A trading indicators are a mathematical tool computed from price, volume, or other market data that helps traders interpret market conditions. Indicators help you answer questions like:

- Is a trend strengthening or weakening?

- Is a security overbought or oversold?

- How volatile is the market?

- When might a reversal or breakout occur?

Indicators do not predict perfectly. They signal probabilities. Their utility increases when combined, filtered, and aligned with your trading plan.

Major Categories of Trading Indicators & Their Uses

- Trend Indicators

— Help confirm the direction of the market.

Examples:- Moving Averages (SMA, EMA)

- MACD (Moving Average Convergence Divergence)

- Average Directional Index (ADX)

- Momentum Indicators

— Measure the speed or strength of a movement.

Examples:- RSI (Relative Strength Index)

- Stochastic Oscillator

- Rate-of-Change (ROC), Momentum

- Volatility Indicators

— Gauge how much price is fluctuating.

Examples:- Average True Range (ATR)

- Bollinger Bands

- Volatility bands, Keltner Channels

- Volume / Money Flow Indicators

— Use volume to validate moves.

Examples:- On-Balance Volume (OBV)

- Money Flow Index (MFI)

- Volume Weighted Average Price (VWAP)

- Support & Resistance / Reversal Indicators

— Estimate zones where price might bounce or reverse.

Examples:- Pivot Points

- Fibonacci Retracements

- Parabolic SAR

- Composite / Hybrid Indicators

— Combine types (trend + volatility + momentum) or use ML/AI overlays.

Example: future research models combining indicators via reinforcement learning (QTMRL)

Top Trading Indicators to Watch in 2025 & Their Use Cases

Here are some indicators that are widely used in 2025 with solid reputations:

- RSI (Relative Strength Index) — A go-to momentum oscillator to identify overbought/oversold conditions.

- MACD — Helps detect trend changes and momentum shifts.

- Bollinger Bands — Useful to see volatility expansion or contraction around a moving average.

- ATR — A volatility measure to help set stops or position sizing.

- Stochastic Oscillator — Good in range markets, spotting turning points.

- VWAP — Intraday average price useful for institutional flows and order decisions.

- ADX — Helps confirm whether trend strength is strong enough for a trend strategy.

- Pivot Points / Support-Resistance tools — useful for areas to watch for reactions.

Data from trading platforms and analysis sites suggests that RSI and Bollinger Bands continue to be among the more reliable indicators across markets in 2025.

Also, combining multiple indicators often leads to better performance than relying on just one.

Click Here To Start Futures Trading Automation For Free

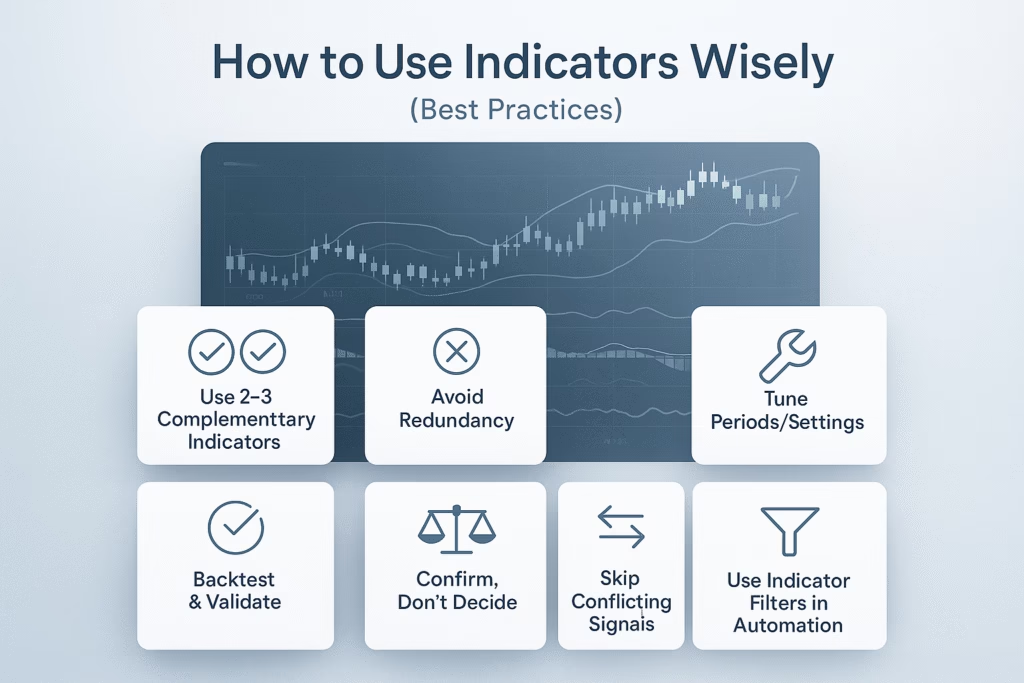

How to Use Indicators Wisely (Best Practices)

- Use 2–3 Indicators that complement each other (e.g. trend + momentum + volatility).

