In the rapidly evolving world of automated trading, choosing the right technical indicators can make the difference between a profitable algorithm and one that underperforms. For traders using PickMyTrade to bridge TradingView with brokers like Tradovate, Rithmic, and Interactive Brokers, understanding how to leverage technical indicators effectively is crucial for building robust algorithmic trading strategies.

Why Technical Indicators Matter in Algorithmic Trading

Technical indicators provide objective, data-driven insights that guide automated trading strategies, offering quantifiable metrics from historical data for identifying patterns and trends. Unlike discretionary trading where emotions can cloud judgment, algorithmic trading systems rely on these mathematical formulas to generate consistent, repeatable trading signals.

For PickMyTrade users, technical indicators serve as the foundation for creating automated strategies that execute seamlessly across multiple broker platforms. By converting TradingView’s powerful charting capabilities into actionable trades, these indicators help traders capitalize on opportunities 24/7 without manual intervention.

The Top 7 Essential Technical Indicators for PickMyTrade Algorithmic Trading

1. Moving Averages (MA) – The Trend Foundation

Moving averages smooth out price data and identify trends by calculating the average closing price over a specified time period. On PickMyTrade, traders commonly implement two types:

- Simple Moving Average (SMA): Equal weight to all periods

- Exponential Moving Average (EMA): Greater weight to recent prices for faster response

PickMyTrade Implementation Tip: Create crossover strategies where your algorithm enters long positions when the 50-day EMA crosses above the 200-day EMA, automatically executing through your connected broker.

2. Relative Strength Index (RSI) – Momentum Master

RSI is a momentum indicator that measures the speed and change of price movements, ranging from 0 to 100 and typically used to identify overbought or oversold conditions.

Optimal Settings for PickMyTrade:

- Overbought: RSI above 70 (potential sell signal)

- Oversold: RSI below 30 (potential buy signal)

- Period: 14 (standard) or adjust based on your timeframe

3. Bollinger Bands – Volatility Navigator

Bollinger Bands provide information about market volatility and predict price movements, making them perfect for mean reversion strategies on PickMyTrade.

Strategy Application: Program your algorithm to:

- Buy when price touches the lower band in an uptrend

- Sell when price reaches the upper band

- Monitor band squeeze for potential breakout trades

4. MACD (Moving Average Convergence Divergence) – Trend Momentum Hybrid

MACD combines trend-following and momentum characteristics, making it ideal for capturing both trend continuations and reversals in automated trading systems.

PickMyTrade Signal Generation:

- Bullish: MACD line crosses above signal line

- Bearish: MACD line crosses below signal line

- Divergence: Price makes new highs/lows while MACD doesn’t (reversal warning)

5. Average True Range (ATR) – Risk Management Tool

ATR is a volatility indicator that measures the average range between high and low prices over a specified period, typically 14 periods. This indicator is crucial for position sizing and stop-loss placement in PickMyTrade algorithms.

Implementation Strategy:

- Dynamic stop-losses: 2x ATR from entry price

- Position sizing: Adjust based on ATR to maintain consistent risk

- Volatility filters: Only trade when ATR is within acceptable ranges

6. Stochastic Oscillator – Momentum Refinement

The Stochastic Oscillator compares a security’s closing price to its price range over a specific period, oscillating between 0 and 100.

PickMyTrade Optimization:

- Combine with trend indicators for confirmation

- Use %K and %D crossovers for entry signals

- Filter trades in ranging vs trending markets

7. Volume-Weighted Average Price (VWAP) – Institutional Edge

VWAP gives more importance to closing prices with high volume, indicating where most trading has taken place. This indicator helps algorithms identify institutional interest and optimal entry/exit points.

