In the evolving world of trading, automation is becoming a game-changer. Today, we dive into how you can seamlessly automate your Rithmic connections using TradingView, especially through the innovative platform of PickMyTrade. This guide will walk you through the steps to integrate TradingView with Rithmic, enhancing your trading capabilities.

Understanding the Integration

Previously, users enjoyed the integration of TradingView with Tradovate, and now, due to popular demand, we have developed a similar solution for Rithmic. The setup process is straightforward and mirrors the Tradovate integration, allowing you to take advantage of both platforms effectively.

Setting Up Your Rithmic Account

To get started, you need to connect your Rithmic account to PickMyTrade. Here’s how:

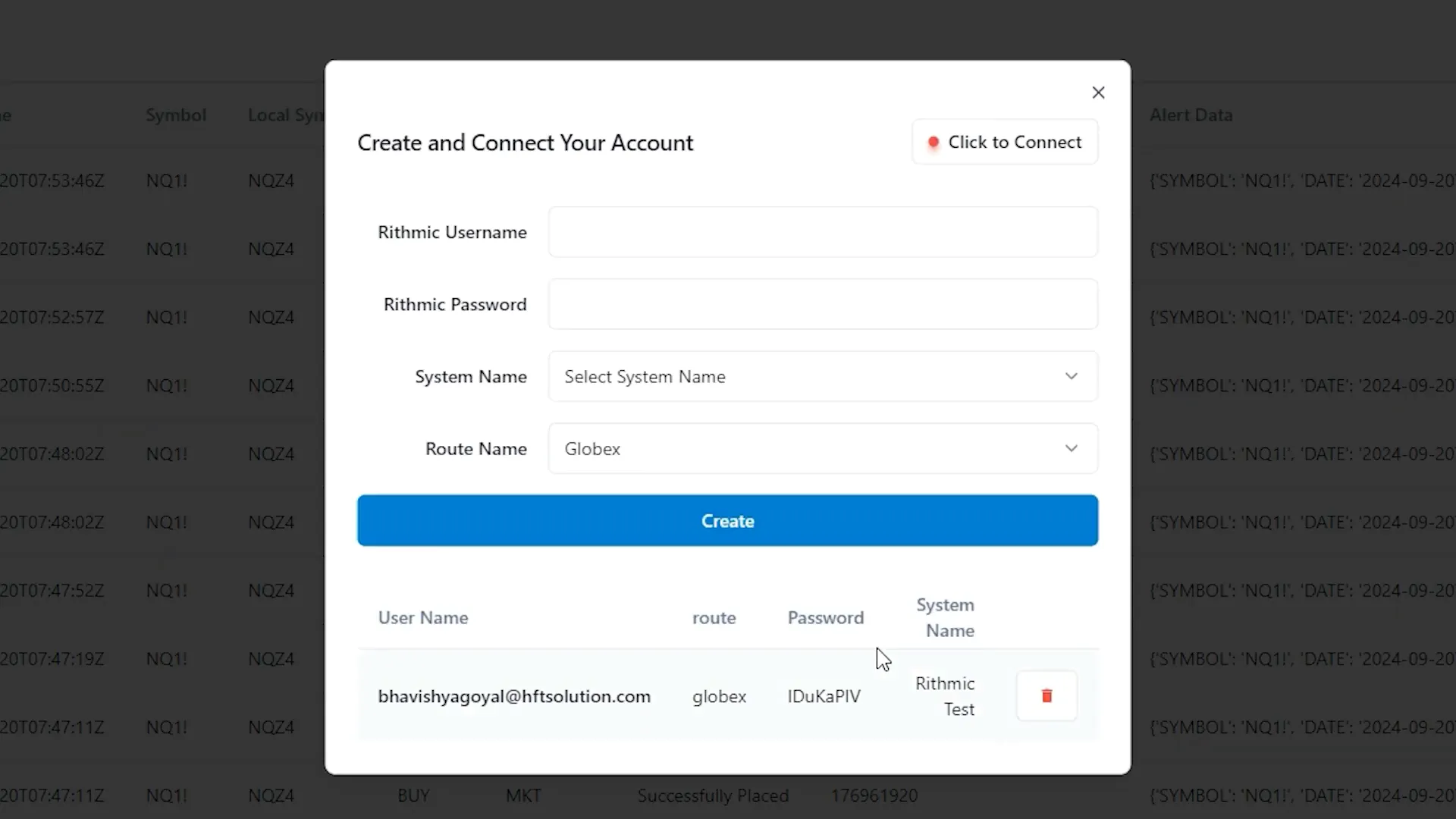

- Login Credentials: Start by entering your Rithmic username and password into the PickMyTrade platform.

- Select System Name: Choose the system name based on your trading requirements. If you opt for ‘Rithmic paper trading’, you’ll be in simulation mode. For ‘Rithmic test’ or ‘Rithmic 01’, you will be in live trading mode.

Once you have entered your details, click on the “Create” button. You will see a pop-up message with terms and conditions; agreeing to this will save your settings. After that, click on “Connect” to finalize the integration.

