The Advanced Strategy Template v6 is a strategy execution and risk-management framework designed to test external indicators under consistent and repeatable conditions.

This script does not generate buy or sell signals internally. Instead, all trade entries and exits are driven by a user-supplied indicator through a numeric connector. This design intentionally separates signal generation from trade execution, allowing users to evaluate indicators without rewriting complex strategy logic.

What is an Indicator Template?

An indicator template in this context refers to a standardized execution framework. Traditionally, TradingView indicators only provide visual signals. To backtest them, you would typically need to convert the entire script into a strategy, which requires manual coding for every new indicator.

This “Indicator Template” acts as a universal bridge. It provides a fixed environment where any signal—whether based on RSI, MACD, or a custom algorithm—can be plugged in and immediately benchmarked against professional risk management constraints. It allows traders to focus on the quality of their signals while the template handles the heavy lifting of position management, stop losses, and take profits.

Purpose and Originality

The purpose of this template is to provide a standardized execution framework rather than a specific trading methodology. By decoupling the signal source from the execution engine, the script focuses on how trades are managed after a signal occurs.

This allows users to:

- Benchmark different indicators under identical execution rules.

- Compare stop-loss and take-profit models objectively.

- Study the impact of specific risk constraints on performance.

- Reduce bias caused by inconsistent trade management.

This makes the script suitable for educational testing and experimentation, rather than presenting a standalone profitable strategy.

How the Signal Connector Works

The strategy listens to a single numeric data source supplied by an external indicator. The indicator must output values using the following convention:

- 1: Open long position

- -1: Open short position

- 0: No action

- 2: Custom close for long positions (optional)

- -2: Custom close for short positions (optional)

The strategy reacts only to these specific values and ignores all other internal logic from the source indicator.

Example Connector Code (Indicator Side)

To make any indicator compatible with this template, users must add a connector snippet to their script. Below is a standard example:

// ─────────────────────────────

// 🔌 Strategy Connector

// 1 = Buy

// -1 = Sell

// 0 = No Signal

// ─────────────────────────────

signal = buySignal ? 1 : sellSignal ? -1 : 0

plot(signal, title="Connector", display=display. None)In this example, buySignal and sellSignal represent the indicator’s own internal logic. The connector plot is hidden and used strictly as a data source for the strategy template.

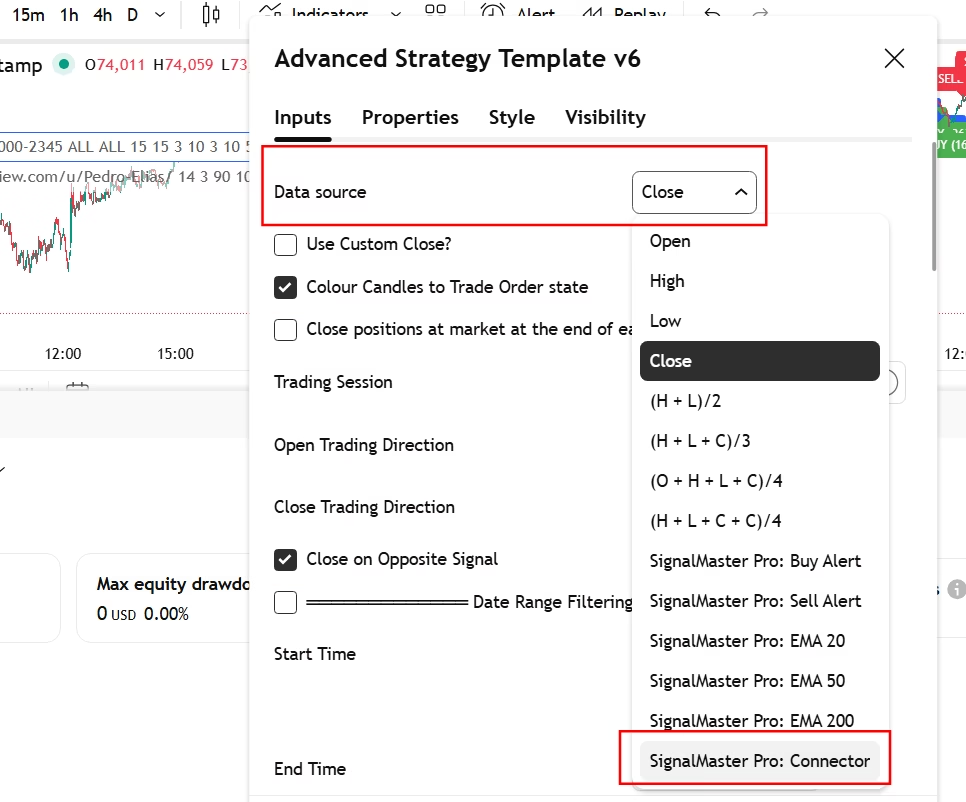

How to Connect the Indicator to the Strategy

- Add the indicator (with the connector snippet) to your TradingView chart.

