In the fast-paced world of trading, having a reliable strategy can make all the difference. One such strategy that has gained popularity among traders is the 5 EMA (Exponential Moving Average) strategy. This method not only helps in identifying potential entry and exit points but also adapts well to various market conditions. In this blog post, we will delve deep into what the 5 EMA strategy entails, how to implement it, and tips for maximizing your trading success.

Understanding the Basics of EMA

Before diving into the strategy, it’s essential to understand what EMA is. The Exponential Moving Average is a technical indicator that places more weight on recent price data, making it more responsive to price movements than a Simple Moving Average (SMA). This responsiveness allows traders to react quickly to market changes, which is particularly useful in short-term trading scenarios.

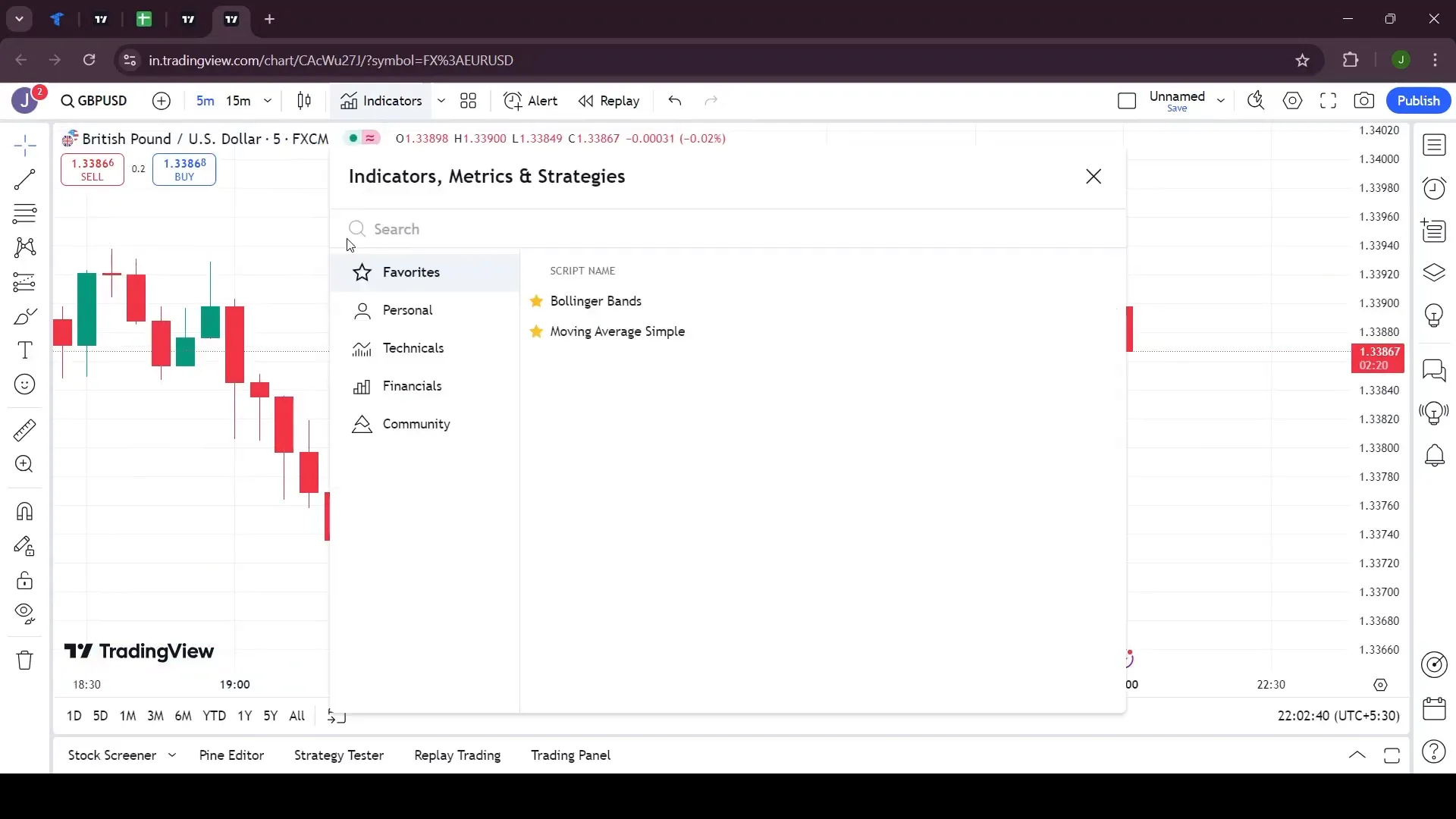

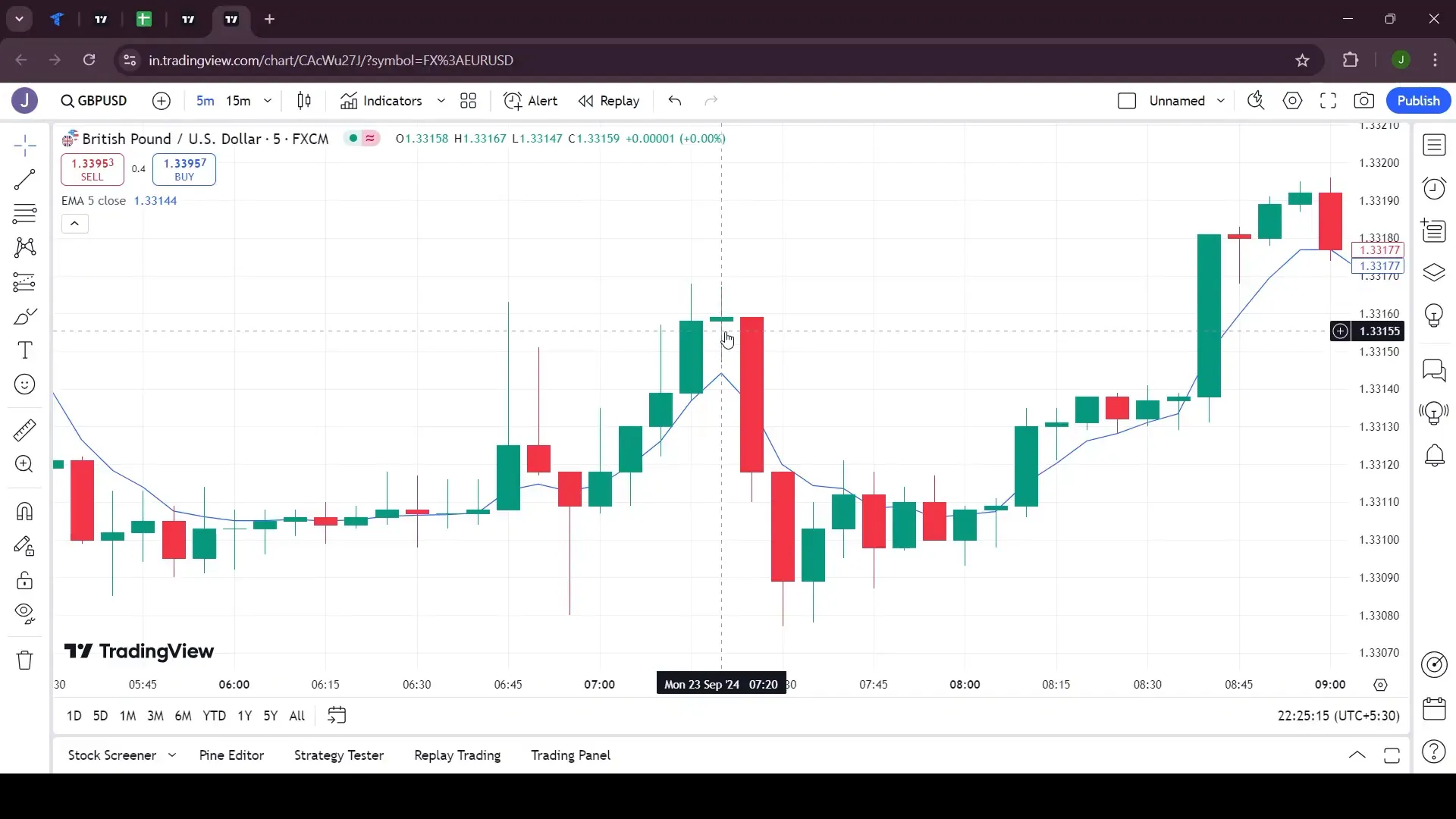

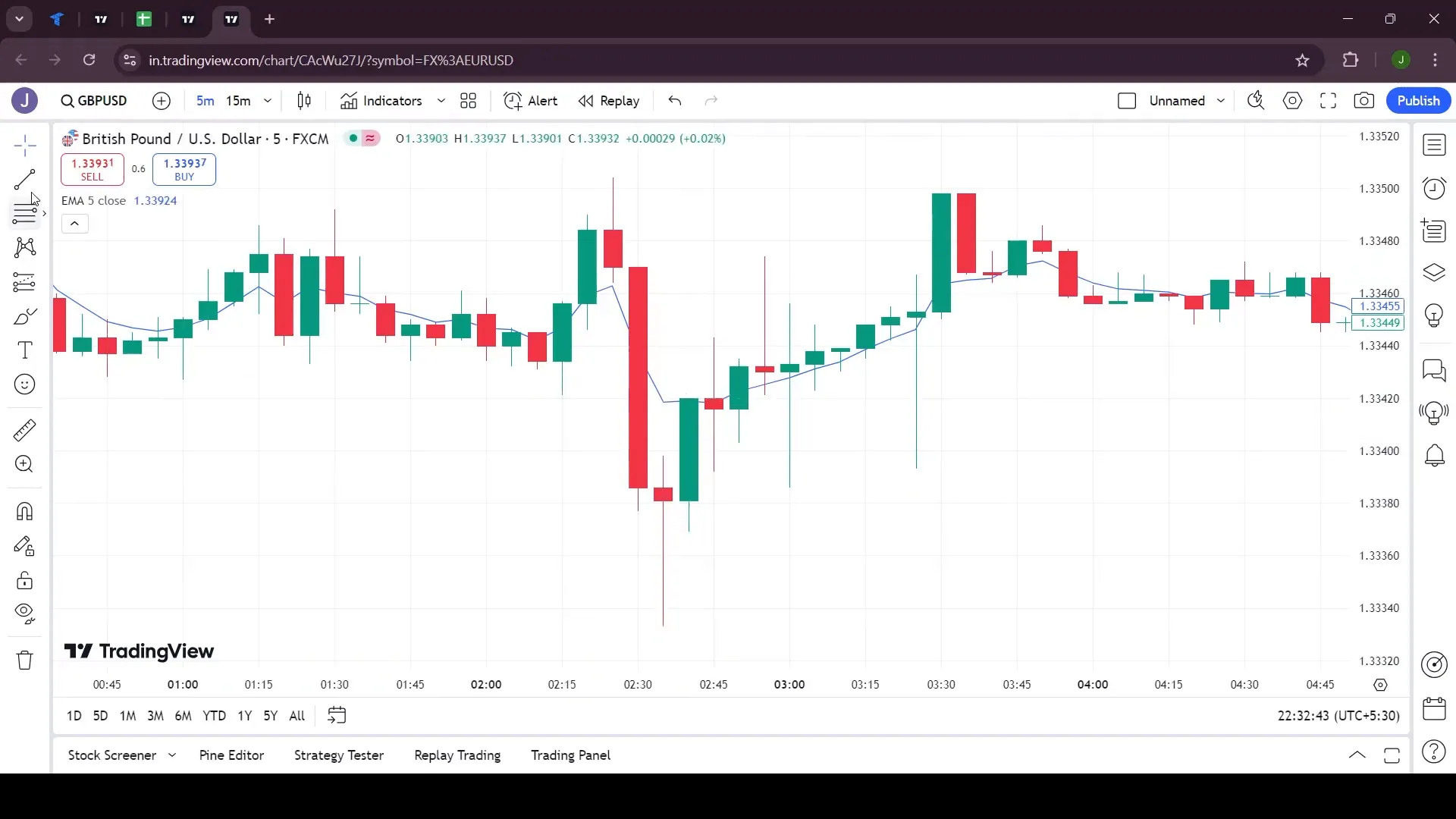

To illustrate the differences, we can compare the 5 EMA and the 5 SMA. The 5 EMA reacts more swiftly to price movements, which can be observed on trading platforms like TradingView. Here, you can see how the EMA closely follows price action, whereas the SMA lags behind, providing less timely signals.

Setting Up the 5 EMA Strategy

Now that we have a foundational understanding of EMA, let’s explore how to set up the 5 EMA strategy effectively. This strategy focuses on both buying and selling conditions, allowing traders to capitalize on market movements in either direction.

