Automation has become one of the most transformative forces in modern trading. By 2025, the best trading bots operate 24/7, analyzing markets, executing precise entries, managing risk, and eliminating emotional bias from decision-making.

Yet, as automation becomes mainstream, one truth has become obvious: automation alone is no longer the edge integration is.

The traders who win in 2025 are those whose tools connect seamlessly across brokers, asset classes, and strategies. That’s where PickMyTrade leads the pack.

Understanding Trading Bots in 2025

A trading bot is an automated software system that executes buy and sell orders when specific conditions are met.

These bots constantly monitor price, volume, and indicator data across multiple markets. When criteria align — for example, a moving average crossover or RSI threshold the bot acts instantly.

Modern bots range from simple rule-based systems to advanced, AI-powered engines that adapt to shifting market structures. Their advantage lies in speed, precision, and discipline removing hesitation and fatigue from the process entirely.

But automation is not “set and forget.” Effective bot trading requires testing, configuration, and ongoing risk management.

Popular Automated Trading Strategies

The best trading bots can execute almost any structured approach. Here are the most common:

- Trend Following: Enter when markets show strength and ride the momentum.

- Mean Reversion: Buy after dips or short after spikes, expecting a return to average.

- Grid & DCA (Dollar-Cost Averaging): Spread orders across a range to capture volatility.

- Arbitrage: Exploit small price differences across exchanges or brokers.

- Scalping: Make many small, quick trades, relying on ultra-low latency.

- Swing Trading: Hold positions for days or weeks with strong stop-loss control.

Each strategy type has its own demands. Scalping needs millisecond execution; swing trading benefits from robust back-testing and portfolio analytics.

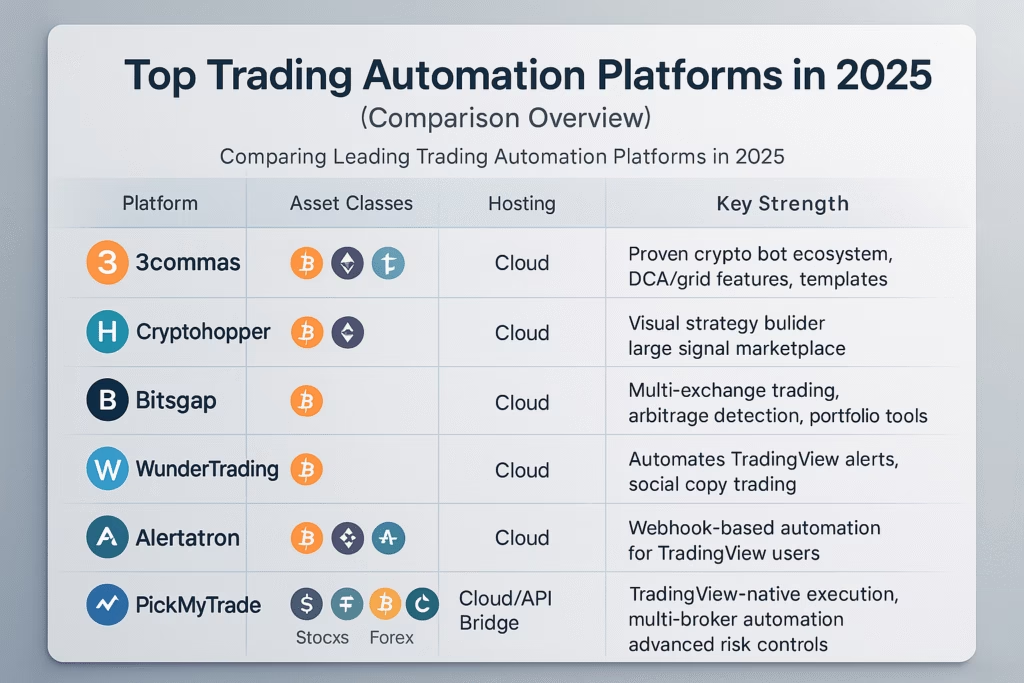

The 2025 Trading-Bot Landscape

A growing number of automation platforms now serve crypto, stocks, futures, and forex markets. The most effective systems combine reliability, analytics, and broker flexibility.