- Access the Advanced Strategy Template v6 and add it to the same chart.

- Open the Strategy settings.

- Set the “Data source” input to the indicator’s “Connector” plot.

- Configure the risk, stop-loss, and take-profit settings as required.

The full strategy execution script is provided below for reference. The strategy will not execute trades unless a valid connector signal is received from the linked indicator.

Execution and Risk-Management Features

This template provides a comprehensive suite of configurable execution modules, including:

- Position Management: Sizing and pyramiding control.

- Risk Constraints: Maximum drawdown and intraday loss limits.

- Streak Protection: Consecutive win, loss, and losing-day limits.

- Stop-Loss Methods: Percent-based, trailing, ATR, or structure-based (pivots).

- Take-Profit Models: Single target, tiered targets, risk-reward ratios, and Fibonacci levels.

- Optimization Tools: Optional breakeven logic and session-based trading controls.

All execution logic operates independently of the signal source, ensuring that the benchmark results accurately reflect the management settings rather than the signal’s bias.

Strategy Properties and Results

Default strategy properties are intentionally conservative and provided only as a demonstration baseline. Backtest results depend entirely on the connected indicator, the market and timeframe selected, and the user-defined execution parameters.

Results generated by this template do not represent a trading edge and should not be interpreted as financial advice.

Intended Use

This script is intended for:

- Educational study of trade execution and risk control.

- Indicator benchmarking under identical execution rules.

- Exploring how different exit strategies influence outcomes.

It is not intended to promote or present a standalone trading strategy. For those looking to automate their results, the template can be used in conjunction with third-party tools such as PickMyTrade to bridge signals to brokerage accounts once a robust execution model is established.

Advanced Strategy Template

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Daveatt - Enhanced Version

//@version=6

// https://www.tradingview.com/blog/en/use-an-input-from-another-indicator-with-your-strategy-19584/

strategyName = "Advanced Strategy Template v6"

traderId = "DAVE"

// Strategy configuration values

initialCapital = 1000000

positionSize = 10.0

commissionRate = 0.075

maxPyramiding = 3

calcOnFills = true

strategy(title=strategyName, shorttitle=strategyName,

overlay=true, pyramiding=maxPyramiding, initial_capital=initialCapital, default_qty_type=strategy.percent_of_equity,

default_qty_value=positionSize, commission_type=strategy.commission.percent, commission_value=commissionRate, calc_on_order_fills=calcOnFills,

precision=6, max_lines_count=500, max_labels_count=500)

// ————— Indicator Connection

signalSource = input.source(close, title="Data source")

// Custom exit signal

enableCustomExit = input.bool(false, title="Use Custom Close?")

// ————— Visual Settings

colorBars = input.bool(true, title="Colour Candles to Trade Order state")

enableSessionClose = input.bool(false, title="Close positions at market at the end of each session ?")

tradingSession = input.session("0000-2345", title="Trading Session")

entryDirection = input.string(defval="ALL", title="Open Trading Direction", options=["ALL", "LONG", "SHORT"])

exitDirection = input.string(defval="ALL", title="Close Trading Direction", options=["ALL", "LONG", "SHORT"])

closeOnReversal = input.bool(true, title="Close on Opposite Signal")

// ————— Date range filtering

enableDateFilter = input.bool(false, title="═════════════ Date Range Filtering")

startDate = input.time(defval = timestamp("01 Jan 2019 13:30 +0000"), title = "Start Time")

endDate = input.time(defval = timestamp("30 Dec 2021 23:30 +0000"), title = "End Time")

isDateAllowed() => enableDateFilter ? time >= startDate and time <= endDate : true

// ————— Consecutive loss/win limits

enableLossStreakLimit = input.bool(title="═════════════ Set Max number of consecutive loss trades", defval=false)

maxLossStreak = input.int(title="Max of consecutive loss trades", defval=15, minval=1)

enableWinStreakLimit = input.bool(title="═════════════ Set Max number of consecutive won trades", defval=false)

maxWinStreak = input.int(title="Max Winning Streak Length", defval=15, minval=1)

// ————— Consecutive losing days

enableLosingDaysLimit = input.bool(title="═════════════ Set MAX consecutive days with a loss in a row", defval=false)

maxLosingDays = input.int(title="Max of consecutive days with a loss in a row", defval=3, minval=1)

enableMaxDD = input.bool(title="═════════════ Set Max Total DrawDown", defval=false)

maxDrawdownPercent = input.int(title="Max Drawdown (%)", defval=10, minval=1, maxval=100)

enableIntradayLossLimit = input.bool(title="═════════════ Set Max Intraday Loss", defval=false)

maxIntradayLossPercent = input.int(title="Max Intraday Loss (%)", defval=3, minval=1, maxval=100)

enableDailyTradeLimit = input.bool(title="═════════════ Limit the number of trades per day", defval=false)

maxTradesPerDay = input.int(title="Number MAX of daily trades", defval=10, minval=1, maxval=100)

enableWeeklyTradeLimit = input.bool(title="═════════════ Limit the number of trades per week", defval=false)

maxTradesPerWeek = input.int(title="Number MAX of weekly trades", defval=50, minval=1, maxval=100)

