In the high-octane world of futures prop trading, Apex vs Topstep remains a heated debate—especially for Tradovate enthusiasts seeking funded accounts without the capital grind. As 2025 unfolds, Apex Trader Funding’s flexible Apex 3.0 rules clash with TopstepX’s structured ProjectX-powered ecosystem, both leveraging Tradovate for seamless execution. This best Tradovate prop firm showdown crunches 2025 updates: Apex’s 100% payout unlocks after five requests and DCA greenlight, versus TopstepX’s mandatory platform with daily withdrawals and Tilt™ sentiment tools. With Apex’s $598M+ payouts and Topstep’s 81K+ trader successes, we’ve benchmarked costs, rules, and automation fit—plus how PickMyTrade automation trading elevates Tradovate strategies on either. Scalpers to swings: Find your best Tradovate prop firm for 2025’s volatile ES and NQ runs.

Apex vs Topstep: Quick Overview of the Best Tradovate Prop Firms in 2025

Apex Trader Funding, launched in 2021, serves 135K+ traders monthly with single-step evals up to $300K, no daily drawdowns, and full Tradovate support. It earns 4.5/5 on Trustpilot from 11K reviews and frequent 80% discounts—making it a best Tradovate prop firm for freedom and cost.

TopstepX, Topstep’s 2025 upgrade on ProjectX tech, requires its platform for new Combines. It blends TradingView charts, zero commissions, and a strong Discord community. Rated 4.3/5 on Trustpilot with $9M+ withdrawn, it boosts pass rates 86% over legacy systems. Tradovate works for older accounts, but TopstepX leads for guided growth.

Both target CME futures, yet Apex vs Topstep splits: Apex offers leniency, while TopstepX provides coaching.

2025 Rules Comparison for the Best Tradovate Prop Firm in Apex vs Topstep

2025 updates refine both—Apex 3.0 removes bracket bans and sets a 5:1 risk-reward cap. Meanwhile, TopstepX drops daily loss limits for personalized risk on its platform. No time limits apply, however, evals vary: Apex uses one step, Topstep two-phase.

| Feature | Apex Trader Funding | TopstepX |

|---|---|---|

| Eval Phases | Single-step (profit target before drawdown) | Two-phase Trading Combine (profit + consistency) |

| Drawdown | Trailing/static EOD (no daily); 30% consistency | End-of-day (personalized on TopstepX); scaled limits |

| News Trading | Allowed (no directional scalping) | Allowed; Tilt™ for sentiment |

| Tradovate Fit | Native support; multi-account copying | Legacy support; TopstepX preferred (86% pass boost) |

| Prohibited | Hedging, set-and-forget bots | Overtrading; must hit 5 winning days for payouts |

In Apex vs Topstep, Apex wins raw flexibility—DCA now OK in funded accounts—while TopstepX’s structure suits rule-followers, with 8% higher pass rates via ProjectX tools.

Apex vs Topstep: Account Sizes & Costs – Pricing the Best Tradovate Prop Firm

Apex shines in affordability: $167/month for $25K eval (80% off codes common), scaling to $597 for $300K—no activation fees. TopstepX starts at $49/month for $50K Combine, but two phases and $149 activation add up—yet zero commissions on TopstepX save big on volume.

| Account Size | Apex Cost (Eval/Mo) | TopstepX Cost (Combine/Mo) |

|---|---|---|

| $25K-$50K | $167-$187 (Full) | $49-$99 |

| $100K | $297 | $129 (w/ scaling) |

| $150K+ | $397-$597 | $165 (up to $150K) |

Max contracts: Apex 4-35; TopstepX 5-15 (micros weighted differently). For best Tradovate prop firm value, Apex edges budget scalpers; TopstepX rewards long-haul via education perks.

Click Here To Start Trading Automation On Tradovate Propfirm For Free

Payout Structures in the Best Tradovate Prop Firm Race

Payouts fuel loyalty—Apex’s on-demand after 8 days (5 profitable) hits 100% on first $25K, then 90/10, with $598M+ total (avg $15M/month). 2025: Probation for windfalls, but 1-4 day processing via ACH/crypto.

TopstepX: Daily after 5 wins in Express Funded; 100% first $10K, 90/10 after—avg $3,250/payout, $1K more than legacy. Five payouts unlock Live Funded; 81K+ successes in 2024.

Apex vs Topstep verdict: Apex for quicker big splits; TopstepX for frequent small wins—both process in hours on Tradovate.

