Apex Trader Funding is a U.S.-based proprietary futures trading firm founded in 2021. It provides traders with fully funded accounts once they complete a one-step evaluation. As of October 2025, Apex reports distributing more than $577 million to traders and holds a 4.5/5 TrustScore from over 13,000 reviews, ranking among the top prop firms globally.

Key Highlights

- Profit Split: 100% of the first $25,000 in profits, then 90% thereafter.

- Payouts: Typically processed every eight trading days.

- Platforms: Tradovate (web/mobile) and Rithmic/NinjaTrader (desktop).

- Reputation: 4.5-star average rating with strong community support.

- Funding Scale: Over $577 million distributed since 2022.

Tradovate vs. Rithmic Accounts

Apex offers two main trading environments with identical payout structures but different performance characteristics.

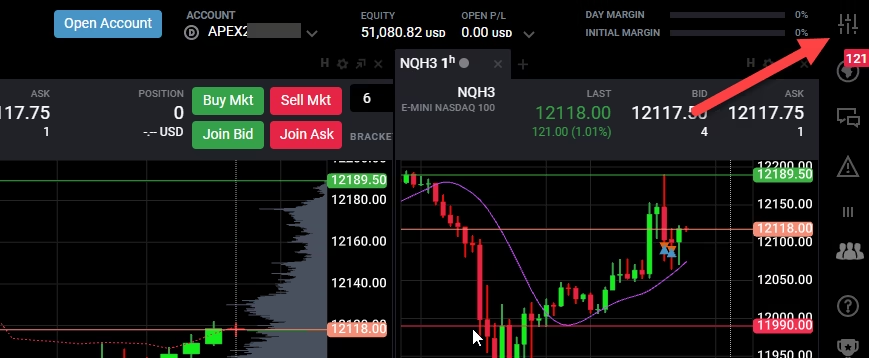

Tradovate

- 100% cloud-based platform accessible via browser, desktop app, or mobile.

- Built-in charting tools with optional TradingView integration.

- No installation required.

- Commission-free trading structure.

- Ideal for traders who value flexibility and ease of use.

Rithmic / NinjaTrader

- Desktop-based setup with ultra-low-latency execution.

- Provides Depth of Market (DOM) and detailed order flow data.

- Suitable for advanced and high-frequency traders.

- Requires software installation and a higher monthly cost.

Both account types support real-time CME data and allow full contract sizes (up to 35 contracts on a $300K account).

Pricing and Costs

Apex’s evaluation pricing is competitive, but traders should be aware of recurring platform and data fees.

| Account Size | Platform | Monthly Cost (Approx.) | Profit Target |

|---|---|---|---|

| $25K | Tradovate | $147 – $167 | $1,500 |

| $25K | Rithmic | $277 (includes NinjaTrader & data) | $1,500 |

| $100K | Tradovate | Around $297 | $6,000 |

Additional Costs

- Activation Fees:

- Tradovate: $105/month or $150–$360 one-time.

- Rithmic: $85/month or $130–$340 one-time.

- Commissions:

- E-mini S&P 500: about $3.10 (Tradovate) or $3.98 (Rithmic) round-turn.

- Micro contracts: $1.02–$1.04 round-turn.

- Market Data: Level-1 included; Level-2 data costs approximately $41/month.

While these fees are standard in the industry, they can accumulate quickly for active traders.

Platform Performance and Execution

Execution speed varies slightly between the two platforms:

- Rithmic/NinjaTrader: Offers ultra-low-latency performance suitable for precision trading and automation.

- Tradovate: WebSocket-based infrastructure provides sub-second execution. Some demo users report up to 500 ms delay, though live accounts are typically faster.

For most discretionary traders, Tradovate’s speed is sufficient, while scalpers and automated traders may prefer Rithmic with a VPS setup.

Apex supports multiple trading platforms, including TradingView, NinjaTrader 8, RTrader Pro, and Sierra Chart.

