Choosing the right trading platform can significantly impact your trading experience and success. Among the many options available, Rithmic vs Tradovate stands out as a key comparison in 2025 for futures traders. This article compares their core features, pricing, tools, and performance.

What Are Rithmic and Tradovate?

While both platforms cater to futures traders, they serve slightly different use cases.

Rithmic: Built for Speed and Precision

Rithmic continues to be the platform of choice for professional, high-frequency, and prop traders. Why? Its ultra-low-latency technology and direct exchange routing provide unmatched execution speed.

Key Features of Rithmic

- Ultra-Low Latency Feeds: Among the fastest in 2025. Offers institutional-grade tick data.

- Third-Party Platform Support: Works best with platforms like NinjaTrader, Jigsaw, and MotiveWave.

- Real-Time Risk Management: Supports auto-liquidation, max drawdowns, and prop firm controls.

- Full Historical Tick Data: Ideal for accurate backtesting and algo tuning.

- Algo-Friendly API: Enables bot deployment with near-instant fills.

If you’re trading high volume or running an automated strategy, Rithmic is built for precision and speed.

Tradovate: Cloud-Based Simplicity

Tradovate, now part of the NinjaTrader Group, appeals to beginners and discretionary traders. It focuses on ease of use and flexibility, all while staying cost-effective.

Key Features of Tradovate

- Commission-Free Options: Choose flat monthly plans or per-contract pricing.

- Fully Cloud-Based: Access from browser, desktop, or mobile with seamless sync.

- User-Friendly Interface: Customize widgets with drag-and-drop functionality.

- Built-In Simulator & Replay Mode: Perfect for learning or strategy practice.

- One-Click Trading: Designed for rapid manual execution.

For traders who want convenience without compromising on features, Tradovate hits the sweet spot.

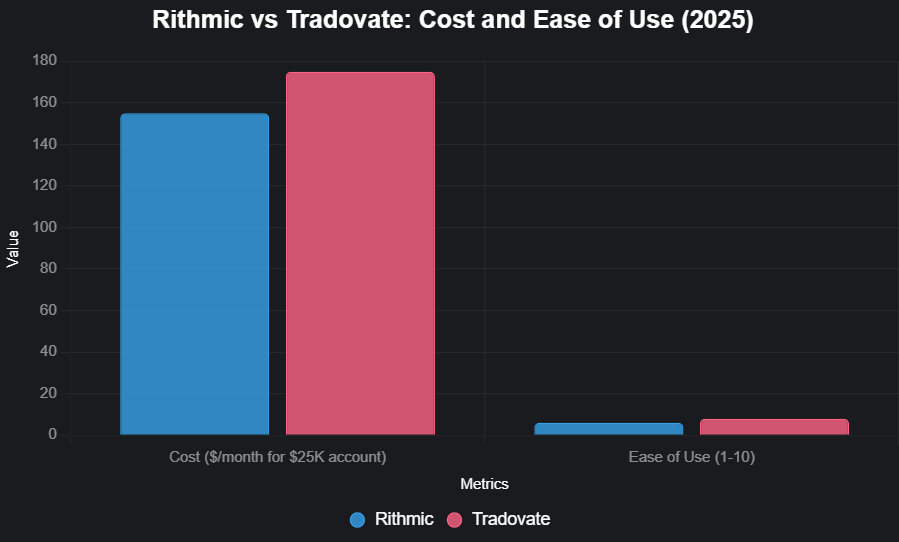

Rithmic vs Tradovate: 2025 Pricing Comparison

Rithmic vs Tradovate: Pricing in 2025

Cost can quickly add up—especially for active traders. Here’s how both platforms compare:

| Feature | Rithmic | Tradovate |

|---|---|---|

| Platform Fee | ~$155/month (via NinjaTrader or Jigsaw) | $175/month (Unlimited) or $0 with per-contract pricing |

| Exchange Fees | Not included | Not included |

| Funded Accounts | Common with prop firms | Supported via NinjaTrader ecosystem |

Pro Tip: Many funded traders automate alerts from TradingView using tools like PickMyTrade, executing orders via Rithmic while monitoring on Tradovate’s cleaner UI.

Platform Experience: Accessibility & Ease of Use

Accessibility

- Tradovate: Runs on browser, Windows, Mac, iOS, and Android—no installation needed.

- Rithmic: Requires Windows-based platforms. Mac users need workarounds like Parallels.

Learning Curve

- Tradovate: Easier for beginners with a shorter ramp-up time.

- Rithmic: Better suited for experienced users or algo traders.

Live Trading: Performance & Latency

For scalpers or news traders, speed matters. Rithmic consistently outperforms when milliseconds count.

- Rithmic: Excellent for algorithmic, high-frequency, or prop firm trading.

- Tradovate: Strong enough for most discretionary trades but may slow under heavy load (e.g. CPI releases).

If you’re focused on tick-perfect execution, Rithmic wins the latency battle hands down.

