Backtesting is the process of applying a trading strategy to historical market data to see how it would have performed. It gives you a simulated track record—without risking real money—which helps you:

- Identify whether a strategy is viable

- Uncover weaknesses or edge decay

- Build confidence before live deployment

- Understand trade statistics (win rate, drawdown, risk/reward)

But backtesting is not a guarantee of future success. You must also guard against pitfalls like overfitting and data leakage.

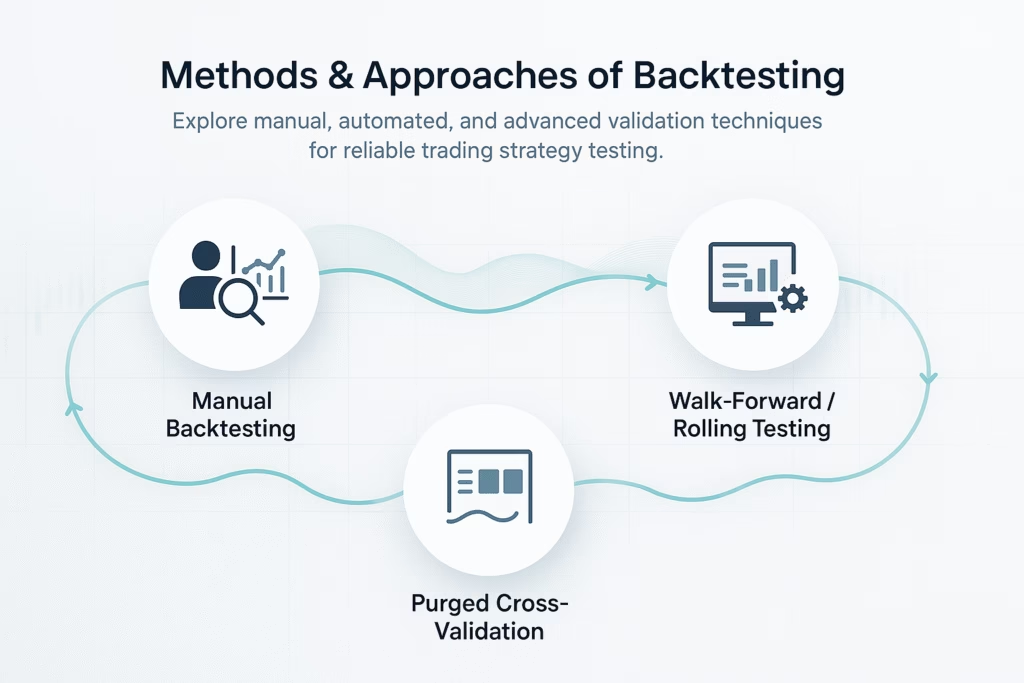

Methods & Approaches of Backtesting

Here are some common types and approaches to backtesting your strategies:

1. Manual Backtesting

You manually scan historical charts and “paper-trade” entries and exits. Useful for beginners, to understand the strategy’s mechanics. But it’s time-consuming and prone to human bias.

2. Automated Backtesting

Use software to automatically simulate trades on historical data. This is the mainstream method for algorithmic and quantitative strategies. You can backtest over large time spans quickly, compare variants, and generate performance reports.

3. Walk-Forward / Rolling Backtesting

Divide data into multiple segments. Optimize parameters on one segment, then test them on a future (out-of-sample) segment. Slide the window forward, and repeat. This approach ensures your strategy remains robust over changing market regimes.

4. Purged Cross-Validation & Embargo Techniques

Especially for machine learning or time-series modelling, conventional k-fold cross validation may leak future information into training sets. Purged cross-validation, where overlapping samples are excluded and a buffer (“embargo”) is added, helps reduce leakage.