Tradovate Setup & TradingView Connection Guide

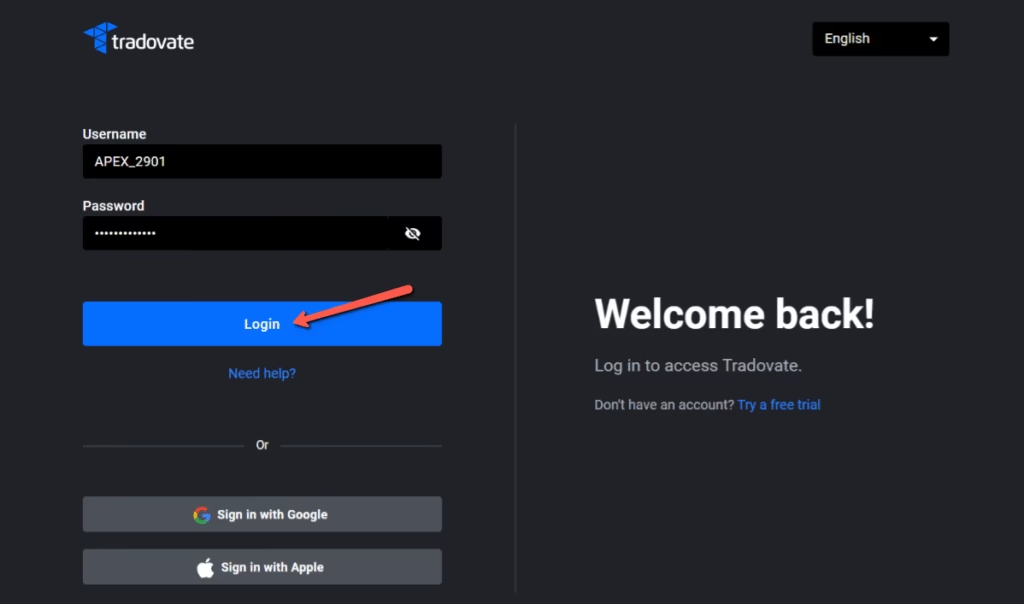

Logging Into Your First Tradovate Account

Once you’ve purchased your first Tradovate account and received your login credentials, go to the Tradovate Welcome Page using a desktop browser (not the mobile app).

Sign in with your Tradovate username and password.

Note: Account creation, resets, and funded (Performance) account setups can take longer during periods of high demand or market volatility.

If it’s been more than six hours since you ordered your account and you still haven’t received your login, please submit a help desk ticket.

After signing your data agreements, data activation can take anywhere from 10 to 90 minutes.

Please wait at least 90 minutes before submitting a ticket about missing live data.

Login Credentials

- Ensure there are no spaces before or after your username or password.