1. Preparing Your Chart

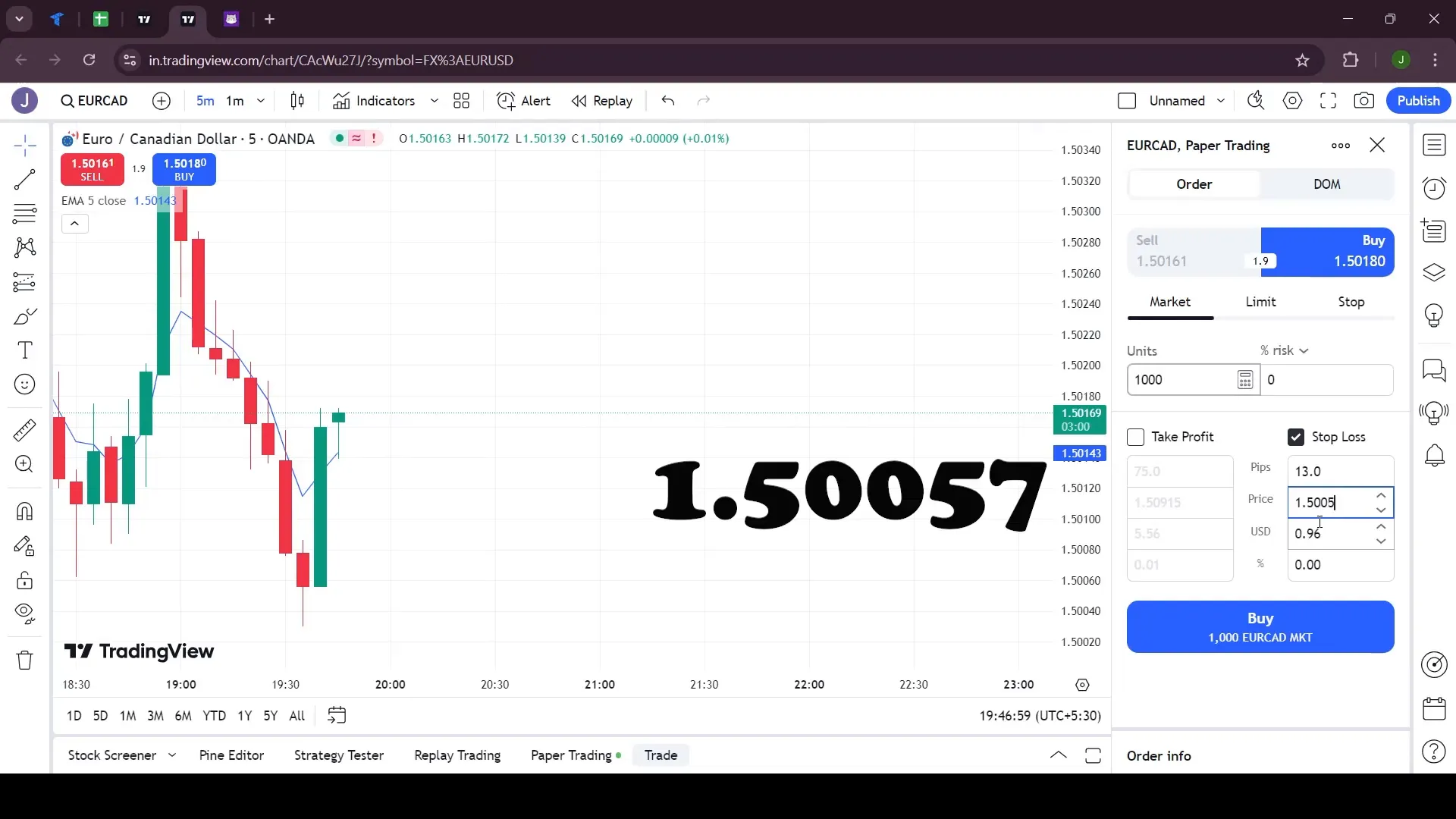

First, you need to set up your chart on a trading platform like TradingView. Open the desired market, for instance, the British Pound, and select the 5-minute time frame. To add the 5 EMA, search for the EMA indicator and set its length to 5.

2. Identifying Selling Opportunities

The first phase of the strategy involves identifying potential selling opportunities. Here are the steps:

- Alert Candle: Look for a candle that is above the 5 EMA line without touching it. This candle serves as your alert candle.

- Activation Candle: The next red candle that touches the 5 EMA is your activation candle. This is when you enter the trade.

For example, if you spot a green candle that does not touch the 5 EMA, it becomes your alert candle. When the subsequent red candle touches the EMA, you enter the trade with the high of the alert candle as your stop loss. Aim for a risk-reward ratio of 1:3.

3. Spotting Buying Opportunities

Conversely, the process for identifying buying opportunities is quite similar but in reverse:

- Alert Candle: Look for a red candle that closes below the 5 EMA without touching it.

- Activation Candle: The next green candle that touches the 5 EMA signals your entry point.

In this case, the low of the alert candle will be your stop loss, and you should also target a 1:3 risk-reward ratio.

Executing Trades in Live Markets

Let’s take a closer look at how to execute trades using the 5 EMA strategy in real-time:

Example of a Selling Trade

Assuming you identify an alert candle and then an activation candle, you would place your trade with the stop loss set at the high of the alert candle. Always remember to set realistic targets based on the 1:3 risk-reward ratio.