// ————— Stop loss management

stopLossType = input.string(title="═════════════ Stop Type Selection", defval="None", options=["None", "Percent", "Trailing", "ATR", "Structure"])

// Percent-based stops

stopLossPercent = input.float(title="Stop Loss (%)", minval=0.0, step=0.5, defval=1) * 0.01

trailingStopPercent = input.float(title="Trail Stop Loss (%)", minval=0.0, step=0.5, defval=3) * 0.01

// ATR stops

atrStopPeriod = input.int(title="═════════════ ATR Stop Length", defval=14)

atrStopMultiplier = input.float(defval=1, title="[ATR ONLY] Risk Ratio", step=0.10)

// Structure-based stops

swingLookback = input.int(title="═════════════ Structure Lookback Period", defval=5, minval=1)

swingStopBuffer = input.float(title="[STRUCTURE] Stop Offset (pips/points)", defval=0, step=0.1)

// ————— Take Profit

takeProfitType = input.string(title="════ Take Profit Type Selection", defval="None", options=["None", "Percent", "ATR", "RiskReward", "Tiered", "Fibonacci"])

// Percent TP

takeProfitPercent = input.float(title="Take Profit (%)", minval=0.0, step=0.5, defval=3) * 0.01

// ATR TP

atrTpPeriod = input.int(title="══════ ATR Take Profit Length", defval=14)

atrTpMultiplier = input.float(defval=2, title="[ATR ONLY] Reward Ratio", step=0.10)

// Risk:Reward Ratio

rrRatio = input.float(title="══════ [R:R] Risk:Reward Ratio", defval=2.0, minval=0.5, step=0.5)

// Tiered Targets

enableTieredTP = input.bool(title="══════ Enable Tiered Targets", defval=false)

tier1Percent = input.float(title="[TIERED] TP1 (%)", defval=1.0, step=0.5) * 0.01

tier1ClosePercent = input.int(title="[TIERED] TP1 Close % of Position", defval=33, minval=1, maxval=100)

tier2Percent = input.float(title="[TIERED] TP2 (%)", defval=2.0, step=0.5) * 0.01

tier2ClosePercent = input.int(title="[TIERED] TP2 Close % of Position", defval=33, minval=1, maxval=100)

tier3Percent = input.float(title="[TIERED] TP3 (%)", defval=3.0, step=0.5) * 0.01

tier3ClosePercent = input.int(title="[TIERED] TP3 Close % of Position", defval=34, minval=1, maxval=100)

// Fibonacci Targets

fibLookbackPeriod = input.int(title="══════ [FIBONACCI] Lookback Period", defval=20, minval=5)

enableFib382 = input.bool(title="[FIBONACCI] Use 0.382 Level", defval=false)

enableFib618 = input.bool(title="[FIBONACCI] Use 0.618 Level", defval=true)

enableFib100 = input.bool(title="[FIBONACCI] Use 1.0 Level", defval=true)

enableFib162 = input.bool(title="[FIBONACCI] Use 1.618 Level", defval=true)

enableFib262 = input.bool(title="[FIBONACCI] Use 2.618 Level", defval=false)

fib382ClosePercent = input.int(title="[FIBONACCI] 0.382 Close %", defval=25, minval=1, maxval=100)

fib618ClosePercent = input.int(title="[FIBONACCI] 0.618 Close %", defval=25, minval=1, maxval=100)

fib100ClosePercent = input.int(title="[FIBONACCI] 1.0 Close %", defval=25, minval=1, maxval=100)

fib162ClosePercent = input.int(title="[FIBONACCI] 1.618 Close %", defval=25, minval=1, maxval=100)

// Breakeven

enableBreakeven = input.bool(title="══════ Move to Breakeven after TP1", defval=false)

breakevenOffsetPercent = input.float(title="[BREAKEVEN] Offset (%)", defval=0.1, step=0.1) * 0.01

// ————— Colors

colorGreenRaw = color.new(color.lime,0)

colorGreenMedium = color.new(#00b300,0)

colorGreenSemiDark = color.new(#009900,0)

colorGreenDark = color.new(#006600,0)

colorGreenDarkDark = color.new(#003300,0)

colorRedRaw = color.new(color.red,0)

colorRedMedium = color.new(#cc0000,0)

colorRedSemiDark = color.new(#990000,0)

colorRedDark = color.new(#330000,0)

colorRedDarkDark = color.new(#330000,0)

colorFuchsiaRaw = color.new(color.fuchsia,0)

colorFuchsiaMedium = color.new(#c000c0,0)

colorFuchsiaDark = color.new(#800080,0)

colorFuchsiaDarkDark = color.new(#400040,0)

colorYellowRaw = color.new(color.yellow,0)

colorYellowMedium = color.new(#c0c000,0)

colorYellowDark = color.new(#808000,0)

colorYellowDarkDark = color.new(#404000,0)

colorOrangeRaw = color.new(#ffa500,0)

colorOrangeMedium = color.new(#cc8400,0)

colorOrangeDark = color.new(#996300,0)

colorBlueRaw = color.new(#4985E7,0)

colorBlueMedium = color.new(#4985E7,0)

colorGreenBg = color.new(#00FF00,93)

colorRedBg = color.new(#FF0000,90)

