In this comprehensive tutorial, we will explore the powerful Tradingview to Tradovate integration, enabling you to manage multiple accounts seamlessly. Discover how to utilize the Trade Copier feature to automate your trading process and enhance your trading efficiency.

Table of Contents

- Step 1: Understanding the Trade Copier Feature

- Step 2: Setting Up Your Trading Accounts

- Step 3: Configuring Risk Percentage and Quantity Multiplier

- Step 4: Adding Multiple Accounts for Trade Copying

- Step 7: Executing Buy, Sell, and Close Trades

- Step 8: Troubleshooting Common Issues

- Step 9: Continuous Usage of PickMyTrade

- Step 10: Additional Resources and Links

- FAQ: Common Questions About Tradingview to Tradovate Integration

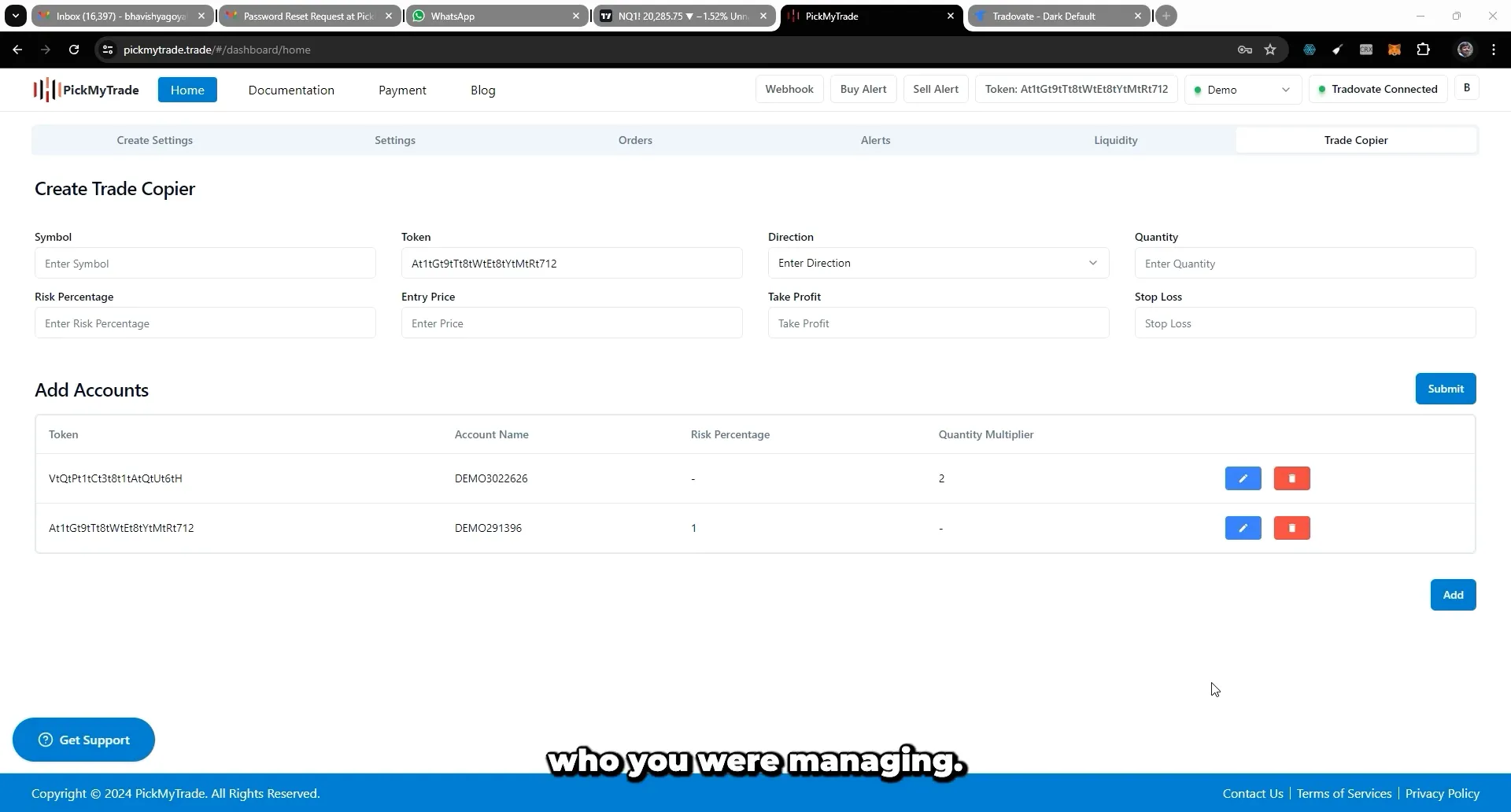

Step 1: Understanding the Trade Copier Feature

The Trade Copier feature is a revolutionary tool that allows you to manage multiple trading accounts from a single interface. Whether you’re handling accounts for friends, clients, or personal use across various platforms, this feature ensures seamless trade execution across all managed accounts. Its uniqueness lies in its ability to operate from TradingView, providing unparalleled control and efficiency.

Key Benefits of the Trade Copier

- Centralized Management: Execute trades across multiple accounts simultaneously, saving time and reducing errors.

- Platform Flexibility: Integrate with different trading platforms, ensuring compatibility and ease of use.

- Customization Options: Tailor trade settings to match individual account requirements, such as risk percentage and quantity multipliers.

Step 2: Setting Up Your Trading Accounts

Before initiating trades, it’s crucial to set up your trading accounts correctly. This involves adding all the accounts you wish to manage and specifying the particular settings for each. Let’s delve into the detailed process of setting up these accounts.

Adding and Managing Accounts

To begin, you need to add the accounts you want to manage. This setup is straightforward: enter the account details and configure them according to your trading strategy. You can add as many accounts as needed, ensuring you have the flexibility to manage multiple portfolios.

