TradingView Paper Trading has become one of the most powerful risk-free environments for learning, testing, and mastering trading strategies in 2025. With upgrades like extended trading hours, full futures contract lifecycle simulation, and customizable commissions and leverage, TradingView’s simulator now mirrors real market behavior more closely than ever. Whether you’re refining indicators, optimizing algorithms, or preparing for live execution, this guide will show you how to unlock the full potential of TradingView Paper Trading.

Key Benefits at a Glance

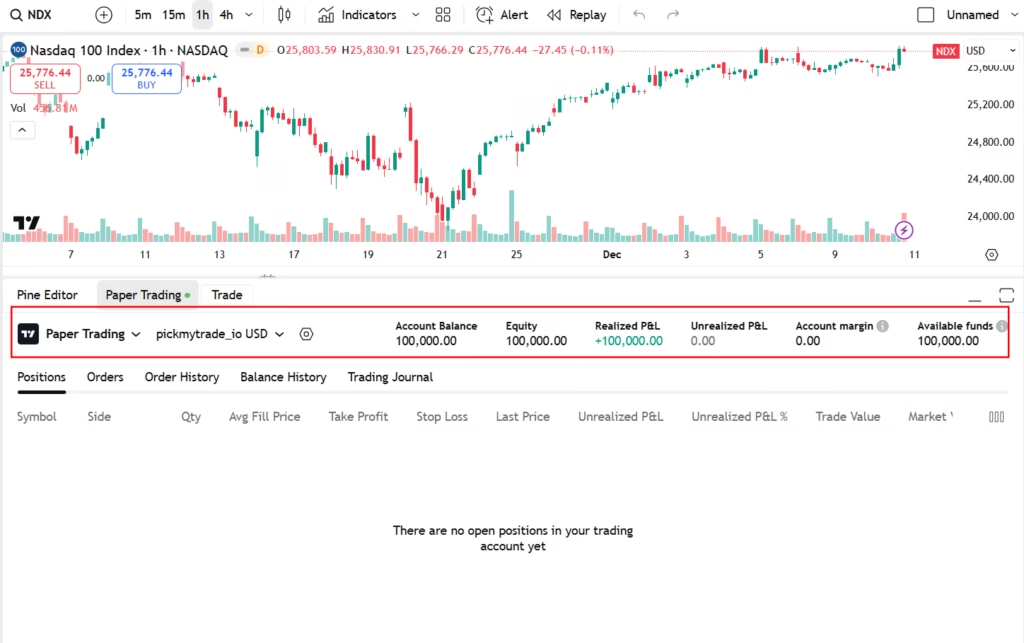

- Zero Risk Practice: Start with $100,000 in virtual funds to experiment freely across stocks, forex, crypto, futures, and more.

- Real-Time Realism: Uses live data feeds with customizable commissions, leverage, and order types to mirror live markets closely.

- 2025 Updates: Now supports pre-market/after-hours trading and complete futures expiration handling for deeper strategy testing.

Quick Setup Guide

- Log into TradingView and open a chart.

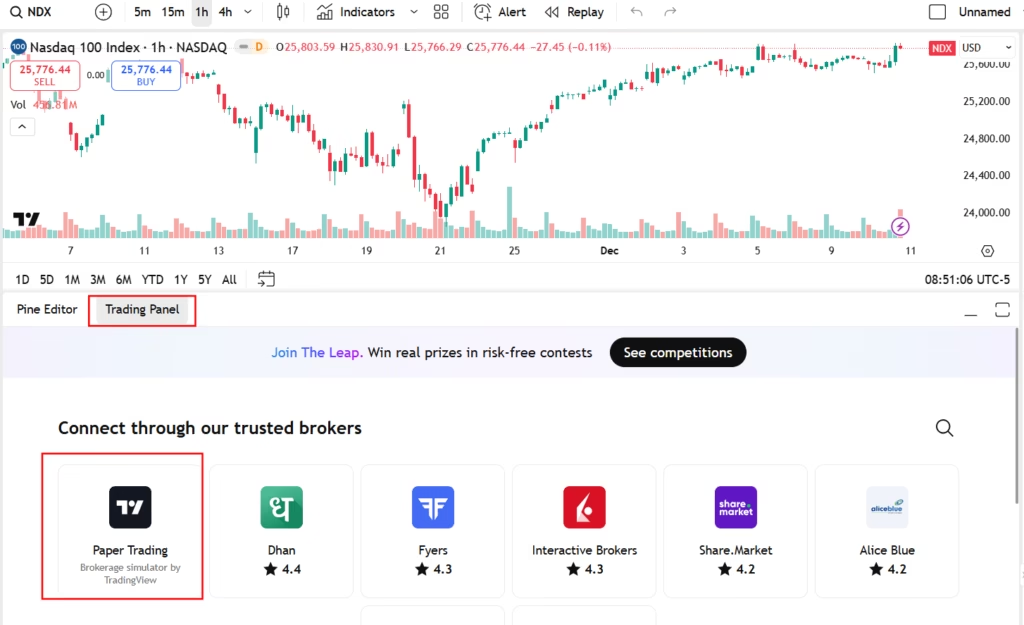

- Access the Trading Panel at the bottom and select “Paper Trading.”