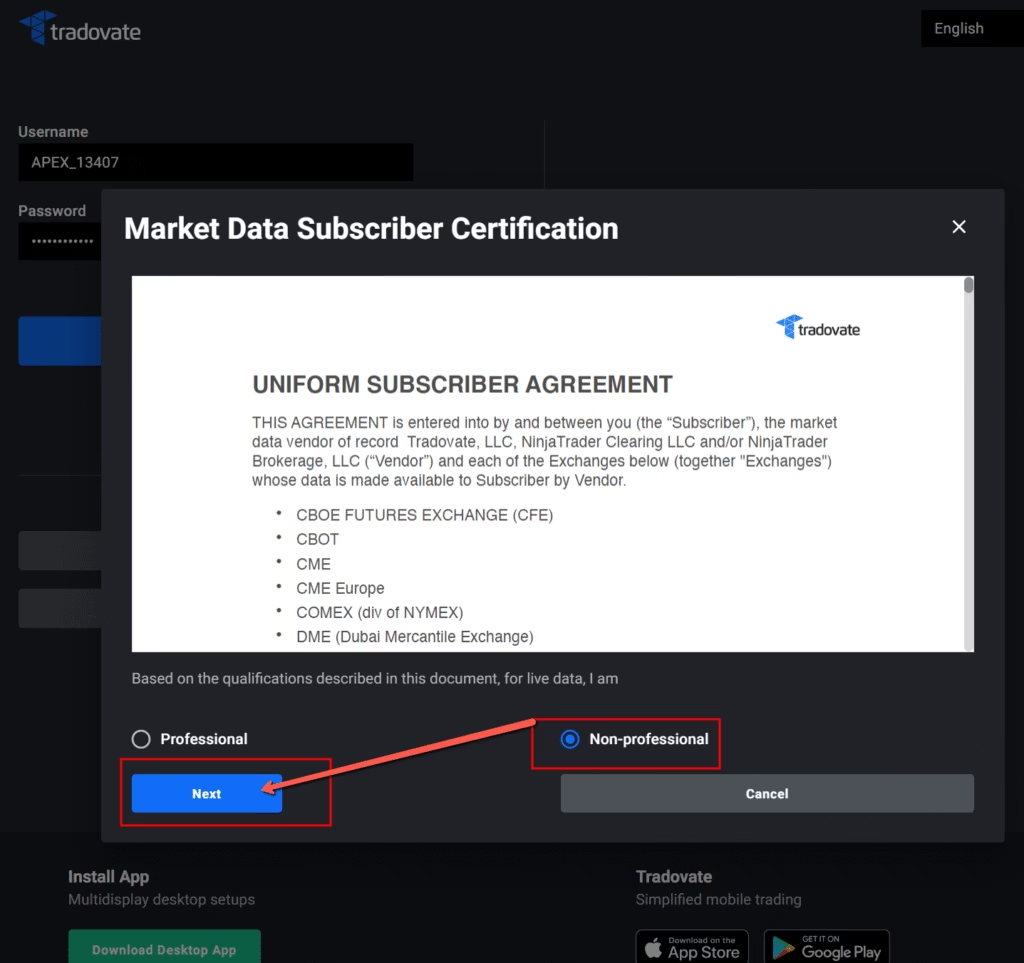

- When prompted, select “NON-PROFESSIONAL” on the subscriber agreement form.

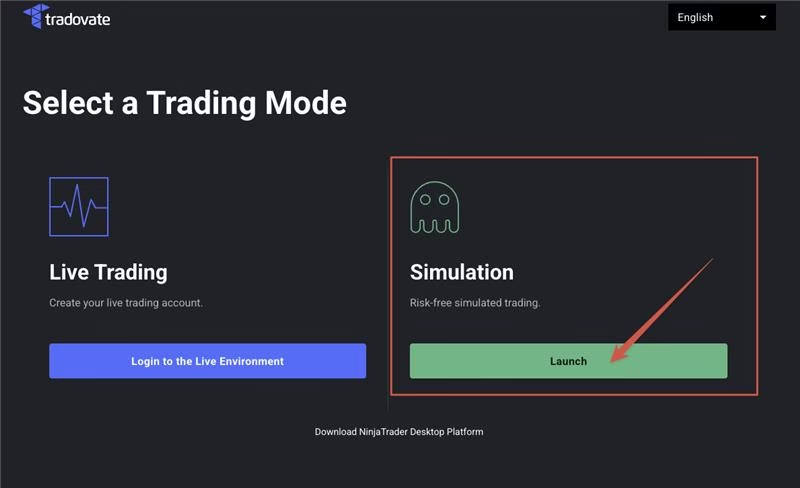

- Once your account is active, you’ll find it under the Simulation section — click Launch to open it.

