What is Tastytrade?

Tastytrade (formerly Tastyworks) is a U.S.-based brokerage and trading platform known for its focus on options, futures, stocks, ETFs, and cryptocurrency.

Founded by veteran traders, the platform emphasizes active trading, data-driven decision making, and educational content via its integrated network Tastylive.

In 2023, Tastyworks was rebranded as Tastytrade, aligning its brokerage and media/education under a unified brand.

Tastytrade is owned by IG Group, which acquired the company in 2021, enhancing its global reach and resources.

Tastytrade Key Features & Offerings

1. Commission & Fee Structure

- Stock & ETF trades: Commission-free.

- Options trades: $1.00 to open a contract, $0.00 closing commission for many options.

- They cap equity option fees at $10 per leg.

- Futures & micro futures: Commissioned at modest rates (e.g. $1.25 per contract open & close in many cases).

- Crypto trades: Tastytrade routes crypto via Zero Hash, applying a mark-up / mark-down of 0.50% to 0.75% (50–75 basis points).

- Additional clearing, regulatory, or exchange fees may apply depending on the instrument.

2. Account Types & Permissions

- Offers cash accounts, margin accounts, IRAs, joint accounts, and entity/trust accounts (for U.S. residents).

- Margin accounts allow leverage; standard margin account privileges require a $2,000 minimum balance to maintain full margin privileges.

- Cash accounts are not subject to PDT (Pattern Day Trader) rules as long as unsettled funds aren’t used.

3. Platforms & Tools

- Web, desktop, and mobile apps (iOS & Android) allow synchronized access.

- Advanced trading tools: custom layouts, charting, options chain with probability tools, futures views, in-platform video / educational feeds, “Follow Feed” (see other traders’ trades) via Tastylive.

- Strong internal educational library via Tastylive (live shows, strategy content, probability modeling) integrated with platform.

4. Tradable Instruments & Markets

- Stocks, ETFs, options, futures, micro futures, index options.

- Cryptocurrencies: supported via Zero Hash (as third-party for custody & execution).

- Tastytrade does not support mutual funds, bonds, forex (natively) or OTC/IPO markets (in many cases).

Click Here To Start Futures Trading Automation For Free

Pros & Cons of Tastytrade

Strengths & Advantages

- Low-cost structure for active traders

Options open at $1, no closing commission for many trades, and stock/ETF trades are commission-free. - Advanced tools & platform design

Customizable dashboards, options analytics, multi-chart layouts, integrated live educational feeds make it powerful for seasoned traders. - Educational content & community integration

Tastylive, follow feed, real-time trade sharing helps traders learn from others. - No account minimums / no inactivity or annual fees

You can open and maintain a Tastytrade account with no deposit minimum and no ongoing fees for inactivity or maintenance.

Weaknesses & Tradeoffs

- Steep learning curve for beginners

Due to the advanced tools, many new users find it overwhelming. - Limited research & external data

Tastytrade’s external research offerings are lean, relying heavily on its internal educational content. - Interest rate on cash is minimal

Uninvested cash gets a very low yield (e.g. ~0.01%) compared to some brokers. - Fees on transfers / withdrawals

Outgoing ACAT (account transfer) fee is $75; IRAs may have $60 closing fees.

Some users report hidden withdrawal/region fees (especially non-U.S. users). - No forex, no mutual funds, limited fixed income

If you want full diversification (forex, bonds, mutual funds), Tastytrade is limited. - Execution & Payment-for-Order-Flow concerns

Tastytrade accepts PFOF; its execution quality is good but not perfect.

User Feedback & Reviews

Reddit & Forums

A user described SPX option fees:

“Commission is $1, charged on opening, nothing to close … clearing is $0.10, SPX single listing fee 0.65 … total round-turn ~$2.56 per contract.”