Mobile Trading Experience

Tradovate shines here:

- Tradovate: Modern, responsive mobile apps with full account management and order placement.

- Rithmic: Requires third-party apps like NinjaTrader Mobile, which offer less intuitive interfaces.

If mobile is critical for your strategy, Tradovate is the better fit.

Summary: Rithmic vs Tradovate – Which Should You Choose?

Ask yourself:

- Need high-frequency execution or prop-level risk tools? → Go with Rithmic

- Prefer simple, mobile-friendly trading with built-in sim? → Choose Tradovate

Many traders even combine both:

- Use Rithmic for automated alerts and fast fills.

- Use Tradovate for mobile trading, manual orders, and visualization.

Check Out These Helpful Automation Resources

- Understanding TradingView to Tradovate Automation

- Tradingview to Rithmic Integration: A Comprehensive Review

Conclusion

Whether you choose Rithmic or Tradovate, both platforms offer excellent tools for futures traders in 2025. The right choice depends on your goals:

- Power and precision → Rithmic

- Ease and flexibility → Tradovate

Whichever you choose, trade smart, stay disciplined, and let the tech work for you.

What is the difference between Tradovate and Rithmic?

Rithmic is a low-latency data feed and execution engine used by professional and algorithmic traders. Tradovate is a modern, commission-free futures brokerage with its own trading platform. Many traders use Tradovate for its interface and pricing, while Rithmic is chosen for its speed and advanced data routing.

What is the difference between Tradovate and Rithmic vs WealthCharts?

WealthCharts is a charting and analysis platform, not a broker or data feed. Tradovate is a futures broker with its own platform, while Rithmic provides direct market data and routing. WealthCharts can integrate with Rithmic but not Tradovate directly.

Can I use Rithmic with Tradovate?

Yes, you can use Rithmic as the data feed with Tradovate if you are connecting through third-party platforms like NinjaTrader or TradingView via automation tools.

Who is Tradovate owned by?

Tradovate is owned by NinjaTrader Group, which acquired it in 2022 to combine futures trading infrastructure under one umbrella.

Is TradingView free with Tradovate?

No, TradingView is not directly included with Tradovate. You need a separate TradingView subscription and a third-party bridge tool to connect it to Tradovate.

How much is Tradovate per month?

Tradovate offers flexible pricing: $0/month with per-contract fees, or $99/month (Active Trader) or $199/month (Unlimited Plan) for commission-free trading.

Is Rithmic the same as NinjaTrader?

No, Rithmic is a data and order routing provider, while NinjaTrader is a trading platform. However, NinjaTrader can use Rithmic as its data feed.

Can I use Rithmic with TradingView?

Yes, but not natively. You need to use a third-party tool like PickMyTrade to bridge TradingView alerts to Rithmic accounts.

Is Tradovate a good futures broker?

Yes, Tradovate is highly rated for its low fees, intuitive interface, and mobile-friendly platform, making it a good option for futures traders of all levels.

Does Rithmic have a trade copier?

Rithmic itself doesn’t offer a trade copier, but third-party tools like CopyTradr or PickMyTrade support copying trades across Rithmic accounts.

Does Tradovate offer tick charts?

Yes, Tradovate offers tick charts natively within its web and desktop platforms, suitable for scalpers and active traders.

What is the margin minimum for Tradovate?

Tradovate’s day trading margin starts as low as $50 per contract for many products, but varies depending on the instrument and account type.

Did NinjaTrader buy Tradovate?

Yes, NinjaTrader acquired Tradovate in January 2022 to consolidate futures trading technology and offerings.

What is the fastest way to fund Tradovate?

The fastest funding method is ACH transfer, which typically clears within 1–2 business days. Wire transfers are also accepted.

Which is better Rithmic or Tradovate?

Rithmic is better for speed and algorithmic execution, while Tradovate is better for ease of use, pricing, and all-in-one trading. Many traders combine both.

Can you trade on Tradovate for free?

You can open a free demo account. For live trading, you can choose a per-contract pricing plan with no monthly platform fee.

What is the difference between Tradovate and Rithmic TradingView?

Tradovate is a broker and trading platform; Rithmic is a data feed. TradingView can send alerts but requires automation tools to trade via Rithmic or Tradovate.

Who is the CEO of Tradovate?

As of 2025, Tradovate operates under the NinjaTrader Group, with Martin Franchi serving as the CEO of NinjaTrader Group.

Which is better, NinjaTrader or Tradovate?

NinjaTrader is more customizable with deep features for advanced traders, while Tradovate is easier for newer traders or those preferring a web-based experience.

Is Tradovate a regulated broker?

Yes, Tradovate is a registered futures commission merchant (FCM) and is regulated by the National Futures Association (NFA) and CFTC.

Appreciate the focus on execution speed with Rithmic. For anyone running strategies that depend on split-second order fills, those latency numbers can make a big difference.