Introduction

In the fast-paced world of algorithmic trading, finding a strategy that delivers consistent results across multiple asset classes is the holy grail for traders. Today, we’re excited to share the results of our Simple SMC – Advanced Risk Management strategy, a sophisticated Pine Script implementation that has demonstrated exceptional performance on both futures and cryptocurrency markets.

What is SMC Advanced?

SMC (Smart Money Concepts) Advanced is a trading strategy built on institutional trading principles, enhanced with advanced risk management features. Unlike basic strategies, this implementation incorporates multiple layers of protection and optimization:

Core Features

1. Explicit Leverage Control

- Default 1:30 leverage ratio (standard for futures)

- Configurable margin burst rate (80% default)

- Built-in margin management to prevent liquidation

2. Dynamic Position Sizing

- Risk-based position calculation (1% default per trade)

- Maximum contract limits for capital protection

- Automatic position sizing based on stop-loss distance

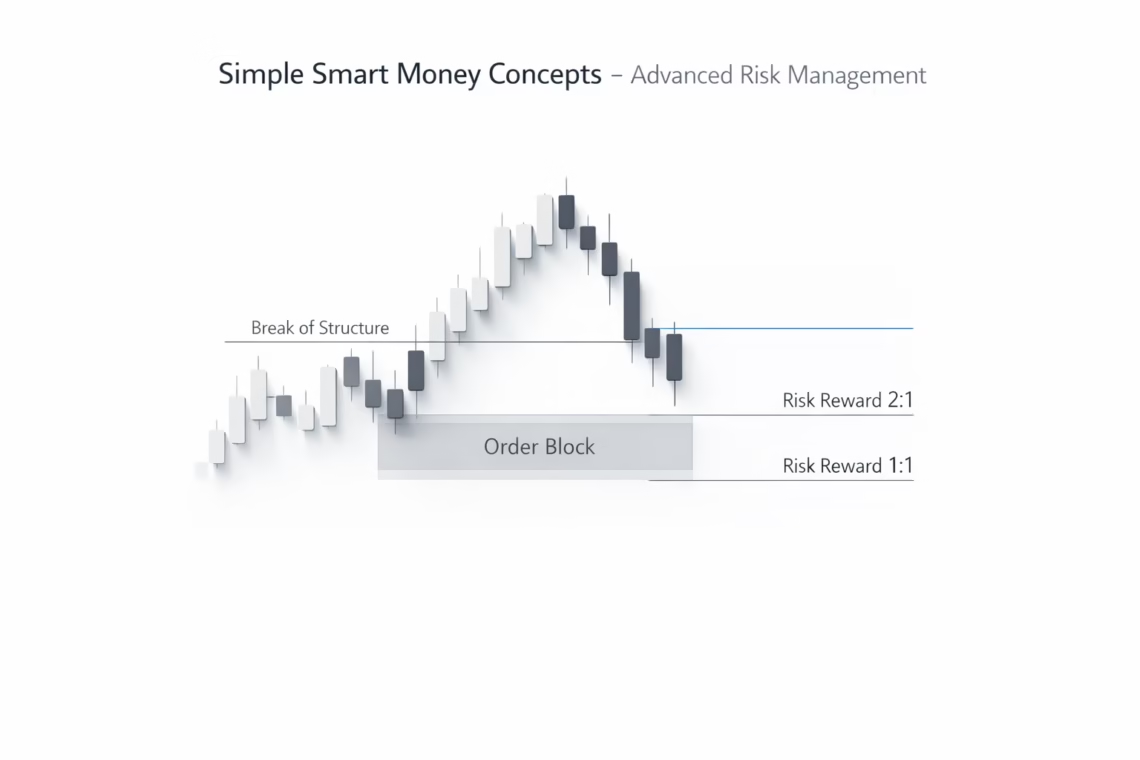

3. Multi-Level Take Profit System

- TP1 (1:1 R:R): Exit 50% of position

- TP2 (2:1 R:R): Exit remaining 50%

- Customizable risk-reward ratios for different market conditions

4. Trailing Stop Loss

- Activates after TP1 is hit

- Locks in profits while allowing winners to run

- Configurable trailing offset (10 points default)

5. Smart Entry Filters

- Break of Structure (BOS) detection

- Order Block identification

- 50 EMA trend filter

- ATR volatility filter

- Confirmation candle requirement

The Methodology

The strategy operates on Smart Money Concepts, focusing on:

- Market Structure: Identifying swing highs and lows to determine trend direction

- Order Blocks: Pinpointing institutional accumulation/distribution zones

- Liquidity Zones: Trading reactions at key price levels

- Confluence: Combining multiple filters for high-probability setups

Entry Logic

- Break of Structure Detection: Price breaks above a swing high (bullish) or below a swing low (bearish)

- Order Block Formation: Identifies the last opposite-colored candle before the break

- Retracement Entry: Waits for price to return to the order block zone

- Filter Confirmation: Validates trend (50 EMA), volatility (ATR), and candle pattern