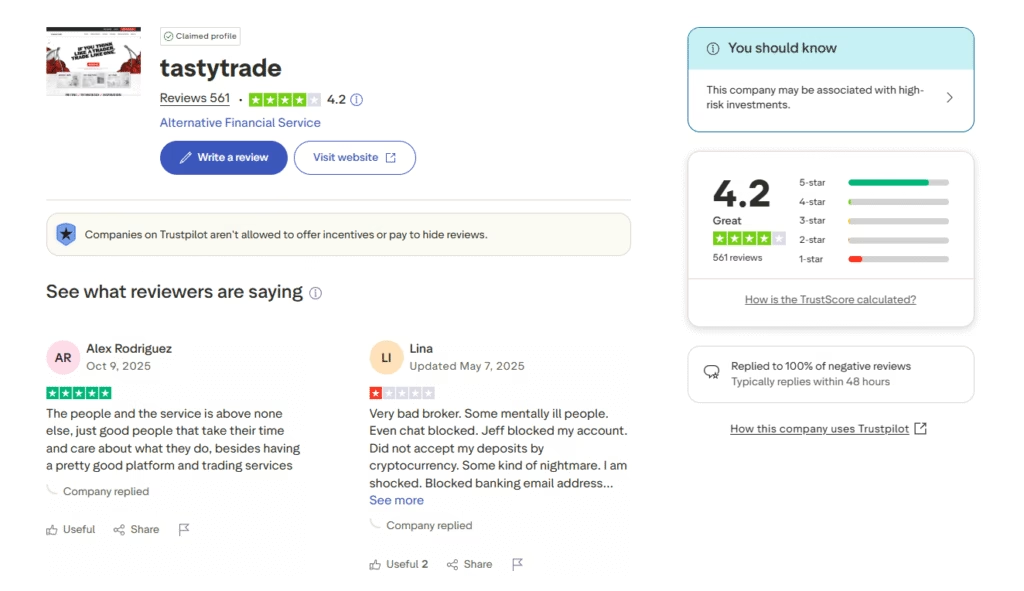

Trustpilot Reviews

- Average rating ~ 4.2 / 5 across ~500+ user reviews.

- Positive feedback often mentions helpful customer support.

- Some complaints: account opening delays, regional withdrawal fees, lack of enforced 2FA by default.

Review Sites

- NerdWallet: Praises the powerful platform and options pricing, calls it better suited for advanced users.

- StockBrokers.com: Strong in options trading and active trading environment; weaker in research support.

- BrokerChooser: Highlights strong options features but warns beginners of platform complexity & lack of demo account.

- Benzinga: Highlights mobile app strength, ease of use, but notes limited product coverage (no forex, no bonds).

- DailyForex: More critical—calls platform “sub-standard” for beginners; highlights withdrawal fees and weak educational content.

Final Verdict: Is Tastytrade Right for You?

Tastytrade is well-suited for experienced / active traders, especially those who trade options or futures. Its combination of low commissions, rich educational content, and advanced tools is compelling.

However, beginners or those seeking one-stop access to all asset classes (forex, bonds, mutual funds) may find it limiting or too complex.

If you’re comfortable navigating a robust, flexible platform and want to automate strategies, pairing Tastytrade with a tool like PickMyTrade can make your trading more efficient and disciplined.

Disclaimer: This article is for informational and educational purposes only. It should not be considered financial, investment, or trading advice. Trading stocks, futures, and other financial instruments involves risk and may not be suitable for all investors. Always conduct your own research or consult with a licensed financial advisor before making trading decisions.

FAQs: Tastytrade

No. Stock and ETF trades are commission-free.

$1.00 opening commission per contract; many closing trades are free. Equity options capped at $10 per leg.

No, Tastytrade does not currently support forex or mutual funds.

No, it does not offer a built-in paper trading/demo account according to several reviews.

Generally positive. Users praise responsive support, but some note delayed responses or account approval issues.

Yes. It’s regulated, supports SIPC protection for eligible assets, and is under IG Group.

Also Checkout: Automate TradingView Indicators with Tradovate Using PickMyTrade