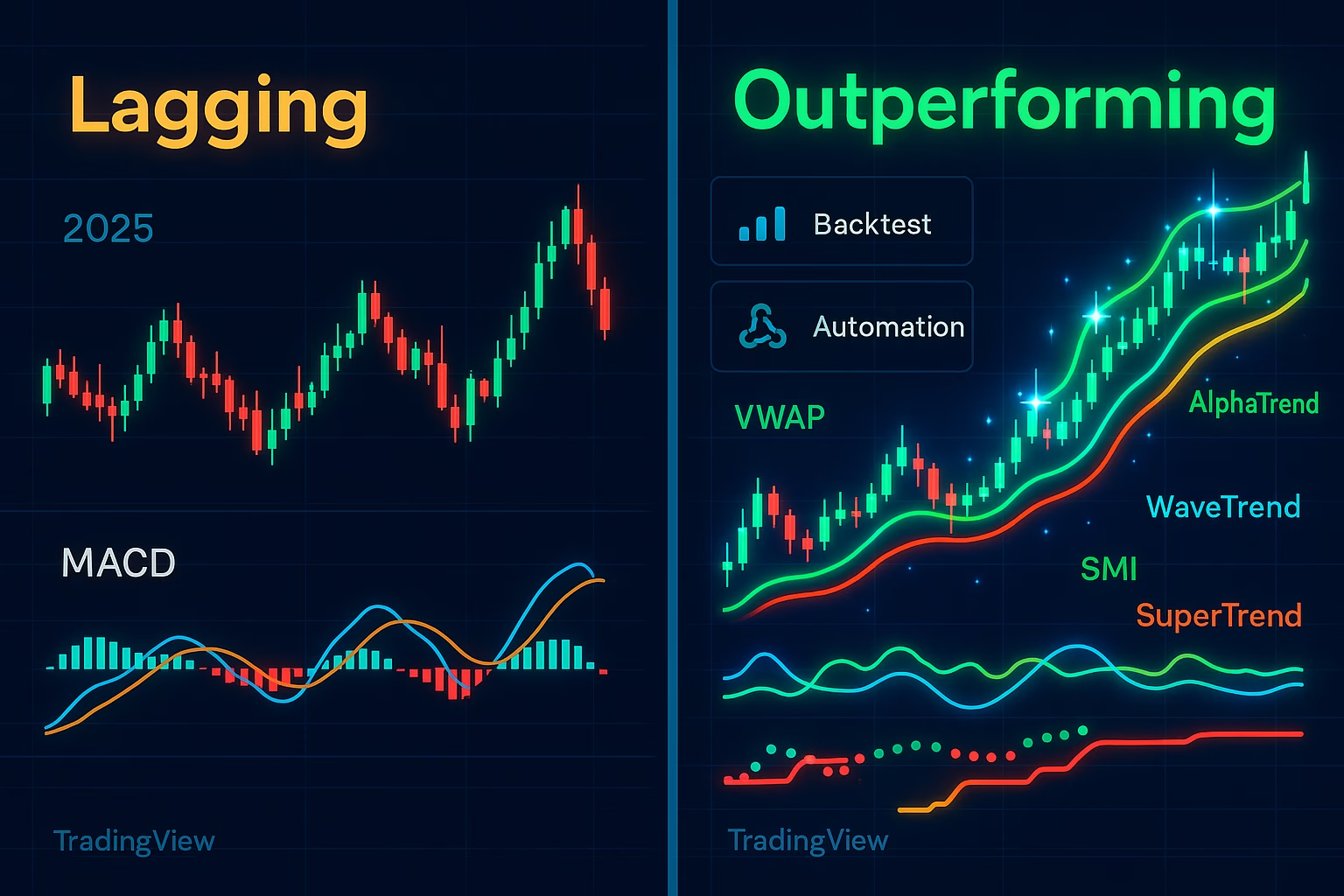

Platforms & Automation: Why Tradovate Shines in Apex vs Topstep

Tradovate’s cloud accessibility crowns it the best Tradovate prop firm backbone: Apex integrates natively for multi-account ease; TopstepX (ProjectX) mandates for newbies but supports Tradovate legacy. Both allow bots if managed—no full automation bans.

PickMyTrade Automation Trading: The Edge on Tradovate

PickMyTrade automation trading transforms Tradovate into a powerhouse: Webhook alerts from TradingView trigger instant orders, SL/TP, and copies across Apex’s 20 accounts or TopstepX’s scales. 2025: 40% faster scalps, per users—pair with Apex’s DCA for averaging or TopstepX’s Tilt™ for sentiment-driven bots. No-code setup: Link Tradovate API, map signals, and automate compliance. In Apex vs Topstep, it’s the great equalizer for hands-free edges.

Pros & Cons: Apex vs Topstep as the Best Tradovate Prop Firm

Apex

Pros: Low costs, flexible rules, high splits; Cons: Monthly fees add up, less hand-holding.

TopstepX

Pros: Structured coaching, zero commissions, community; Cons: Two-phase eval, platform lock-in.

X traders echo: Apex for “freedom,” TopstepX for “discipline”.

Verdict: Which Wins as the Best Tradovate Prop Firm in 2025?

Apex Trader Funding takes the best Tradovate prop firm crown for versatile, low-barrier scalpers—its 2025 flexibility and payout speed seal the deal amid $500M+ disbursed. TopstepX? Ideal for structured learners, with ProjectX’s 86% pass uplift and daily cashouts. Layer PickMyTrade automation trading on Tradovate for either, and you’re primed. Test evals—your style decides the winner in this Apex vs Topstep thriller.

Frequently Asked Questions (FAQs)

Which is the best Tradovate prop firm: Apex or TopstepX?

Apex edges for flexibility and costs; TopstepX for structure and pass rates—both excel on Tradovate.

What's new in Apex vs Topstep rules for 2025?

Apex: DCA allowed, 100% after five payouts; TopstepX: Personalized loss limits, mandatory platform.

How do payouts compare in Apex vs Topstep?

Apex: On-demand post-8 days, 100% first $25K; TopstepX: Daily after 5 wins, 100% first $10K—both 90/10 after.

Does PickMyTrade work with Apex vs Topstep on Tradovate?

Yes—PickMyTrade automation trading integrates seamlessly for alert-based orders on both.

Apex vs Topstep: Which for beginners?

TopstepX’s coaching and Tilt™ tools win for noobs; Apex for experienced with looser rules.

Also Checkout: Automate TradingView Indicators with Tradovate Using PickMyTrade