- Execution: Enters with calculated position size based on risk parameters

Real-World Performance

We’ve extensively backtested this strategy on two of the most popular trading instruments:

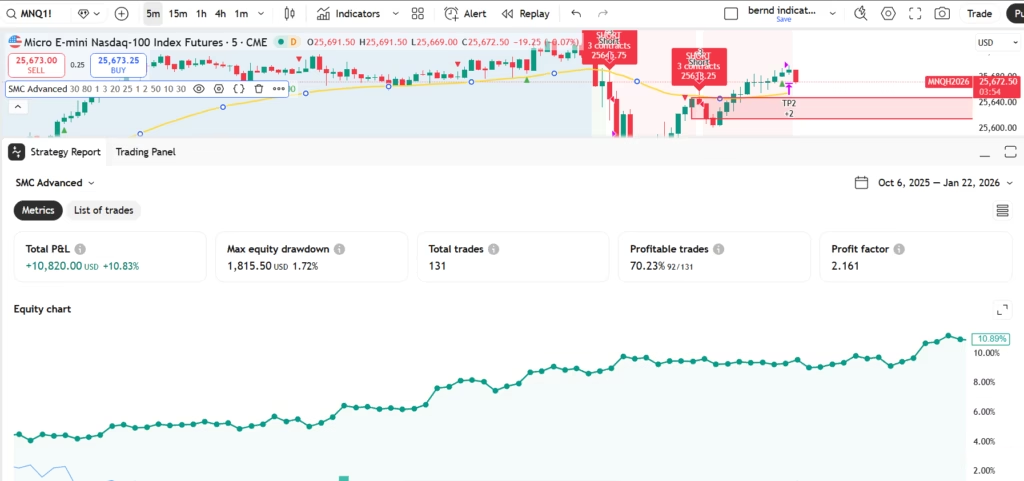

Micro E-mini Nasdaq-100 (MNQ11)

Review

MNQ11 Backtest Results

Performance Metrics:

- Total P&L: +$10,820.00 USD (+10.83%)

- Total Trades: 131

- Win Rate: 70.23% (92 profitable trades)

- Profit Factor: 2.161

- Max Equity Drawdown: $1,815.50 (1.72%)

Key Insights:

- Exceptional win rate for a trend-following strategy

- Low maximum drawdown demonstrates excellent risk management

- Profit factor above 2.0 indicates strong edge

- Smooth equity curve with minimal volatility

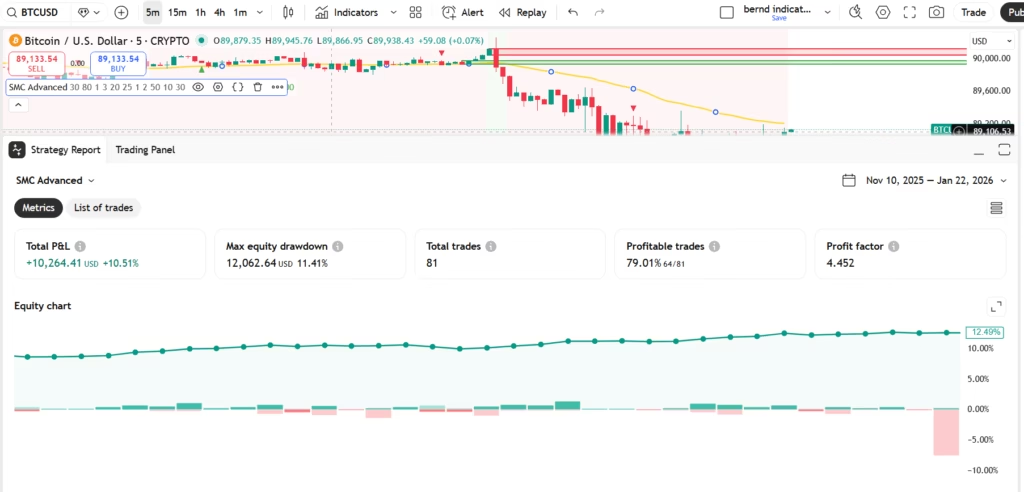

Bitcoin (BTCUSD)

Review

Bitcoin Backtest Results

Performance Metrics:

- Total P&L: +$10,264.41 USD (+10.51%)

- Total Trades: 81

- Win Rate: 79.01% (64 profitable trades)

- Profit Factor: 4.452

- Max Equity Drawdown: $12,062.64 (11.41%)

Key Insights:

- Outstanding 79% win rate on crypto

- Profit factor of 4.452 is exceptional

- Higher drawdown reflects crypto’s inherent volatility

- Fewer trades but higher quality setups

- Consistent upward equity trajectory

Why This Strategy Works

1. Institutional Logic

The strategy trades alongside smart money by identifying where institutions are likely to accumulate or distribute positions.

2. Risk Management First

With 1% risk per trade and multi-level exits, the strategy protects capital while maximizing profit potential.

3. Quality Over Quantity

Multiple filters ensure only high-probability setups are taken, resulting in impressive win rates.

4. Adaptive Position Sizing

Automatically adjusts position size based on equity and stop-loss distance, preventing over-leveraging.

