Have you ever wondered what happens when a trading bot is let loose on Bitcoin? At Seacrest Funded, traders often experiment with automated strategies to maximize their funded account potential. One such strategy, built on moving averages, was recently tested on the BTC/USD pair. The results? A 61% win rate, 47% profit, and a 13.36% drawdown.

Let’s break down how this bot works, the rules it follows, and what its results could mean for traders using Seacrest Funded accounts.

Understanding the Seacrest Funded Automated Trading Strategy

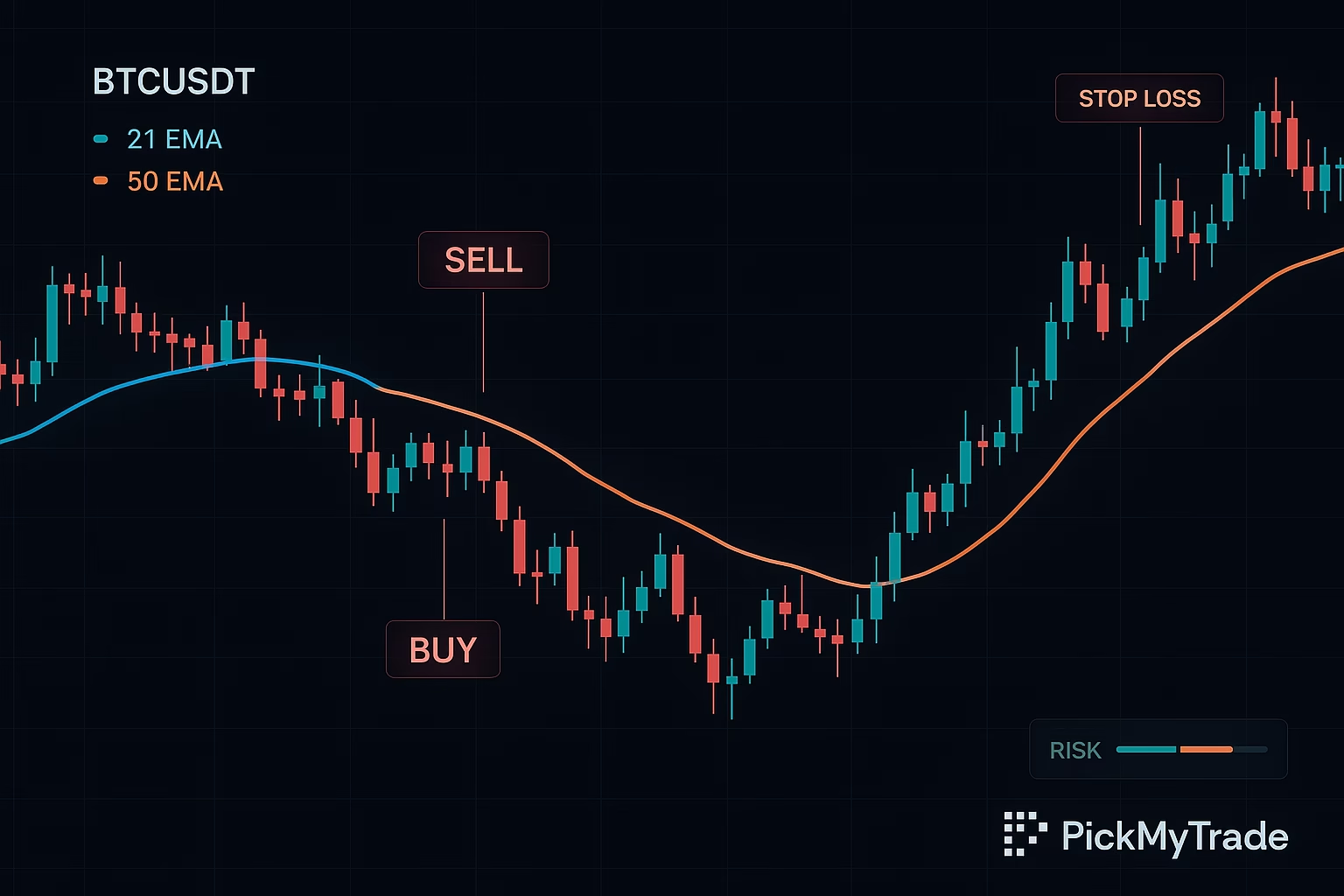

Trading bots run on strict, rule-based systems. This Seacrest Funded test strategy relied on moving averages—a classic tool to spot trends.

- Fast 21-period moving average: reacts quickly to price changes.

- 15-period moving average: a shorter-term trend filter.

Trading Rules:

- When the 21 MA crosses above the 15 MA → Long entry (expecting price to rise).

- When the 21 MA crosses below the 15 MA → Short entry (expecting price to fall).

The strategy was tested on a 4-hour timeframe, filtering out noise and focusing on medium-term trends.

