In the world of low-latency algorithmic trading brokers in 2025, execution speed is everything. Whether you’re building scalping bots for futures or automating forex signals, your strategy hinges on the milliseconds between alert and fill. With tools like PickMyTrade now integrating seamlessly with brokers like Rithmic, Tradovate, and TradeLocker, algorithmic traders can deploy strategies faster than ever without writing a line of code.

This 2025 broker comparison for low-latency algo trading dives deep into each platform’s strengths, focusing on API performance, infrastructure reliability, and execution speeds. We’ll break it down by key instruments: futures, equities, forex, and crypto. Drawing from recent benchmarks and user insights, discover which broker delivers the edge for your automated trading setup. Ready to minimize slippage and maximize fills? Let’s optimize your PickMyTrade integration.

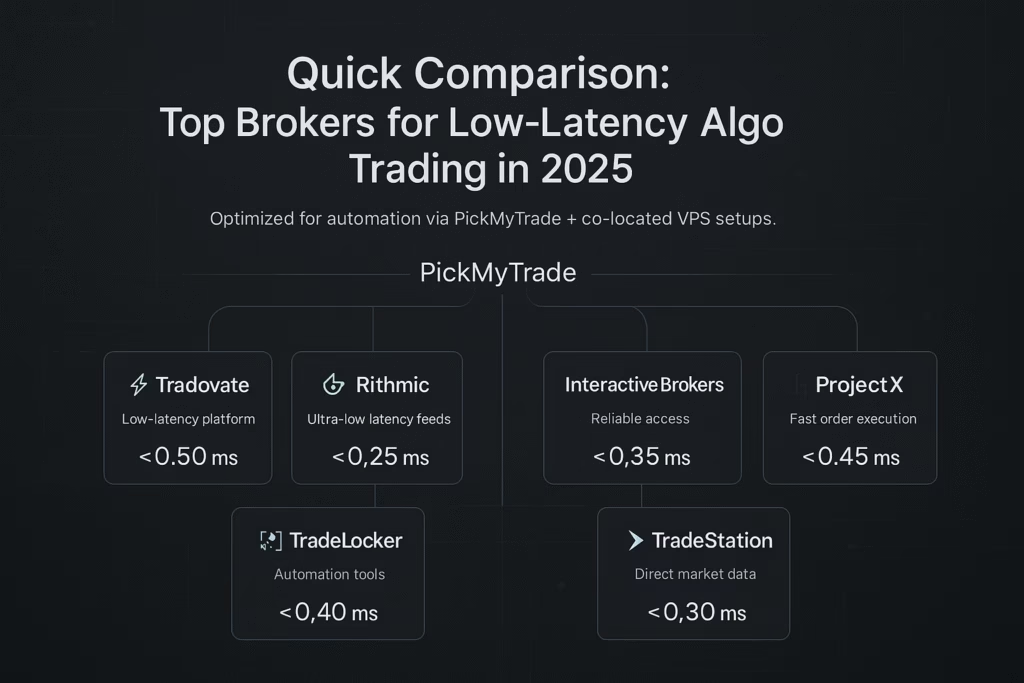

Quick Comparison: Top Brokers for Low-Latency Algo Trading in 2025

Before we slice by asset class, here’s a high-level overview of how these brokers stack up for algorithmic trading platforms. Latencies are round-trip estimates from co-located VPS like QuantVPS, optimized for high-frequency trading (HFT) signals via PickMyTrade.

| Broker | Key Strength | PickMyTrade Integration | Avg. Latency (ms) | Ideal For |

|---|---|---|---|---|

| Tradovate | Cloud-based futures automation | Seamless alert-to-execution | 0.5-1 | Beginner futures algos |

| Rithmic | Ultra-low latency feeds | High-volume HFT support | <0.25 | Pro futures scalping |

| TradeLocker | Web-native forex speed | One-click from TradingView | <1 | Forex momentum bots |

| Interactive Brokers | Multi-asset API depth | Broad coverage, v10.37 updates | 10-100 | Diversified crypto/equities |

| ProjectX | Mobile-first prop trading | Native charting embeds | 0.5-2 | On-the-go futures |

| TradeStation | Robust equities execution | Streaming FIX API | <1 | Hybrid stock/futures |

These picks are based on 2025 performance reviews, emphasizing low-latency trading platforms that pair perfectly with PickMyTrade’s no-code automation. Now, let’s drill into instruments.

