In the fast-paced world of trading, staying ahead requires more than just intuition it demands precision, speed, and consistency. Auto trading bots have emerged as essential tools for traders aiming to enhance their strategies across various markets, including stocks, forex, and cryptocurrencies.

What Is an Auto Trading Bot?

An auto trading bot is a software application that automatically executes buy or sell orders on behalf of a trader. These bots operate based on predefined algorithms, analyzing market data and executing trades at optimal times without human intervention. With advancements in artificial intelligence and machine learning, these bots have become increasingly sophisticated, offering traders a seamless and efficient trading experience.

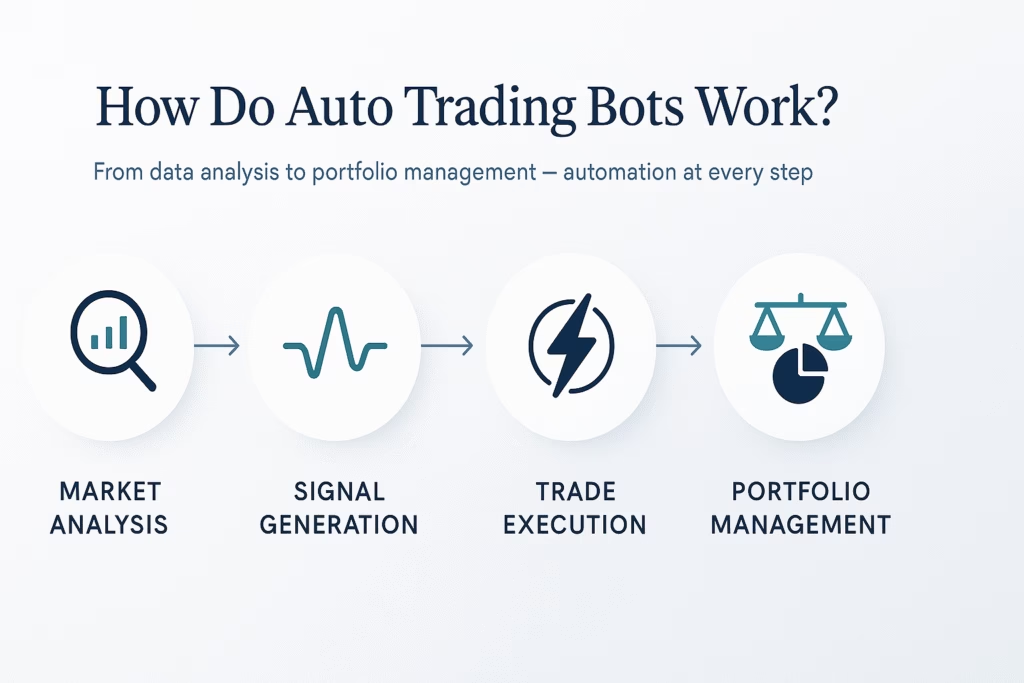

How Do Auto Trading Bots Work?

Auto trading bots function by connecting to your trading account and executing trades based on the bot’s programming. Here’s a step-by-step breakdown of their operation:

- Market Analysis: The bot continuously monitors and analyzes market data, including price movements, volume, and other relevant indicators.

- Signal Generation: Based on the analysis, the bot generates trading signals, indicating potential buy or sell opportunities.

- Trade Execution: Once a signal is generated, the bot executes the trade automatically, taking into account factors such as market conditions and risk management protocols.

- Portfolio Management: Some advanced bots offer features for managing and rebalancing your trading portfolio, ensuring that your investments are aligned with your goals.