Here’s how the key players compare in 2025:

| Platform | Asset Classes | Hosting | Key Strength |

|---|---|---|---|

| 3Commas | Crypto spot & futures | Cloud | Proven crypto bot ecosystem with DCA/grid features and templates. |

| Cryptohopper | Crypto spot & futures | Cloud | Visual strategy builder and large signal marketplace. |

| Bitsgap | Crypto | Cloud | Multi-exchange trading, arbitrage detection, and portfolio tools. |

| WunderTrading | Crypto | Cloud | Automates TradingView alerts and enables social copy trading. |

| Alertatron | Crypto & multi-asset via webhook | Cloud | Webhook-based alert automation for TradingView users. |

| PickMyTrade | Stocks, Futures, Forex, Crypto | Cloud / API Bridge | TradingView-native execution across multiple brokers and accounts with advanced risk controls. |

Why PickMyTrade Is Different

While most bots automate trading within a single exchange, PickMyTrade acts as the bridge between TradingView signals and multiple brokers.

It was built for traders who need multi-asset, multi-account execution without writing a single line of code.

PickMyTrade Highlights

- Multi-broker support: Execute the same signal on Interactive Brokers, Tradovate, Rithmic, and more — all at once.

- TradingView-native automation: No external webhooks or custom scripting required.

- Unlimited strategies and alerts: Scale across tickers, accounts, and markets without limits.

- Comprehensive risk tools: Stop-loss, take-profit, trailing stops, dynamic position sizing, and daily loss protection.

- Institutional-grade performance: Millisecond-level execution built for prop-firm and professional traders.

PickMyTrade eliminates friction between signal and execution uniting your trading view, strategy, and brokers into one connected system.

Alerts Across Exchanges and Brokers

Most traders today rely on TradingView for charting and strategy alerts. The challenge begins when trying to convert those alerts into actual broker trades especially if you manage multiple accounts or asset types.

PickMyTrade solves this with its direct TradingView integration, allowing you to automate across brokers and exchanges simultaneously.

This means you can run one strategy across multiple venues stocks, futures, forex, and crypto all synchronized with consistent position sizing, stops, and logs.

With PickMyTrade, there’s no delay, no manual confirmation, and no need to maintain separate bots for different markets.

Your TradingView alert becomes a live, risk-managed trade instantly.

2025 Trading Bot Comparison — PickMyTrade vs the Rest

| Capability | PickMyTrade | 3Commas | Cryptohopper | Bitsgap | WunderTrading | Alertatron | Hummingbot | Trade Ideas |

|---|---|---|---|---|---|---|---|---|

| TradingView alerts to live execution | Yes (native) | Limited (via webhooks) | Limited (via webhooks) | Limited (via webhooks) | Yes | Yes | Custom integration only | Not focus |

| Multi-broker support | Yes (Tradovate, Rithmic, IB, etc.) | Crypto only | Crypto only | Crypto only | Mainly crypto | Mainly crypto | Crypto only | Equities only |

| Multi-account broadcast | Yes | Partial | Partial | Partial | Yes | Partial | Manual | N/A |

| Unlimited strategies & alerts | Yes | Plan limits | Plan limits | Plan limits | Plan limits | Plan limits | Unlimited (manual setup) | Limited |

| Risk management suite (SL, TP, trailing, daily loss) | Full suite | Moderate | Moderate | Moderate | Moderate | Basic | Manual | Moderate |

| Execution latency | Millisecond-grade | Exchange-dependent | Exchange-dependent | Exchange-dependent | Cloud latency | Webhook delay | VPS-dependent | API latency |

| Hosting | Cloud / API bridge | Cloud | Cloud | Cloud | Cloud | Cloud | Self-hosted | Cloud |

| Asset-class coverage | Stocks, Futures, Forex, Crypto | Crypto | Crypto | Crypto | Crypto | Crypto | Crypto | Equities |

| Backtesting & analytics | TradingView integration + logs | Yes | Yes | Yes | Limited | None | Custom | Advanced |

| Copy/social features | Optional | Yes | Yes | Yes | Core | No | No | No |

| Security | Encrypted API, 2FA, full audit logs | Trade-only keys | Trade-only keys | Trade-only keys | Trade-only keys | Trade-only keys | User-managed | Broker security |

| Ideal user | Professional, multi-broker, prop trader | Crypto trader | Crypto trader | Crypto trader | TradingView crypto user | Alert relay user | Developer | Stock trader |

Why PickMyTrade Is Superior

- Multi-asset coverage: Works with stocks, futures, forex, and crypto not just crypto exchanges.

