If you like clean price action, you’re going to like this one.

The PickMyTrade Advanced Trend Following Strategy is built on top of an excellent open-source Pine Script by @crazyrabbitheart that automatically draws and trades off trendlines. We took that script, wrapped it into a complete TradingView strategy, and added professional-grade risk and trade management so it’s ready for both backtesting and full automation.

Just like in our MACD + ADX post, the idea is simple:

An indicator shows you what might be a trade.

A strategy decides when to enter, how much to risk, where to exit, and when to stand aside.

In this post we’ll walk through:

- How the trendline breakout logic actually works

- The risk and position-sizing engine we added

- Real backtest performance across stocks, crypto, forex, and futures

- How to automate everything with PickMyTrade

From Trendline Indicator to Complete Strategy

Original Idea (by @crazyrabbitheart)

The original script focuses on one thing and does it very well:

- Automatically detecting downtrend resistance lines

- Validating them using multiple touches

- Entering long when price breaks above that trendline

It’s pure price action – no oscillators, no lagging filters. Great for visual discretionary trading and semi-automated entries.

What We Added

We turned it into a full TradingView strategy with automation-grade features:

Trend & Entry Logic (core kept from original)

- Automatic detection of downtrend lines using pivot highs

- Configurable pivot length for trend detection

- Touch count requirement (e.g., 3 touches) to validate the trendline

- Optional extra pivot validation for stricter trendlines

- Session filter so the system only trades during specific hours

Risk & Position Management (our enhancements)

- Fixed dollar-based risk per trade (default: $100)

- Automatic position sizing based on stop distance

- Pivot-based stop loss with optional buffer

- Three different take-profit modes:

- Risk/Reward ratio (e.g., 1.5R)

- Lookback-based exits

- Fibonacci extension targets (multi-level scaling)

- Optional trailing stop using new pivot lows

- Multi-trend mode so it can track and trade multiple simultaneous breakouts

With that, you get a pure price-action strategy that:

- Only buys strong, confirmed breakouts

- Sizes each trade based on risk, not emotion

- Handles exits mechanically from start to finish

Understanding Profit Factor (Again)

Just like in the MACD article, one of the key metrics here is Profit Factor:

Profit Factor = Gross Profit ÷ Gross Loss

- PF > 1.0 → profitable

- PF > 1.5 → solid

- PF > 2.0 → excellent

In a trend strategy like this, we care less about being right on every trade and more about:

- Cutting losers at logical pivots

- Letting winners run into clean trend legs

So Profit Factor and average R:R tell us more than raw win rate.

Backtest Results: Stocks, Crypto, Forex & Futures

All tests use the same default parameters (3 touches, risk–reward 1.5R, $100 risk per trade, session 09:00–18:00 where applicable).

Numbers are from TradingView Strategy Tester using the script below.

AAPL – 5 Minute (NASDAQ)

- Total P&L: +$3,229.90

- Max Equity Drawdown: $869.47

- Total Trades: 106

- Win Rate: 50.00% (53 / 106)

- Profit Factor: 1.572

Comment:

Even with very conservative dollar risk, AAPL shows a strong profit factor and a clean equity curve, with half the trades profitable and losers capped by pivot-based stops.

SOLUSDT – 1 Hour (Binance)

- Total P&L: +3,108.37 USDT

- Max Equity Drawdown: 592.72 USDT

- Total Trades: 118

- Win Rate: 50.85% (60 / 118)

- Profit Factor: 1.55

Comment:

SOL is a volatile trending crypto, and the strategy handles it nicely – profit factor stays around 1.5 with a drawdown that is small relative to total movement. Trendline breakouts really shine on coins that trend hard after consolidation.