LARGE_NUMBER = 1000

// Signal interpretation

signalValue = nz(signalSource)

// 1 = bullish signal

isBullSignal = (signalValue == 1)

// -1 = bearish signal

isBearSignal = (signalValue == -1)

// 2 = custom exit long

customExitLong = enableCustomExit and (signalValue == 2)

// -2 = custom exit short

customExitShort = enableCustomExit and (signalValue == -2)

// Entry Price tracking

entryPriceLevel = ta.valuewhen(condition=isBearSignal or isBullSignal, source=close, occurrence=0)

// ————— RISK MANAGEMENT

intradayLossValue = (enableIntradayLossLimit) ? maxIntradayLossPercent : 100

strategy.risk.max_intraday_loss(value=intradayLossValue, type=strategy.percent_of_equity)

drawdownValue = (enableMaxDD) ? maxDrawdownPercent : 100

strategy.risk.max_drawdown(value=drawdownValue, type=strategy.percent_of_equity)

// Daily trades

dailyTradeCount = (enableDailyTradeLimit) ? maxTradesPerDay : LARGE_NUMBER

strategy.risk.max_intraday_filled_orders(count=dailyTradeCount)

// Weekly trades calculation

var int tradesAtWeekStart = 0

tradesAtWeekStart := if (dayofweek == dayofweek.monday) and (dayofweek != dayofweek[1])

strategy.closedtrades[1] + strategy.opentrades[1]

else

tradesAtWeekStart[1]

weeklyTradeCount = (strategy.closedtrades + strategy.opentrades) - tradesAtWeekStart

isWeeklyTradeAllowed = (enableWeeklyTradeLimit) ? (weeklyTradeCount < maxTradesPerWeek) : true

// Consecutive losing days

losingDaysCount = (enableLosingDaysLimit) ? maxLosingDays : LARGE_NUMBER

strategy.risk.max_cons_loss_days(losingDaysCount)

// Calculate losing streaks

hasNewLoss = (strategy.losstrades > strategy.losstrades[1]) and

(strategy.wintrades == strategy.wintrades[1]) and

(strategy.eventrades == strategy.eventrades[1])

var int currentLossStreak = 0

currentLossStreak := if (hasNewLoss)

nz(currentLossStreak[1]) + 1

else

if (strategy.wintrades > strategy.wintrades[1]) or (strategy.eventrades > strategy.eventrades[1])

0

else

nz(currentLossStreak[1])

isLossStreakOk = (enableLossStreakLimit) ? currentLossStreak < maxLossStreak : true

// Calculate winning streaks

hasNewWin = (strategy.wintrades > strategy.wintrades[1]) and

(strategy.losstrades == strategy.losstrades[1]) and

(strategy.eventrades == strategy.eventrades[1])

var int currentWinStreak = 0

currentWinStreak := if (hasNewWin)

nz(currentWinStreak[1]) + 1

else

if (strategy.losstrades > strategy.losstrades[1]) or (strategy.eventrades > strategy.eventrades[1])

0

else

nz(currentWinStreak[1])

isWinStreakOk = (enableWinStreakLimit) ? currentWinStreak < maxWinStreak : true

// Stop loss calculations

longStopPercent = strategy.position_avg_price * (1 - stopLossPercent)

shortStopPercent = strategy.position_avg_price * (1 + stopLossPercent)

// Trailing stops

var float longTrailingStop = 0.0

var float shortTrailingStop = 0.0

longTrailingStop := if (strategy.position_size > 0)

stopValue = close * (1 - trailingStopPercent)

math.max(stopValue, longTrailingStop[1])

else

0

shortTrailingStop := if (strategy.position_size < 0)

stopValue = close * (1 + trailingStopPercent)

math.min(stopValue, shortTrailingStop[1])

else

999999

useStopLoss = stopLossType != "None"

usePercentStop = stopLossType == "Percent"

useTrailingStop = stopLossType == "Trailing"

useAtrStop = stopLossType == "ATR"

useStructureStop = stopLossType == "Structure"