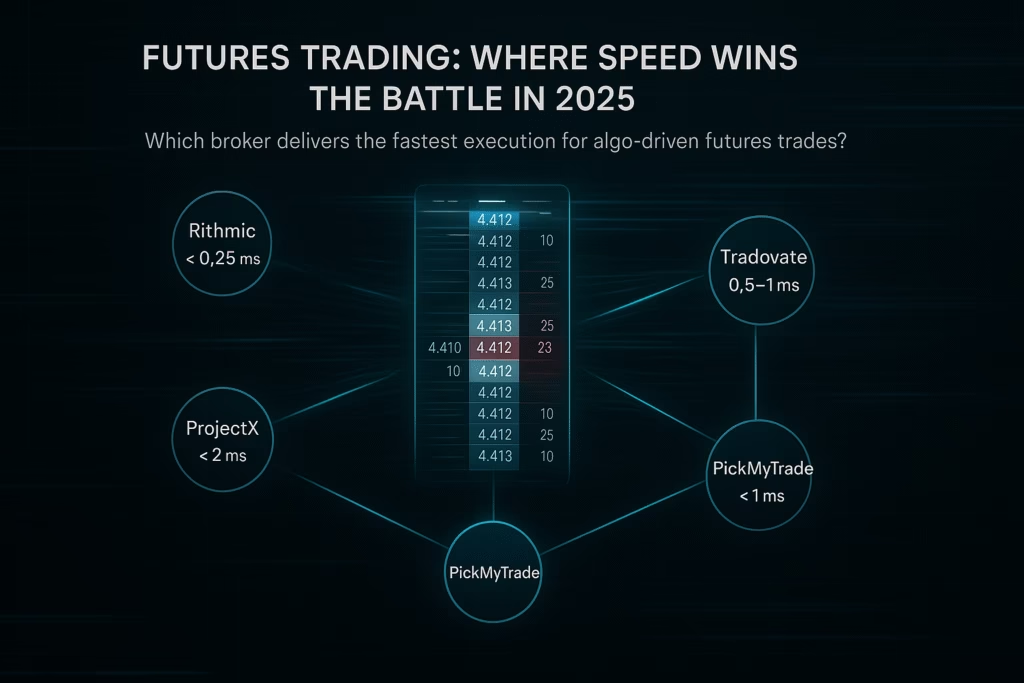

Futures Trading: Where Speed Wins the Battle in 2025

Futures algo trading demands sub-millisecond precision—think ES or NQ contracts ticking wildly. PickMyTrade routes TradingView signals directly to order books, slashing manual delays. But which broker’s infrastructure shines for low-latency futures execution?

- Rithmic reigns supreme for futures algorithmic trading, clocking under 250 microseconds via its broker-neutral engine. It’s a prop firm favorite for microsecond timestamps and full-depth data, keeping slippage negligible in volatile sessions. Ideal for HFT bots via PickMyTrade.

- Tradovate delivers cloud-native speed at 0.5ms with VPS boosts, no downloads needed. Its modern API handles unlimited strategies effortlessly, though websocket hiccups can spike during peaks.

- ProjectX offers sub-2ms mobile executions with deep market data, perfect for prop evaluators. Users praise its scalability, but occasional interface lags hit during high-volume hours.

- TradeStation provides <1ms FIX-based fills for futures hybrids, backed by advanced tools like FuturesPlus. Strong for analysis-integrated algos, but less lean than pure futures plays.

