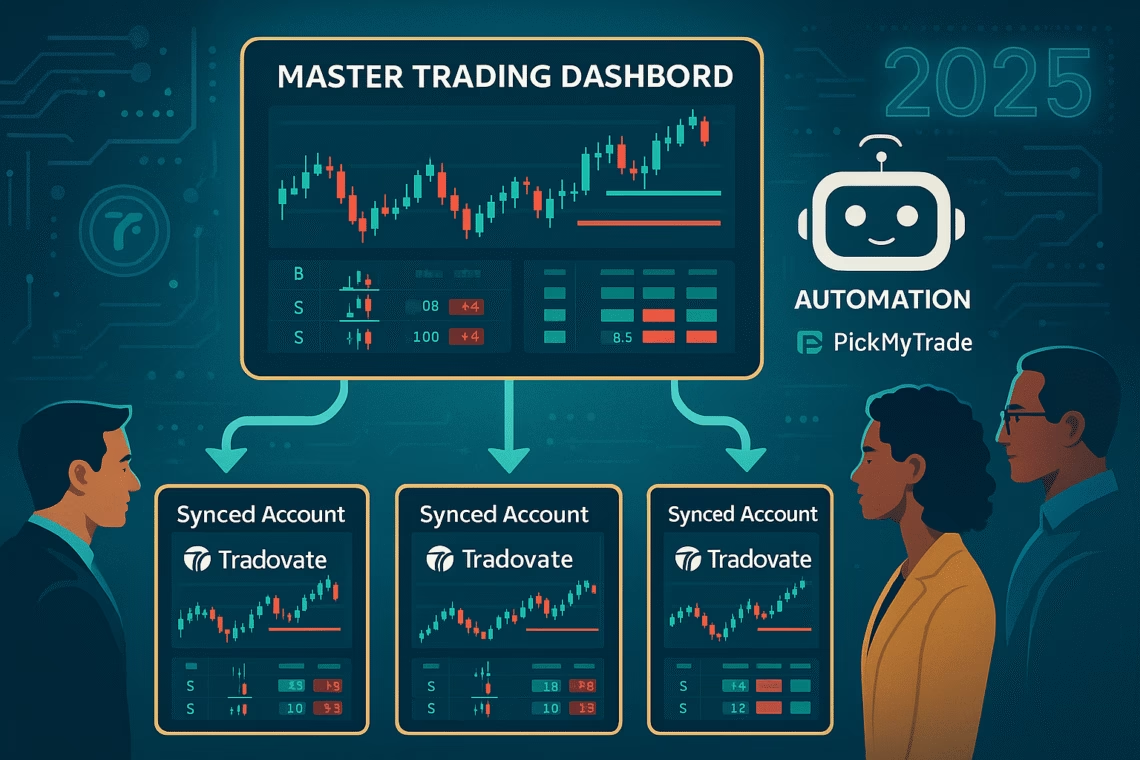

In the dynamic trading world of 2025, scaling strategies across multiple accounts isn’t just efficient—it’s essential for maximizing returns while diversifying risk. Multi-account trading automation empowers traders to copy trade multiple accounts seamlessly, turning a single signal into synchronized executions across prop firm challenges, personal portfolios, or client setups. With Tradovate’s Q3 updates enabling unlimited nicknames for accounts and enhanced API for group trades, tools like trade copier software are evolving faster than ever. This guide explores Can I automate trading across several accounts—yes, you can—with step-by-step setups, top tools, and portfolio automation tips. Spotlight: PickMyTrade automation trading, a no-code powerhouse for copy trade multiple accounts on Tradovate, boasting 3M+ executions and millisecond precision. Whether managing Apex evals or family accounts, master account management for 2025’s volatile ES and NQ markets—backed by Reddit insights and QuantVPS benchmarks showing 40% time savings.

What Is Multi-Account Trading Automation? Unlocking Copy Trade Multiple Accounts in 2025

Multi-account trading automation refers to systems that replicate trades from a master account to slaves, streamlining account management without manual intervention. In 2025, amid FINRA’s PDT reforms and prop firm booms, it’s surged 35% in adoption (per Statista), driven by trade copier tools handling 20+ accounts with sub-100ms latency.