// ATR calculations

atrStopValue = ta.atr(atrStopPeriod)

atrTpValue = ta.atr(atrTpPeriod)

var float atrStopAtEntry = 0.0

var float atrTpAtEntry = 0.0

if isBullSignal or isBearSignal

atrStopAtEntry := atrStopValue

atrTpAtEntry := atrTpValue

// Structure-based stops

var float longSwingStop = 0.0

var float shortSwingStop = 0.0

if useStructureStop

swingLowPrice = ta.pivotlow(low, swingLookback, swingLookback)

if not na(swingLowPrice)

longSwingStop := swingLowPrice - swingStopBuffer

else

longSwingStop := nz(longSwingStop[1])

swingHighPrice = ta.pivothigh(high, swingLookback, swingLookback)

if not na(swingHighPrice)

shortSwingStop := swingHighPrice + swingStopBuffer

else

shortSwingStop := nz(shortSwingStop[1])

// Final stop loss levels

finalStopLong = usePercentStop ? longStopPercent :

useTrailingStop ? longTrailingStop :

useAtrStop ? entryPriceLevel - (atrStopAtEntry * atrStopMultiplier) :

useStructureStop ? longSwingStop : na

finalStopShort = usePercentStop ? shortStopPercent :

useTrailingStop ? shortTrailingStop :

useAtrStop ? entryPriceLevel + (atrStopAtEntry * atrStopMultiplier) :

useStructureStop ? shortSwingStop : na

// Plot stop loss

plot(series=(strategy.position_size > 0 and useStopLoss) ? finalStopLong : na,

color=color.red, style=plot.style_cross,

linewidth=2, title="Long Stop Loss")

plot(series=(strategy.position_size < 0 and useStopLoss) ? finalStopShort : na,

color=color.red, style=plot.style_cross,

linewidth=2, title="Short Stop Loss")

// ————— Take Profit Management

useTakeProfit = takeProfitType != "None"

usePercentTp = takeProfitType == "Percent"

useAtrTp = takeProfitType == "ATR"

useRiskRewardTp = takeProfitType == "RiskReward"

useTieredTp = takeProfitType == "Tiered"

useFibonacciTp = takeProfitType == "Fibonacci"

// Calculate stop distance for R:R

stopDistanceValue = strategy.position_size > 0 ? math.abs(strategy.position_avg_price - finalStopLong) :

strategy.position_size < 0 ? math.abs(finalStopShort - strategy.position_avg_price) : 0.0

// Fibonacci calculations

var float fibSwingRange = 0.0

var float fibBasePrice = 0.0

if useFibonacciTp

highestPrice = ta.highest(high, fibLookbackPeriod)

lowestPrice = ta.lowest(low, fibLookbackPeriod)

fibSwingRange := highestPrice - lowestPrice

fibBasePrice := entryPriceLevel

// Standard TP prices

tpLongPrice = usePercentTp ? strategy.position_avg_price * (1 + takeProfitPercent) :

useAtrTp ? strategy.position_avg_price + (atrTpAtEntry * atrTpMultiplier) :

useRiskRewardTp ? strategy.position_avg_price + (stopDistanceValue * rrRatio) :

strategy.position_avg_price + (atrTpAtEntry * atrTpMultiplier)

tpShortPrice = usePercentTp ? strategy.position_avg_price * (1 - takeProfitPercent) :

useAtrTp ? strategy.position_avg_price - (atrTpAtEntry * atrTpMultiplier) :

useRiskRewardTp ? strategy.position_avg_price - (stopDistanceValue * rrRatio) :

strategy.position_avg_price - (atrTpAtEntry * atrTpMultiplier)

// Tiered target prices

tier1Long = strategy.position_avg_price * (1 + tier1Percent)

tier2Long = strategy.position_avg_price * (1 + tier2Percent)

tier3Long = strategy.position_avg_price * (1 + tier3Percent)

tier1Short = strategy.position_avg_price * (1 - tier1Percent)

tier2Short = strategy.position_avg_price * (1 - tier2Percent)

tier3Short = strategy.position_avg_price * (1 - tier3Percent)

// Fibonacci target prices

fib382Long = fibBasePrice + (fibSwingRange * 0.382)

fib618Long = fibBasePrice + (fibSwingRange * 0.618)

fib100Long = fibBasePrice + (fibSwingRange * 1.0)

fib162Long = fibBasePrice + (fibSwingRange * 1.618)

fib262Long = fibBasePrice + (fibSwingRange * 2.618)

fib382Short = fibBasePrice - (fibSwingRange * 0.382)

fib618Short = fibBasePrice - (fibSwingRange * 0.618)

fib100Short = fibBasePrice - (fibSwingRange * 1.0)

fib162Short = fibBasePrice - (fibSwingRange * 1.618)

fib262Short = fibBasePrice - (fibSwingRange * 2.618)