Generating Alerts

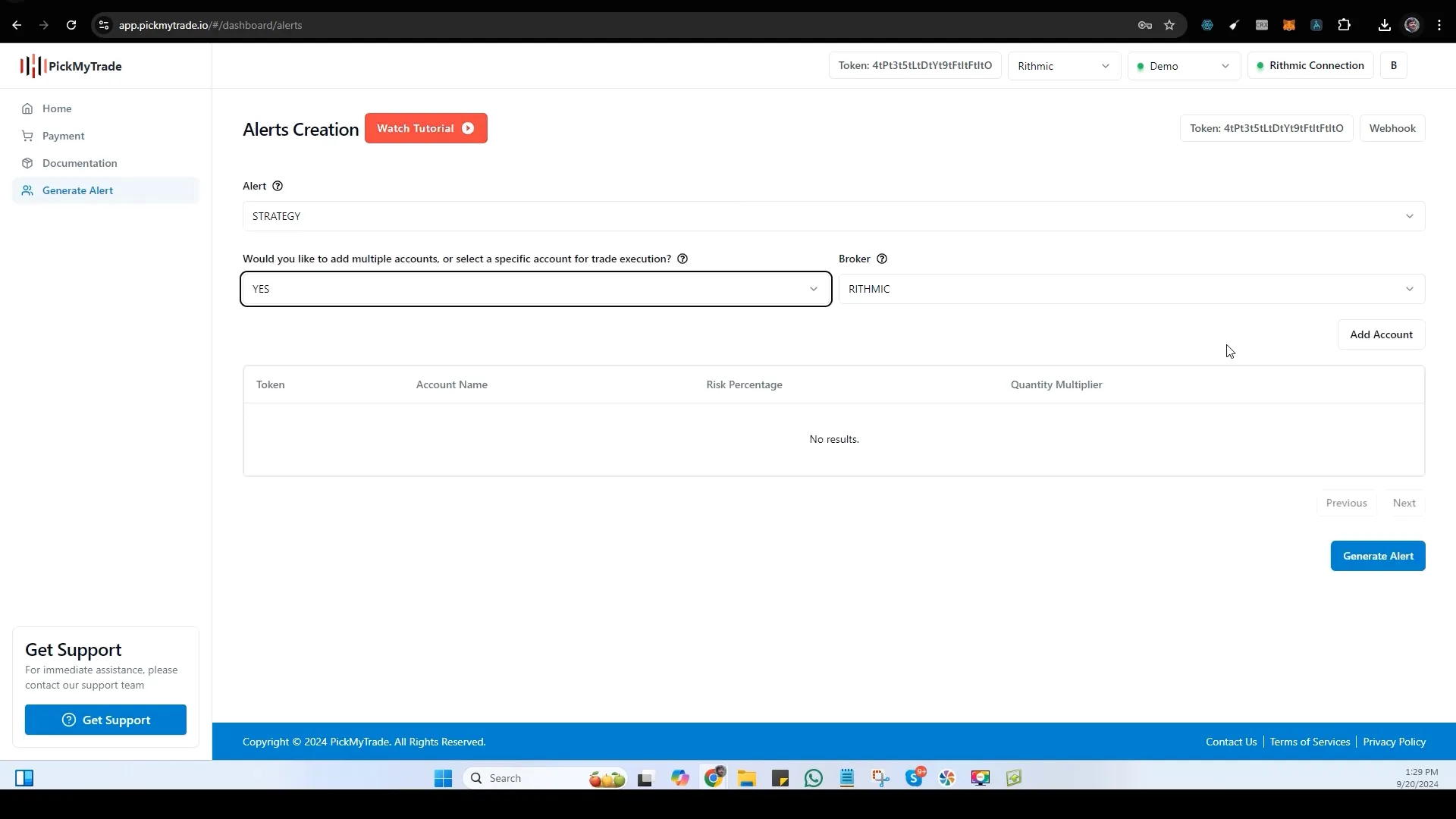

After successfully connecting your account, the next step is to generate alerts. Alerts are crucial for automated trading as they trigger actions based on your predefined strategies. Here’s how to set it up:

- Generate Alert: Click on “Generate Alert” and choose either an indicator or a strategy. Various tutorials are available to guide you through this process.

- Account Specification: Specify your account and confirm by clicking “Yes”.

- Add Account: Here, you’ll input your account name and click on “Save Changes”.

Integrating with TradingView

To automate your trades effectively, you need to integrate your alerts with TradingView. Follow these steps:

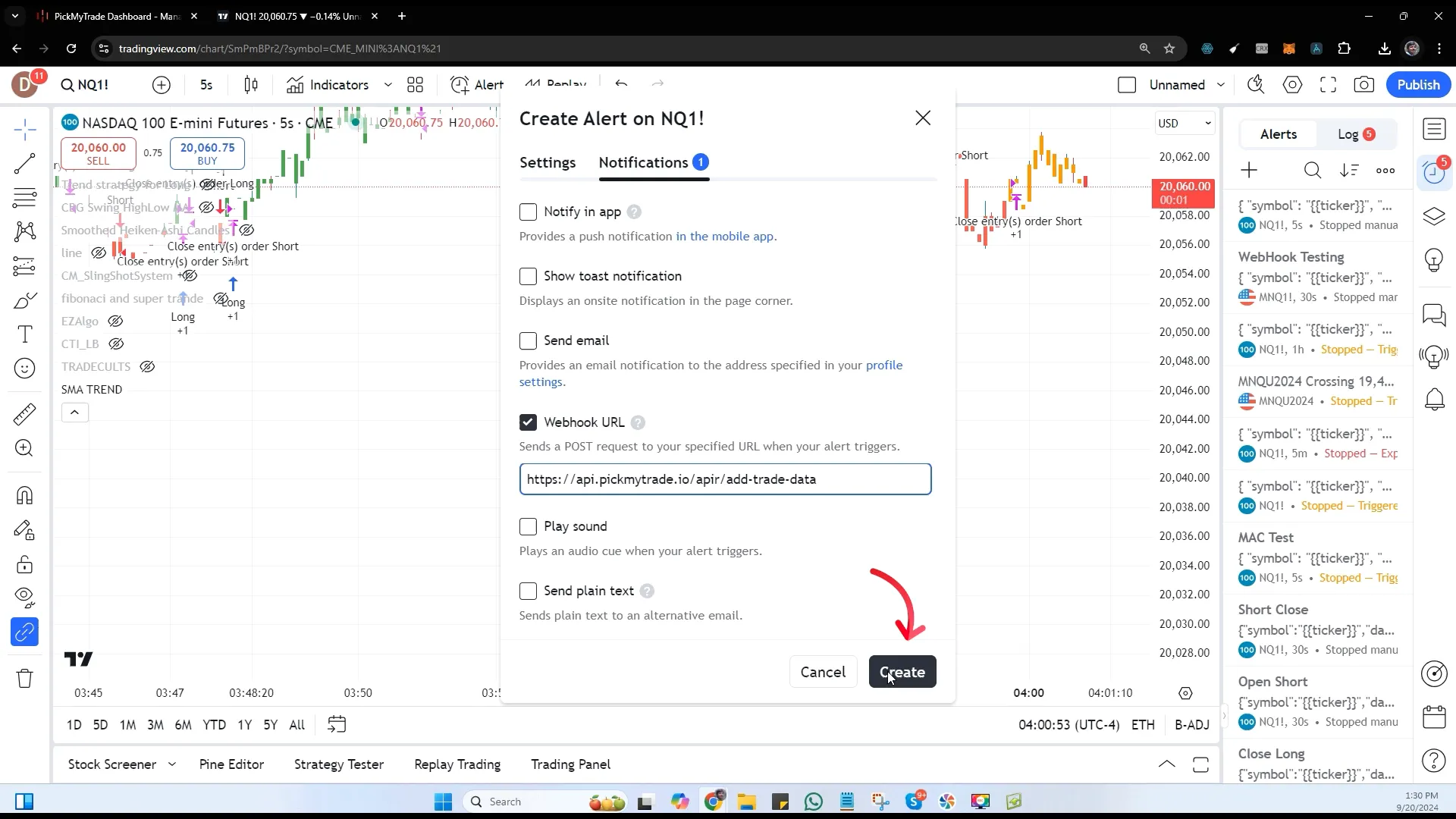

- Copy Code: After generating the alert, click on “Copy Code”.

- TradingView Alerts: Go to TradingView, select your strategy, and paste the copied code into the alert settings.

- Webhook URL: In the webhook URL field within TradingView, paste the URL from PickMyTrade. This step is crucial for ensuring that alerts trigger actions in your Rithmic account.

Monitoring Alerts and Orders

Once your alerts are set, you can monitor them directly from the PickMyTrade homepage. Alerts will be displayed as entry IDs, and any take profit or stop-loss orders will also be visible here. You can keep track of all orders placed in your Rithmic account, including any that may have been rejected.

