade while closing any existing buy positions and canceling open orders.

- Close Alerts: These alerts are specifically for closing all open positions without opening new ones.

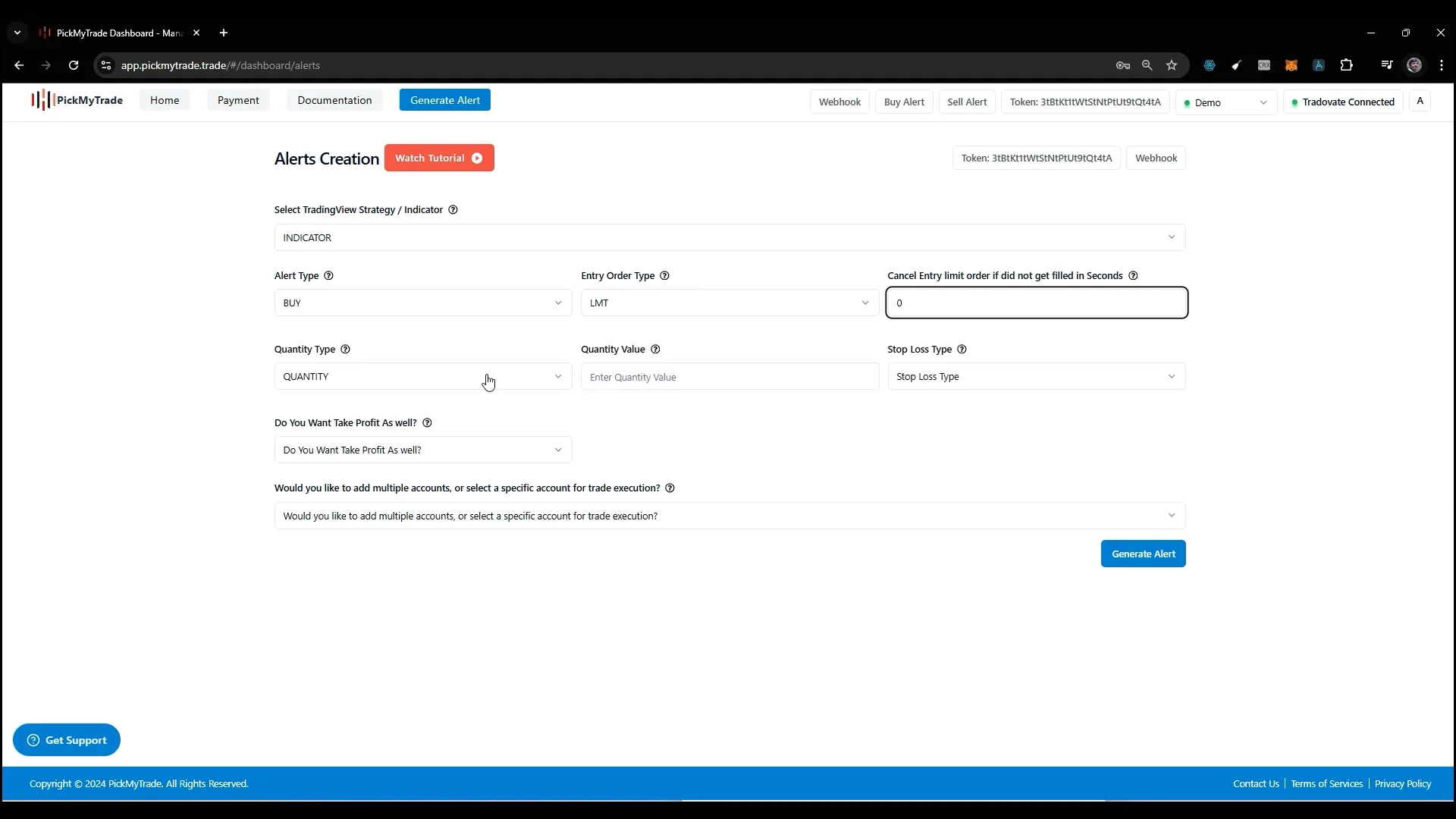

Order Types

When setting up alerts, you have the option to choose between different order types:

- Limit Orders: These orders are set at a specific price point and will only execute when the market reaches that price.

- Market Orders: These orders execute immediately at the current market price.

Additionally, there is a new feature that allows you to cancel limit orders if they do not get filled within a specified time frame. For instance, if you set a limit order to cancel after five seconds, the system will automatically cancel the order if it has not been filled in that time.