// Breakeven tracking

var bool beActivated = false

// Breakeven stop prices

beStopLong = strategy.position_size > 0 ? strategy.position_avg_price * (1 + breakevenOffsetPercent) : 0.0

beStopShort = strategy.position_size < 0 ? strategy.position_avg_price * (1 - breakevenOffsetPercent) : 0.0

if strategy.position_size == 0

beActivated := false

// Plot TP levels

plot(series=(strategy.position_size > 0 and useTakeProfit and not useTieredTp and not useFibonacciTp) ? tpLongPrice : na,

color=color.green, style=plot.style_circles,

linewidth=3, title="Long Take Profit")

plot(series=(strategy.position_size < 0 and useTakeProfit and not useTieredTp and not useFibonacciTp) ? tpShortPrice : na,

color=color.red, style=plot.style_circles,

linewidth=3, title="Short Take Profit")

// Plot tiered targets

plot(series=(strategy.position_size > 0 and useTieredTp) ? tier1Long : na,

color=colorGreenMedium, style=plot.style_circles, linewidth=2, title="TP1 Long")

plot(series=(strategy.position_size > 0 and useTieredTp) ? tier2Long : na,

color=colorGreenSemiDark, style=plot.style_circles, linewidth=2, title="TP2 Long")

plot(series=(strategy.position_size > 0 and useTieredTp) ? tier3Long : na,

color=colorGreenDark, style=plot.style_circles, linewidth=2, title="TP3 Long")

plot(series=(strategy.position_size < 0 and useTieredTp) ? tier1Short : na,

color=colorRedMedium, style=plot.style_circles, linewidth=2, title="TP1 Short")

plot(series=(strategy.position_size < 0 and useTieredTp) ? tier2Short : na,

color=colorRedSemiDark, style=plot.style_circles, linewidth=2, title="TP2 Short")

plot(series=(strategy.position_size < 0 and useTieredTp) ? tier3Short : na,

color=colorRedDark, style=plot.style_circles, linewidth=2, title="TP3 Short")

// Plot Fibonacci targets

plot(series=(strategy.position_size > 0 and useFibonacciTp and enableFib382) ? fib382Long : na,

color=colorYellowRaw, style=plot.style_cross, linewidth=2, title="Fib 0.382 Long")

plot(series=(strategy.position_size > 0 and useFibonacciTp and enableFib618) ? fib618Long : na,

color=colorYellowMedium, style=plot.style_cross, linewidth=2, title="Fib 0.618 Long")

plot(series=(strategy.position_size > 0 and useFibonacciTp and enableFib100) ? fib100Long : na,

color=colorYellowDark, style=plot.style_cross, linewidth=2, title="Fib 1.0 Long")

plot(series=(strategy.position_size > 0 and useFibonacciTp and enableFib162) ? fib162Long : na,

color=colorOrangeMedium, style=plot.style_cross, linewidth=2, title="Fib 1.618 Long")

plot(series=(strategy.position_size > 0 and useFibonacciTp and enableFib262) ? fib262Long : na,

color=colorOrangeDark, style=plot.style_cross, linewidth=2, title="Fib 2.618 Long")

plot(series=(strategy.position_size < 0 and useFibonacciTp and enableFib382) ? fib382Short : na,

color=colorYellowRaw, style=plot.style_cross, linewidth=2, title="Fib 0.382 Short")

plot(series=(strategy.position_size < 0 and useFibonacciTp and enableFib618) ? fib618Short : na,

color=colorYellowMedium, style=plot.style_cross, linewidth=2, title="Fib 0.618 Short")

plot(series=(strategy.position_size < 0 and useFibonacciTp and enableFib100) ? fib100Short : na,

color=colorYellowDark, style=plot.style_cross, linewidth=2, title="Fib 1.0 Short")

plot(series=(strategy.position_size < 0 and useFibonacciTp and enableFib162) ? fib162Short : na,

color=colorOrangeMedium, style=plot.style_cross, linewidth=2, title="Fib 1.618 Short")

plot(series=(strategy.position_size < 0 and useFibonacciTp and enableFib262) ? fib262Short : na,

color=colorOrangeDark, style=plot.style_cross, linewidth=2, title="Fib 2.618 Short")

// Plot breakeven stop

plot(series=(strategy.position_size > 0 and beActivated) ? beStopLong : na,

color=colorBlueMedium, style=plot.style_line,

linewidth=3, title="Breakeven Stop Long")

plot(series=(strategy.position_size < 0 and beActivated) ? beStopShort : na,

color=colorBlueMedium, style=plot.style_line,

linewidth=3, title="Breakeven Stop Short")

// ————— Session Management

isInSession(sess) => not na(time(timeframe.period, sess))

inTradingSession = isInSession(tradingSession)

canTradeInSession = enableSessionClose ? inTradingSession : true

sessionJustStarted = inTradingSession and not inTradingSession[1]

bgcolor(color=(enableSessionClose and isInSession(tradingSession)[1]) ? color.new(color.green, 85) : na,

title="Trading Session")

// Consolidate trading conditions

canTrade = isWeeklyTradeAllowed and isLossStreakOk and isWinStreakOk and isDateAllowed() and canTradeInSession