Advanced Indicator Combinations for PickMyTrade

The Power of Multi-Indicator Strategies

Combining momentum indicators with trend indicators helps avoid trading against strong trends and improves strategy effectiveness. Here are proven combinations for PickMyTrade users:

Trend + Momentum Combo:

- Primary: 200-day EMA for trend direction

- Secondary: RSI for entry timing

- Filter: Only take RSI signals in the direction of the EMA trend

Volatility + Volume Strategy:

- Bollinger Bands for volatility assessment

- VWAP for institutional levels

- OBV (On-Balance Volume) for volume confirmation

TradingView to Tradovate integration

Implementing Technical Indicators on PickMyTrade with TradingView

Step 1: Creating Your Pine Script Strategy

PickMyTrade seamlessly integrates with TradingView’s Pine Script, allowing you to build custom indicators and strategies. Pine Script enables traders to create custom indicators, automate entries and exits, and optimize strategies for faster execution and improved efficiency.

Basic Pine Script Template for PickMyTrade:

//@version=5

strategy("PickMyTrade Multi-Indicator Strategy", overlay=true)

// Define indicators

ema_fast = ta.ema(close, 20)

ema_slow = ta.ema(close, 50)

rsi = ta.rsi(close, 14)

// Entry conditions

long_condition = ta.crossover(ema_fast, ema_slow) and rsi < 70

short_condition = ta.crossunder(ema_fast, ema_slow) and rsi > 30

// Execute trades

if (long_condition)

strategy.entry("Long", strategy.long)

if (short_condition)

strategy.entry("Short", strategy.short)

Step 2: Backtesting and Optimization

Backtesting in TradingView evaluates historical performance by simulating trades on past price data, helping traders assess strategy effectiveness and tweak risk parameters. Before deploying your strategy through PickMyTrade:

- Test across multiple timeframes

- Analyze different market conditions

- Optimize indicator parameters

- Evaluate risk-reward ratios

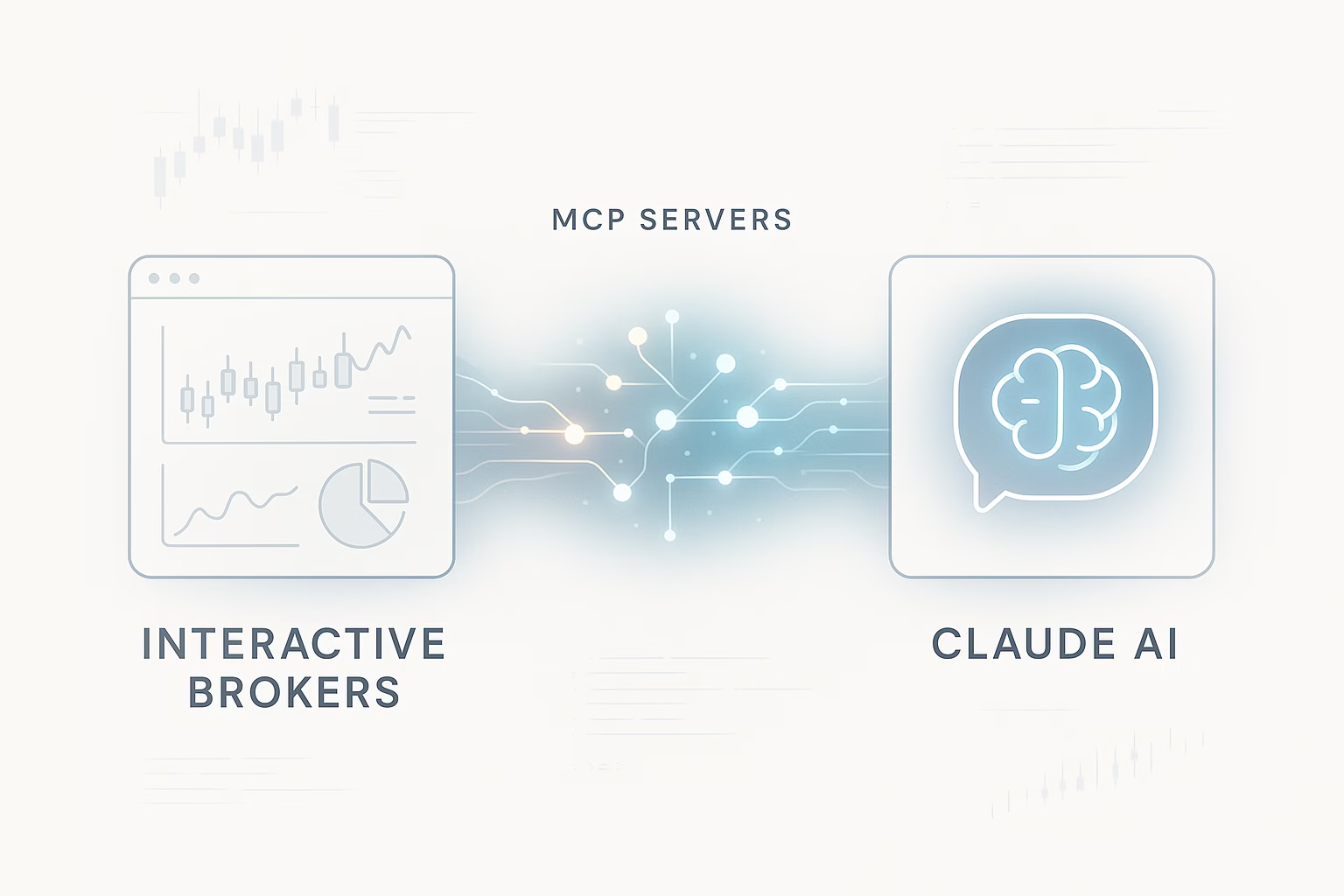

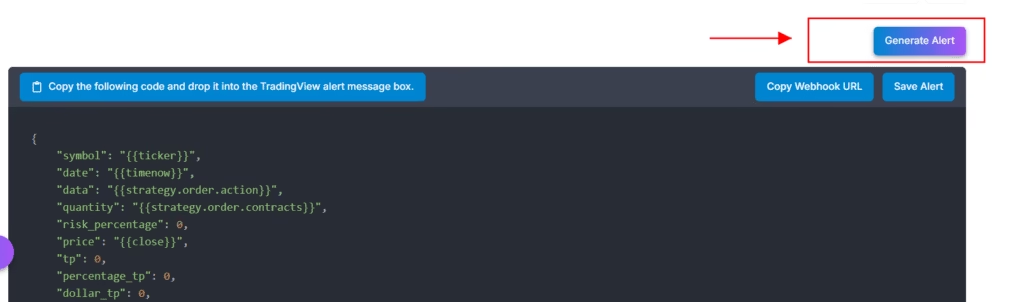

Step 3: Connecting to Your Broker via PickMyTrade

Once your strategy is refined, PickMyTrade handles the critical connection between TradingView alerts and your broker’s execution platform. The process is straightforward:

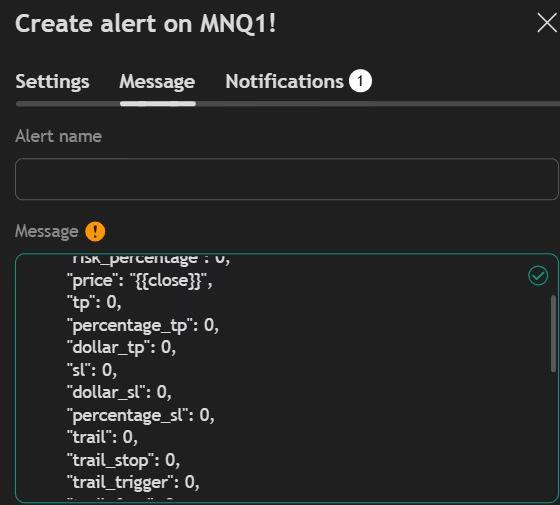

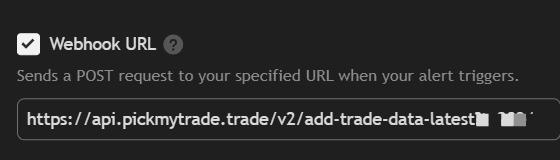

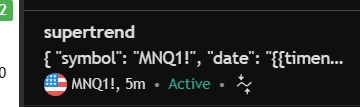

- Generate alert code in PickMyTrade and copy it

- Create a new alert in TradingView and paste the code in the message box

- Copy the webhook URL from PickMyTrade and add it to TradingView’s settings

- Verify the alert code and webhook URL are correctly placed

- Create the alert in TradingView to activate automated trading with PickMyTrade

Risk Management with Technical Indicators

Position Sizing Based on Indicator Signals

Position sizing based on deviation magnitude allows traders to adjust positions based on the extent of deviation from the mean, with larger deviations potentially warranting larger positions.