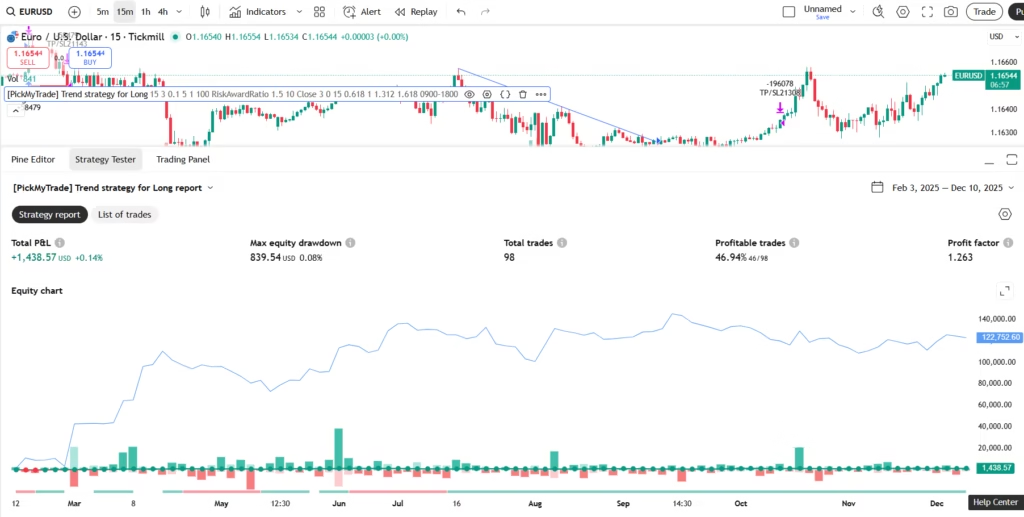

EURUSD – 15 Minute (Tickmill)

- Total P&L: +1,438.57 USD

- Max Equity Drawdown: $839.54

- Total Trades: 98

- Win Rate: 46.94% (46 / 98)

- Profit Factor: 1.263

Comment:

FX is choppier, so the win rate dips just under 50%, but the strategy is still comfortably profitable. This is where touch count and session filtering help filter noisy London/NY overlaps.

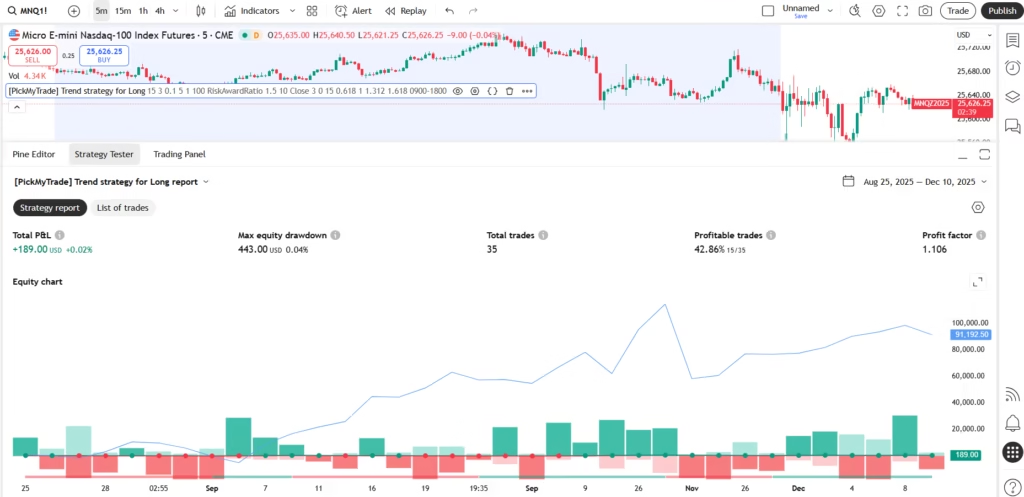

MNQ – 5 Minute (Micro Nasdaq Futures, CME)

- Total P&L: +$189.00 USD

- Max Equity Drawdown: $443.00

- Total Trades: 35

- Win Rate: 42.86% (15 / 35)

- Profit Factor: 1.106

Comment:

Short test window and a volatile index future, yet still positive with PF > 1.0. Tightening parameters (higher touch count, enabling extra pivot validation) usually improves PF here.

Key Takeaways from the Tests

- Consistent Profit Factor Across Markets

Stocks, crypto, FX, and futures all show PF > 1.1, with the best performers (AAPL & SOL) around 1.55–1.57 using the same default settings. - You Don’t Need a Huge Win Rate

Win rates hover around 45–51%, yet the strategies remain profitable. The edge comes from logical stops + asymmetric targets, not trying to be right all the time. - Trend Markets Reward the Strategy Most

SOLUSDT and AAPL – both capable of strong, clean trends – deliver the best numbers. Exactly what you’d expect from a trendline breakout system. - Risk Is Contained by Construction

Every trade starts with:- Pre-defined dollar risk

- Stop loss at a structural pivot low

- Optional buffer and trailing stop

Drawdowns in the tests stay modest relative to the number of trades taken.