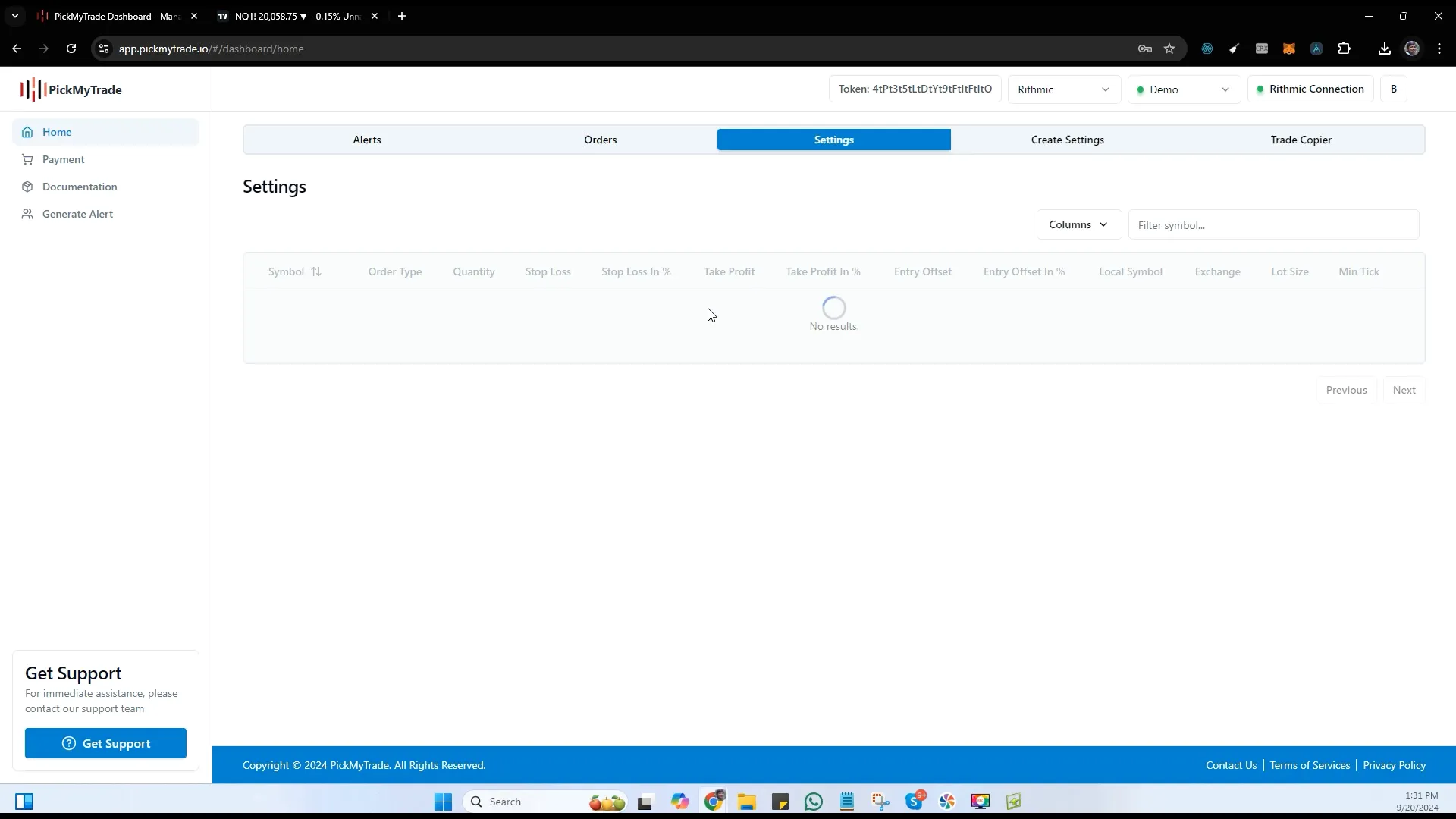

Settings and Customization

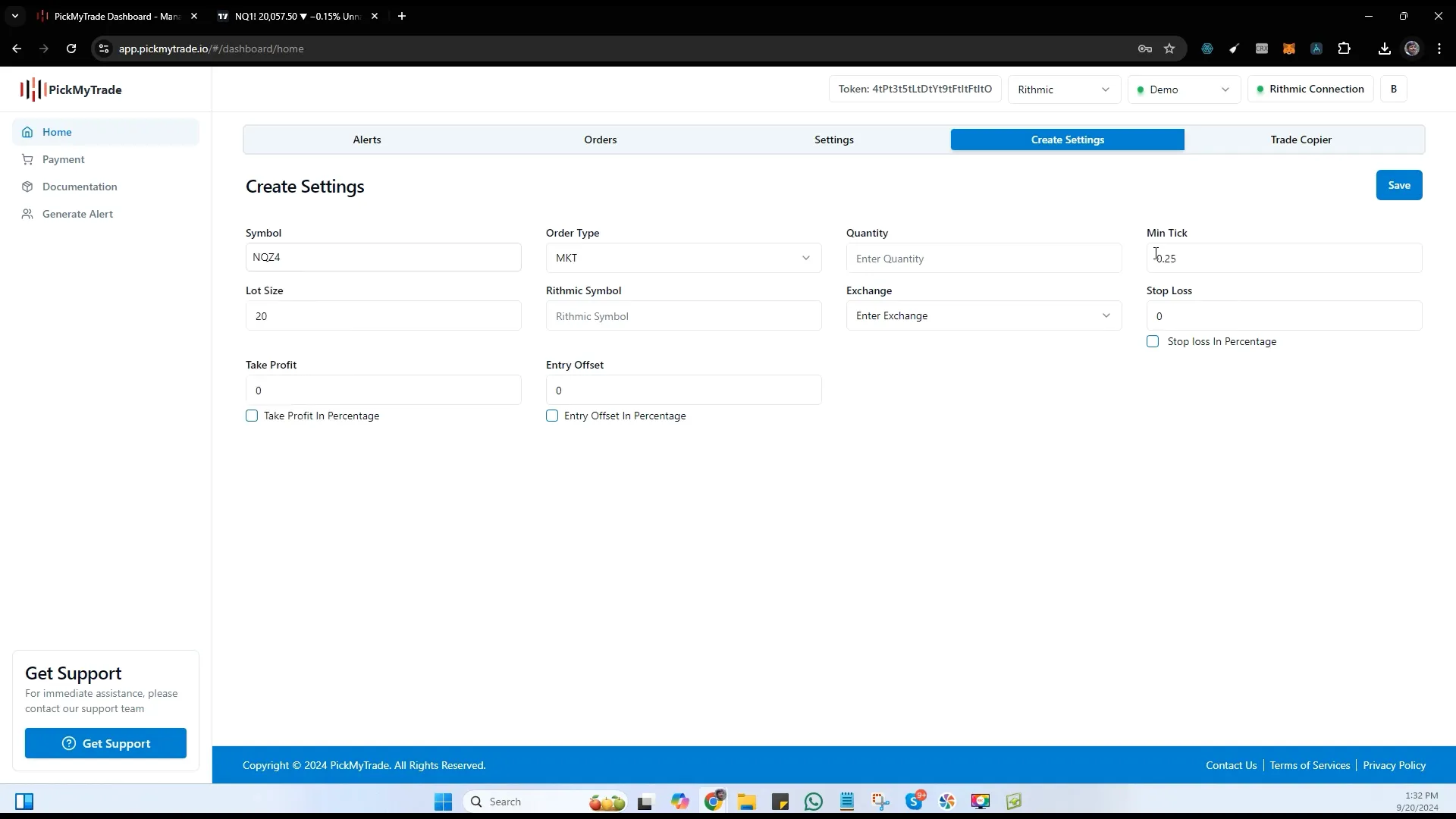

PickMyTrade offers a settings section that auto-populates commonly used symbols. If you can’t find a specific setting, simply search for it. For example, if you want to look up the NQ symbol, you can easily find it or create a mapping for it if it’s not available.

- Order Type: Specify whether you’re placing a market or limit order.

- Quantity: You can input the quantity for your trades.

Understanding Symbol Mapping

If your symbol does not conform to standard tick sizes or lot sizes, you can go to TradingView and click on the security info for the specific symbol. This will provide you with the necessary point value and tick size to input into PickMyTrade.

After entering the relevant details, ensure you save your settings for future trades.

Conclusion

The integration of TradingView to Rithmic via PickMyTrade opens up new avenues for automated trading, making it more efficient and streamlined. As you venture into automated trading, remember to monitor your trades and alerts regularly to ensure everything runs smoothly.

If you have any questions or need assistance, don’t hesitate to reach out to our support team. Join the automated trading revolution with PickMyTrade and enhance your trading experience today!

For more tutorials and insights, check out our complete guides on TradingView and Rithmic integrations at:

PickMyTrade

PickMyTrade specializes in automating trading bots, enabling seamless strategy execution for futures from platforms like TradingView, across well-known brokers such as Tradovate.