Top Prop Firms Using Tradovate in 2025

In 2025, proprietary trading—also known as prop trading—continues to attract traders who want to scale their futures strategies without using personal capital. These traders rely on funded accounts from prop firms. In this model, traders use a firm’s capital, and profits are shared. One key factor in the success of such setups? The broker. And that’s where Tradovate plays a huge role.

Many of the top prop firms now offer funded accounts through Tradovate, a modern futures broker built for automation and ease of use. In this guide, we’ll break down the top prop firms using Tradovate, and show how tools like PickMyTrade can automate your trades for consistent execution and performance.

Why Tradovate is a Go-To Futures Broker

Tradovate is known for its speed, simplicity, and automation-friendly environment—making it a top choice for both traders and prop firms.

Core benefits:

- Browser-based trading – No software install required

- Subscription pricing – Flat monthly plans instead of per-trade commissions

- Real-time metrics – View drawdown, PnL, and exposure instantly

- Seamless integrations – Works with TradingView, Rithmic, and automation tools

Its robust infrastructure is why leading firms like Apex and TradeDay prefer offering accounts on Tradovate.

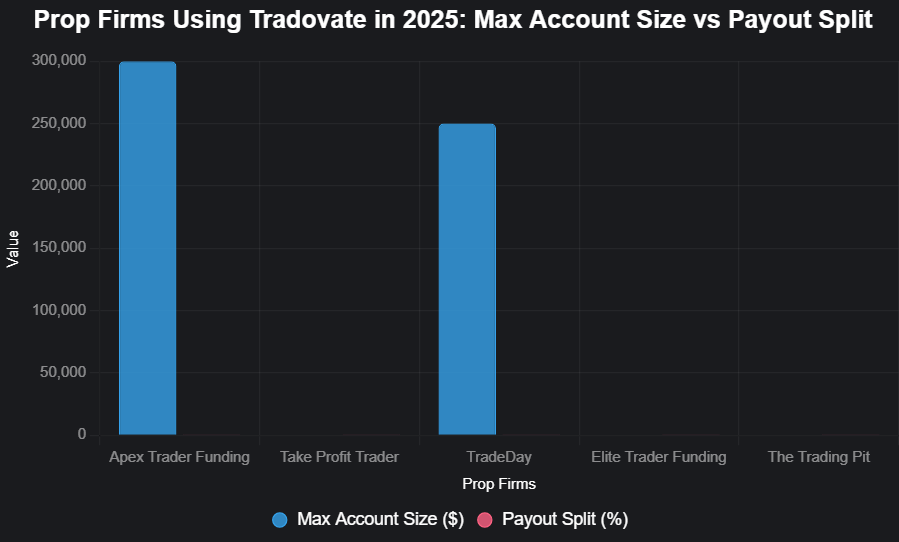

Top Prop Firms Using Tradovate in 2025: Quick Comparison

| Firm | Year Started | Location | Account Sizes | Payout Structure | Evaluation Model | Highlights |

|---|---|---|---|---|---|---|

| Apex Trader Funding | 2021 | Austin, TX | $25K–$300K | 100% first $25K, 90% after | One-step | Multiple accounts, no daily loss, supports Rithmic/NinjaTrader/Tradovate |

| Take Profit Trader | 2022 | Orlando, FL | Plan-based | 80% profit split | One-step | No scaling, education-focused, works with Tradovate & TradingView |

| TradeDay | 2020 | Chicago, IL | $10K–$250K | 80%+ | One-step | Coaching, zero commissions, supports TradingView, NinjaTrader |

| Elite Trader Funding | 2022 | Florida | Futures-only | 80% | One-step | Straightforward rules, Tradovate + Rithmic supported |

| The Trading Pit | Global | Multi-region | Futures, FX, CFDs | Up to 80% | Two-step | Global access, multiple asset classes, automation-ready |

What Makes Each Prop Firm Stand Out?

- Apex Trader Funding: Best for high-volume traders who manage multiple accounts. Flexible rules and frequent discounts make it a favorite.

- Take Profit Trader: Simple, education-first setup—ideal for beginners and consistent traders.

- TradeDay: Strong focus on trader development with coaching and zero commissions.

- Elite Trader Funding: Clear-cut rules and futures-only approach appeal to focused traders.

- The Trading Pit: Great for global traders wanting futures, FX, and CFDs under one roof.

Automate Trades Across Prop Firms with PickMyTrade

Juggling multiple accounts or platforms can be hard—especially during evaluations. PickMyTrade bridges the gap between your strategy and execution.

Key Features:

- Connects TradingView to Tradovate and Rithmic

- Instant trade execution without manual intervention

- Time-based and volatility filters

- Dynamic position sizing and trailing stops

If you’re using a prop firm with Tradovate, this automation gives you the edge.

Final Thoughts: Which Tradovate Prop Firm Is Right for You?

- Choose Apex if you need scale and flexibility.

- Pick Take Profit for a clean, rule-based structure.

- Go with TradeDay for guidance and coaching.

- Try Elite if you want no-nonsense futures funding.

- Explore The Trading Pit for multi-asset and global access.

No matter which you pick, PickMyTrade + Tradovate creates a winning combo for automation and scale.

Does Tradovate have prop firms?

Yes, several proprietary trading firms use Tradovate as their broker of choice. Firms like Apex Trader Funding, Take Profit Trader, TradeDay, and Elite Trader Funding offer funded accounts through Tradovate due to its automation-friendly interface and modern infrastructure.

Who uses Tradovate?

Tradovate is used by futures traders, both retail and funded, who value fast execution, browser-based access, and automation tools. It’s popular among prop firm traders, algo traders using TradingView, and those seeking low-latency order routing with platforms like Rithmic.

What platforms are supported by Tradovate?

Tradovate supports several leading trading platforms, including:

Rithmic (via API and third-party tools)

This allows traders to connect with their preferred charting or automation setup easily.

Tradovate’s own web-based platform

NinjaTrader

TradingView

Is Tradovate owned by NinjaTrader?

Yes, Tradovate is owned by NinjaTrader Group, LLC. The acquisition allows for deeper integration between NinjaTrader’s desktop platform and Tradovate’s cloud-based infrastructure, giving traders more flexibility across devices and systems.

This is a helpful comparison for anyone exploring prop firms using Tradovate. I’d be curious to know how the evaluation styles differ in practice—especially for newer traders who might be navigating this space for the first time.

Great breakdown of how Tradovate isBlog Comment Creation Guide becoming a core part of the prop trading ecosystem. The browser-based access and integration with automation tools are definitely game changers for traders looking to streamline their setups. Curious to see how more firms will leverage these features moving forward.

I think the integration with tools like TradingView really sets Tradovate apart for prop firms. The flexibility it offers for optimizing automated strategies is a big advantage for traders who want to scale efficiently.