// Position tracking

hasLongPosition = strategy.position_size > 0

hasShortPosition = strategy.position_size < 0

hasAnyPosition = strategy.position_size != 0

canOpenLongs = entryDirection != "SHORT"

canOpenShorts = entryDirection != "LONG"

// ————— ENTRY LOGIC

if (isBullSignal and canTrade and canTradeInSession and canOpenLongs)

strategy.entry("Long", strategy.long, alert_message="{{ticker}} Long Signal - Entry Price: " + str.tostring(close) + " Timeframe: {{interval}}")

alert(syminfo.tickerid + " Long Signal - Entry Price: " + str.tostring(close) + " Timeframe: " + timeframe.period, alert.freq_once_per_bar_close)

if (isBearSignal and canTrade and canTradeInSession and canOpenShorts)

strategy.entry("Short", strategy.short, alert_message="{{ticker}} Short Signal - Entry Price: " + str.tostring(close) + " Timeframe: {{interval}}")

alert(syminfo.tickerid + " Short Signal - Entry Price: " + str.tostring(close) + " Timeframe: " + timeframe.period, alert.freq_once_per_bar_close)

// ————— CLOSE ON OPPOSITE SIGNAL

if closeOnReversal and strategy.position_size > 0 and isBearSignal

strategy.close(id="Long", alert_message="{{ticker}} Short Signal - Close Long Signal - Timeframe: {{interval}}", comment="Short Signal\nClose Long")

if closeOnReversal and strategy.position_size < 0 and isBullSignal

strategy.close(id="Short", alert_message="{{ticker}} Long Signal - Close Short Signal - Timeframe: {{interval}}", comment="Long Signal\nClose Short")

// ————— CUSTOM CLOSE

if (strategy.position_size > 0 and customExitLong)

strategy.close(id="Long", alert_message="{{ticker}} Custom Close Long Signal - Timeframe: {{interval}}", comment="Custom Close Signal\nClose Long")

alert(syminfo.tickerid + " Custom Close Long Signal - Entry Price: " + str.tostring(close) + " Timeframe: " + timeframe.period, alert.freq_once_per_bar_close)

if (strategy.position_size < 0 and customExitShort)

strategy.close(id="Short", alert_message="{{ticker}} Custom Close Short Signal - Timeframe: {{interval}}", comment="Custom Close Signal\nClose Short")

alert(syminfo.tickerid + " Custom Close Short Signal - Entry Price: " + str.tostring(close) + " Timeframe: " + timeframe.period, alert.freq_once_per_bar_close)

canCloseLongs = exitDirection != "SHORT"

canCloseShorts = exitDirection != "LONG"

// ————— BREAKEVEN LOGIC

if enableBreakeven and not beActivated

if strategy.position_size > 0 and useTieredTp

if high >= tier1Long

beActivated := true

if strategy.position_size < 0 and useTieredTp

if low <= tier1Short

beActivated := true

// Adjusted stops with breakeven

adjustedStopLong = beActivated ? beStopLong : finalStopLong

adjustedStopShort = beActivated ? beStopShort : finalStopShort

// ————— EXIT LOGIC - TIERED TARGETS

if (strategy.position_size > 0 and canCloseLongs and useTieredTp)

strategy.exit(id="TP1 Long", from_entry="Long", qty_percent=tier1ClosePercent,

stop=useStopLoss ? adjustedStopLong : na, limit=tier1Long,

alert_message="{{ticker}} TP1 Long Hit - Timeframe: {{interval}}")

strategy.exit(id="TP2 Long", from_entry="Long", qty_percent=tier2ClosePercent,

stop=useStopLoss ? adjustedStopLong : na, limit=tier2Long,

alert_message="{{ticker}} TP2 Long Hit - Timeframe: {{interval}}")

strategy.exit(id="TP3 Long", from_entry="Long", qty_percent=tier3ClosePercent,

stop=useStopLoss ? adjustedStopLong : na, limit=tier3Long,

alert_message="{{ticker}} TP3 Long Hit - Timeframe: {{interval}}")

if (strategy.position_size < 0 and canCloseShorts and useTieredTp)

strategy.exit(id="TP1 Short", from_entry="Short", qty_percent=tier1ClosePercent,

stop=useStopLoss ? adjustedStopShort : na, limit=tier1Short,

alert_message="{{ticker}} TP1 Short Hit - Timeframe: {{interval}}")

strategy.exit(id="TP2 Short", from_entry="Short", qty_percent=tier2ClosePercent,

stop=useStopLoss ? adjustedStopShort : na, limit=tier2Short,

alert_message="{{ticker}} TP2 Short Hit - Timeframe: {{interval}}")

strategy.exit(id="TP3 Short", from_entry="Short", qty_percent=tier3ClosePercent,

stop=useStopLoss ? adjustedStopShort : na, limit=tier3Short,

alert_message="{{ticker}} TP3 Short Hit - Timeframe: {{interval}}")