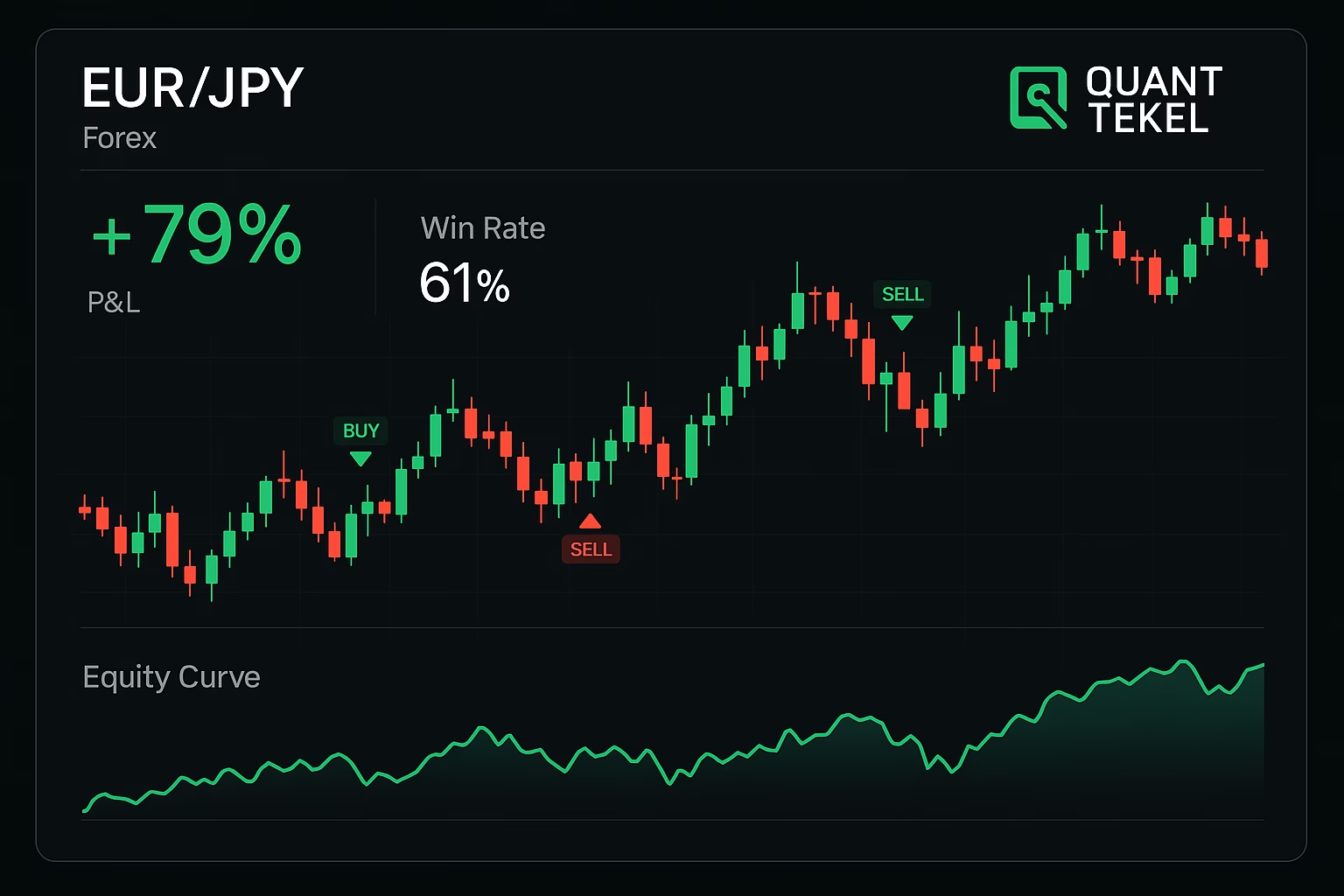

Seacrest Funded Bot Performance Results

Here’s how the Seacrest Funded bot performed during backtesting:

- Total Trades: 57 (not overactive, waited for clear signals)

- Max Drawdown: 13.36% (shows manageable risk exposure)

- Total Profit & Loss (P&L): ~47% growth during test period

- Win Rate: 61% (more winners than losers)

- Profit Factor: 1.4 (for every $1 lost, the bot earned $1.40)

These results suggest that Seacrest Funded traders using this bot could potentially grow accounts steadily while keeping risk under control.

Click Here to Automate Trades On Tradovate

Bot vs Buy-and-Hold: Which is Better?

- Buy-and-Hold: Profits depend solely on Bitcoin’s long-term rise. Drawdowns can be brutal during downtrends.

- Seacrest Funded Bot Strategy: Actively captures up and down moves, with structured rules and risk control.

With a 47% return and only 13.36% drawdown, the bot shows a strong case for active management, especially for funded account traders who must respect risk limits.

Why Automated Trading Fits Seacrest Funded Traders

At Seacrest Funded, consistency and discipline are key. Automated bots bring:

- No emotions (fear/greed removed)

- Fast execution (no missed signals)

- 24/7 monitoring (perfect for Bitcoin’s nonstop market)

Platforms like TradingView allow traders to design and test these strategies. Tools like PickMyTrade connect strategies to brokers such as Tradovate, Rithmic, Interactive Brokers, TradeLocker, TradeStation, and ProjectX, making automation seamless.

Conclusion

The Seacrest Funded Bitcoin Bot Strategy delivered:

- 61% Win Rate

- 47% Profit

- 13.36% Drawdown

For Seacrest Funded traders, this demonstrates the power of disciplined automation. While no system guarantees future results, combining clear rules with automated execution creates a strong edge in prop firm trading.

If you’re trading with Seacrest, strategies like this can help you manage risk, stay consistent, and potentially outperform simple buy-and-hold approaches in crypto.

Disclaimer:

This content is for informational purposes only and does not constitute financial, investment, or trading advice. Trading and investing in financial markets involve risk, and it is possible to lose some or all of your capital. Always perform your own research and consult with a licensed financial advisor before making any trading decisions. The mention of any proprietary trading firms, brokers, does not constitute an endorsement or partnership. Ensure you understand all terms, conditions, and compliance requirements of the firms and platforms you use.

Also, Checkout: Automate TradingView Indicators with Tradovate Using PickMyTrade