- Adjust your starting balance, currency, and settings via the gear icon for personalized simulations.

Essential Order Types

Practice with core tools like market orders for instant execution, limit orders for price targets, and stop orders for risk control—now enhanced for futures with automatic settlements.

Why It Matters for Beginners and Pros

Build confidence, analyze performance metrics like P&L and drawdowns, and prepare for live trading. It’s especially valuable in volatile 2025 markets influenced by AI-driven assets and global events.

For seamless automation of your tested strategies, PickMyTrade bridges the gap with direct integrations to brokers like Alpaca and Interactive Brokers—try our free 7-day trial to go from simulation to execution effortlessly.

Unlocking the Full Potential of TradingView Paper Trading: A Comprehensive 2025 Guide for Aspiring and Seasoned Traders

In the fast-evolving world of financial markets, where volatility from geopolitical shifts, AI integrations, and cryptocurrency surges defines daily trading, honing your edge without exposure to losses is paramount. Enter TradingView Paper Trading—a powerhouse simulator that’s evolved significantly in 2025 to deliver an even more immersive, data-driven practice arena. This isn’t just demo trading; it’s a strategic sandbox powered by real-time feeds, advanced order mechanics, and now, full-spectrum futures handling that replicates the highs and lows of live execution. Whether you’re a novice charting your first candlestick or a quant refining algorithmic edges, this tool equips you to iterate, validate, and dominate.

At PickMyTrade, we specialize in transforming these simulated insights into automated, live-market realities. Our platform connects effortlessly with TradingView via webhooks, enabling one-click deployment of your Pine Script strategies to brokers like Alpaca, TradeStation, and Interactive Brokers. But before we dive into that synergy, let’s unpack everything you need to know about TradingView’s Paper Trading as of December 2025—updated with the latest enhancements for a truly forward-looking approach.

The Core of TradingView Paper Trading: What It Is and Why It Stands Out

At its heart, TradingView Paper Trading is a no-deposit, no-risk simulator that lets you buy, sell, and manage positions using virtual funds in conditions that echo live markets. Launched as a foundational feature, it has matured into a robust ecosystem supporting over 20 asset classes, from equities and forex to commodities, indices, and cryptocurrencies. You begin with a default $100,000 USD balance, but customization is key: tweak currencies (fiat or crypto options available), leverage ratios (e.g., 1:1 for stocks, up to 50:1 for forex), and even commission structures to align with your real-world setup.

What sets it apart in 2025? Recent upgrades emphasize realism and depth. For instance, the January update introduced extended trading hours, allowing limit orders during pre-market and after-hours sessions for symbols like major U.S. stocks—critical for testing strategies around earnings announcements or overnight news. Then, in August, futures trading got a massive overhaul: now, you can simulate the entire contract lifecycle, from entry and rollover to expiration settlement at the final price, complete with fee deductions and automatic position closures. This means no more manual cleanups or guesswork—your P&L reflects true performance, including margin impacts and balance adjustments. These tweaks make it indispensable for futures traders navigating 2025’s choppy energy and index contracts amid global supply chain flux.

The platform’s integration with TradingView’s Supercharts amplifies this: drag-and-drop order modifications, Depth of Market (DOM) views, and seamless Pine Script backtesting let you visualize and execute ideas on the fly. Plus, export your trade history as CSV for external analysis—perfect for quants building portfolios in tools like Python or Excel.

Step-by-Step: Setting Up and Customizing Your Paper Trading Arena

Getting started is straightforward, ensuring even beginners can jump in within minutes. Here’s the updated 2025 workflow:

- Account Access: Log into your TradingView account (free tier suffices for basics; Premium unlocks multi-chart views and deeper alerts).

- Launch the Panel: On any chart, scroll to the bottom Trading Panel and click the “Paper Trading” icon. Hit “Connect” to activate your $100,000 virtual wallet is ready.