- One Strategy, Many Markets

With no indicator soup and no asset-specific config, this is a good “core” system you can apply across stocks, crypto, FX and index futures with only minor tuning (timeframe, touch count, session hours).

How the Trendline Strategy Actually Works

Here’s the high-level logic behind the Pine Script you shared.

1. Pivot Detection & Trendline Building

- The script finds pivot highs using a configurable length (

pivotLength, default 15). - When a new pivot high forms below the previous pivot high, it assumes a downtrend and draws a line between them.

- It then checks how many candles:

- Touch or slightly pierce that line

- Or come within a small percentage buffer (

valid)

If the number of touches is ≥ touchNum (default 3), the line is considered a valid downtrend resistance.

Optional: a second pivot length (plen) can be used to demand an extra confirming swing between those two highs – a stricter filter for “real” trendlines.

2. Entry: Breakout Above a Valid Trendline

A long entry is triggered when:

- The current bar closes above the validated downtrend line

- The bar is within your active session (if the session filter is enabled)

- The maximum allowed number of open positions (

posNum) has not been reached

In multi-trend mode, this can happen on any active trendline. In single-trend mode, it only tracks one main line at a time.

3. Stop Loss: Pivot-Based

To place the stop:

- The script searches backward through recent pivot lows (

plenforsl) - It finds the most recent low that makes sense as structural support

- Optional offset (

offsetForSL) is subtracted to add a safety buffer - The stop is never allowed above the bar’s low (basic sanity check)

This gives you market-based stops instead of random fixed ticks.

4. Position Sizing: Dollar Risk Model

Once entry and stop are known:

Risk per trade = riskAmount (e.g., $100)

Qty = floor( riskAmount / |Entry - Stop| / syminfo.pointvalue )

- If calculated size is ≤ 0 (risk too small vs. stop distance) → no trade,

unless you enable Default Contract Size, in which case it forces 1 unit.

This keeps risk consistent across markets and volatility regimes.

5. Take Profit Options

You can choose 1 of 3 TP styles:

a) Risk/Reward Ratio (default)

- TP = Entry + (Entry − Stop) ×

riskAwardRatio(1.5R by default) - A simple, robust rule that works across most instruments.

b) Lookback-Based Exit

- No fixed TP limit – only a stop.

- The strategy closes all positions when:

- Price makes the lowest low (or close) of the last

lookBackCandlesbars in a long trade.

- Price makes the lowest low (or close) of the last

- Great for swing trading, letting winners run until structure breaks.

c) Fibonacci Extensions

- It finds a swing high (

phFib) above the trade and calculates:- 0.618, 1.0, 1.312, 1.618 extensions between that high and your stop.

- As price breaks above these levels, it marks them as triggered.

- When price later closes back below the highest triggered level, the strategy exits.

This effectively creates a tiered TP system, letting you hold into strong trends while still banking gains.

6. Trailing Stop (Optional)

When enabled:

- If a new pivot low (

plsl) forms above your original stop level, - And price then drops back below that pivot,

- The strategy exits the trade.

That turns newly formed higher lows into dynamic trailing stops.

7. Session Control

For intraday traders:

- You can specify a session (e.g.

"0900-1800") - The strategy will:

- Only open trades during those hours

- Optionally close all positions at session end

Great if you want to avoid overnight gaps or news.

The Actual Strategy Code (Pine Script v5)

Here’s the complete script, including original license and credit:

// This work is licensed under a Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0) https://creativecommons.org/licenses/by-nc-sa/4.0/

// © crazyrabbitheart

//@version=5

strategy("[PickMyTrade] Trend strategy for Long", overlay = true, pyramiding = 1000, process_orders_on_close = true, calc_on_every_tick = true, max_bars_back = 5000, max_lines_count = 500, max_labels_count = 500)

pivotLength = input.int(15, title = "pivot Length For Trend")

touchNum = input.int(3, title = "Touch Number")

valid = input.float(0.1, title = "valid percentage")

enablePivotToCheck = input.bool(false, title = "Enable Pivot To Valid")

plen = input.int(5, title = "pivot Length For valid")

isMulti = input.bool(true, title = "Enable Multi Trend")

posNum = input.int(1, title = "position number")

riskAmount = input.int(defval = 100, title = "Risk Amount", group = "strategy", minval = 1)