Once the accounts are added, you can adjust the settings for each account. This includes setting the risk percentage and quantity multiplier, which are vital for customizing your trading approach.

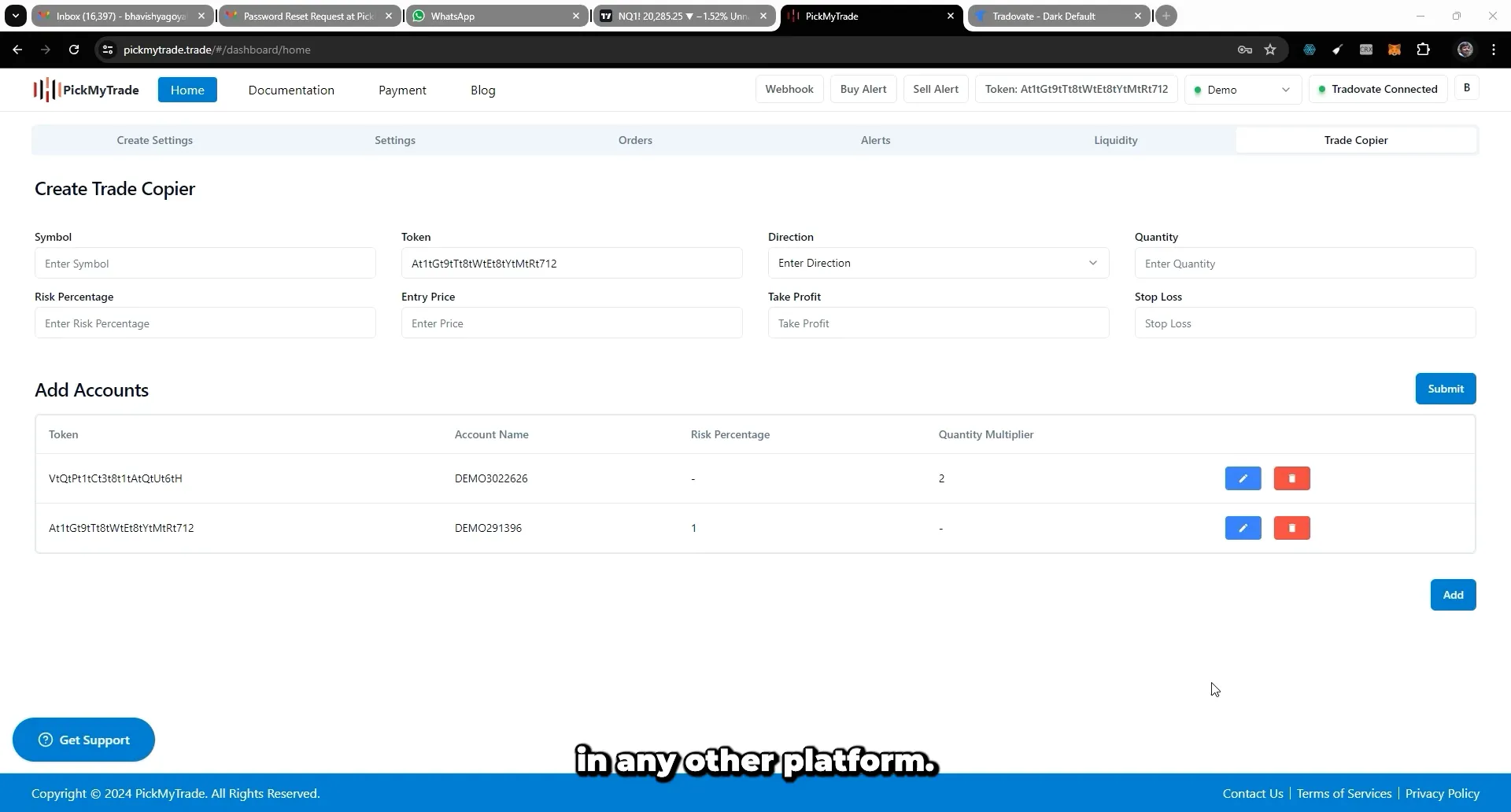

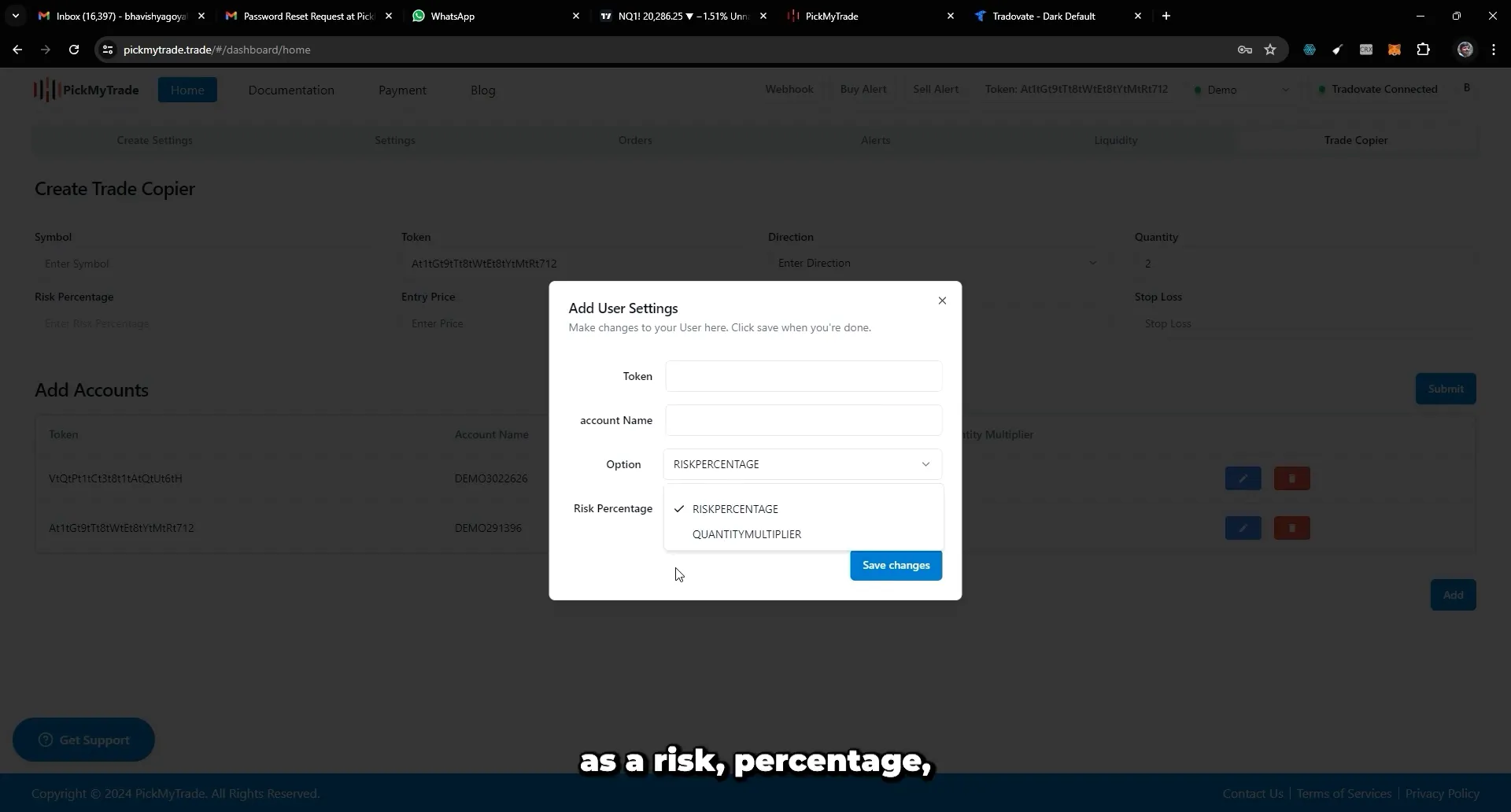

Configuring Risk Percentage and Quantity Multiplier

Risk management is a cornerstone of successful trading. The Trade Copier allows you to set a specific risk percentage for each account, giving you control over how much of the account’s capital is risked per trade.

The quantity multiplier further enhances this customization by allowing you to determine how trade quantities are adjusted based on your initial inputs. By setting these parameters, you ensure that each account is aligned with its unique risk profile and trading objectives.

Step 3: Configuring Risk Percentage and Quantity Multiplier

Fine-tuning your risk management settings is essential to align with your overall trading strategy. Both risk percentage and quantity multiplier play crucial roles in this adjustment.

How to Set Risk Percentage

Setting the risk percentage involves specifying what portion of your account’s balance is at risk for each trade. This setting is crucial for maintaining a disciplined approach to trading, as it prevents overexposure to market volatility.

You can set different risk percentages for each account based on its specific requirements. For instance, more conservative accounts might have a lower risk percentage, while more aggressive strategies might allow for higher risk.

Utilizing the Quantity Multiplier

The quantity multiplier is a powerful tool that allows you to scale your trades efficiently. By setting a multiplier, you can automatically adjust the size of your trades based on your initial input, ensuring consistency across your accounts.

This feature is particularly useful when managing multiple accounts with varying balances, as it helps maintain proportional trade sizes relative to each account’s equity.

