What if you could make over $3,000 in just 3 days — without manually placing trades? That’s exactly what I did using a Tradovate futures strategy powered by the SuperTrend indicator, automated through PickMyTrade and TradingView.

In this post, I’ll break down:

- How the SuperTrend strategy works on Nasdaq E-mini futures (NQ)

- Step-by-step automation with TradingView → PickMyTrade → Tradovate

- Real 3-day performance results (+$3,118 profit)

- Compliance documents required for posting futures content on YouTube with Tradovate

What is the Tradovate Futures SuperTrend Strategy?

The SuperTrend strategy is a trend-following system widely used on futures markets like Nasdaq (NQU5). On a 15-minute chart:

- Green = bullish → Buy signal

- Red = bearish → Sell signal

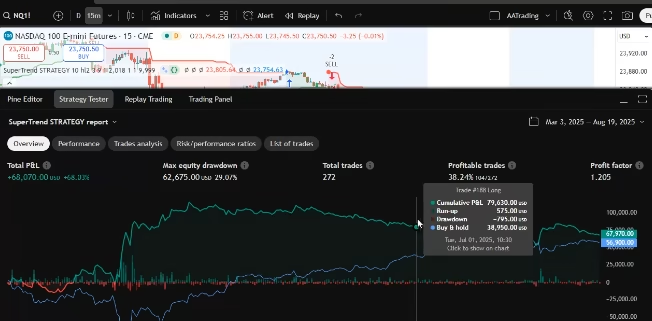

Backtesting (Mar 3 – Aug 19, 2025) showed:

- 272 trades executed

- 38.24% win rate

- Profit factor: 1.2

- Net profit: +$68,070 (68% growth from $100k)

- Max drawdown: 29% ($62k)

The edge lies not in high accuracy, but in letting winners run bigger than losers.

Automating a Tradovate Futures Strategy with PickMyTrade

Instead of manually reacting to every SuperTrend flip, I automated execution using PickMyTrade. Here’s how:

- Generate Alert in PickMyTrade → choose SuperTrend strategy on NQ1!

- Risk Settings: Stop-loss fixed at 1% of entry price

- Account Linking: Connected to Tradovate demo, quantity multiplier = 1

- Copy/Paste Alert Code into TradingView alert message

- Webhook URL from PickMyTrade → pasted into TradingView alert settings

- Alerts instantly sent orders to Tradovate, fully hands-free

Every buy/sell signal from TradingView was executed in real time inside my Tradovate account.

Results: +$3,118 Profit in Just 3 Days From Automation of Tradovate Futures Strategy

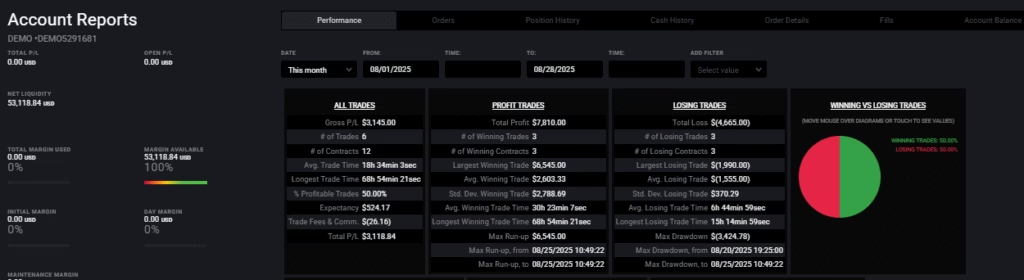

From Aug 20 – Aug 25, 2025, the automation ran live. The Tradovate futures strategy results were:

- Total P&L: +$3,118.84

- 6 trades (3 winners, 3 losers)

- Win rate: 50%

- Avg. Winning Trade: $2,603

- Avg. Losing Trade: -$1,555

- Largest Win: $6,545

- Largest Loss: -$1,990

Even at 50% accuracy, the average profit outweighed average loss, thanks to the fixed stop-loss and SuperTrend trend-following.

Orders were confirmed in the Orders Report, showing execution on NQU5 contracts across Aug 20–25, 2025.

Managing Risk in Futures Trading

Trading futures carries significant risk, but automation + discipline helps:

- Fixed 1% stop-loss per trade kept losses capped

- Winners were allowed to run based on strategy signals

- Max drawdown during the test: -$3,424

Next test: tighten stop-loss to 0.5% and compare. Could this reduce drawdowns further and improve consistency?

Final Thoughts: Try It Yourself

That’s how I built and automated a Tradovate futures strategy with SuperTrend on TradingView + PickMyTrade:

- Fully automated execution → Tradovate

- $3,118 profit in 3 demo days

- Edge comes from bigger wins than losses, not accuracy

Want to test it yourself? Sign up for a 5-day free demo trial on PickMyTrade and run your own strategies on Tradovate.

Click here and start your free demo trial

Key Takeaways

- Tradovate futures strategies can be automated with TradingView + PickMyTrade

- SuperTrend is simple yet profitable when managed with strict stop-loss

- Risk management > accuracy for consistent profits

Proof Documents:

Disclaimer:

The information shared in this blog is for educational and informational purposes only and should not be considered financial or investment advice. Futures trading involves substantial risk and is not suitable for all investors. You may lose more than your initial investment. The performance results and reports shown here are based on a demo trading account and do not reflect live trading with real funds. Past performance is not indicative of future results. Always conduct your own research, use proper risk management, and consult with a licensed financial advisor before making trading decisions.