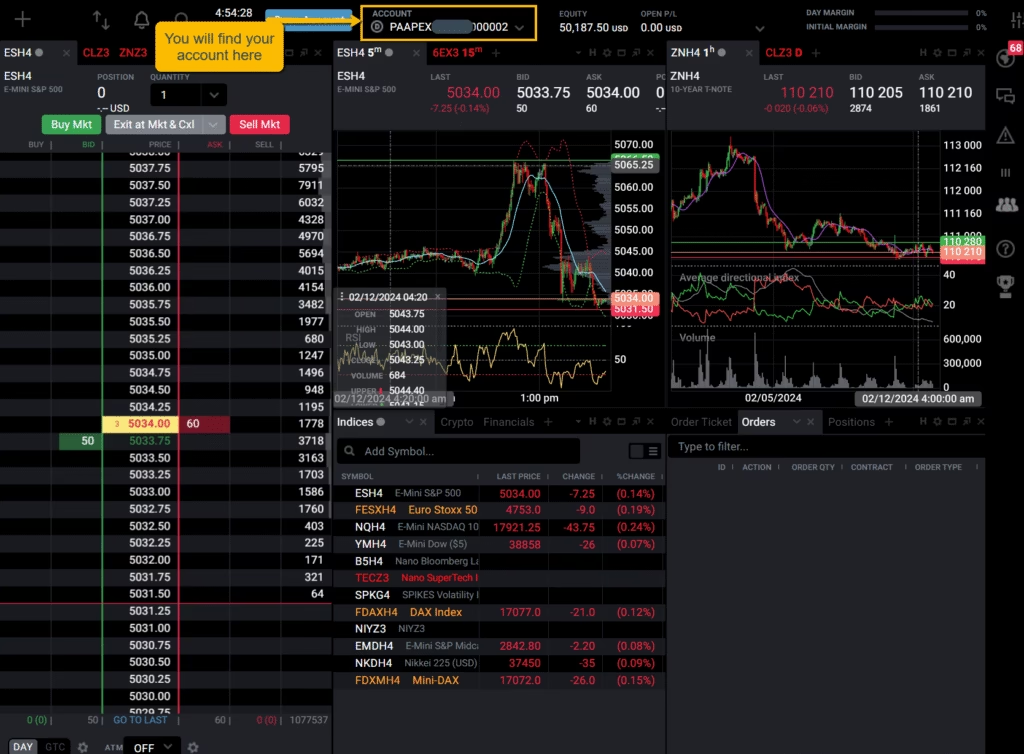

This will bring you to your Tradovate Dashboard, where you can access your trading account.

For help customizing your charts or dashboard, check out the Tradovate Support Page.

Connecting Tradovate to TradingView

You must have an active and tradable account before connecting to TradingView.

If setup isn’t completed properly, you may see errors such as:

- “TradingView Error” messages

- Or “TradingView Add-On is charging me $9.99”

When your account meets the connection requirements, you can use TradingView for free through Tradovate but remember to renew the subscription every month.

This free connection provides data updates every 5 seconds; for real-time streaming data, you’ll need a paid TradingView plan.

Important Notes

- Choose “NON-PROFESSIONAL” when signing the data agreement to avoid a $300/month data fee.

- Initial data activation may take 10–90 minutes.

- Avoid sending a help ticket about missing live data until after 90 minutes.

Step-by-Step Connection Instructions

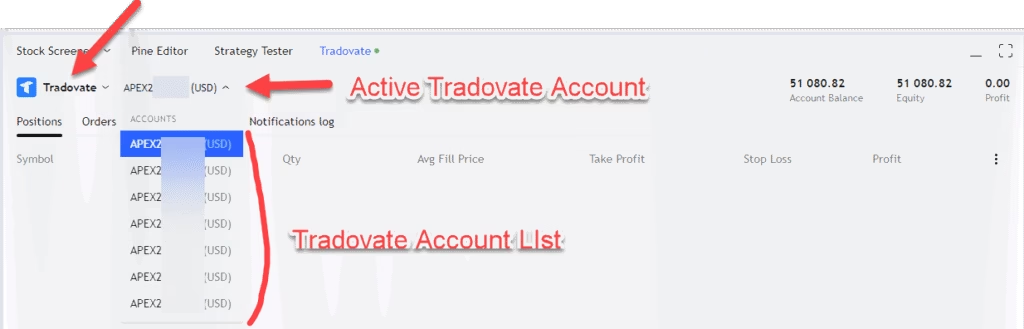

Once connected, you’ll see the Tradovate icon and your account listed in the Trading Panel dropdown — confirming a successful connection.