EnableContractSizeByDefault = input.bool(false, title = "Enable Default Contract Size")

setMethodForTP = input.string(defval = "RiskAwardRatio", title = "Set TP Method", options = ["RiskAwardRatio", "LookBackCandles", "Fibonacci"])

riskAwardRatio = input.float(defval = 1.5, title = "riskAwardRatio", group = "strategy", minval = 1.0)

lookBackCandles = input.int(defval = 10, title = "Look Back Candles", minval =1)

// nextCandles = input.int(1, title = "candles to check breakout")

sourceForTP = input.string(defval = "Close", title = "Source for TP", options = ["Close", "High/Low"])

enabledSL = input.bool(true, title = "Turn On/Off SL")

plenforsl = input.int(3, title = "pivot length for sl")

offsetForSL = input.float(0.0, title = "Buffer For SL", minval = 0.0)

enabledTrailing = input.bool(false, title = "Turn On/Off trailing stop")

lengthForFib = input.int(15, title = "Pivot length for Fibonacci", group = "Fibonacci")

// isFib1 = input.bool(true, title = "", group = "Fibonacci", inline = "Fibonacci1")

fibLevel1 = input.float(0.618, title = "Pivot length for Fibonacci", group = "Fibonacci", inline = "Fibonacci1")

// isFib2 = input.bool(false, title = "", group = "Fibonacci", inline = "Fibonacci2")

fibLevel2 = input.float(1, title = "Pivot length for Fibonacci", group = "Fibonacci", inline = "Fibonacci2")

// isFib3 = input.bool(false, title = "", group = "Fibonacci", inline = "Fibonacci3")

fibLevel3 = input.float(1.312, title = "Pivot length for Fibonacci", group = "Fibonacci", inline = "Fibonacci3")

// isFib4 = input.bool(false, title = "", group = "Fibonacci", inline = "Fibonacci4")

fibLevel4 = input.float(1.618, title = "Pivot length for Fibonacci", group = "Fibonacci", inline = "Fibonacci4")

enabledSession = input.bool(false, title = "", group = "Session", inline = "Session")

i_sess = input.session("0900-1800", "Session", group = "Session", inline = "Session")

t = time(timeframe.period, i_sess)

bgcolor(time == t and enabledSession ? color.new(color.white, 95) : na)

ph = ta.pivothigh(high, pivotLength, pivotLength)

pl = ta.pivotlow(low, pivotLength, pivotLength)

var phh = 0.0

var pll = 0.0

phh := na(ph) ? phh[1] : ph //pivot high value

pll := na(pl) ? pll[1] : pl //pivot low value

var phbar = 0

var plbar = 0

phbar := na(ph) ? phbar[1] : bar_index - pivotLength // pivot high bar_index

plbar := na(pl) ? plbar[1] : bar_index - pivotLength // pivot low bar_index

phbar := na(phbar) ? 0 : phbar

plbar := na(plbar) ? 0 : plbar

pph = ta.pivothigh(high, plen, plen) // pivot high for valid

ppl = ta.pivotlow(low, plen, plen) // pivot low for valid

var pphbar = 0

var pplbar = 0

pphbar := na(pph) ? pphbar[1] : bar_index - plen // pivot high bar_index for valid

pplbar := na(ppl) ? pplbar[1] : bar_index - plen // pivot low bar_index for valid

h = ta.pivothigh(high, plenforsl, plenforsl) //pivot high for SL

l = ta.pivotlow(low, plenforsl, plenforsl) //pivot low for SL

var phsl = 0.

var plsl = 0.

phsl := na(h) ? phsl[1] : h

plsl := na(l) ? plsl[1] : l

h := ta.pivothigh(high, lengthForFib, lengthForFib)

l := ta.pivotlow(low, lengthForFib, lengthForFib)

var phFib = 0.

var plFib = 0.