Managing Quantity and Risk

When placing trades, you can specify the quantity and risk percentage for each trade:

- Quantity: This is the absolute number of contracts you wish to trade.

- Risk Percentage: This allows you to define how much of your account you are willing to risk on a trade. For example, if your account value is $10,000 and you set a risk percentage of 1, you are risking $100 on that trade.

Stop Loss Types

Stop loss settings are crucial for managing risk in trading. PickMyTrade offers multiple stop-loss types to suit different trading strategies:

- Total Loss: Set a total loss value in USD for one contract. If the loss reaches this amount, the trade will be closed.

- Tick-Based Stop Loss: Specify a stop loss based on tick movement. The system adjusts your take profit and stop loss according to the tick size of the asset.

- Price-Based Stop Loss: Set an absolute price for your stop loss. This will be based on the entry fill price.

- Percentage-Based Stop Loss: This sets the stop loss as a percentage of the entry price.

- Trail Stop Loss: Allows for a trailing stop that adjusts as the market moves in your favor.

Generating Alerts

To generate alerts, follow these steps:

- Select the desired indicator (e.g., MACD) from TradingView.

- Create an alert based on the indicator’s signal.

- In the alert settings, paste the webhook URL provided by PickMyTrade.

- Ensure the alert is set to trigger on the appropriate conditions, such as “once per bar close.”