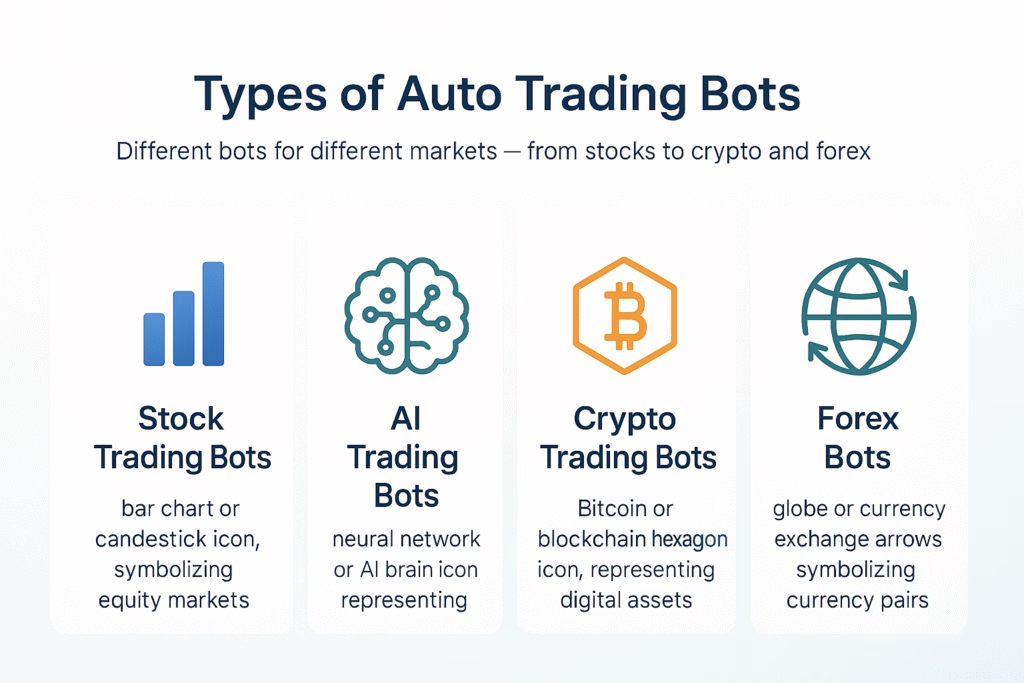

Types of Auto Trading Bots

- Stock Trading Bots: These bots focus on traditional stock markets, analyzing price movements and executing trades based on market trends.

- AI Trading Bots: Leveraging artificial intelligence, these bots adapt to changing market conditions, learning from past data to improve trade accuracy.

- Crypto Trading Bots: Designed for the volatile world of cryptocurrencies, these bots trade various digital assets, from Bitcoin to altcoins.

- Forex Bots: Specialized for the forex market, these bots trade currency pairs, aiming to capitalize on fluctuations in exchange rates.

Benefits of Using Auto Trading Bots

- Efficiency: Bots can process vast amounts of data quickly, making decisions in milliseconds—something no human trader can achieve.

- Emotionless Trading: Bots operate based on logic and data, eliminating the emotional biases that often cloud human judgment.

- 24/7 Operation: Markets, especially cryptocurrency markets, operate around the clock. Bots can trade continuously without needing rest.

- Backtesting Capabilities: Many trading bots allow users to test their strategies on historical data, helping refine and optimize trading approaches before risking real capital.

Click Here To Start Futures Trading Automation For Free

Choosing the Right Auto Trading Bot

When selecting an auto trading bot, consider the following factors:

- Compatibility: Ensure the bot is compatible with your preferred trading platform. Popular platforms include Binance for crypto and MetaTrader for forex.

- Customization: Look for bots that allow you to customize trading strategies and parameters to suit your individual preferences and risk tolerance.

- Security: Since bots require access to your trading account, ensure they have robust security features to protect your assets and personal information.

- Pricing: Evaluate the pricing against the bot’s features and potential returns.

PickMyTrade: A Leading Auto Trading Solution

PickMyTrade offers seamless integration with various trading platforms, customizable algorithmic trading, and custom app development. It empowers traders by automating TradingView strategies/indicators for futures, seamlessly connecting TradingView. It also supports manual trades, allowing users to copy them instantly across multiple accounts.

Traders have praised PickMyTrade for its helpfulness in automating strategies and providing quick and precise support. One user mentioned, “The bot is very helpful and does a good job of automating strategies.” Another user expressed, “This is the exact thing that I’m looking for in automation. It helps my dream come true.”

Risks and Considerations

While auto trading bots offer numerous benefits, they are not without risks:

- Market Volatility: Rapid market changes can result in losses if the bot’s algorithms are not equipped to handle such fluctuations.

- Technical Issues: Bugs or connectivity issues can disrupt trading activities, potentially leading to missed opportunities or losses.

- Over-optimization: Relying too heavily on backtested strategies may result in overfitting, where the bot performs well on historical data but poorly in live markets.

Conclusion

Auto trading bots have revolutionized the way investors and traders approach the financial markets. By automating the trading process, these bots offer increased efficiency, consistency, and the ability to capitalize on opportunities 24/7. Whether you’re a seasoned trader or just starting, utilizing an auto trading bot can enhance your trading strategy and potentially lead to better outcomes.

If you’re considering incorporating a trading bot into your investment strategy, take the time to research and choose the right bot that aligns with your goals and trading style.

Disclaimer: This article is for informational and educational purposes only. It should not be considered financial, investment, or trading advice. Trading stocks, futures, and other financial instruments involves risk and may not be suitable for all investors. Always conduct your own research or consult with a licensed financial advisor before making trading decisions.

FAQs

Yes, auto trading bots are legal in many jurisdictions, including the United States and India. However, it’s essential to ensure that the bot complies with the regulations of your specific country and trading platform.

Not necessarily. Many auto trading bots offer user-friendly interfaces that allow traders to set up and customize strategies without coding knowledge.

No, while auto trading bots can enhance trading efficiency and consistency, they do not guarantee profits. Market conditions can change rapidly, and no system can predict all market movements accurately.

Most auto trading bots provide dashboards or reporting tools that allow you to monitor trade history, performance metrics, and other relevant data.

It depends on the bot’s compatibility. Some bots, like PickMyTrade, support multiple platforms, allowing you to automate trades across different accounts.

Also Checkout: Automate TradingView Indicators with Tradovate Using PickMyTrade