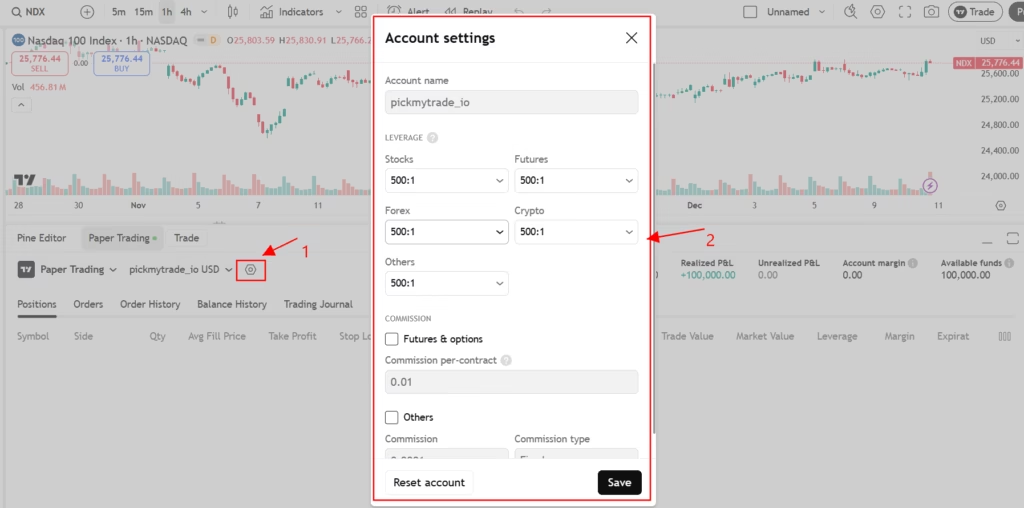

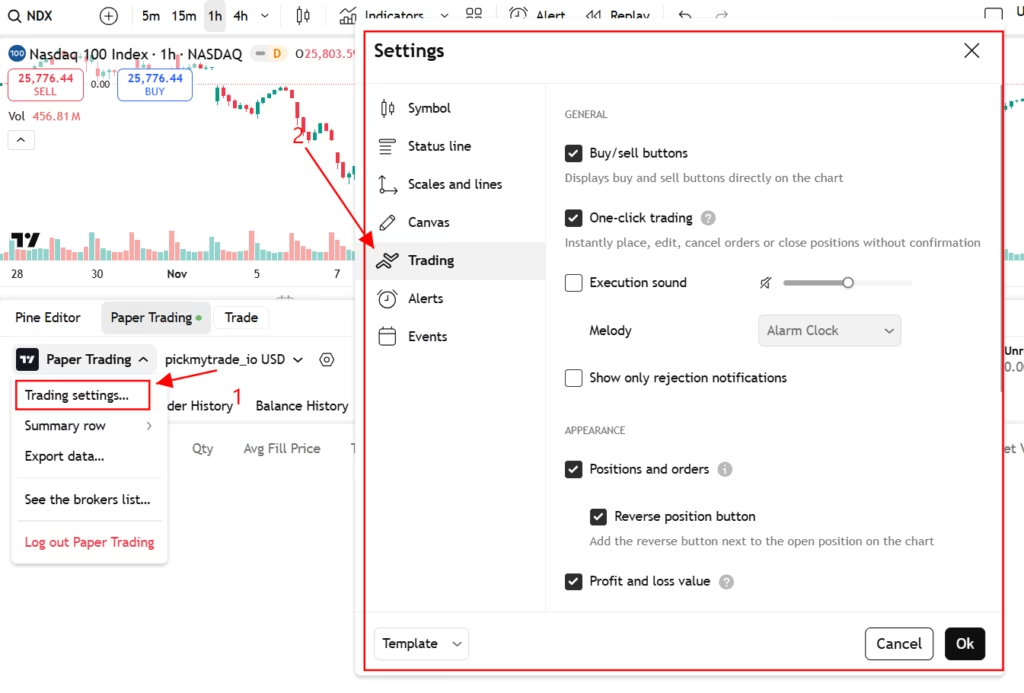

- Personalize Settings: Click the gear icon beside your account name. Set leverage per asset (e.g., 20:1 for futures), commissions (fixed or percentage-based), and base currency. For realism, mirror your live broker’s fees—say, 0.1% per trade.

- Multi-Account Strategy: Create up to multiple accounts via the Accounts tab to silo tests (e.g., one for scalping crypto, another for swing trading indices). Switch or delete them easily, but note: resets wipe history irreversibly.

- Advanced Tweaks: Enable instant order placement, toggle position/order displays, and integrate with The Leap—TradingView’s monthly paper trading competitions offering real prizes (up to $10,000 in December 2025’s Christmas Edition) without entry fees.

This setup isn’t static; 2025’s extended hours mean you can now simulate 24/7 forex or crypto flows, or U.S. equity gaps, fostering discipline in low-liquidity scenarios.

