In the fast-evolving world of trading, heatmap trading has emerged as a game-changer for visualizing market depth, liquidity, and order flow. By using color-coded heatmaps, traders can spot hidden support/resistance levels, absorption patterns, and institutional activity that traditional charts miss. This approach is especially powerful in futures markets, where speed and precision matter.

As of 2026, advancements in tools like Bookmap, LuxAlgo indicators on TradingView, TrendSpider, and CME’s Open Interest Heatmap have made trading more accessible and effective. Recent updates emphasize integrating volume bubbles, liquidity heatmaps, and real-time order flow for better decision-making in volatile US futures like ES (S&P 500 E-mini), NQ (Nasdaq-100), and more.

What Is Heatmap Trading and How Does It Work?

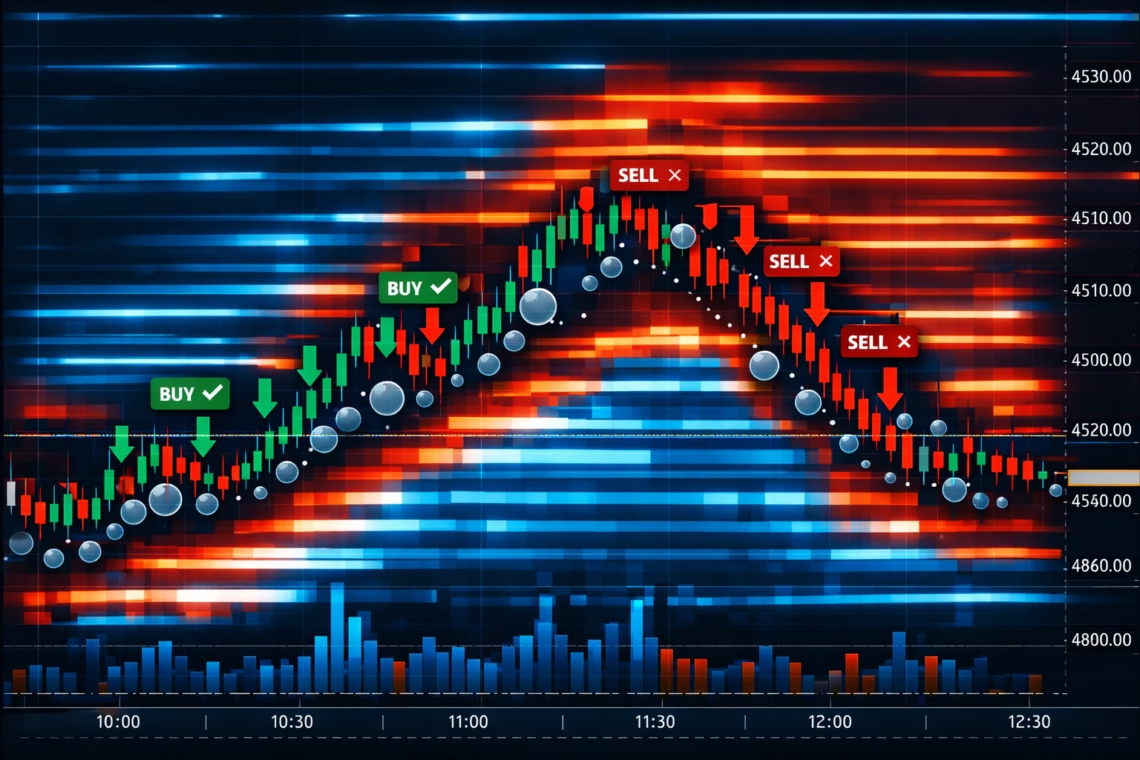

Heatmap trading refers to using visual heatmaps to represent market data, primarily order book depth, executed volume, or liquidity clusters. Unlike standard candlestick charts, a heatmap trading tool displays historical and real-time limit orders as color gradients—brighter or warmer colors indicate higher concentrations of orders or volume.

