In the world of trading, automating processes can save time and enhance efficiency. One of the key features that traders often look for is the ability to create a trailing stop. This article will guide you through the process of setting up a trail stop using PickMyTrade, focusing on the integration between Tradovate and TradingView. By the end, you’ll have a clear understanding of how to effectively use these tools to manage your trades.

What is a Trailing Stop?

A trailing stop is a type of stop-loss order that moves with the market price. It allows traders to lock in profits while still providing room for potential gains. In essence, the trailing stop follows the price movement, adjusting as the market fluctuates. This feature is particularly useful in volatile markets, where prices can change rapidly.

Setting Up Your Trailing Stop in Tradovate

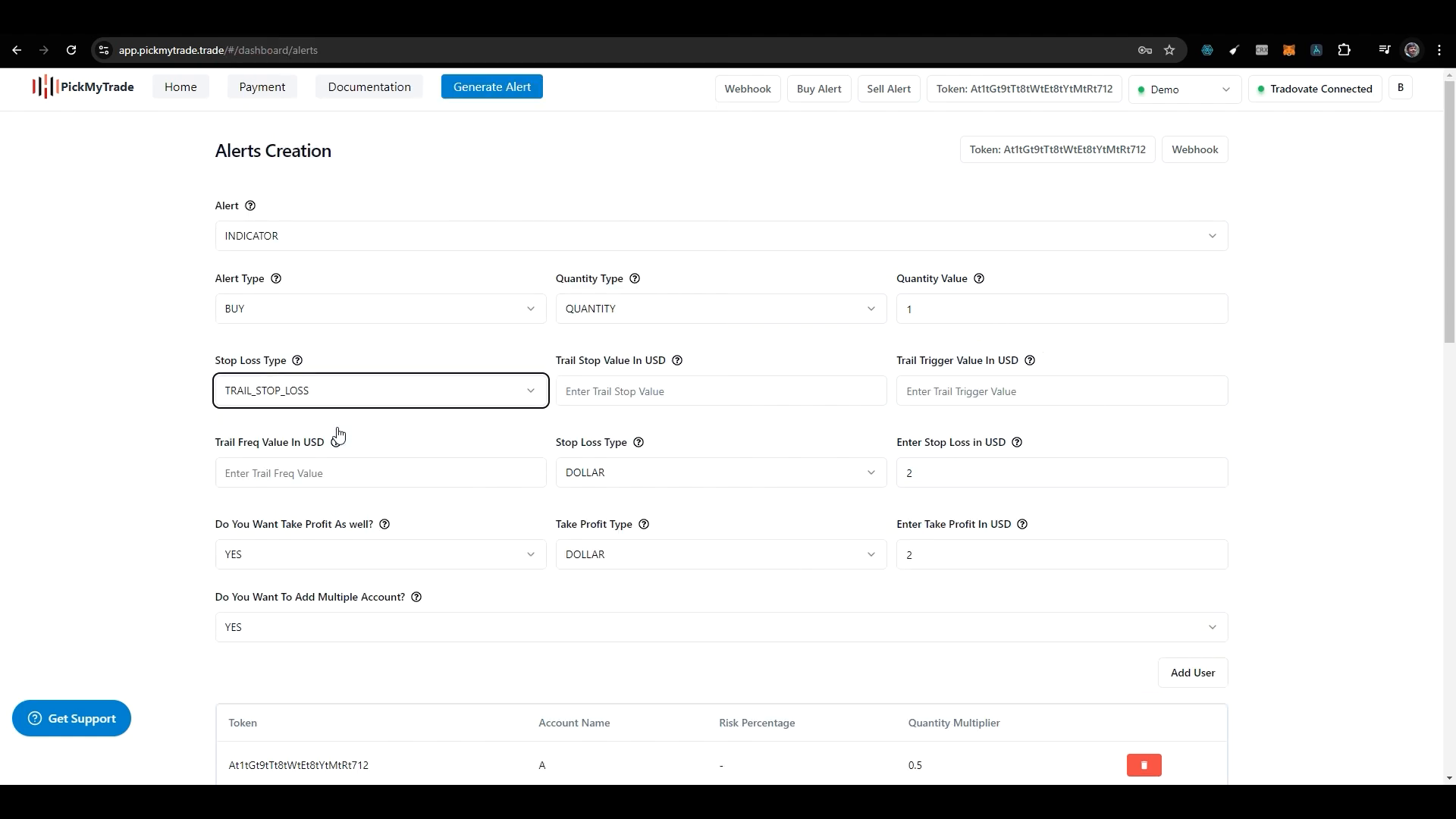

To begin, you need to select the trailing stop loss option in Tradovate. This is a crucial step, as it activates the fields necessary for configuring your trailing stop. Make sure you understand the different stop-loss types and how they function. Once you select the trailing stop loss, you will see various fields that need to be filled out.

Key Fields to Configure

When setting up a trailing stop, several key fields must be filled out:

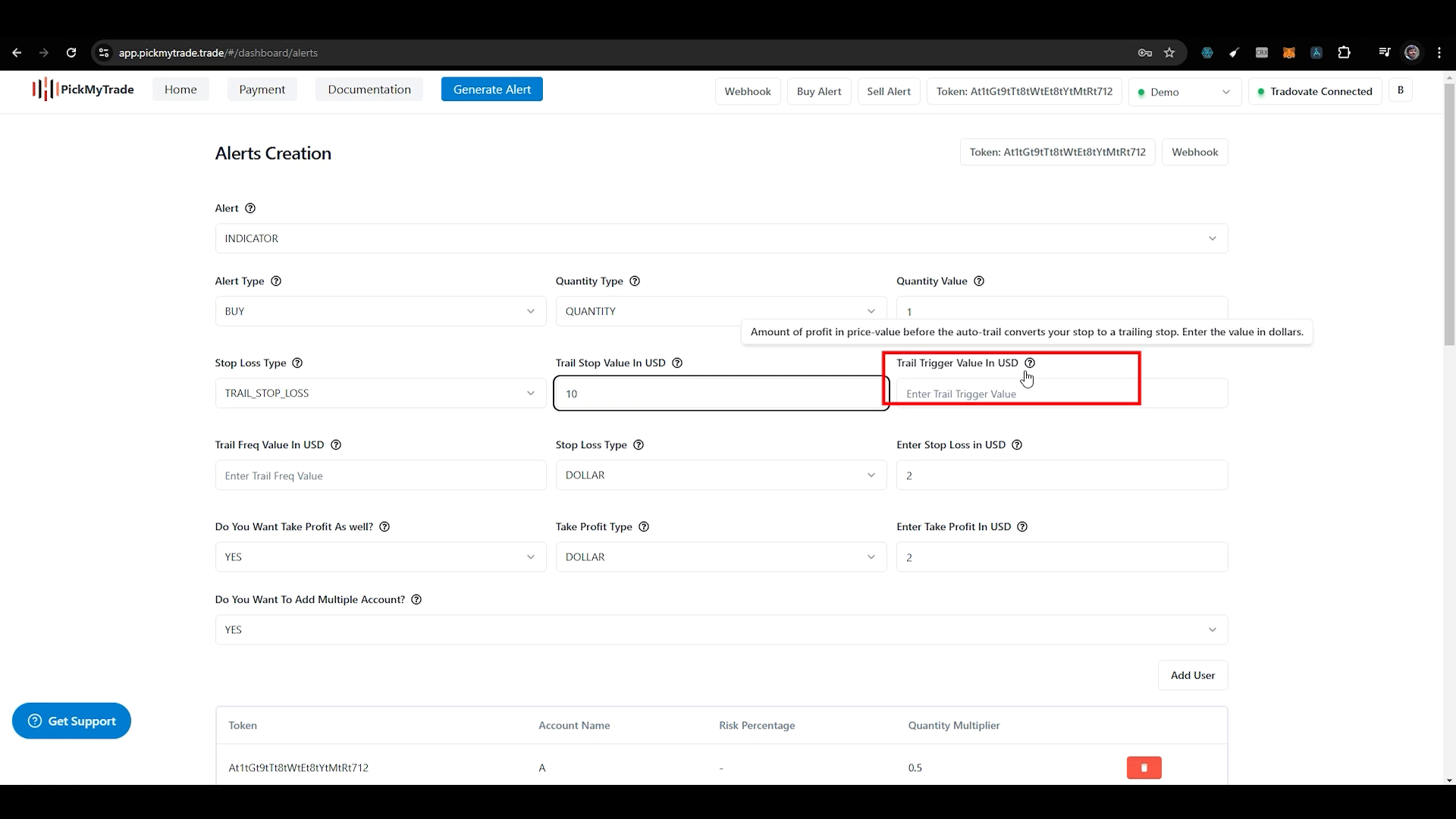

- Trail Stop Loss Value in USD: This value determines how far the trailing stop will be from the current price. For example, if you enter $10, the trailing stop will maintain a distance of $10 from the market price.

- Trail Trigger Value in USD: This value indicates when the trailing stop will activate. If you set this to $10, the trailing stop will only begin once your trade has moved $10 in profit.

- Trail Frequency: This is the amount of price change required before the trailing stop will adjust. For example, if you set this to $2, the trailing stop will only move after a $2 price change in your favour.

Generating Alerts in TradingView

Once you have configured your trailing stop settings, the next step is to generate an alert in TradingView. This is essential for keeping track of your trade and ensuring that you receive notifications when certain conditions are met.

Steps to Generate Alerts

Follow these steps to generate alerts in TradingView:

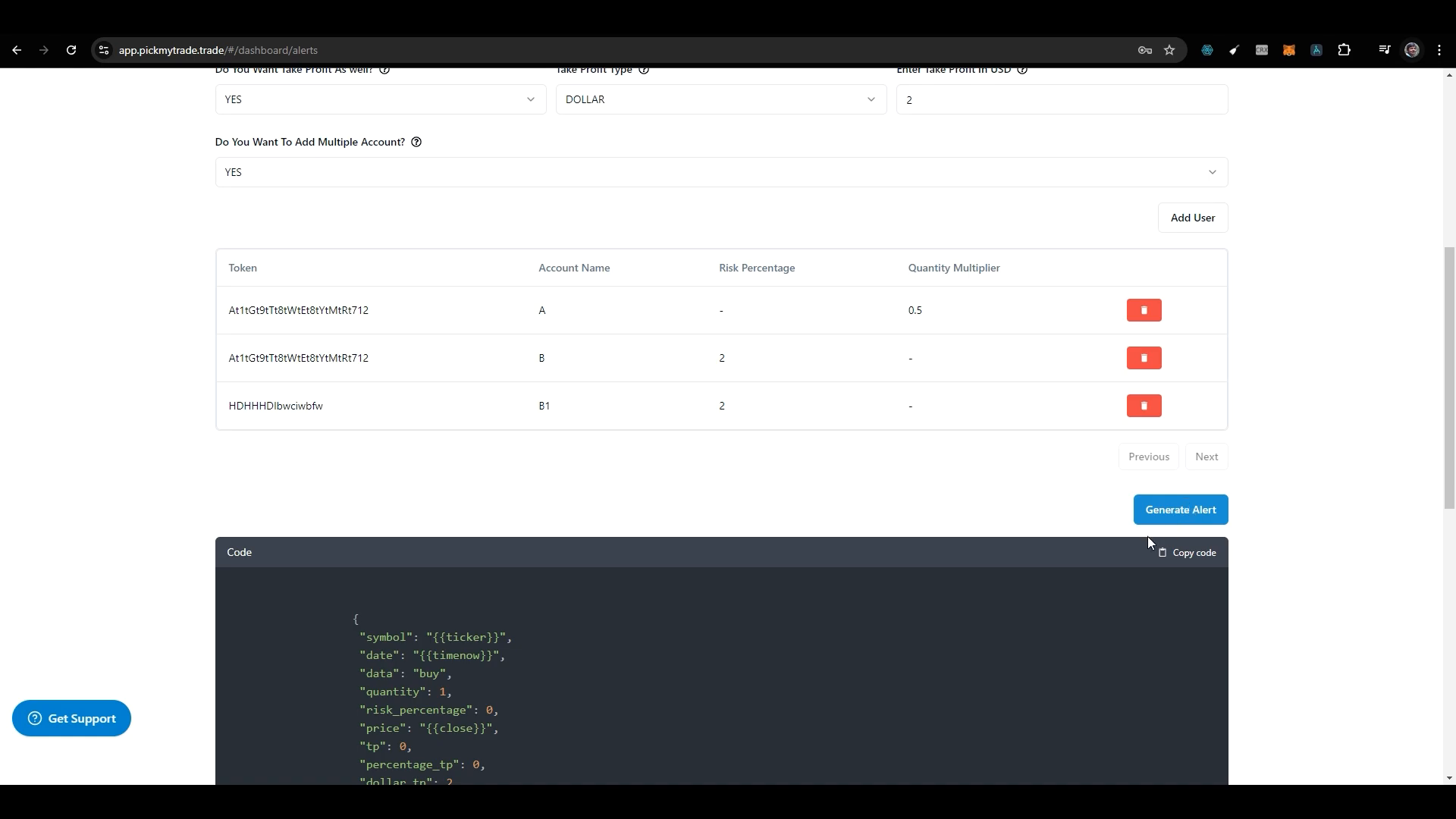

- Click on the “Generate Alert” button after configuring your trailing stop.

- Copy the generated alert code.

- Paste this code into TradingView.

- Ensure the green tick appears, indicating that your alert is set up correctly.

- In the notification settings, enter your webhook URL to receive updates directly.