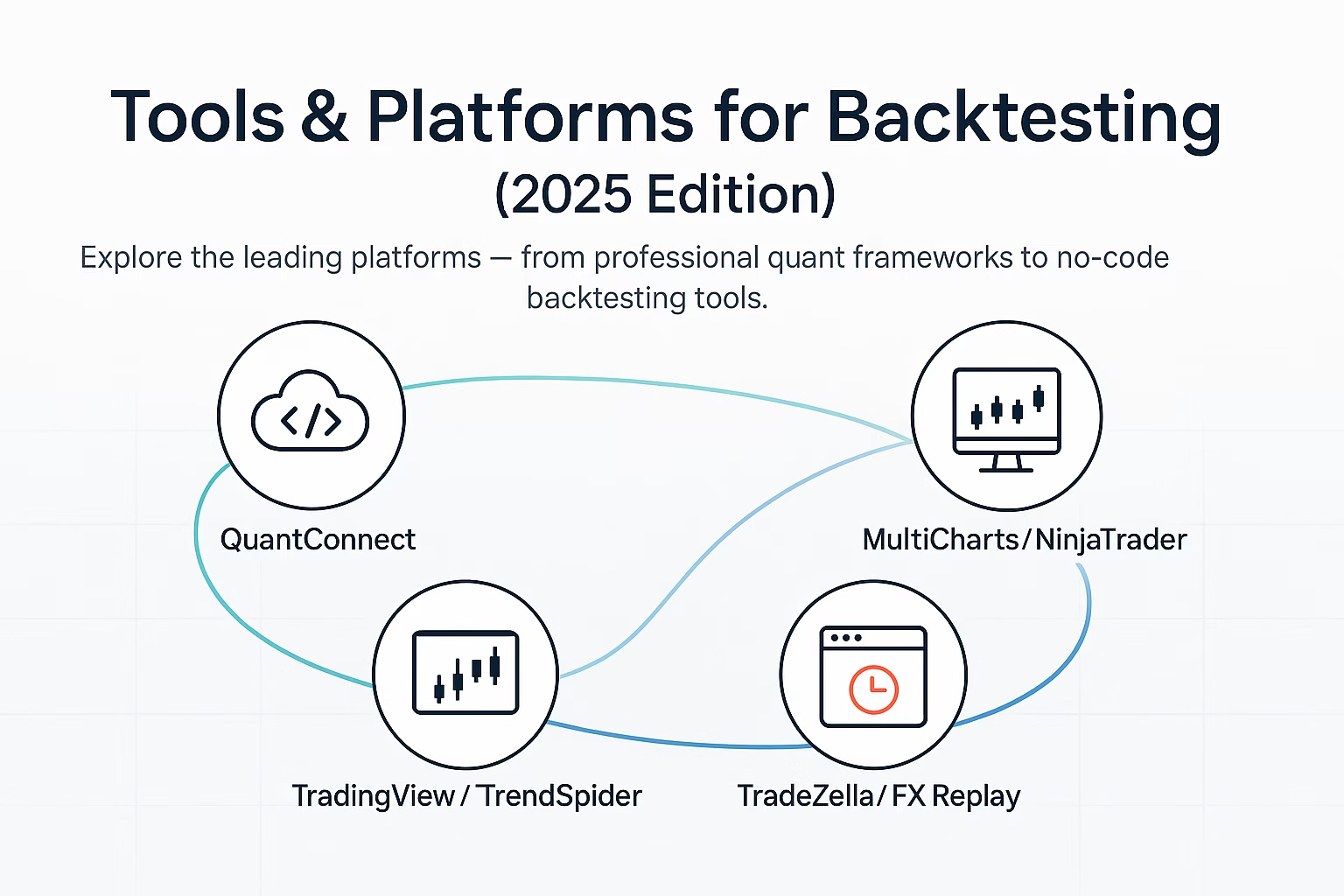

Tools & Platforms for Backtesting (2025 Edition)

Here is a list of popular backtesting tools and platforms you can use today:

| Tool / Platform | Best For / Highlights |

|---|---|

| QuantConnect (LEAN) | Cloud-based, supports Python & C#, multi-asset backtesting + live trading. |

| MultiCharts | Professional desktop platform with deep customization and execution capabilities. |

| NinjaTrader | Strong for futures & hybrid strategies; includes strategy analyzer and replay tools. |

| TradingView | Useful for chart-based strategies via Pine Script; convenient for strategy prototyping. |

| TrendSpider | No-code / visual backtesting + AI features. |

| TradeZella | Web-based tool offering backtesting + journaling in one interface. |

| FX Replay | Focused tool for replaying historical data; useful to visually test strategies. |

Also, more specialized tools like MetaTrader 5, Backtrader (Python), and ProRealTime are widely used by traders.