- Liquidity Heatmaps (e.g., Bookmap): Show resting buy/sell orders over time, helping identify potential support (buy-side liquidity) or resistance (sell-side).

- Volume Heatmaps (e.g., LuxAlgo Volume Grid Heatmap): Map trading volume across price and time, revealing “hot zones” of institutional participation.

- Order Flow Heatmaps: Combine footprints with heat to spot imbalances, absorption, or exhaustion.

In futures, where leverage amplifies moves, heatmap trading reveals true market flow beyond price action alone.

Benefits of Heatmap Trading in Modern Markets

Heatmap trading offers several advantages:

- Real-Time Liquidity Visualization — Spot large orders before price reacts.

- Improved Risk Management — Avoid fakeouts by confirming levels with order flow.

- Edge in Volatile Sessions — Ideal for US futures opens, where liquidity shifts rapidly.

- Automation Potential — Combine insights with alerts for hands-free execution.

Recent 2025-2026 developments include enhanced indicators like LuxAlgo’s Volume Bubbles & Liquidity Heatmap, which highlight buyer/seller dominance and session imbalances. Tools like TrendSpider’s Heatmaps use AI to cluster support/resistance levels automatically.

Click Here To Automate Futures Trading

How to Use Heatmap Trading to Automate Decisions

Automating heatmap trading decisions involves interpreting signals and executing via rules-based systems.

- Identify Key Zones — Look for bright liquidity pools as magnets or barriers.

- Monitor Reactions — Watch price absorption (large orders eaten without breakthrough) or rejection.

- Set Rules — Enter long above strong buy-side heatmap support; exit on exhaustion signals.

- Automate Execution — Use platforms that trigger trades from indicators or alerts.

For US futures markets, PickMyTrade stands out as a leading automation solution. It connects TradingView strategies (including heatmap-based alerts) to brokers like Tradovate, Rithmic, Interactive Brokers, and TradeStation. With unlimited alerts, tickers, and risk controls, PickMyTrade enables 24/7 automated futures trading—perfect for scalping ES/NQ or multi-session strategies. It supports low-latency execution, multi-account management, and compliance-friendly automation under CFTC regulations, making it ideal for retail traders automating trading signals.

Integrating Heatmap Trading with Automation Tools

Pair heatmap trading indicators with automation:

- Use LuxAlgo or Bookmap for visuals.

- Set TradingView alerts on heatmap confluences (e.g., price approaching high-volume zone).

- Route via PickMyTrade for instant execution in US futures.

This setup removes emotion, captures opportunities outside trading hours, and scales strategies across contracts.

Heatmap trading continues to evolve, with 2026 seeing deeper integration of AI-driven heatmaps and order flow in platforms like TradingView and Bookmap. For futures traders, combining these visuals with automation like PickMyTrade unlocks consistent, data-driven edges in the US markets.

Ready to level up? Explore heatmap trading tools and automate with PickMyTrade today.

Most Asked FAQs

What is heatmap trading?

Heatmap trading uses color-coded visuals to show liquidity, order flow, or volume density, helping identify support/resistance and market sentiment.

How does heatmap trading differ from traditional charting?

It reveals hidden order book data and real-time flow, unlike price-only charts, providing deeper insights into why price moves.

Can beginners use heatmap trading?

Yes—start with tools like Bookmap or LuxAlgo on TradingView for intuitive visuals; practice on demo accounts.

Is heatmap trading effective for futures?

Highly effective in US futures (e.g., ES, NQ) due to high liquidity and order flow visibility.

Disclaimer:

This content is for informational purposes only and does not constitute financial, investment, or trading advice. Trading and investing in financial markets involve risk, and it is possible to lose some or all of your capital. Always perform your own research and consult with a licensed financial advisor before making any trading decisions. The mention of any proprietary trading firms, brokers, does not constitute an endorsement or partnership. Ensure you understand all terms, conditions, and compliance requirements of the firms and platforms you use.

Also Checkout: Automate TradingView Indicators with Tradovate Using PickMyTrade