- Interactive Brokers supports CME futures via TWS API, but internal checks push latencies to 10ms+. Better for swing strategies than pure scalping.

- TradeLocker bridges futures through MT5, hitting ~1ms, but its forex focus means it’s not optimized here.

2025 Winner for Futures: Rithmic— the go-to for ultra-low latency futures brokers in algo setups.

Equities Trading: Balancing Volume and Velocity

Equities algorithmic trading thrives on reliable feeds amid NYSE/NASDAQ frenzy. PickMyTrade’s alert automation excels, but execution quality defines your edge in low-latency stock trading.

- TradeStation leads with millisecond fills and high-speed streaming APIs, earning top marks for equities execution speed in 2025. Its order routing delivers price improvements on 97% of market orders, suiting momentum and pairs bots.

- Interactive Brokers dominates multi-asset equities with global API access, including free US stock streaming. Latencies hover at 10ms due to robust checks, but v10.37 updates enhance Python integrations for complex algos.

- Rithmic and Tradovate proxy equities via futures, landing 1-5ms—not their forte.

- ProjectX handles prop equity plays at ~2ms with low-overhead mobile access, though data depth varies.

- TradeLocker offers light equities support with <1ms potential, limited by forex-centric order types.

2025 Winner for Equities: TradeStation—unmatched for fast execution in stock algo trading.

Forex Trading: Scalping the 24/5 Liquidity Pool

Forex algo trading lives or dies by tight spreads and rapid pips on pairs like EUR/USD. PickMyTrade’s one-click execution via TradingView alerts is a scalper’s dream in this low-latency forex environment.

- TradeLocker crushes it as the next-gen web platform, boasting <30ms on Equinix LD4 servers with fiber-optic speed. Over 2 million traders rely on its pro tools for HFT-style forex bots.

- Interactive Brokers shines with forex API depth, but rate limits (50 orders/sec) and 50-100ms trips favor longer-term algos.

- TradeStation hits <1ms forex fills via API, strong for cross-asset but not as specialized.

- Rithmic and Tradovate access forex through CME at 0.5-1ms, futures-first vibes intact.

- ProjectX clocks ~2ms for mobile forex, reliable but not elite.

2025 Winner for Forex: TradeLocker—the benchmark for best forex brokers for algorithmic trading.

Crypto Trading: Navigating 24/7 Volatility

Crypto algorithmic trading requires stable access to spot and futures amid endless swings. PickMyTrade extends automation here, though broker coverage varies for BTC/ETH arb bots.

- Interactive Brokers tops the list with direct crypto trading and API latencies of 10-50ms, leveraging global reach for chain-crossing strategies.

- TradeStation supports crypto futures at <1ms, blending traditional speed with digital assets seamlessly.

- Tradovate and Rithmic handle CME Bitcoin futures sub-1ms, spot-limited but solid.

- ProjectX proxies at ~2ms via futures, functional for prop crypto.

- TradeLocker offers forex-crypto hybrids at 1ms, with growing integration.