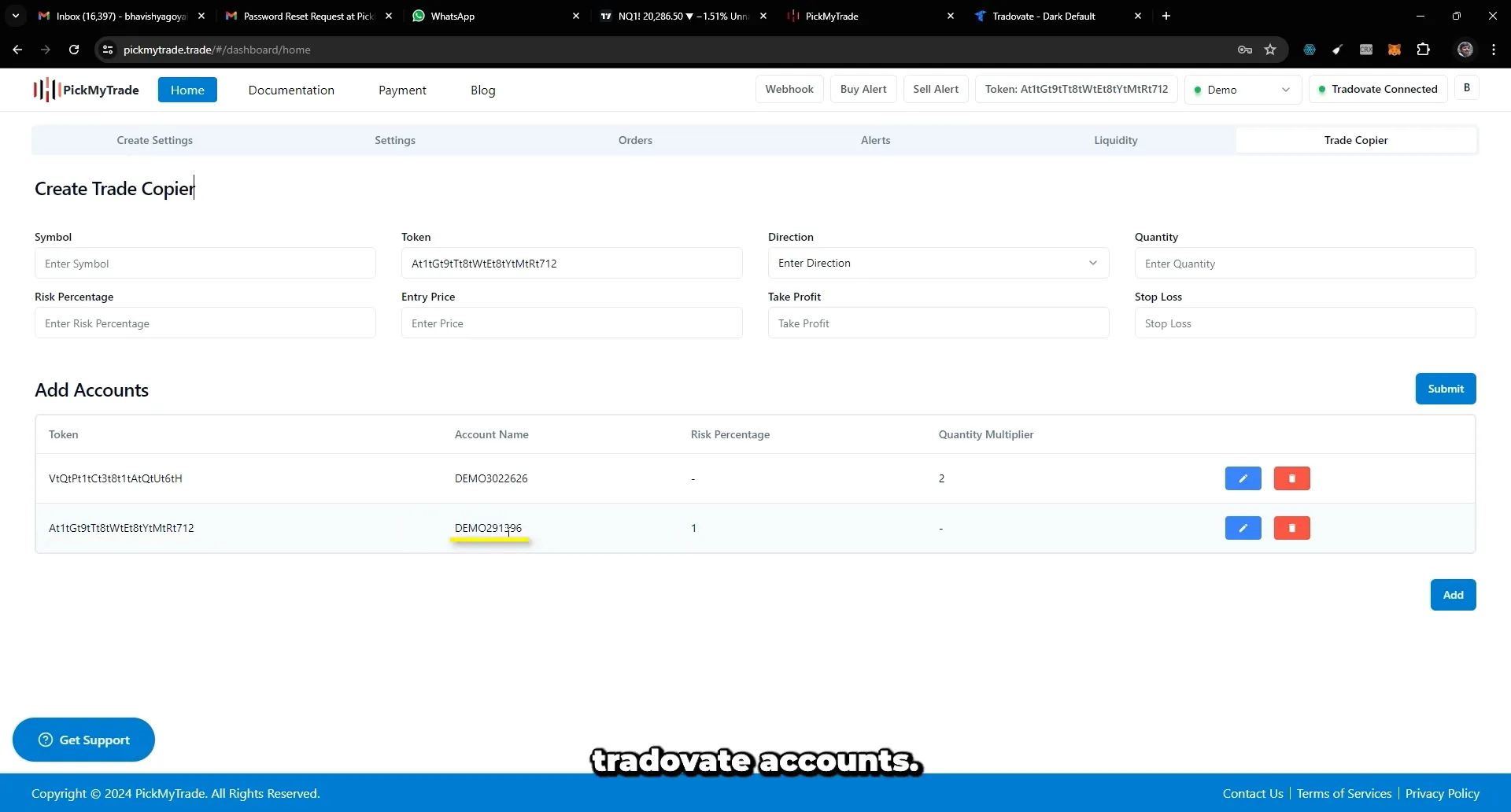

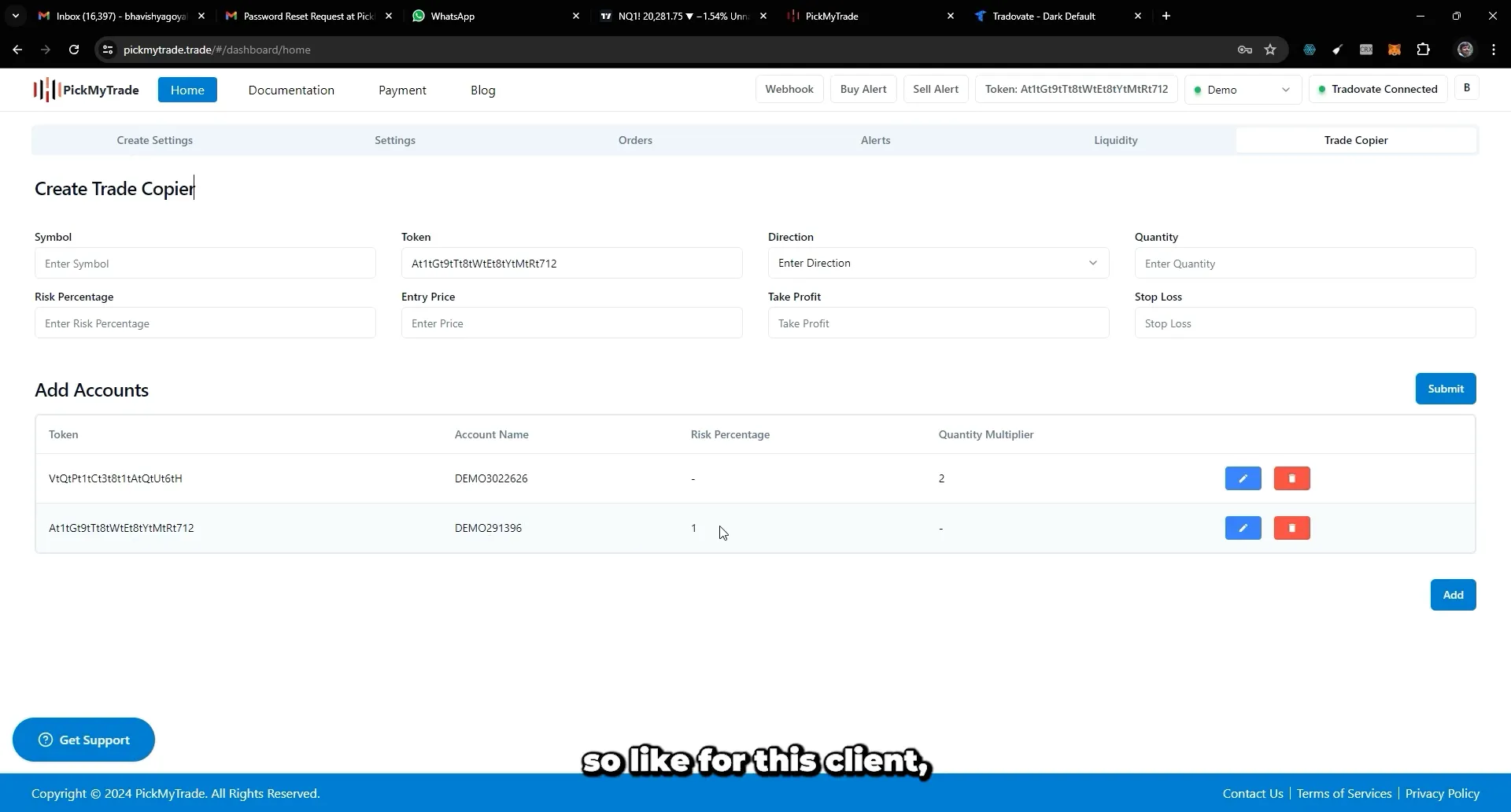

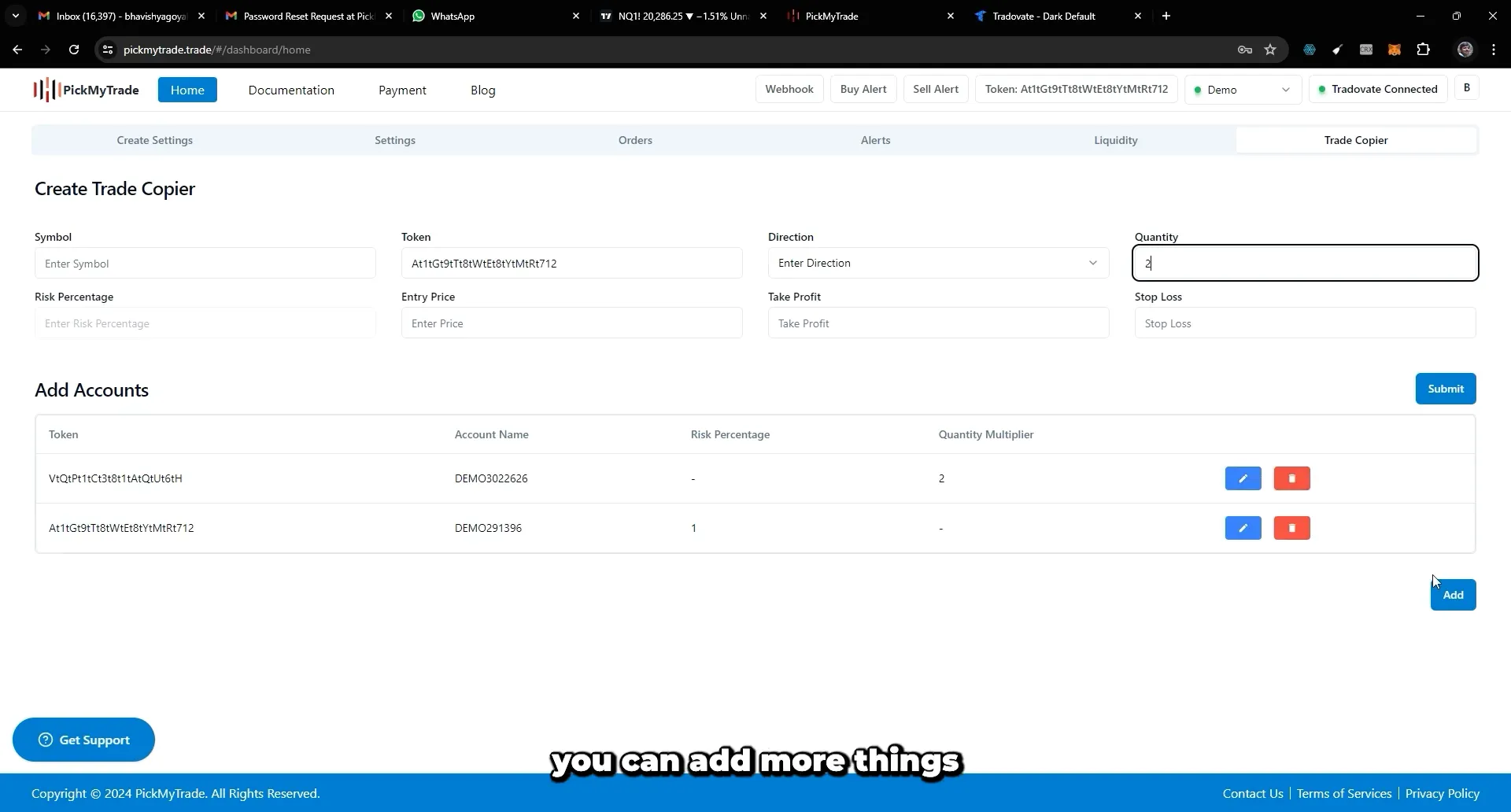

Step 4: Adding Multiple Accounts for Trade Copying

With your risk and quantity settings configured, the next step is to add multiple accounts for trade copying. This process ensures that all your trades are executed simultaneously across all selected accounts, maintaining consistency in your trading strategy.

Steps to Add Accounts

- Access the account management section of the Trade Copier feature.

- Input the account details for each platform you wish to manage.

- Specify whether the account will use risk percentage or quantity multiplier settings.

- Save the configuration to ensure all accounts are ready for trade copying.

Once the accounts are added, you can monitor their performance and make adjustments as needed. The Trade Copier’s flexibility allows you to seamlessly manage and execute trades across your entire portfolio.

