Trading supply and demand zones is a proven way to improve your entries and risk management. When paired with Tradovate chart, you gain the tools needed for fast, efficient, and confident decision-making — especially when using automated futures trading systems.

This guide will show you how to combine chart setup, Tradovate margin settings, and entry/exit strategies to master supply and demand zones like a pro.

Demand Zone Trading Using Tradovate App

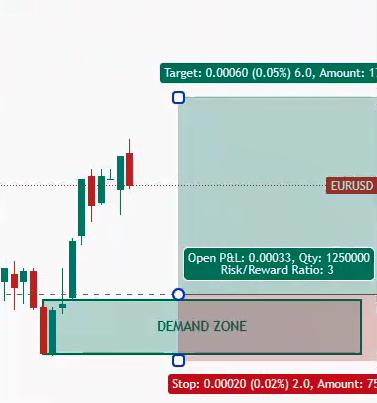

To trade long from a demand zone:

- Mark Your Demand Zone on Tradovate Chart

Use the Tradovate app chart or web platform to identify price zones where demand caused previous reversals. - Adjust Chart Settings

You can customize Tradovate settings to enhance visibility—change timeframes, overlays, or even adjust Tradovate candle colors for better clarity. - Set Entry & Stop-Loss

- Entry: Slightly above the demand zone

- Stop-loss: Below the zone

- Take profit: Use a 2:1 or 3:1 risk-reward ratio

- Use TradingView with Tradovate

Want to trade from TradingView? Yes — you can allow TradingView on Tradovate by enabling API connectivity via third-party tools like ProjectX or PickMyTrade.io.

Supply Zone Strategy with Tradovate Chart Trading

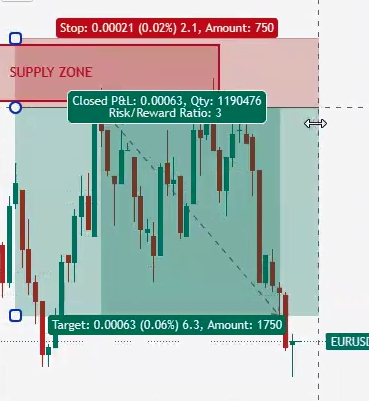

Supply zones help you short the market where selling pressure is high.

Steps:

- Identify a Supply Zone

Look for sharp reversals down — use Tradovate trading tools to draw your zones. - Set Up the Trade

- Entry: Below the supply zone

- Stop-loss: Above the zone

- TP: Defined by previous support or reward ratio

- Automate Execution

Want to automate this setup? Tools like PickMyTrade connect directly with Tradovate app charts to automate order execution based on TradingView signals.

Chart Settings and Technical Features to Know

Tradovate charts are highly customizable. Here’s what traders frequently look for:

- Tradovate not showing chart? Clear cache, reset the chart layout, or reconnect your data feed.

- Footprint charts on Tradovate? Currently, Tradovate does not natively offer footprint charts, but integrations like Jigsaw or Sierra Chart can help.

- Sierra Chart + Tradovate: Use Rithmic or CQG data feed for connecting with external platforms like Sierra Chart.

- Customizing Your Workspace

Modify Tradovate candle colors and indicators in the chart settings panel to align with your personal strategy and visual preferences.

Tradovate Margins & Risk Management

Before placing trades, always check Tradovate margins for your chosen instrument (e.g., micros, minis, crude oil, indices). Use their margin calculator or refer to contract specifications in the account dashboard.

Use stop-loss and take-profit placements that reflect your capital and position size — especially when trading on leverage.

Automate Your Supply & Demand Strategy

For traders who want more precision and speed, automated futures trading is a game changer. Here’s how:

- Create your zones on TradingView charts

- Send alerts via webhook to PickMyTrade

- Execute trades instantly on Tradovate trading platform

This setup lets you turn a manual process into a systemized strategy that works 24/7 without emotional bias.

Final Thoughts

Combining supply and demand zone strategies with Tradovate, custom chart settings, and automated trading tools gives you the confidence to trade like a pro. Whether you’re analyzing margins, tweaking visuals, or placing trades directly from TradingView — Tradovate offers everything you need to stay ahead.

Also checkout: Automate TradingView Indicators with Tradovate Using PickMyTrade