Mastering Order Types: From Basics to 2025-Enhanced Precision

TradingView’s order suite is comprehensive, supporting the mechanics that define pro-level execution. Practice here to internalize timing and risk without the sting of slippage.

| Order Type | Description | Key 2025 Use Case | Potential Pitfalls |

|---|---|---|---|

| Market Order | Executes immediately at the current best price; always fills. | Quick entries during high-volatility breakouts, like crypto pumps. | Exposed to slippage in fast markets—test with 2025’s extended hours to gauge impacts. |

| Limit Order | Buys/sells only at or better than your specified price; may partial-fill. | Precision scalping on indices; now viable pre/after-hours for earnings plays. | Unfilled if price gaps away—monitor liquidity via DOM. |

| Stop (Stop-Market) Order | Triggers at a set price, then executes as market order; protects against reversals. | Trailing stops on futures; auto-cancels on expiration per August update. | Gaps can cause poor fills—pair with volatility filters. |

| Stop-Limit | Combines stop trigger with limit execution for tighter control. | Risk management in bear markets; enhanced for futures rollovers. | Complex in illiquid assets—use analytics to backtest. |

These tools now handle partial fills dynamically, reflecting real broker behaviors. For futures, the 2025 update ensures expiring contracts settle accurately, deducting fees and updating equity—vital for strategies involving ES or NQ minis.

The Strategic Edge: Benefits and Performance Analytics

Paper Trading’s true value lies in its educational depth. Risk-free, it lets you dissect strategies across bull runs (e.g., AI stock rallies), bear squeezes (2025’s rate hike echoes), or high-vol environments (crypto winters). Dive into timeframes: 1-minute scalps for day traders or weekly swings for investors.

Analytics are robust—track profit factors, max drawdowns, win rates, and Sharpe ratios via the History and Account tabs. Export data to refine with external models, and use Pine Script for automated alerts on simulated breaches. In 2025, with futures fully modeled, you can stress-test against expirations, revealing hidden costs like rollover fees that erode edges.

For portfolio builders, experiment with diversification: rotate sectors (tech vs. energy) or layer options/VIX hedges. The Leap competitions add gamification—December’s event pits you against global traders on a $100,000 sim account, with prizes for top performers.

Elevating Your Game: Advanced Techniques and Realism Best Practices

Go beyond basics with sector rotation (e.g., shifting from EVs to renewables amid 2025 policy shifts) or volatility plays using VIX futures—now seamlessly simulated. Multi-account setups shine here: one for long-only equities, another for leveraged crypto.

To keep it real:

- Trade live hours for peak liquidity; leverage extended sessions sparingly.

- Factor events via TradingView’s economic calendar—simulate Fed announcements.

- Enforce 1-2% risk per trade; test leverage sustainably (avoid 100:1 fantasies).

- Log emotions in a journal alongside metrics—2025’s journal templates emphasize this for psychological prep.

Pitfalls to Sidestep: Common Traps in Simulated Sanctuaries

Even in safety, bad habits lurk. Over-reliance on perfect fills ignores real slippage—2025’s futures updates help, but calibrate for 0.5-1% variances. Complacency kills: treat virtual dollars like real ones, and shadow with a parallel live micro-account. Finally, don’t chase The Leap wins over learning—prioritize consistency.

From Simulation to Supremacy: Transitioning with PickMyTrade

Mastered your edge? PickMyTrade streamlines the leap to live. Code your Pine Script from paper wins, webhook to our automation engine, and execute via integrated brokers—no recoding needed. Steps:

- Ideate Manually: Refine in Paper Trading.

- Automate: Port to script; test in our paper mode.

- Validate: Run 3-6 months simulated.

- Deploy: Go live with risk controls intact.

Our 2025 integrations now support extended hours and futures auto-rolls, ensuring fidelity. Sign up for a free 7-day trial and automate today elevate from practice to profit.

Wrapping Up: Paper Trading as Your 2025 Trading Catalyst

TradingView Paper Trading isn’t a toy—it’s a precision forge for strategies that thrive in today’s multifaceted markets. With 2025’s futures lifecycle and extended hours upgrades, it’s more potent than ever, bridging theory to triumph. Pair it with PickMyTrade’s automation, and you’re not just trading; you’re architecting success. Dive in, iterate relentlessly, and watch your portfolio flourish.

Ready to automate? Try PickMyTrade Free for 7 Days

Disclaimer: Trading involves substantial risk of loss and is not suitable for all investors. Content from PickMyTrade is for educational purposes only and does not constitute financial advice. Past performance isn’t indicative of future results. Consult a qualified advisor, and conduct your own due diligence. Authors may hold positions in discussed assets, potentially influencing views.

You may also like:

Comparing TradingView Automation: PickMyTrade vs TradersPost vs NinjaTrader

Troubleshooting TradingView Alerts: Common Issues & Solutions

Key Citations

- TradingView Support: Paper Trading Main Functionality

- TradingView Blog: Full Support for Futures Paper Trading (Aug 2025)

- TradingView Blog: Extended Trading Hours in Paper Trading (Jan 2025)

- TradingView Features Overview

- The Leap December 2025 Competition

- Quantribe: Biggest TradingView Updates of 2025