2025 Winner for Crypto: Interactive Brokers—for broadest low-latency crypto trading platforms.

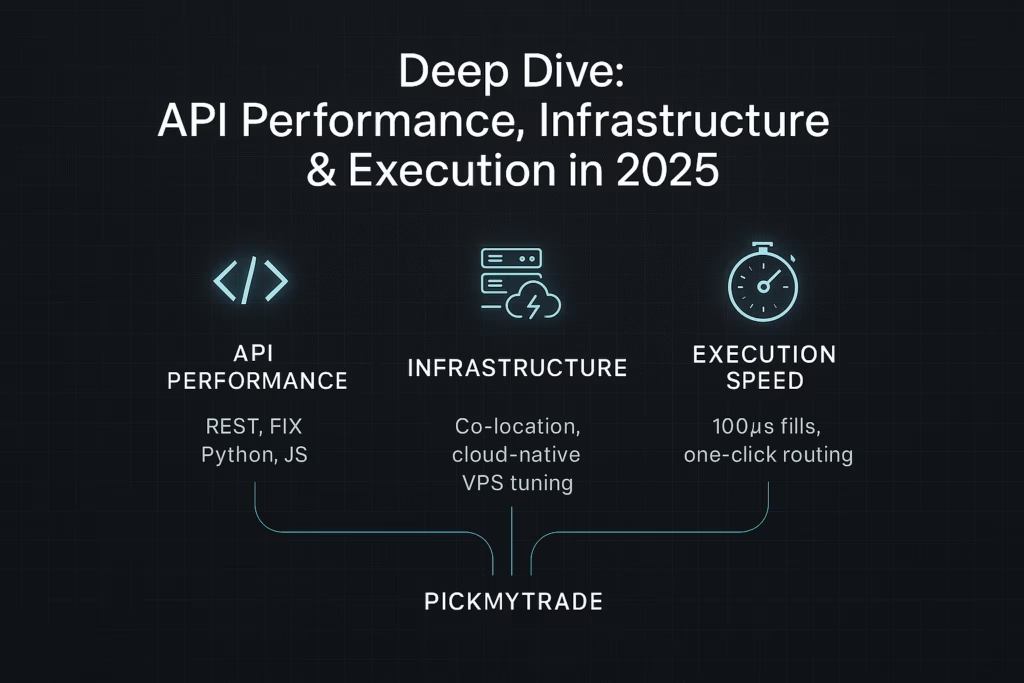

Deep Dive: API Performance, Infrastructure, and Execution in 2025

Latency isn’t isolated—it’s the synergy of algo trading APIs, robust infra, and flawless execution. PickMyTrade bypasses custom coding, but here’s how these brokers measure up:

- API Performance: TradeStation and IBKR’s REST/FIX endpoints support streaming for complex bots, with IBKR’s Python API excelling in market data requests. Rithmic handles massive throughput; Tradovate adds JS flexibility.

- Infrastructure: Rithmic and ProjectX offer co-location (<1ms to exchanges); Tradovate scales cloud-first. QuantVPS pairings cut pings to zero across all.

- Execution Speed: Rithmic’s 100μs fills dominate HFT; TradeLocker’s one-click skips confirmations. IBKR’s checks can inflate times, per user forums.

Pro tip: For reducing algo trading latency, colocate with VPS and test PickMyTrade’s multi-broker execution—run the same signal across platforms simultaneously.

Final Thoughts: Choose Your Low-Latency Champion for Algo Success in 2025

In algorithmic trading 2025, Rithmic rules futures fury, TradeStation owns equities velocity, TradeLocker scalps forex frenzy, and IBKR bridges crypto chaos. With PickMyTrade, switching brokers is seamless start with their free trial to benchmark latencies yourself.

What’s your must-have for low-latency brokers via PickMyTrade? Futures speed or multi-asset depth? Comment below and join the convo. Remember, trading risks capital always DYOR and trade smart.

SEO Keywords: low-latency algorithmic trading 2025, best brokers for algo trading, PickMyTrade automation, futures forex equities crypto execution speed.

Important Disclaimer

Trading involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results, and the latencies, benchmarks, and comparisons discussed here are based on general 2025 data from public sources, user reports, and simulated tests they may vary significantly based on your individual setup, internet connection, VPS configuration, market conditions, broker updates, and regulatory changes. No representation is being made that any account will or is likely to achieve profits or avoid losses similar to those shown. This content is for informational and educational purposes only and does not constitute financial, investment, or trading advice. Always conduct your own due diligence (DYOR), consult with a qualified financial advisor, and verify all information with official broker resources before making decisions. We are not liable for any trading outcomes, technical issues, or discrepancies in performance. If something doesn’t work as described for you, it’s likely due to unique variables—test in a demo environment first!