Dynamic Position Sizing Formula:

- Base position = Account equity × Risk percentage

- Adjustment factor = Current ATR / Average ATR

- Final position = Base position × Adjustment factor

Stop-Loss Strategies

Implement multiple stop-loss approaches based on indicators:

- ATR-based: 2-3x ATR from entry

- Bollinger Band: Outside opposite band

- Support/Resistance: Below key technical levels

- Time-based: Exit after X bars if no profit

Common Pitfalls to Avoid

Over-Optimization Warning

Rigorous backtesting across various market regimes is crucial to assess strategy robustness and optimize parameters. However, avoid curve-fitting by:

- Testing on out-of-sample data

- Using walk-forward analysis

- Keeping strategies simple with 3-4 indicators maximum

Market Condition Awareness

Not all indicators work in all market conditions:

- Trending markets: Focus on moving averages and MACD

- Ranging markets: Emphasize RSI and Stochastic

- Volatile markets: Prioritize ATR and Bollinger Bands

PickMyTrade-Specific Optimization Tips

1. Leverage Multi-Timeframe Analysis

Create algorithms that analyze indicators across multiple timeframes:

- Daily for trend direction

- 4-hour for entry timing

- 1-hour for fine-tuning exits

2. Implement Smart Order Routing

Use PickMyTrade’s broker connectivity to:

- Split orders across multiple venues

- Use limit orders based on VWAP levels

- Implement iceberg orders for large positions

3. Continuous Monitoring and Adjustment

Set up automated performance tracking:

- Monitor win rate by indicator combination

- Track slippage and execution quality

- Adjust parameters based on recent performance

TradingView to Tradovate integration

Future-Proofing Your Indicator Strategy

Machine Learning Integration

With AI and machine learning driving automation, traders achieve faster execution, higher accuracy (70% – 95%), and 24/7 market coverage. Consider incorporating:

- Adaptive indicator parameters based on market regime

- Pattern recognition to filter indicator signals

- Sentiment analysis to complement technical signals

Alternative Data Enhancement

Modern algorithmic trading increasingly combines traditional indicators with alternative data sources:

- Social media sentiment

- News flow analysis

- Economic indicators

- Options flow data

Conclusion: Building Your Edge with PickMyTrade

Success in algorithmic trading on PickMyTrade comes from understanding not just individual indicators, but how to combine them effectively for your specific trading style and market conditions. No indicator is perfect or yields 100% results all the time – they are additional tools to reduce the probability of losses and enhance the decision-making process of trading algorithms.

Start with a simple strategy using 2-3 indicators, thoroughly backtest it, and gradually add complexity as you gain experience. PickMyTrade’s seamless integration with TradingView and multiple brokers provides the perfect environment to implement and refine your indicator-based strategies.

Remember: The best algorithmic trading system is one that matches your risk tolerance, capital requirements, and market understanding. Use these technical indicators as building blocks to create a robust, profitable trading system that works consistently across different market conditions.

TradingView to Tradovate integration

Ready to Implement Your Strategy?

Take action today:

- Start with education: Master one indicator at a time

- Paper trade first: Test your strategies without risk

- Scale gradually: Begin with small positions and increase as confidence grows

- Monitor consistently: Track performance and adjust parameters regularly

With PickMyTrade’s powerful integration capabilities and the right technical indicators, you’re equipped to build sophisticated algorithmic trading strategies that can compete in today’s dynamic markets. The combination of TradingView’s analytical power and PickMyTrade’s execution efficiency creates endless possibilities for automated trading success.

Want to learn more about implementing these strategies on PickMyTrade? Visit our comprehensive guides on TradingView to Tradovate integration and explore our library of pre-built algorithmic trading templates designed specifically for technical indicator strategies.

You May also like:

Complete Guide to Automated Futures Trading Systems with PickMyTrade

Best Trading Bot 2025