Trade smarter using automated future trading tools like PickMyTrade.trade — integrated with TradingView and Tradovate.

Want to make better trades with sniper accuracy? It starts by mastering supply and demand zones in automated futures trading. These zones show where prices are likely to reverse. With the help of automated platforms like PickMyTrade.trade, you can mark, monitor, and trade these levels with precision—without staring at charts all day.

What Are Supply and Demand Zones?

Supply and demand zones are key levels on a price chart where institutional traders — the “smart money” — place large buy or sell orders. These areas often trigger powerful reversals, making them ideal for:

– Sniper entries

– Swing trading and day trading

– Automated trading strategies

– Paper trading simulations

How to Find Demand Zones in Automated Futures Trading

A demand zone marks where buyers enter the market aggressively, often pushing the price higher. To find one:

1. Spot the Last Red Candle: Look for the final bearish candle before a sharp upward move.

2. Draw the Zone: Mark the area from the wick’s bottom to the body’s top of that candle.

When price revisits this zone, it often acts as strong support — a key entry point for both manual and automated trades using TradingView alerts.

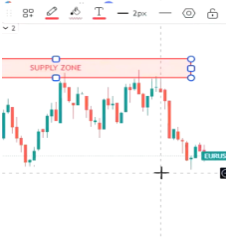

Identifying Supply Zones for Smart Trade Entries

A supply zone signals heavy seller interest.

To find it:

1. Find the Last Green Candle: Look for the final bullish candle before a sharp drop.

2. Mark the Zone: Draw from the wick’s top to the body’s bottom of that candle.

This area acts as resistance. It’s ideal for short setups and automated trading bots looking for reversal trades.

Automated Futures Trading with PickMyTrade

Using PickMyTrade.trade, an automated futures trading platform integrated with TradingView and Tradovate, you can:

– Auto-execute trades at supply and demand zones

– Set take profit (TP) and stop loss (SL) based on zone width

– Automate across multiple markets like futures, crypto, and forex

– Run strategies across multiple accounts — even prop firm demos

– Avoid emotional bias in decision-making

No coding needed. No manual execution. 100% automation.

Smarter Strategies with AI and Bots

Platforms like PickMyTrade let you automate trading using TradingView indicators and price action setups. You can:

– Deploy futures trading bots

– Execute crypto bot trading strategies

– Practice risk-free with paper trading apps

– Run TradingView strategy alerts automatically

These tools give even beginner traders an edge — and pros can scale their automation easily.

Final Tip

Start with paper trading on TradingView to master your sniper entries. Then, integrate with PickMyTrade to go live. With real-time execution, stop loss protection, and multi-account support, you’ll be trading like a pro — with confidence and consistency.

Also Checkout: Automate TradingView Indicators with Tradovate Using PickMyTrade – PickMyTrade Maximize Your Trading Efficiency with Automation