- Avoid Redundancy: Don’t use multiple indicators that all tell the same thing.

- Confirm, Don’t Decide: Use indicators to confirm what price action already suggests.

- Tune Periods/Settings: Default settings are okay to start, but optimize to the instrument & timeframe.

- Backtest & Validate: Always test indicator-based strategies over historical data to see how they perform.

- Skip Conflicting Signals: If your trend indicator says “go with trend”, skip signals from reversal indicators unless conditions are strong.

- Use Indicator Filters in Automation: If automating (via PickMyTrade), embed indicator logic as filters so trades are only triggered when your suite aligns.

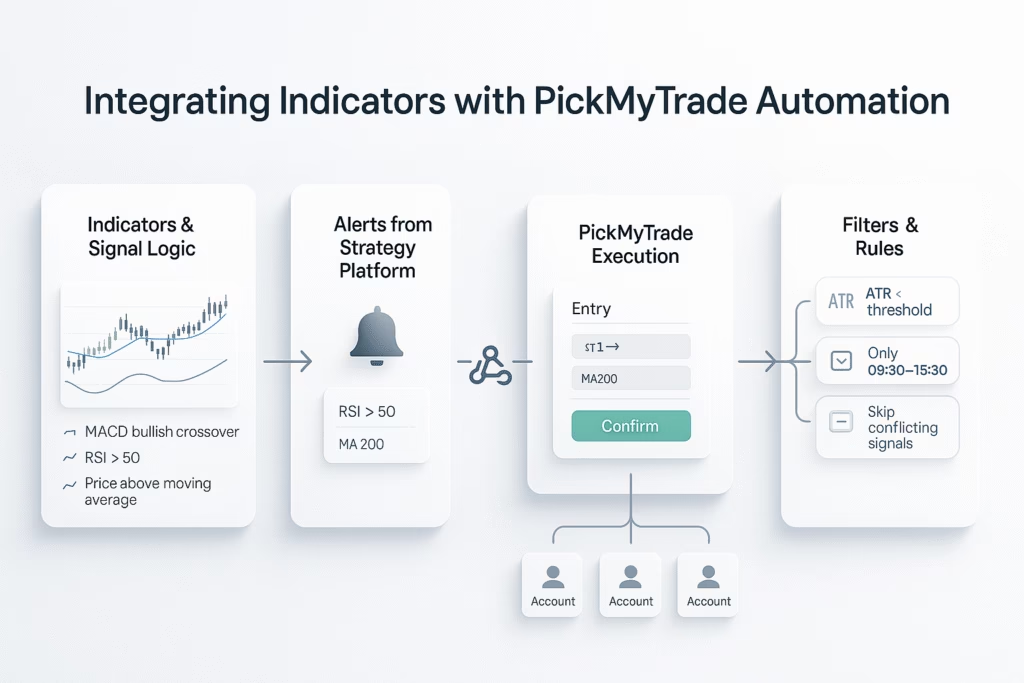

Integrating Indicators with PickMyTrade Automation

Once you have indicator-based signal logic (for example, “MACD bullish crossover + RSI > 50 + price above moving average”), you can turn this into automated trades using PickMyTrade:

- Use your charting or strategy platform (like TradingView) to set up indicator-based alerts.

- Send those alerts (with parameters) into PickMyTrade.

- PickMyTrade can execute entries, attach stop-loss / take-profit, and replicate across accounts.

- You can include conditions, e.g. “only execute if ATR < threshold” or “only between certain hours”.

- This closes the loop: indicator → signal → execution — and you reduce manual work and emotional delay.

Limitations & Risks of Trading Indicators

- They are lagging (except some leading ones) — they rely on past data.

- False signals: In choppy or sideways markets, many indicators send bad signals.

- Over-optimization: Tuning them too tightly to past data may fail in live markets.

- Doesn’t account for fundamentals/news: Big news or macro events can override indicator signals.

- Indicator overload: Too many indicators can confuse and lead to indecision.

FAQs About Trading Indicators

Q1: Which indicator is the best for stock trading?

A: There is no one-size-fits-all. Many traders use a combination like moving average + RSI + ATR to balance trend, momentum and volatility.

Q2: Can indicators work on all timeframes?

A: Yes, but their effectiveness changes. For example, RSI works differently on daily than on 1-minute charts. Always test for your timeframe.

Q3: Do indicators alone make profits?

A: No — they need price confirmation, risk management, and context. Indicators are tools, not complete systems.

Q4: How many indicators should I use?

A: Usually 2 to 4, each serving a distinct role (trend, momentum, volatility) is sufficient.

Q5: Can I use indicators in automated trading?

A: Absolutely. You can embed indicator logic as conditions/triggers in automation systems like PickMyTrade.

Q6: Are new AI / hybrid indicator models becoming popular?

A: Yes, recent research is blending classical indicators with reinforcement learning or transformer models to adapt dynamically.

Also Checkout: Automate TradingView Indicators with Tradovate Using PickMyTrade