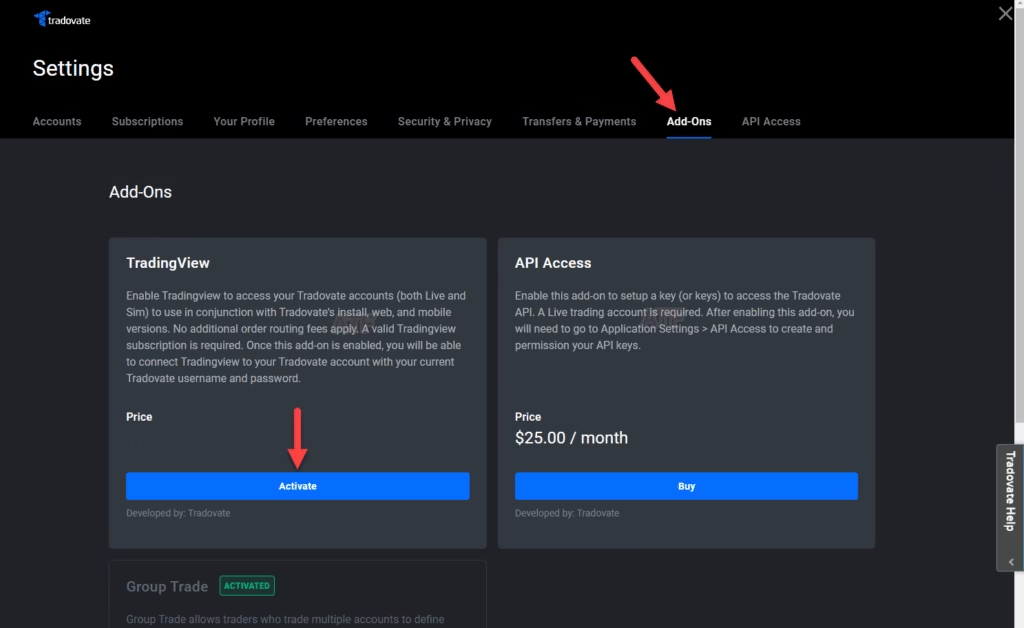

Open Tradovate Application Settings.

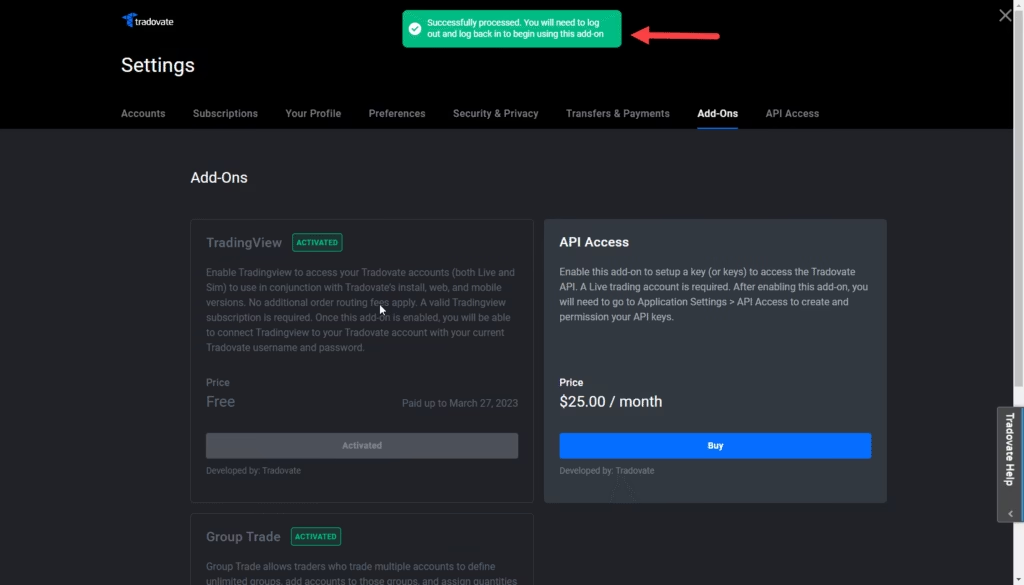

Go to the Add-Ons tab → find the TradingView section → click Activate. If the free TradingView connection isn’t enabled immediately, allow up to 4 hours for full activation.

Log out of Tradovate and log back in to complete activation.