Understanding Auto Trail Features

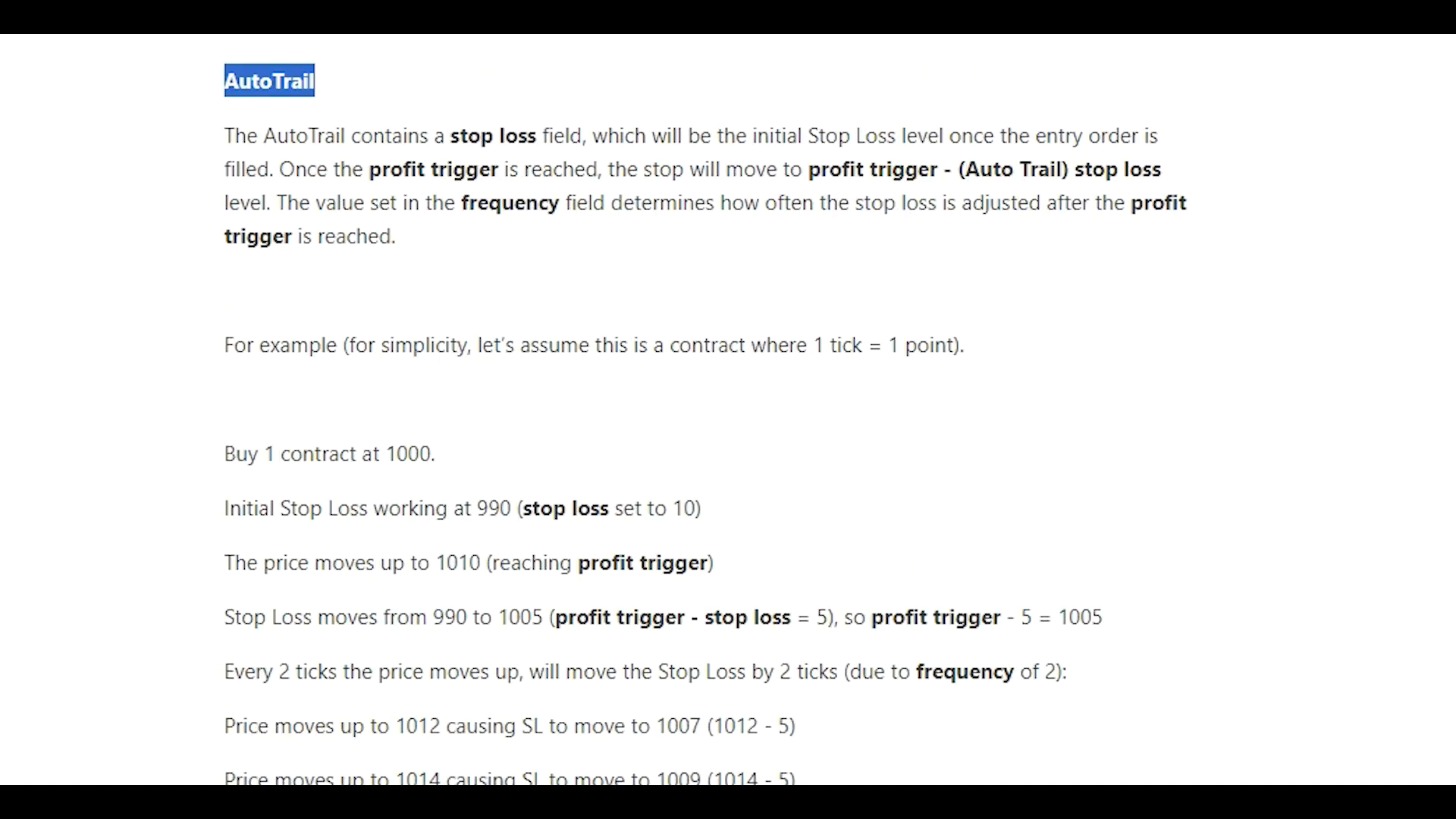

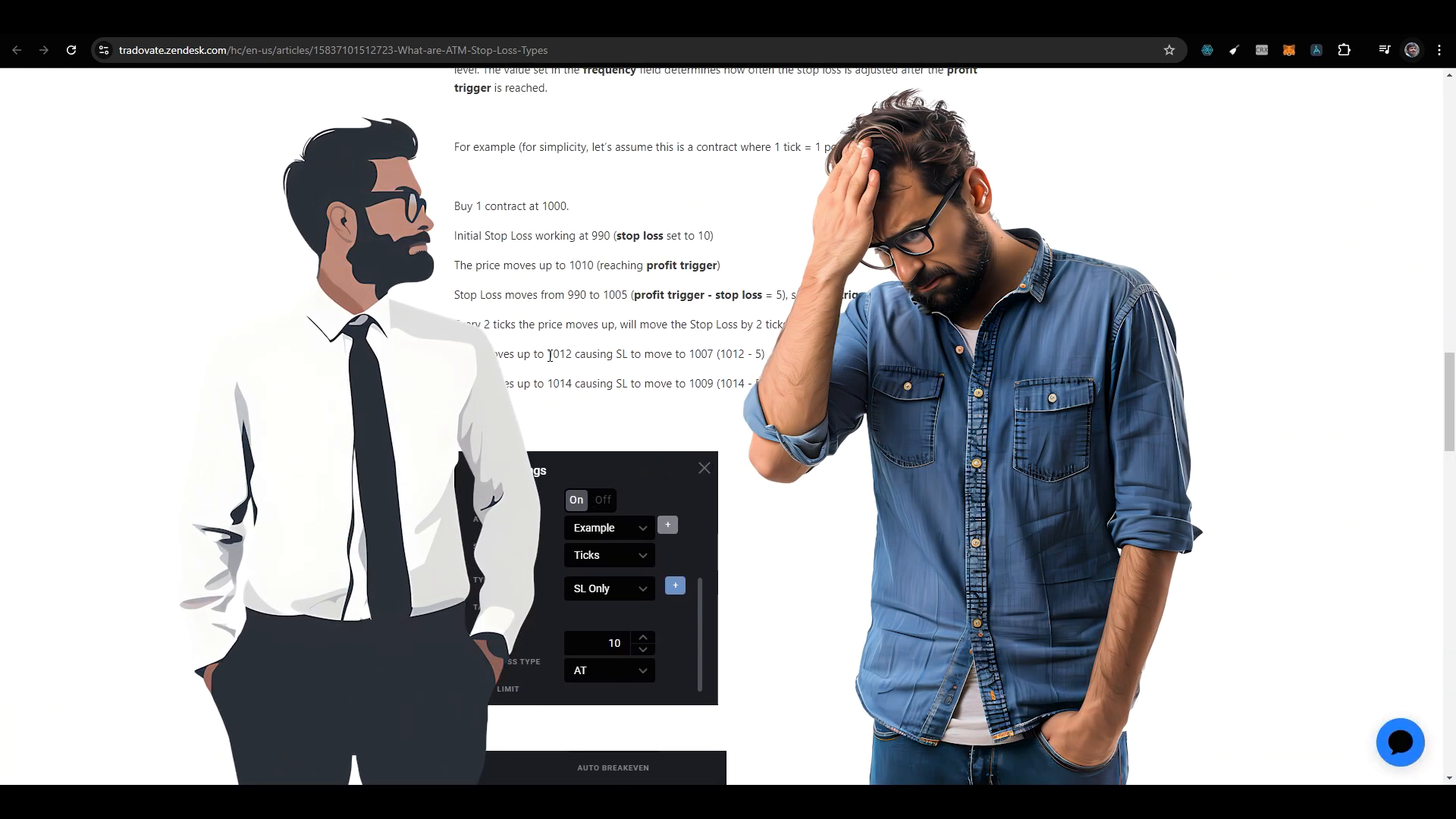

Many users experience confusion regarding the Auto Trail feature. It is important to refer to the documentation provided by Tradovate for a comprehensive understanding. The Auto Trail functionality includes initial stop-loss orders, profit triggers, and frequency settings.

By comparing your setup with the documentation, you can identify any discrepancies and troubleshoot potential issues. This is crucial, especially if you are using a demo account, where market data permissions can affect your results.

Common Issues and Troubleshooting

Some traders report that their trailing stops do not function as expected. This can often be attributed to a lack of market data permissions or incorrect configurations. If you encounter issues, it is advisable to reach out to Tradovate support for assistance.

Additionally, ensure that you have followed all steps correctly when setting up your trailing stop and alerts. Regularly reviewing your settings can help mitigate problems before they arise.

Conclusion

Setting up a trailing stop using PickMyTrade with Tradovate and TradingView is a powerful tool for traders. It enhances your ability to manage trades effectively and can significantly improve your trading strategy. By understanding the key components and settings involved, you can make informed decisions and optimise your trading performance.

If you have any further questions or require assistance, do not hesitate to reach out to the support teams or refer to the provided documentation. Happy trading!

For more insights and tutorials, visit the following links:

- Complete Video Explained from TradingView to Tradovate – YouTube

- Complete Video Explained How to create alert message for TradingView Strategy – YouTube

- Complete Video Explained How to create alert message for TradingView Indicator – YouTube

PickMyTrade specializes in automating trading bots, enabling seamless strategy execution for futures from platforms like TradingView, across well-known brokers such as Tradovate.

Made with VideoToBlog