Click Here To Start Futures Trading Automation For Free

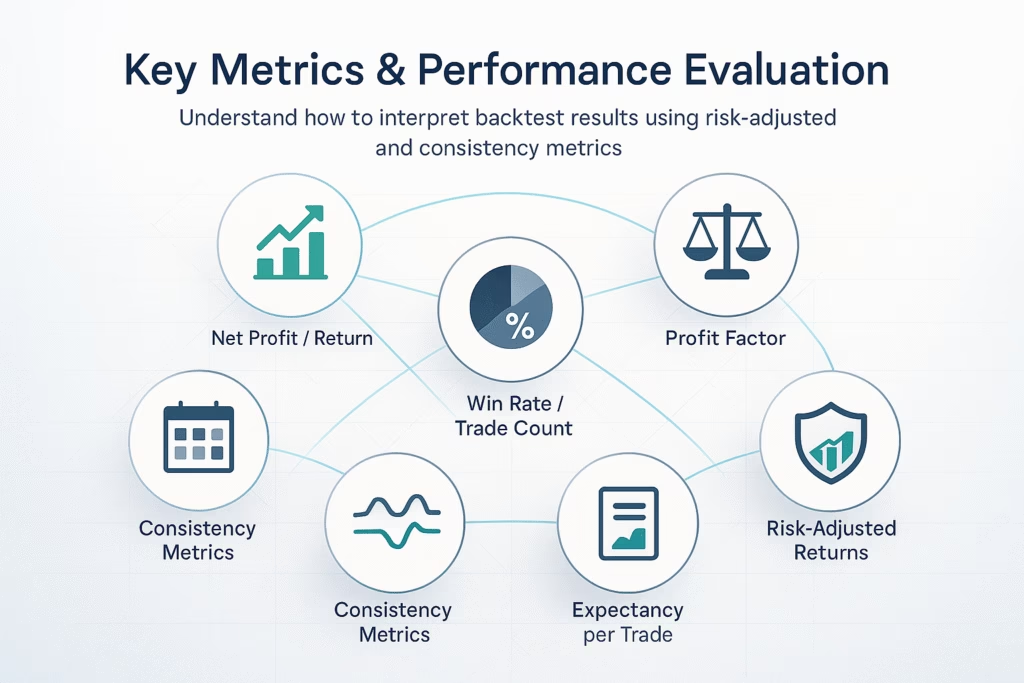

Key Metrics & Performance Evaluation

When reviewing backtest results, focus on these metrics:

- Net Profit / Return

- Win Rate / Trade Count

- Profit Factor (gross wins ÷ gross losses)

- Maximum Drawdown (largest peak-to-valley loss)

- Sharpe Ratio / Sortino Ratio (returns adjusted for risk)

- Consistency Metrics: monthly or quarterly return stability

- Expectancy per Trade

- Risk-Adjusted Returns

Also inspect the equity curve visually—look for large spikes, sudden declines, or periods of flat performance.

Avoiding Common Pitfalls & Biases

Backtesting has traps. These are some to watch out for:

- Overfitting / Curve-Fitting

Tailoring strategy too tightly to historical data makes it brittle in live markets. - Look-ahead Bias / Data Leakage

Using future information in the past, or overlapping labels, gives inflated performance. Use methods like purged cross-validation to minimize this. - Survivorship Bias

Excluding delisted stocks or failed companies can skew results upward. - Ignoring Slippage & Transaction Costs

Always model realistic spreads, commissions, and execution delays. - Changing Market Regimes

A strategy that worked in trending markets might fail in sideways or volatile regimes. - Insufficient Out-of-Sample Testing

Never rely solely on in-sample results—always reserve data for truly unseen testing.

Integrating PickMyTrade for Strategy Execution

Once your strategy passes backtesting, you can bridge it to live markets using PickMyTrade:

- Backtesting + Paper Trading: PickMyTrade provides built-in backtesting and paper trading to validate strategy behavior.

- Strategy Signals to Execution: You can connect your strategy signals (e.g. from TradingView) to PickMyTrade, which routes orders automatically to supported brokers.

- Auto Stop-Loss / Take-Profit: The automation engine can immediately attach SL/TP to trades according to your rules.

- Multi-account replication: One validated strategy can be deployed across multiple accounts via PickMyTrade.

Thus, backtesting becomes not just a validation step, but the foundation of your automated trading workflow.

Final Thoughts

Backtesting is essential if you want to trade seriously. But good backtesting isn’t just running a script it’s careful design, honest modeling, robust testing, and then cautious translation to live markets.

By combining:

- rigorous backtesting methods (walk-forward, purging, cross-validation)

- validated metrics and stress tests

- real-world cost & slippage modeling

- a pipeline to execution using PickMyTrade

…you build a system with higher chances of survival and success in real trading.

FAQs About Backtesting

Q1: Can backtesting guarantee future profits?

A: No. It shows how a strategy would have performed historically. Market conditions change, so always be conservative in interpreting results.

Q2: How much historical data do I need?

A: More is better—at least several years across different market regimes. For futures, using tick-level or minute-level data improves fidelity.

Q3: What is walk-forward testing?

A: Dividing data into training and test segments in a rolling manner to see how your strategy adapts over time.

Q4: What is purged cross-validation?

A: A method that avoids data leakage by purging overlapping data and applying embargo windows in time-series cross-validation.

Q5: When should I move from backtesting to live?

A: Only after your strategy shows good stability across multiple backtests, out-of-sample data, and you start small with live capital (scale gradually).

Q6: Can PickMyTrade handle backtesting, execution and scaling?

A: Yes — it supports strategy backtesting, paper trading, and automated trade execution with SL/TP and multi-account support.

Also Checkout: Automate TradingView Indicators with Tradovate Using PickMyTrade