In real trading, especially in prop firm futures challenges, such a drawdown is unacceptable. It means not only losing all your starting capital but also owing more. No prop firm or serious trader would allow that level of risk.

So the big question is: Can we keep the high profits while removing the massive risks? The good news is yes. This post shows you three powerful fixes to make risky strategies like PMAX safer, sustainable, and more suitable for real futures or prop firm trading.

Understanding the Problem: Why 160% Drawdown Fails in Prop Firm Futures

Imagine starting with $10,000 in your trading account. A 160% drawdown means your balance would fall by $16,000. That’s not only losing your $10,000 but owing $6,000 more.

In prop firm futures trading, such a loss would instantly fail your evaluation. Prop firms enforce strict drawdown rules to protect capital. Even if a strategy shows billions in profit potential, it’s worthless if it cannot respect these limits.

Good trading is not just about making money; it’s about keeping losses controlled so you can stay funded and keep trading.

The Foundation of Safe Trading in Prop Firm Futures

The core of smart prop firm futures trading is risk management. Many new traders focus only on potential profits, forgetting to manage losses. This is why so many fail funding challenges.

To succeed, you must think like a risk manager first. The goal is survival and consistency, not reckless bets. With proper risk management, you can turn a high-risk strategy into one that passes prop firm rules and grows your account steadily.

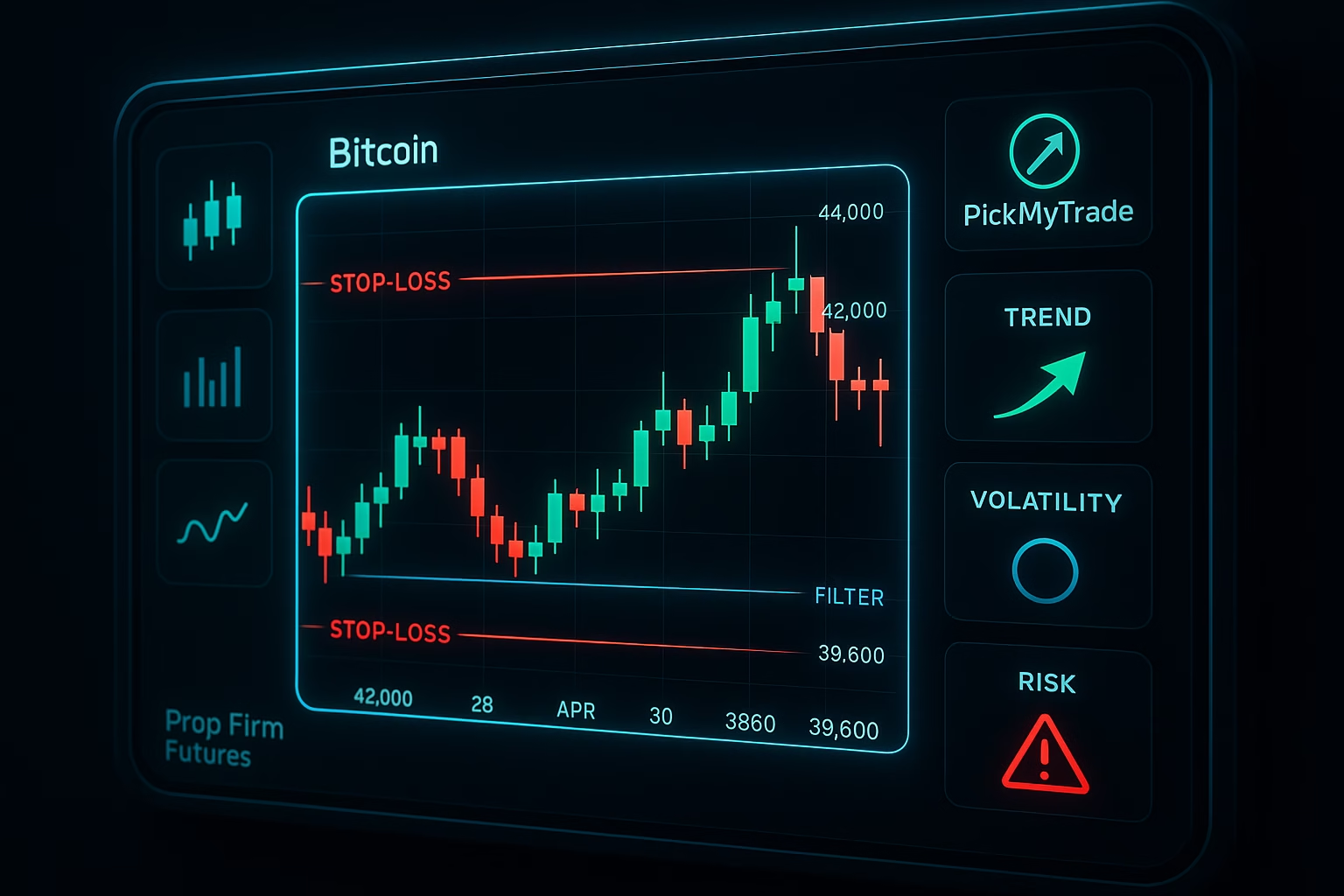

Fix 1: Add a Stop-Loss to Cap Losses

The first fix is using a stop-loss. In futures and prop firm challenges, stop-losses are essential because they prevent one trade from wiping out your account.

- ATR-Based Stop-Loss: Adapts to volatility.

- Fixed Percentage Stop-Loss: Simple, caps every trade at a set % risk.

Both ensure no single loss becomes catastrophic — a must in prop firm trading.

Fix 2: Use Trend Filters to Avoid Chop

The second fix is applying trend filters. Prop firms want consistency. Trading during sideways chop or fakeouts is where many traders fail.

- Use higher time frame confirmation (daily trend for intraday trades).

- Only take trades aligned with the main trend.

This avoids unnecessary losses and keeps your equity curve smooth — vital for passing a prop firm futures challenge.

Fix 3: Limit Position Sizing for Controlled Risk

Finally, position sizing is key. Even with a stop-loss, if you risk too much per trade, you’ll fail the prop firm drawdown limits.

- Use the 2% rule: risk no more than 2% of your account per trade.

- Adjust contracts based on your stop distance.

This keeps your account safe, even through multiple losing trades, ensuring you don’t blow up during a prop firm evaluation.

Small Tweaks, Big Difference

The PMAX strategy originally showed $18 billion in profits but with a deadly 160% drawdown. That’s instant disqualification in prop firm trading.

By adding stop-losses, trend filters, and smart position sizing, the same strategy becomes funding-friendly and sustainable. These tweaks don’t kill performance — they unlock consistent growth without breaking risk rules.

Automate Your Prop Firm Futures Trading

Risk rules are easier to follow when automated. You can connect your strategies from TradingView to brokers like Tradovate, Rithmic, Interactive Brokers, TradeLocker, or ProjectX.

Automation helps you stick to prop firm rules without emotional mistakes.

Conclusion: Smarter Prop Firm Futures Success

The lesson is clear: trading success in prop firm is not about chasing billions in backtests. It’s about passing challenges, protecting capital, and trading consistently.

With stop-losses, trend filters, and position sizing, you transform risky strategies into reliable ones. This is the difference between failing a challenge and building a long-term funded trading career.

Smart trading is safe trading — and safe trading is the only way to win in prop firm futures.

Also Checkout: Automate TradingView Indicators with Tradovate Using PickMyTrade