phFib := na(h) ? phFib[1] : h

plFib := na(l) ? plFib[1] : l

// ------------- Multi-trend mode -------------

if isMulti

var line[] trendline = array.new_line()

var int[] distance = array.new_int()

var float[] stepY = array.new_float()

var int[] startPointX = array.new_int()

var float[] startPointY = array.new_float()

if not na(ph) and phh < phh[1]

dis = bar_index - phbar[1]

step = (phh[1] - phh) / (phbar - phbar[1])

y = phh[1] - step * (bar_index - phbar[1])

n = 0

for int i = 0 to dis

pricen = y + i * step

if high[i] > pricen

n := n + 1

else

if (pricen - high[i]) < ((high[i] - low[i]) * valid / 100)

n := n + 1

isValidLine = n >= touchNum ? true : false

if enablePivotToCheck

isValidLine := isValidLine and (pphbar[bar_index - phbar] < phbar and pphbar[bar_index - phbar] > phbar[1]) ? true : false

if isValidLine

array.push(trendline, line.new(phbar[1], phh[1], bar_index, y, xloc = xloc.bar_index))

array.push(distance, dis)

array.push(stepY, step)

array.push(startPointX, phbar[1])

array.push(startPointY, phh[1])

var string[] entryId = array.new_string()

var float[] slPerEntry = array.new_float()

var string[] fibLevel = array.new_string()

var float[] isFibTriggered = array.new_float()

i = 0

for tline in trendline

y2 = array.get(startPointY, i) - array.get(stepY, i) * (bar_index - array.get(startPointX, i))

line.set_xy2(tline, bar_index, y2)

if close > y2 and ((timeframe.isintraday and time == t and enabledSession) or not timeframe.isintraday or not enabledSession)

if strategy.opentrades < posNum

j = 0

minl = plsl

while close < plsl[j]

j := j + 1

minl := plsl[j]

if j == 1000

minl := low

break

minl := offsetForSL > 0 ? minl - offsetForSL : minl

minl := low > minl ? minl : low

qtyLong = math.floor((riskAmount / math.abs(close - minl)) / syminfo.pointvalue)

if (not EnableContractSizeByDefault and qtyLong <= 1) or qtyLong < 0

qtyLong := 0

else if EnableContractSizeByDefault and qtyLong <= 1

qtyLong := 1

takeProfitLong = close + (close - minl) * riskAwardRatio

entryId_ = "long"+str.tostring(bar_index)

strategy.entry(entryId_, strategy.long, qtyLong)

array.push(entryId, entryId_)

sl = line.new(x1=bar_index, y1=minl, x2=bar_index + 10, y2=minl, color=color.red, width=2)

if setMethodForTP == "Fibonacci"

k = 1

q = phFib

while close > phFib[k]

k := k + 1

q := phFib[k]

if k == 1000

q := close

break

l1 = (q - minl) * fibLevel1 + minl

l2 = (q - minl) * fibLevel2 + minl

l3 = (q - minl) * fibLevel3 + minl

l4 = (q - minl) * fibLevel4 + minl

fl1 = line.new(x1=bar_index, y1=l1, x2=bar_index + 10, y2=l1, color=color.green, width=1)

fl2 = line.new(x1=bar_index, y1=l2, x2=bar_index + 10, y2=l2, color=color.green, width=1)

fl3 = line.new(x1=bar_index, y1=l3, x2=bar_index + 10, y2=l3, color=color.green, width=1)

fl4 = line.new(x1=bar_index, y1=l4, x2=bar_index + 10, y2=l4, color=color.green, width=1)

strlvl = str.tostring(l1) + "," + str.tostring(l2) + "," + str.tostring(l3) + "," + str.tostring(l4)

array.push(fibLevel, strlvl)

array.push(isFibTriggered, 0.0)

if enabledSL

if setMethodForTP == "RiskAwardRatio" or setMethodForTP == "Fibonacci"

strategy.exit("TP/SL" + str.tostring(bar_index), entryId_, stop=minl, limit=takeProfitLong)

else if setMethodForTP == "LookBackCandles"

strategy.exit("TP/SL" + str.tostring(bar_index), entryId_, stop=minl)

array.push(slPerEntry, minl)

array.remove(trendline, i)

array.remove(distance, i)

array.remove(stepY, i)

array.remove(startPointX, i)

array.remove(startPointY, i)

i := i + 1

exitLongCondition = false

exitShortCondition = false

if sourceForTP == "Close"

exitLongCondition := close == ta.lowest(close, lookBackCandles+1) and open > close

