Introduction

The rise of the AI trading bot is reshaping how traders analyze markets, automate strategies, and respond to real-time data. Elon Musk’s Grok AI—built by his xAI team—has now entered the arena. Designed to interact in natural language and tap into live sentiment from X (formerly Twitter), Grok claims to assist with market analysis and automation.

But how well does this AI trading bot actually perform in real trading environments?

In this blog, we put Grok to the test across five hands-on use cases to evaluate whether it deserves a place in your trading workflow.

Watch the full breakdown on YouTube:

1. Market Sentiment Analysis: NASDAQ 100

We began by asking Grok: “Is the NASDAQ 100 bullish or bearish for intraday trading today?”

Grok responded with a nuanced view, highlighting both bullish and bearish factors. It also incorporated real-time sentiment from X (formerly Twitter), pointing to a possible build-up in bullish momentum.

This approach offers traders a more balanced perspective by combining technical conditions with social sentiment—an increasingly important edge in modern markets.

2. Identifying High-Momentum Stocks

Next, we asked Grok to identify three U.S. stocks with strong momentum on the day. Its response:

- Tesla (TSLA): up to +5.1%

- Palantir (PLTR)

- Magna International (MGA): up +3.8%

These quick scans helped narrow down potential trading opportunities without manual chart checking or external screeners. Grok provided actionable, concise answers—ideal for intraday traders.

3. Entry, Target, and Stop-Loss Analysis

We then tested Grok’s ability to define trade levels. For Tesla (TSLA), the prompt asked for a precise entry, target, and stop-loss:

- Entry: $286

- Target: $290

- Stop-loss: $282

On reviewing the 4-hour chart, the momentum aligned with this setup. The 15-minute chart confirmed the $286 entry just above a resistance zone, suggesting a swing opportunity post-consolidation.

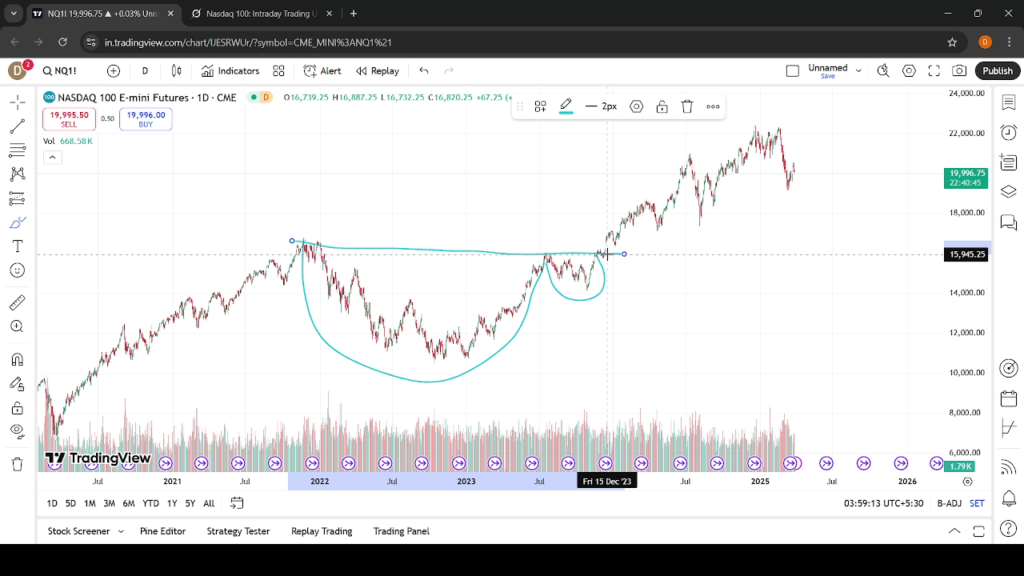

4. Chart Pattern Recognition: NQ Daily

To assess Grok’s technical pattern recognition, we shared the Nasdaq Futures (NQ) daily chart and asked if it could identify a known pattern.

Grok accurately identified a textbook cup and handle formation:

- Cup: November 2021 to July 2023

- Handle: July to November 2023

- Breakout point: November 2023 onward

This confirmed that Grok can perform deeper technical analysis—not just summarizing, but spotting legitimate chart structures often used in trading systems.

5. From Indicator to Pine Script Strategy

Finally, we tested whether Grok could convert an indicator into a full Pine Script strategy inside TradingView. Using Bollinger Bands, we copied the code and asked Grok to generate a trading strategy version.

In seconds, it created a working strategy script. After pasting it into the Pine Script editor and clicking “Add to Chart,” the script executed as expected, showing long entry and exit signals.

For traders who aren’t programmers, this dramatically reduces the time needed to prototype and test strategies—turning a manual idea into an executable system in minutes.

Conclusion

Grok AI isn’t a replacement for solid trading skills or experience—but it can serve as a valuable assistant in the trading process. From scanning markets and identifying patterns to building full strategies, Grok performs well when used with well-crafted prompts.

If you’re looking to streamline your analysis or develop faster trading ideas, tools like Grok AI may become part of your trading toolkit in the near future.

Using Grok to scan for high-momentum stocks sounds like a major time-saver. It’s interesting how it blends real-time social data with stock performance.

I love how Grok can identify high-momentum stocks so quickly. For intraday traders, that time-saving aspect seems super valuable. The fact that it integrates live data from platforms like X is a great touch.

I’m curious about the accuracy of Grok’s sentiment analysis over time. How well does it handle sudden market shifts or volatile news events? It seems like the bot’s strength lies in its adaptability, but I’d love to see how it performs during a major market correction.

Nice breakdown of Grok’s capabilities! The way it can scan high-momentum stocks so quickly is impressive. Do you think Grok might face challenges in highly unpredictable markets, or is it flexible enough to adjust its strategies on the fly?

Really interesting breakdown of Grok’s trading capabilities. I like how you tested its use of real-time sentiment from X—something most bots still struggle to interpret effectively. It would be great to see future tests comparing Grok’s signals against actual intraday performance to gauge how that sentiment analysis translates into profitable trades.