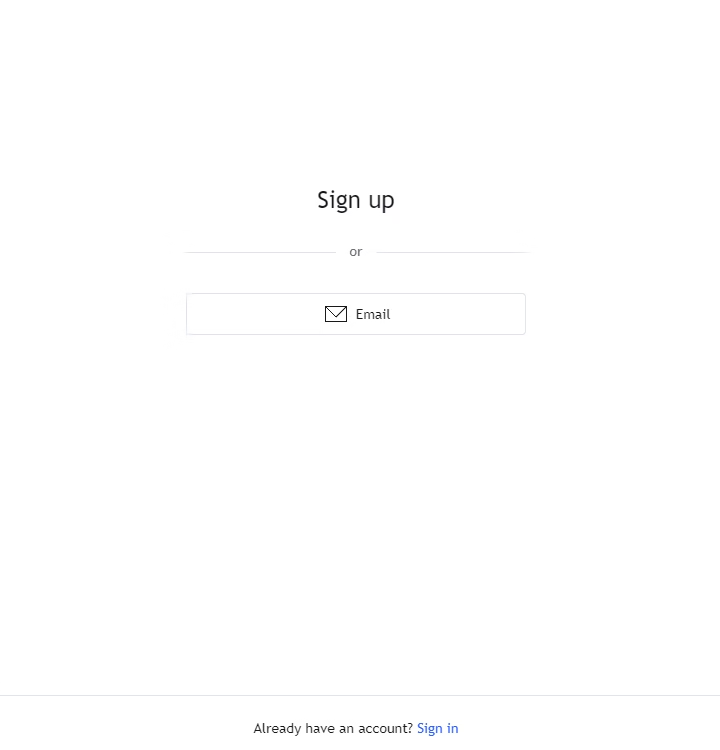

Go to the TradingView website, log into your account, and open a chart.

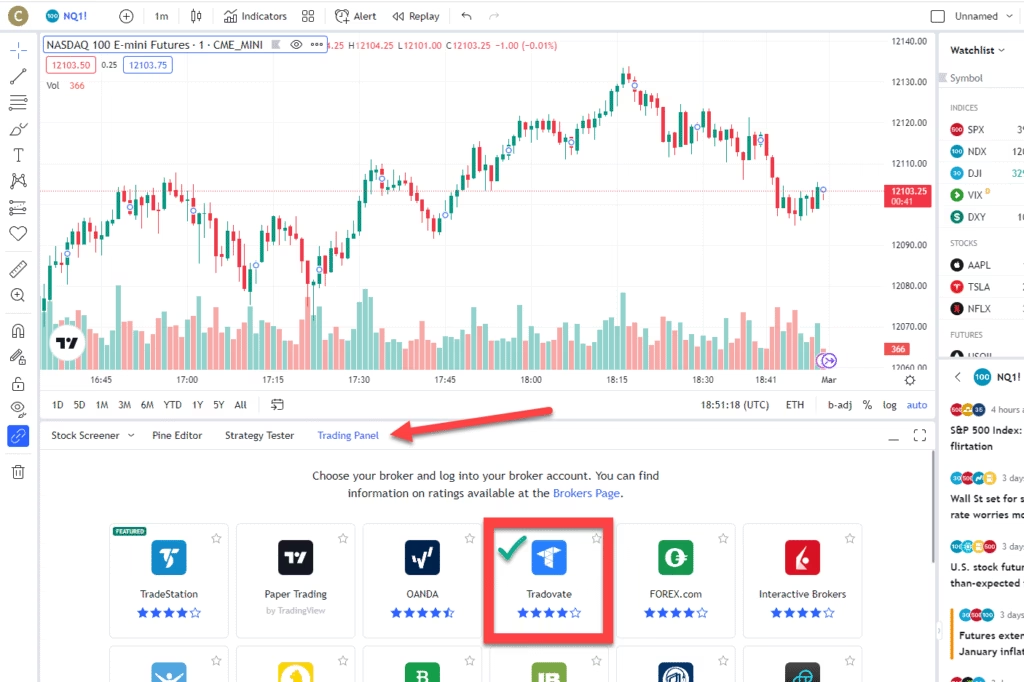

Click the Trading Panel at the bottom → select Tradovate.

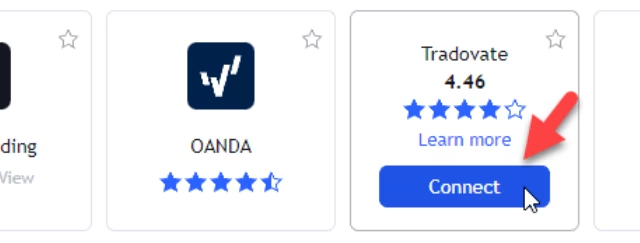

Hover over the Tradovate icon and click Connect.