exitShortCondition := close == ta.highest(close, lookBackCandles+1) and open < close

else

exitLongCondition := low == ta.lowest(low, lookBackCandles+1) and open > close

exitShortCondition := high == ta.highest(high, lookBackCandles+1) and open < close

if setMethodForTP == "LookBackCandles"

if (strategy.position_size > 0 and exitLongCondition) or (strategy.position_size < 0 and exitShortCondition)

strategy.close_all()

array.clear(entryId)

array.clear(slPerEntry)

array.clear(fibLevel)

array.clear(isFibTriggered)

if setMethodForTP == "Fibonacci"

i := 0

for isTrig in isFibTriggered

if isTrig > 0 and close < isTrig and open < isTrig

strategy.close_all()

array.clear(entryId)

array.clear(slPerEntry)

array.clear(fibLevel)

array.clear(isFibTriggered)

i := i + 1

i := 0

for fib in fibLevel

a = str.split(fib, ",")

if array.size(a) > 0

for k = 0 to array.size(a) - 1

if close > str.tonumber(array.get(a, k)) and array.get(isFibTriggered, i) < str.tonumber(array.get(a, k))

array.set(isFibTriggered, i, str.tonumber(array.get(a, k)))

i := i + 1

i := 0

if enabledTrailing

for slPerEntry_ in slPerEntry

if plsl > slPerEntry_ and close < plsl

strategy.close(array.get(entryId, i))

array.remove(entryId, i)

array.remove(slPerEntry, i)

array.remove(fibLevel , i)

array.remove(isFibTriggered, i)

i := i + 1

if na(t) and enabledSession

strategy.close_all()

array.clear(entryId)

array.clear(slPerEntry)

array.clear(fibLevel)

array.clear(isFibTriggered)

// ------------- Single-trend mode -------------

else

var line line1 = na

var hvalid = false

var distanceh = 0

var steph = 0.

var startLineXPointh = 0

var startLineYPointh = 0.

if not na(ph) and phh < phh[1] and not hvalid

distanceh := bar_index - phbar[1]

steph := (phh[1] - phh) / (phbar - phbar[1])

y = phh[1] - steph * (bar_index - phbar[1])

line1 := line.new(phbar[1], phh[1], bar_index, y, xloc = xloc.bar_index)

startLineXPointh := phbar[1]

startLineYPointh := phh[1]

n = 0

for int i = 0 to distanceh

pricen = line.get_price(line1, bar_index - i)

if high[i] > pricen

n := n + 1

else

if (pricen - high[i]) < ((high[i] - low[i]) * valid / 100)

n := n + 1

hvalid := n >= touchNum ? true : false

if enablePivotToCheck

hvalid := hvalid and (pphbar[bar_index - phbar] < phbar and pphbar[bar_index - phbar] > phbar[1]) ? true : false

else

distanceh := distanceh[1]

steph := steph[1]

startLineXPointh := startLineXPointh[1]

startLineYPointh := startLineYPointh[1]

hvalid := hvalid[1]

var entryIndexh = 0

var entrySl = 0.

var fibLevel = ""

var isFibTriggered = 0.

if hvalid

y2 = startLineYPointh - steph * (bar_index - startLineXPointh)

line.set_xy2(line1, bar_index, y2)

if close > y2 and ((timeframe.isintraday and time == t and enabledSession) or not timeframe.isintraday or not enabledSession)

if strategy.opentrades <= posNum

j = 0

minl = plsl

while close < plsl[j]

j := j + 1

minl := plsl[j]

if j == 1000

minl := low

break

minl := offsetForSL > 0 ? minl - offsetForSL : minl

minl := low > minl ? minl : low

qtyLong = math.floor((riskAmount / math.abs(close - minl)) / syminfo.pointvalue)

if (not EnableContractSizeByDefault and qtyLong <= 1) or qtyLong < 0

qtyLong := 0

else if EnableContractSizeByDefault and qtyLong <= 1

qtyLong := 1

takeProfitLong = close + (close - minl) * riskAwardRatio

strategy.entry("long"+str.tostring(bar_index), strategy.long, qtyLong)

entrySl := minl

line3 = line.new(x1=bar_index, y1=minl, x2=bar_index + 10, y2=minl, color=color.red, width=2)

entryIndexh := bar_index

if setMethodForTP == "Fibonacci"