Key benefits? Portfolio automation diversifies exposure (e.g., one account for scalps, another for swings), complies with prop rules, and scales signals from TradingView. Can I automate trading across several accounts? Absolutely—cloud-based solutions like Duplikium or PickMyTrade bypass API limits, supporting Tradovate’s multi-account groups (unlimited via nicknames). Recent Tradovate update: Group Trade feature assigns quantities per account, cutting setup time by 50%. For pros, it’s a game-changer; Reddit r/Daytrading calls it “the ultimate hedge against single-account blowups.”

Can I Automate Trading Across Several Accounts? Yes—With These Trade Copier Tools

Can I automate trading across several accounts? The answer is a resounding yes, thanks to 2025’s robust trade copier ecosystem. We’ve ranked top tools based on latency, compatibility (MT4/5, NinjaTrader, Tradovate), and multi-broker support—sourced from QuantVPS and ForexBrokers.com reviews.

| Tool | Latency (ms) | Accounts Supported | Cost (2025) | Best For Copy Trade Multiple Accounts |

|---|---|---|---|---|

| PickMyTrade | <50 | Unlimited (Tradovate/ Rithmic/ IB/ ProjectX/ TradeLocker/ TradeStation) | $50/mo | Prop firms; no-code portfolio automation |

| Duplikium | 150-300 | Unlimited (MT4/5/cTrader) | $29/mo | Forex; risk-adjusted copying |

| CrossTrade | <100 | 20+ (NinjaTrader focus) | $49/mo | Futures scalps; ATM sync |

| FX Blue | <150 | Unlimited (local VPS) | Free/Premium $99 | Beginners; simple account management |

| Tradesyncer | <150 | Multi-broker | $49/mo | Cloud-based; analytics dashboard |

PickMyTrade leads for Tradovate users with webhook-driven copying—no API needed, per their docs. Duplikium shines for cross-platform, while CrossTrade’s 2025 VPS optimizations cut drift to zero.

Click Here To Start Multi-Account Trading Automation For Free

Top Trade Copier Tools for Multi-Account Trading Automation in 2025

1. PickMyTrade: The Go-To for Copy Trade Multiple Accounts on Tradovate

PickMyTrade automation trading revolutionizes copy trade multiple accounts with its manual trade copier: Link TradingView alerts to Tradovate sub-accounts, auto-applying SL/TP brackets. 2025 features: Multi-level TP, trailing stops, and OCO orders across unlimited accounts—ideal for prop like Apex (up to 20 evals). Setup per docs: Enable multi-account in settings, add tokens, tag alerts (e.g., “multi:qty=2”). Users report 40% faster execution vs. manual, with 3M+ trades processed. ProjectX advantages? Seamless integration for TopstepX too.

2. Duplikium: Versatile Portfolio Automation for Global Brokers

Cloud-based Duplikium handles portfolio automation across MT4/5 and cTrader, with blacklist/whitelist filters and equity protection. 2025 update: Reverse trading flips losers to winners—perfect for hedging account management. Latency: 150ms global; supports Tradovate via API bridges.

3. CrossTrade: High-Speed Trade Copier for NinjaTrader Pros

For futures, CrossTrade’s sub-100ms sync excels in copy trade multiple accounts, with cross-contract management. 2025: Enhanced error recovery for vol spikes—QuantVPS rates it top for scalpers.

4. FX Blue: Free Entry to Account Management Automation

FX Blue’s personal copier runs locally (VPS recommended), customizing lot sizes per slave. Free tier suits testing Can I automate trading across several accounts—premium adds unlimited slaves.

5. Tradesyncer: Analytics-Driven Multi-Account Trading Automation

Tradesyncer’s dashboard tracks P&L across copies, with AI risk tools. 2025: Sentiment integration for smarter portfolio automation.

Step-by-Step Setup: How to Automate Trading Across Several Accounts with Trade Copier

Can I automate trading across several accounts on Tradovate? Follow this trade copier blueprint using PickMyTrade (adaptable to others).