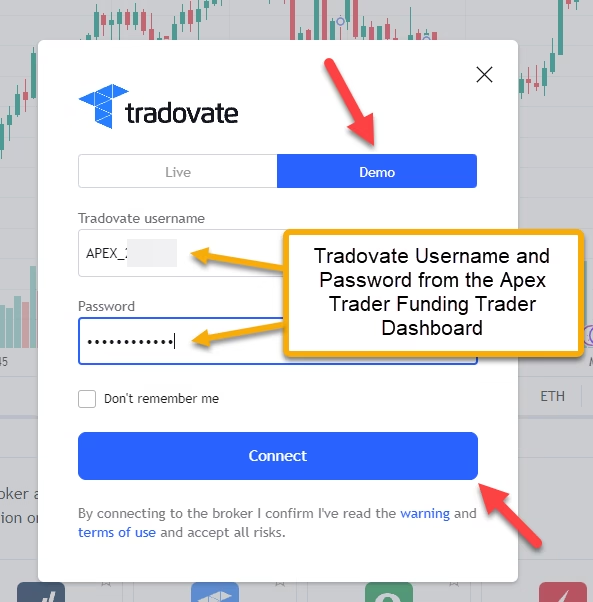

Choose Demo, then enter your Tradovate username and password (found on your Apex Trader Funding Dashboard) and click Connect.

Trading Rules and Payout Structure

Apex uses a single-step evaluation with straightforward rules:

- Profit Target: Approximately 6% of account balance (e.g., $1,500 on a $25K account).

- Trailing Drawdown: Moves dynamically with the account; no fixed daily loss limit.

- Trading Hours: 6:00 PM – 4:59 PM ET, no overnight positions allowed.

- News Trading: General strategies permitted, but trading around scheduled news releases is discouraged.

- Consistency Rule: Until the sixth payout, no single trading day can represent more than 30% of total profits.

- Contract Limits: Exceeding the maximum contract limit results in an automatic evaluation failure.

After successful evaluation, traders retain 100% of the first $25,000 in profits and 90% thereafter. Payouts are generally processed within a few business days.

Pros and Cons

Advantages

- High profit split structure (100% of first $25,000).

- Transparent and flexible trading rules.

- Multiple supported platforms, including TradingView.

- Frequent payout opportunities.

- Ability to hold up to 20 funded accounts simultaneously.

Disadvantages

- Platform and data fees increase monthly costs.

- Tradovate execution is slightly slower than Rithmic.

- Some user complaints about rule changes and payout delays on public forums.

- Trailing drawdown can be challenging for less experienced traders.

Overall Assessment – October 2025

As of late 2025, Apex Trader Funding remains one of the leading prop firms for futures traders. It combines generous payouts, reasonable evaluations, and wide platform flexibility.

For most retail traders, the Tradovate setup offers a simple and cost-effective way to trade funded futures accounts with direct TradingView access. Professional or algorithmic traders may find better performance with Rithmic/NinjaTrader, especially when using a VPS for execution speed.

Overall, Apex provides a strong balance of accessibility, flexibility, and profit potential—provided that traders fully understand its fee structure and trailing drawdown rules.

Automate Your Trading with PickMyTrade

For traders looking to automate trading strategies, PickMyTrade offers seamless integrations with multiple platforms. You can connect Rithmic, Interactive Brokers, TradeStation, TradeLocker, or ProjectX through pickmytrade.io.

If your focus is Tradovate automation, use pickmytrade.trade for a dedicated, fully integrated experience. These integrations allow traders to execute strategies automatically, manage risk efficiently, and monitor trades with minimal manual intervention.

You May also Like:

Automate TradingView Indicators with Tradovate Using PickMyTrade

Connect Tradovate with Trading view using PickMyTrade

FundedNext Futures Tradovate Connection Guide (2025)

Prop Firm Red Flags: 5 Warnings Traders Must Know

Prop Firm Payouts 2025