// ————— EXIT LOGIC - FIBONACCI TARGETS

if (strategy.position_size > 0 and canCloseLongs and useFibonacciTp)

if enableFib382

strategy.exit(id="Fib 0.382 Long", from_entry="Long", qty_percent=fib382ClosePercent,

stop=useStopLoss ? adjustedStopLong : na, limit=fib382Long,

alert_message="{{ticker}} Fib 0.382 Long Hit - Timeframe: {{interval}}")

if enableFib618

strategy.exit(id="Fib 0.618 Long", from_entry="Long", qty_percent=fib618ClosePercent,

stop=useStopLoss ? adjustedStopLong : na, limit=fib618Long,

alert_message="{{ticker}} Fib 0.618 Long Hit - Timeframe: {{interval}}")

if enableFib100

strategy.exit(id="Fib 1.0 Long", from_entry="Long", qty_percent=fib100ClosePercent,

stop=useStopLoss ? adjustedStopLong : na, limit=fib100Long,

alert_message="{{ticker}} Fib 1.0 Long Hit - Timeframe: {{interval}}")

if enableFib162

strategy.exit(id="Fib 1.618 Long", from_entry="Long", qty_percent=fib162ClosePercent,

stop=useStopLoss ? adjustedStopLong : na, limit=fib162Long,

alert_message="{{ticker}} Fib 1.618 Long Hit - Timeframe: {{interval}}")

if enableFib262

strategy.exit(id="Fib 2.618 Long", from_entry="Long",

stop=useStopLoss ? adjustedStopLong : na, limit=fib262Long,

alert_message="{{ticker}} Fib 2.618 Long Hit - Timeframe: {{interval}}")

if (strategy.position_size < 0 and canCloseShorts and useFibonacciTp)

if enableFib382

strategy.exit(id="Fib 0.382 Short", from_entry="Short", qty_percent=fib382ClosePercent,

stop=useStopLoss ? adjustedStopShort : na, limit=fib382Short,

alert_message="{{ticker}} Fib 0.382 Short Hit - Timeframe: {{interval}}")

if enableFib618

strategy.exit(id="Fib 0.618 Short", from_entry="Short", qty_percent=fib618ClosePercent,

stop=useStopLoss ? adjustedStopShort : na, limit=fib618Short,

alert_message="{{ticker}} Fib 0.618 Short Hit - Timeframe: {{interval}}")

if enableFib100

strategy.exit(id="Fib 1.0 Short", from_entry="Short", qty_percent=fib100ClosePercent,

stop=useStopLoss ? adjustedStopShort : na, limit=fib100Short,

alert_message="{{ticker}} Fib 1.0 Short Hit - Timeframe: {{interval}}")

if enableFib162

strategy.exit(id="Fib 1.618 Short", from_entry="Short", qty_percent=fib162ClosePercent,

stop=useStopLoss ? adjustedStopShort : na, limit=fib162Short,

alert_message="{{ticker}} Fib 1.618 Short Hit - Timeframe: {{interval}}")

if enableFib262

strategy.exit(id="Fib 2.618 Short", from_entry="Short",

stop=useStopLoss ? adjustedStopShort : na, limit=fib262Short,

alert_message="{{ticker}} Fib 2.618 Short Hit - Timeframe: {{interval}}")

// ————— EXIT LOGIC - STANDARD (Single TP)

if (strategy.position_size > 0 and canCloseLongs and not useTieredTp and not useFibonacciTp)

strategy.exit(id="Exit Long", from_entry="Long", stop=useStopLoss ? adjustedStopLong : na, limit=useTakeProfit ? tpLongPrice : na, alert_message="{{ticker}} Close Long Signal - Timeframe: {{interval}}")

alert(syminfo.tickerid + " Exit Long Signal - Exit Price: " + str.tostring(close) + " Timeframe: " + timeframe.period, alert.freq_once_per_bar_close)

if (strategy.position_size < 0 and canCloseShorts and not useTieredTp and not useFibonacciTp)

strategy.exit(id="Exit Short", from_entry="Short", stop=useStopLoss ? adjustedStopShort : na, limit=useTakeProfit ? tpShortPrice : na, alert_message="{{ticker}} Close Short Signal - Timeframe: {{interval}}")

alert(syminfo.tickerid + " Exit Short Signal - Exit Price: " + str.tostring(close) + "Timeframe: " + timeframe.period, alert.freq_once_per_bar_close)

// ————— SESSION END CLOSE

if not canTradeInSession and hasAnyPosition

strategy.close_all()

// ————— EMERGENCY FLATTEN

shouldFlatten = not isWeeklyTradeAllowed or not isLossStreakOk or not isWinStreakOk or not isDateAllowed()

if (shouldFlatten)

strategy.close_all()

// ————— BAR COLORING

barColor = not colorBars ? na : strategy.position_size == 0 ? color.gray :

hasLongPosition ? color.lime :

hasShortPosition ? color.red : color.gray

barcolor(barColor, title="Trade State Bar Colouring")