Step 1: Choose & Link Master/Slave Accounts

Select master (e.g., TradingView demo) and slaves (Tradovate props). In PickMyTrade dashboard: Account Settings > Enable Multi-Account > Add Tradovate tokens/names. Tradovate tip: Use nicknames for easy ID.

Step 2: Configure Trade Copier Parameters

Set risk: Qty multipliers, SL/TP offsets, equity caps. For copy trade multiple accounts, tag alerts (e.g., “multi:account=Demo1,Demo2”). Docs: Supports brackets, trails, OCO—auto-syncs fills.

Step 3: Integrate Signals & Test Portfolio Automation

Link TradingView webhook to PickMyTrade endpoint. Test in sim: Alert triggers → Instant copies with SL/TP. Monitor via dashboard—2025’s cloud ensures 24/7 uptime, no login needed.

Step 4: Go Live with Account Management Safeguards

Scale to live: Set daily loss locks, diversify (e.g., 50% ES, 50% NQ). Tradovate’s Group Trade complements for manual tweaks.

Pro: 99.9% uptime; con: Initial token setup (5-10 mins). Reddit: “PickMyTrade saved hours on Apex multis.”

Portfolio Automation Strategies: Enhancing Account Management in 2025

Leverage trade copier for diversified portfolio automation:

- Prop Scaling: Copy signals across 10+ evals (Apex/TopstepX)—PickMyTrade’s tags adjust sizes per rules.

- Risk Parity: Vary lots (e.g., 1x master, 0.5x slaves) for balanced account management.

- Hybrid Manual/Auto: Use copier for entries, manual for exits—Tradovate’s ATM supports.

- Backtesting Multi-Accounts: Simulate with PickMyTrade’s paper mode; 2025 AI scores validate.

X traders note: “Automation turned my 5-account chaos into 30% YTD gains.”

Pros & Cons of Multi-Account Trading Automation Tools in 2025

Pros:

- Copy trade multiple accounts scales edges 5-20x without effort.

- Trade copier reduces errors 80%; cloud = no VPS hassle.

- Portfolio automation via analytics boosts ROI 25%.

Cons:

- Latency risks in peaks (mitigate with VPS).

- Prop compliance: Over-copying flags breaches.

- Costs: $29-50/mo; free tiers limit slaves.

Verdict: Revolutionize Your Trading with Multi-Account Automation in 2025

Multi-account trading automation via trade copier tools like PickMyTrade isn’t hype—it’s the 2025 edge for efficient account management and scaled profits. Can I automate trading across several accounts? With Tradovate’s updates and no-code copiers, yes—start small, test rigorously, and watch your portfolio automation soar. Dive into PickMyTrade’s free trial; your multi-account empire awaits.

Frequently Asked Questions (FAQs) on Multi-Account Trading Automation 2025

Can I automate trading across several accounts with a trade copier?

Yes—tools like PickMyTrade enable copy trade multiple accounts on Tradovate with <50ms latency, auto-SL/TP.

What's the best trade copier for portfolio automation in 2025?

PickMyTrade tops for Tradovate/Rithmic, with unlimited slaves and no-code account management—$50/mo.

How does multi-account trading automation work on Tradovate?

Link accounts via nicknames/groups; use trade copier webhooks for instant replication—2025 updates add unlimited scaling.

Is PickMyTrade good for copy trade multiple accounts?

Absolutely—supports brackets, trails, and 20+ accounts; cloud-based for 24/7 portfolio automation.

What are risks in automating trading across several accounts?

Slippage, overexposure—use risk multipliers and backtest for safe account management.

Disclaimer:

This content is for informational purposes only and does not constitute financial, investment, or trading advice. Trading and investing in financial markets involve risk, and it is possible to lose some or all of your capital. Always perform your own research and consult with a licensed financial advisor before making any trading decisions. The mention of any proprietary trading firms, brokers, does not constitute an endorsement or partnership. Ensure you understand all terms, conditions, and compliance requirements of the firms and platforms you use.

Also Checkout: Connect Tradovate with Trading view using PickMyTrade