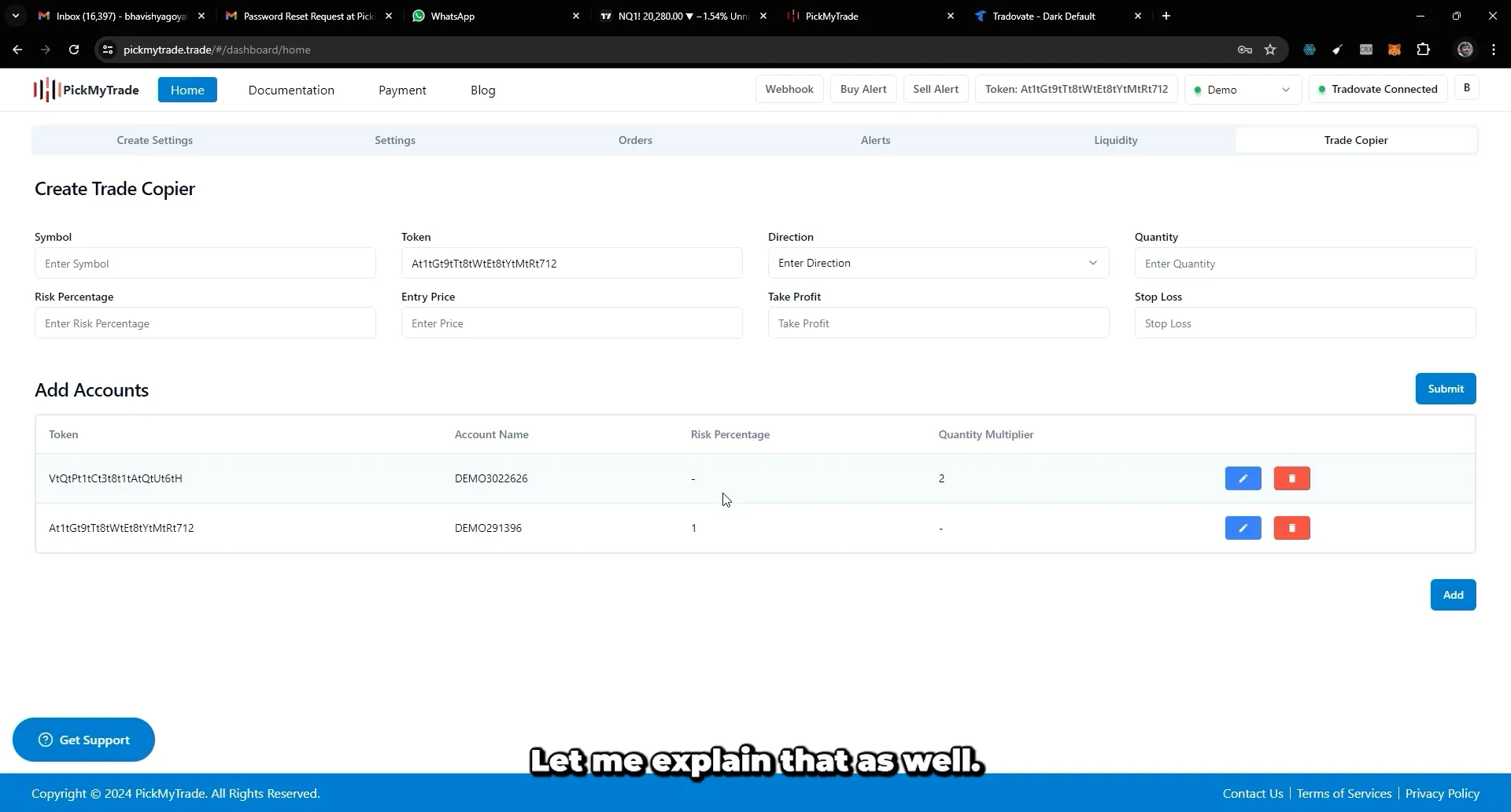

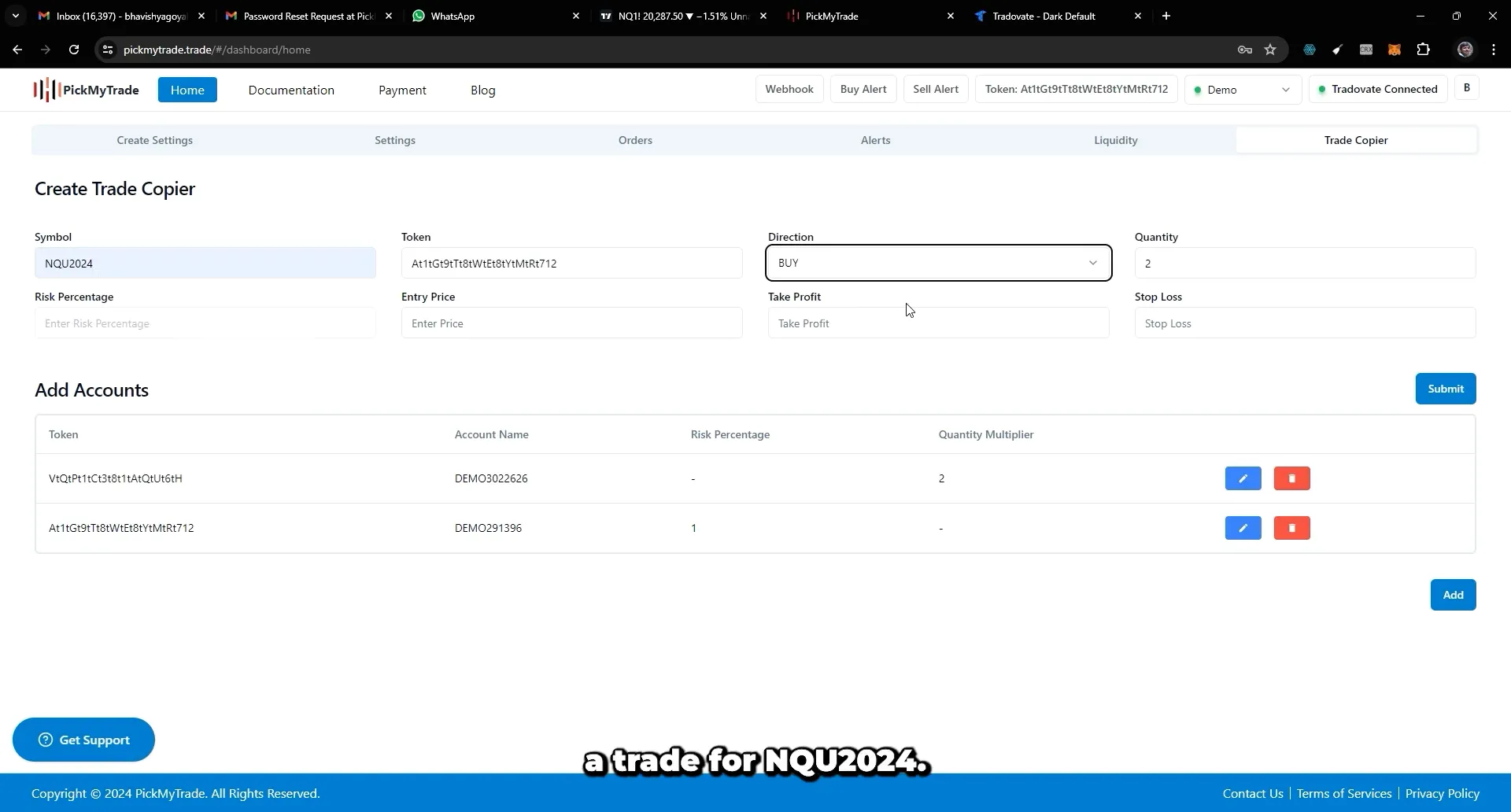

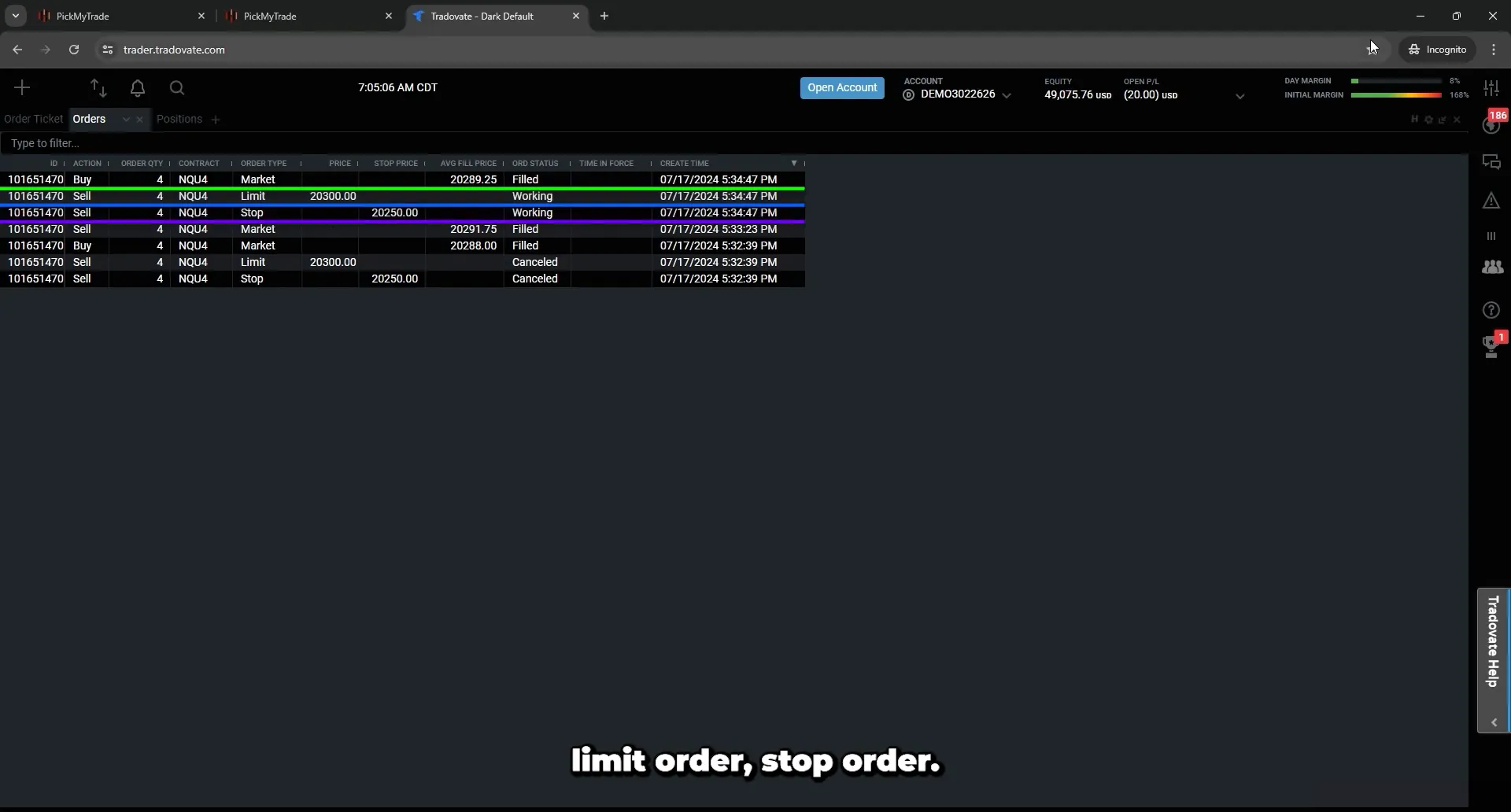

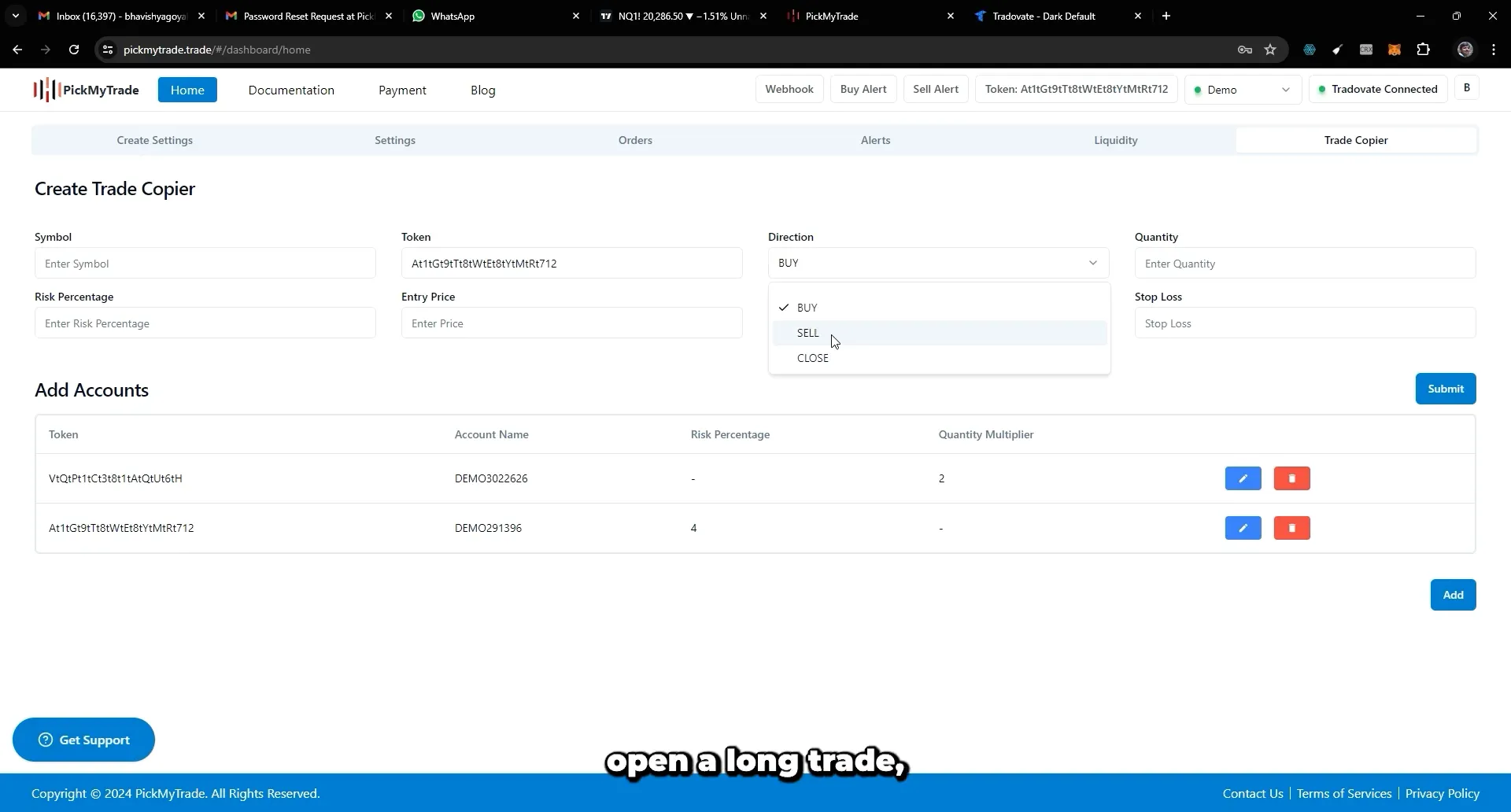

Step 7: Executing Buy, Sell, and Close Trades

Once you’ve set up your trading accounts and configured the risk and quantity settings, it’s time to execute trades. The Tradingview to Tradovate Integration simplifies this process, allowing you to easily place buy, sell, or close orders across all managed accounts.

Placing a Buy Trade

To initiate a buy trade, select the desired trading instrument and enter the necessary parameters such as entry price, take profit, and stop loss. This ensures that your trade aligns with your trading strategy and risk management plan.

Once all details are confirmed, submit the order. The Trade Copier will automatically replicate this trade across all selected accounts, maintaining consistency and efficiency.

Executing a Sell Trade

Executing a sell trade follows a similar process. Choose the instrument, set your entry and exit parameters, and submit the order. This feature is particularly useful for traders employing short-selling strategies or looking to hedge positions.

Closing Existing Trades

If you need to close an open position, the Trade Copier allows you to do so with ease. Simply select the trade you wish to close and confirm the action. This is ideal for traders who want to lock in profits or minimize losses quickly.

Step 8: Troubleshooting Common Issues