For instance, if you enter a trade at a price level aiming for a drop, monitor the trade closely to ensure it aligns with your expectations.

Example of a Buying Trade

Similarly, for a buying trade, once you confirm your alert and activation candles, you would place your trade and set the stop loss at the low of the alert candle. Monitor the market closely to adjust your targets accordingly.

Key Tips for Successful Trading with 5 EMA

To enhance your trading success with the 5 EMA strategy, consider the following tips:

- Respect Stop Losses: Always adhere to the stop loss set by the alert candle’s high or low, depending on whether you are buying or selling.

- Patience is Key: Sometimes, it’s crucial to wait for the perfect activation candle to ensure a higher probability of success.

- Set Realistic Targets: Aim for at least a 1:3 reward ratio to maintain profitability over time, even if you experience losses on some trades.

It’s important to remember that no trading strategy is foolproof. However, with discipline and careful execution, you can achieve consistent profits.

Conclusion

The 5 EMA strategy is a powerful tool for traders looking to capitalize on short-term market movements. By understanding how to identify alert and activation candles, you can effectively implement this strategy in your trading routine. Always remember to practice good risk management and maintain a disciplined approach to trading.

For those interested in automating their trading strategies, consider exploring PickMyTrade, which offers automated trading solutions tailored for various markets.

PickMyTrade

PickMyTrade specializes in automating trading bots, enabling seamless strategy execution for futures from platforms like TradingView, across well-known brokers such as Tradovate.