k = 1

q = phFib

while close > phFib[k]

k := k + 1

q := phFib[k]

if k == 1000

q := close

break

l1 = (q - minl) * fibLevel1 + minl

l2 = (q - minl) * fibLevel2 + minl

l3 = (q - minl) * fibLevel3 + minl

l4 = (q - minl) * fibLevel4 + minl

fl1 = line.new(x1=bar_index, y1=l1, x2=bar_index + 10, y2=l1, color=color.green, width=2)

fl2 = line.new(x1=bar_index, y1=l2, x2=bar_index + 10, y2=l2, color=color.green, width=2)

fl3 = line.new(x1=bar_index, y1=l3, x2=bar_index + 10, y2=l3, color=color.green, width=2)

fl4 = line.new(x1=bar_index, y1=l4, x2=bar_index + 10, y2=l4, color=color.green, width=2)

fibLevel := str.tostring(l1) + "," + str.tostring(l2) + "," + str.tostring(l3) + "," + str.tostring(l4)

isFibTriggered := 0.

if enabledSL

if setMethodForTP == "RiskAwardRatio" or setMethodForTP =="Fibonacci"

strategy.exit("TP/SL" + str.tostring(bar_index), "long"+str.tostring(bar_index), stop=minl, limit=takeProfitLong)

else if setMethodForTP == "LookBackCandles"

strategy.exit("TP/SL" + str.tostring(bar_index), "long"+str.tostring(bar_index), stop=minl)

hvalid := false

exitLongCondition = false

exitShortCondition = false

if sourceForTP == "Close"

exitLongCondition := close == ta.lowest(close, lookBackCandles+1) and open > close

exitShortCondition := close == ta.highest(close, lookBackCandles+1) and open < close

else

exitLongCondition := low == ta.lowest(low, lookBackCandles+1) and open > close

exitShortCondition := high == ta.highest(high, lookBackCandles+1) and open < close

if setMethodForTP == "LookBackCandles" and bar_index > entryIndexh

if (strategy.position_size > 0 and exitLongCondition)

strategy.close_all()

if (strategy.position_size < 0 and exitShortCondition)

strategy.close_all()

if setMethodForTP == "Fibonacci"

if close < isFibTriggered and open < isFibTriggered

strategy.close_all()

a = str.split(fibLevel, ",")

if array.size(a) > 0

for k = 0 to array.size(a) - 1

if close > str.tonumber(array.get(a, k)) and isFibTriggered < str.tonumber(array.get(a, k))

isFibTriggered := str.tonumber(array.get(a, k))

if enabledTrailing

if plsl > entrySl and close < plsl

strategy.close_all()

if na(t) and enabledSession

strategy.close_all()

Automate It with PickMyTrade

Backtesting is great. Automation is better.

Because this is written as a TradingView strategy, you can:

- Turn it into alerts

- Use PickMyTrade to convert those alerts into live orders on your broker

Typical workflow:

- Add the strategy to your chart and adjust settings (risk, TP method, time window).

- In TradingView, create an alert based on “strategy order fills”.

- Point the alert to your PickMyTrade webhook URL.

- In PickMyTrade, map that alert to:

- Your broker & symbol

- Order type, quantity mode, etc.

From there:

- Every trendline breakout the strategy takes on TradingView becomes a live trade on your broker.

- Stops and targets are pre-defined in the script.

- You’re no longer glued to the screen waiting for the perfect breakout candle.

(Always start on demo / paper trading first.)

Final Thoughts & Disclaimers

We’ve taken a smart, open-source trendline concept by @crazyrabbitheart and wrapped it into a risk-controlled, automation-ready TradingView strategy that:

- Waits for confirmed multi-touch trendlines

- Enters only when price decisively breaks out

- Sizes positions by fixed dollar risk

- Manages exits with R:R, lookback, or Fibonacci

- Plays well across stocks, crypto, FX and futures

Still, the usual reminders apply:

- Backtests are historical, not guarantees.

- Live execution includes slippage, commissions, and human error.

- Markets evolve – no strategy works in every condition forever.

Use it as a framework, not a magic box:

- Risk 1–2% per trade

- Test per market and timeframe

- Demo first, real money later

You may also like:

UT Bot Indicators: Futures Trading Strategy

TradingView Alert Enhancement: Tools & Indicators