Even with a robust system like Tradingview to Tradovate Integration, you might encounter issues. Here are some common problems and how to address them:

Connection Issues

If you’re experiencing connectivity problems, first ensure that your internet connection is stable. Restarting the Trade Copier application and checking for any software updates can also help resolve these issues.

Incorrect Trade Replication

Should you notice discrepancies in trade replication, verify that all account settings are correctly configured. Double-check the risk percentage and quantity multiplier settings for each account to ensure they align with your strategy.

Order Execution Delays

In case of order execution delays, consider optimizing your network settings or contacting support for assistance. Ensure that your system meets the necessary technical requirements for smooth operation.

Step 9: Continuous Usage of PickMyTrade

To get the most out of PickMyTrade, it’s important to integrate it seamlessly into your daily trading routine. Regularly review your account settings and trade performance to identify areas for improvement.

Monitoring Trade Performance

Keep a close eye on the performance of your trades across all accounts. Utilize the reporting features of the Trade Copier to analyze trends and make data-driven decisions.

Adjusting Strategies as Needed

The trading landscape is dynamic, and so should be your strategies. Be prepared to adjust your risk management settings and trading parameters in response to market changes.

Step 10: Additional Resources and Links

For further learning and support, explore these additional resources:

- Tutorials: Access a range of tutorials on using the Trade Copier effectively.

- Community Forums: Join discussions with other traders to share insights and strategies.

- Customer Support: Reach out to the support team for any technical assistance or queries.

FAQ: Common Questions About Tradingview to Tradovate Integration

Here are some frequently asked questions regarding the integration:

How do I ensure my trades are executed accurately?

Double-check all account settings and parameters before executing trades. Regularly monitor trade performance to catch any discrepancies early.

Can I manage accounts on different platforms with this integration?

Yes, the Tradingview to Tradovate Integration allows you to manage multiple accounts across different platforms, providing you with flexibility and control.

What should I do if I encounter a technical issue?

First, troubleshoot common issues as outlined in Step 8. If the problem persists, contact customer support for further assistance.

PickMyTrade specializes in automating trading bots, enabling seamless strategy execution for futures from platforms like TradingView, across well-known brokers such as Tradovate.

PickMyTrade

PickMyTrade specializes in automating trading bots, enabling seamless strategy execution for futures from platforms like TradingView, across well-known brokers such as Tradovate.

Top crypto influencers