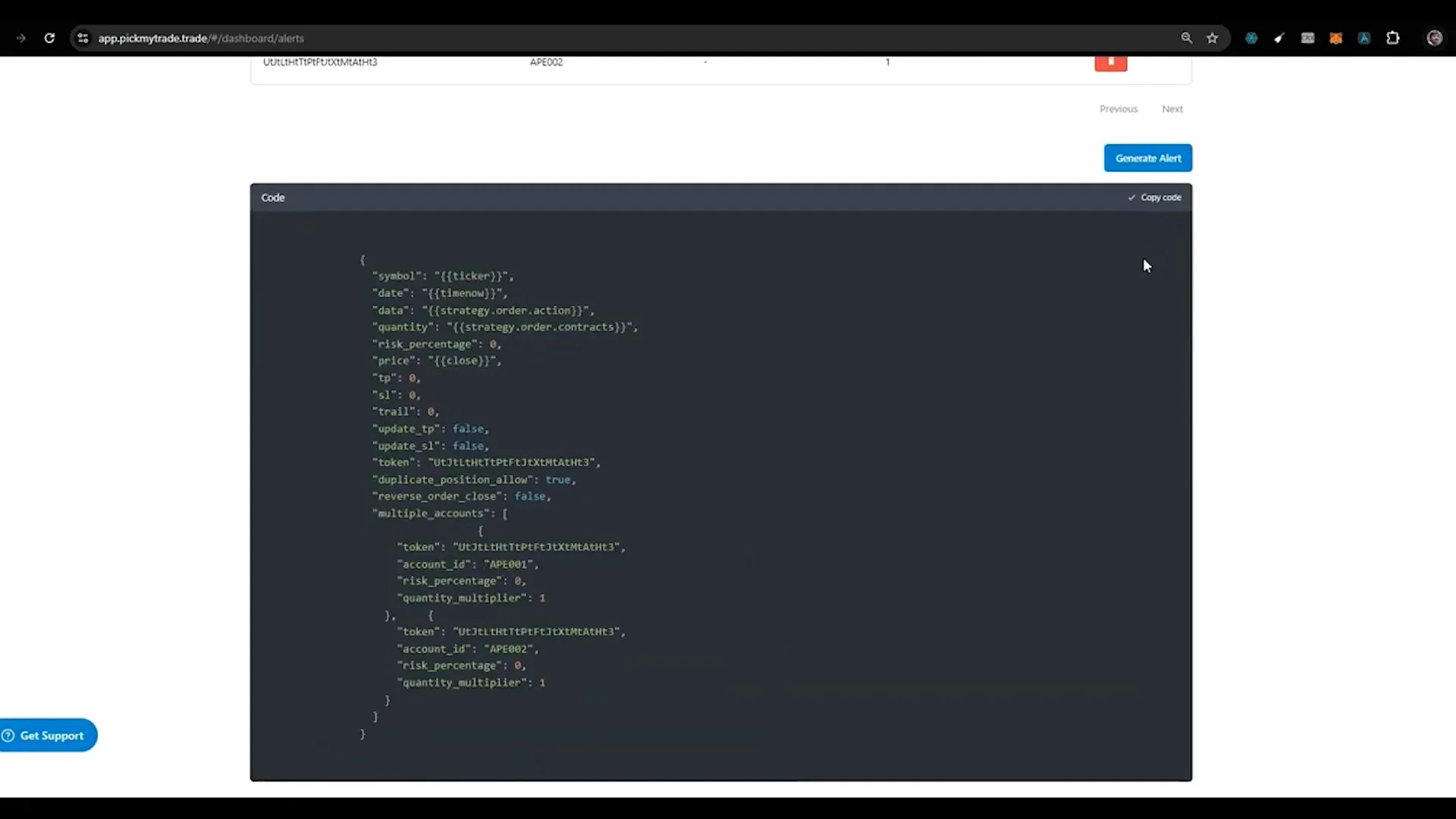

Multi-Account Management

PickMyTrade allows users to manage multiple accounts effectively. This feature is beneficial in two scenarios:

- If you want to copy trades to a specific account, you can select the account from a list of connected accounts.

- If you’re managing a friend’s account, simply input their PickMyTrade token and account name to automate their trades.

Conclusion

Automating your trading with PickMyTrade and TradingView can significantly enhance your trading efficiency and help you manage risk more effectively. By understanding the various types of alerts, order types, and risk management strategies available, you can create a robust trading system tailored to your needs. Whether you’re a seasoned trader or just starting, leveraging these tools can lead to more disciplined and profitable trading practices.

For further insights and tutorials, consider checking out additional resources, including:

- How to Place Auto Trail Order with TradingView

- Complete Video Explained from TradingView to Tradovate

- How to Create Alert Message for TradingView Strategy

- How to Create Alert Message for TradingView Indicator

To get started with automated trading, you can sign up at PickMyTrade.

PickMyTrade

PickMyTrade specializes in automating trading bots, enabling seamless strategy execution for futures from platforms like TradingView, across well-known brokers such as Tradovate.

555

555

555

555

555

555

555

555

555

555

555*if(now()=sysdate(),sleep(15),0)

5550″XOR(555*if(now()=sysdate(),sleep(15),0))XOR”Z

555-1); waitfor delay ‘0:0:15’ —

555-1; waitfor delay ‘0:0:15’ —

555qxYKNtCg’ OR 487=(SELECT 487 FROM PG_SLEEP(15))–

555-1) OR 455=(SELECT 455 FROM PG_SLEEP(15))–

555sJl6ohTZ’ OR 145=(SELECT 145 FROM PG_SLEEP(15))–

555*DBMS_PIPE.RECEIVE_MESSAGE(CHR(99)||CHR(99)||CHR(99),15)

555′”

Write more, thats all I have to say. Literally, it seems as

though you relied on the video to make your point.

You definitely know what youre talking about, why throw away your intelligence on just posting videos to your weblog when you could be giving us something enlightening

to read?

casino en ligne

Great info. Lucky me I ran across your site by chance (stumbleupon).

I’ve book-marked it for later!

casino en ligne

I have been browsing online more than three hours today, yet I never found any interesting article

like yours. It’s pretty worth enough for me.

Personally, if all website owners and bloggers made good content as

you did, the web will be much more useful than ever

before.

casino en ligne

What i don’t understood is if truth be told how you are not actually a lot more well-liked than you might be right now.

You’re very intelligent. You already know therefore considerably in relation to this matter, produced me individually imagine it from numerous numerous angles.

Its like women and men aren’t involved except it’s

one thing to do with Woman gaga! Your individual stuffs outstanding.

All the time take care of it up!

casino en ligne

This site was… how do you say it? Relevant!!

Finally I’ve found something which helped me.

Appreciate it!

casino en ligne

Very rapidly this web site will be famous among all blog visitors, due to it’s

nice articles or reviews

casino en ligne

It’s impressive that you are getting thoughts from this paragraph as well as from our discussion made at this place.

casino en ligne

Having read this I thought it was really enlightening.

I appreciate you spending some time and energy to put this content together.

I once again find myself spending a significant amount of time both

reading and leaving comments. But so what, it was still worthwhile!

casino en ligne

I visited several web pages however the audio quality for audio

songs existing at this web site is genuinely superb.

casino en ligne

My relatives every time say that I am killing my time here at net, except I know I am getting knowledge

daily by reading such pleasant content.

casino en ligne