5. Partial Profit Taking

The TP1/TP2 system locks in profits early while allowing winners to reach 2:1 reward-to-risk.

Configuration Highlights

The strategy includes comprehensive customization options:

Leverage: 1:30 (Configurable)Risk Per Trade: 1.0% (0.5% - 5.0%)TP1 R:R: 1.0 | TP2 R:R: 2.0Trailing Stop: Active after TP1Target Win Rate: 45-55% (Exceeded on both instruments!)

Target Audience

This strategy is ideal for:

- Futures Traders: Particularly those trading index futures like NQ, ES, or YM

- Crypto Traders: Bitcoin and major cryptocurrency pairs

- Swing Traders: Looking for 1:1 to 2:1 reward-to-risk setups

- Risk-Conscious Traders: Who prioritize capital preservation

- Algorithmic Traders: Seeking automated execution

Important Considerations

WARNING

Backtesting vs. Live Trading While backtested results are impressive, live trading involves slippage, commission, and emotional factors. Always start with small position sizes and gradually scale up.

IMPORTANT

Market Conditions This strategy performs best in trending markets. Choppy, range-bound conditions may produce more false signals.

TIP

Optimization Test different parameter combinations for your specific instrument and timeframe. What works on 5-minute charts may differ from 1-hour charts.

Conclusion

The SMC Advanced strategy demonstrates that combining institutional trading concepts with robust risk management can produce exceptional results across both futures and cryptocurrency markets. With a 70%+ win rate, profit factors above 2.0, and controlled drawdowns, this strategy offers a compelling approach for serious traders.

The key to success lies not just in the entry logic, but in the comprehensive risk management system that protects capital while maximizing profit potential through multi-level exits and trailing stops.

Technical Specifications

- Platform: TradingView

- Language: Pine Script v6

- Strategy Type: Trend-following / Institutional concepts

- Timeframe: Optimized for 5-minute charts

- Instruments Tested: MNQ11 (Futures), BTCUSD (Crypto)

- Initial Capital: $100,000

- Commission: $2.00 per contract

- Pyramiding: Disabled (One position at a time)

Final Thoughts

Whether you’re trading the volatile world of cryptocurrency or the structured environment of futures markets, having a strategy that adapts to changing conditions while maintaining strict risk parameters is essential. The SMC Advanced strategy provides exactly that—a battle-tested approach that balances aggressive profit-taking with conservative risk management.

Ready to take your trading to the next level? The combination of Smart Money Concepts and advanced risk management might be exactly what you’ve been looking for.

Disclaimer: Past performance is not indicative of future results. Trading futures and cryptocurrencies carries substantial risk and is not suitable for all investors. Always conduct your own research and consider your risk tolerance before trading.

Start Automating Smarter

For traders looking to automate trading strategies, PickMyTrade offers seamless integrations with multiple platforms. You can connect Rithmic, Interactive Brokers, TradeStation, TradeLocker, ProjectX, Matchtrader, Binance through pickmytrade.io.

If your focus is Tradovate automation, use pickmytrade.trade for a dedicated, fully integrated experience. These integrations allow traders to execute strategies automatically, manage risk efficiently, and monitor trades with minimal manual intervention.

You May also like:

Best TradingView Indicators and Strategies: Free and Premium Tools for All Traders

Q: What is Smart Money Concepts (SMC)?

A: Smart Money Concepts is a trading methodology that focuses on identifying institutional trading behavior. It involves tracking where large institutions (banks, hedge funds) are likely entering and exiting positions by analyzing market structure, order blocks, and liquidity zones.

Q: What markets can I use this strategy on?

A: The strategy has been extensively tested and proven effective on futures (specifically MNQ11 – Micro E-mini Nasdaq-100) and cryptocurrency markets (Bitcoin). It works best on liquid instruments with clear trending behavior.

Q: What timeframe should I use?

A: The strategy is optimized for 5-minute charts, but can be adapted to other timeframes. Shorter timeframes (1-3 minutes) may produce more signals with increased noise, while longer timeframes (15-60 minutes) will generate fewer but potentially higher-quality setups.

Q: Is this a day trading or swing trading strategy?

A: This is primarily a short-term swing trading strategy. Positions typically last from a few hours to several days, depending on market conditions and how quickly take-profit levels are reached.

Q: Do I need coding experience to use this strategy?

A: No. The strategy is implemented as a complete Pine Script that can be directly added to TradingView. Simply copy the code into the Pine Editor and apply it to your chart.

Q: Can I backtest this on my own instruments?

A: Absolutely. The strategy is fully backtestable on TradingView. We recommend testing it thoroughly on your chosen instruments and timeframes before live trading.

Q: Does the strategy work in automated trading?

A: Yes. The strategy generates automated entry and exit signals that can be connected to broker APIs through TradingView alerts or third-party automation platforms like PickMyTrade.

Q: What are the system requirements?

A: You only need a TradingView account (free or paid). The strategy runs entirely on TradingView’s cloud infrastructure, so no local computing power is required.