- Native TradingView integration: Direct, no-code connection from alerts to brokers.

- Multi-account scaling: Execute strategies across all your accounts instantly.

- Unlimited growth: No restrictions on the number of strategies or tickers.

- Advanced safety features: Built-in stop-loss, trailing stops, and global kill switch.

- Enterprise-grade speed and security: Millisecond execution with encrypted APIs and transparent logs.

PickMyTrade is not just another bot it’s a full execution infrastructure for serious traders.

Evaluating Performance and Risk

When assessing any bot, go beyond return percentages.

Focus on risk-adjusted results and long-term consistency.

Key metrics to track:

- Sharpe/Sortino ratios: Measure profit versus volatility.

- Max drawdown: Understand how deep losses can go.

- Consistency: Monitor win rate and average profit per trade.

- Execution quality: Track slippage and order fill times.

Always back-test with tick-level data and realistic slippage assumptions, and confirm with walk-forward testing before going live.

Security and Risk Management Essentials

Automation demands trust and protection.

Every serious trader should enforce these principles:

- Use trade-only API keys (disable withdrawals).

- Enable 2FA on all connected platforms.

- Define daily loss limits and position size caps.

- Maintain a global kill switch for emergencies.

- Use encrypted keys and secure VPS/cloud environments.

PickMyTrade enforces strict encryption and audit trails so traders retain complete control and accountability.

Cost Structure and Profitability Planning

Different platforms use different pricing models.

- Subscription bots (3Commas, Cryptohopper): Monthly tiers around $15–$150+.

- Self-hosted bots (Hummingbot): Free, but technical.

- PickMyTrade: Flat-rate monthly pricing with unlimited strategies and brokers.

Calculate your break-even edge:

- Add trading fees, spreads, and slippage.

- Include software or VPS costs.

- Determine how many profitable trades you need per month to stay net positive.

This transparency is key before scaling automation to larger capital.

Getting Started with Automation

- Paper trade first: Validate signals and execution.

- Start small: Use minimal size until your setup is proven.

- Track everything: Log trades, win rates, and latency.

- Re-test quarterly: Refresh assumptions and re-optimize.

- Secure all credentials: 2FA and trade-only permissions are non-negotiable.

Automation should enforce your rules, not replace your oversight.

Future Trends and Regulation

The next evolution of automation blends AI, multi-market connectivity, and compliance transparency.

Regulators are introducing stricter standards for algorithmic systems, requiring clearer audit trails and execution logs.

PickMyTrade already aligns with this direction providing full transparency, secure logs, and multi-broker compliance capabilities.

As the line between retail and professional automation continues to blur, these capabilities will define which platforms survive the next wave of regulation.

Conclusion

By 2025, automated trading bots are the backbone of both retail and professional trading.

Platforms like 3Commas, Cryptohopper, and Bitsgap serve crypto traders effectively. Trade Ideas dominates equities.

But for traders who want cross-broker, multi-account, TradingView-driven automation, there is one clear choice PickMyTrade.

Automation amplifies your performance but it also amplifies your structure.

PickMyTrade ensures that structure is built for speed, safety, and scale.

Start Automating Smarter

For traders looking to automate trading strategies, PickMyTrade offers seamless integrations with multiple platforms. You can connect Rithmic, Interactive Brokers, TradeStation, TradeLocker, or ProjectX through pickmytrade.io.

If your focus is Tradovate automation, use pickmytrade.trade for a dedicated, fully integrated experience. These integrations allow traders to execute strategies automatically, manage risk efficiently, and monitor trades with minimal manual intervention.

You May also Like:

Top Trading Indicators Tools to Enhance Your Strategy in 2025

Top Stock Market Software in 2025: Boost Your Strategy Today

Kraken vs Coinbase: Best Trading Features & API Access in 2025

ProjectX vs Tradovate: Complete Comparison for Futures Traders