Global Overview

The three major U.S. stock indexes closed lower on May 6, 2025, marking a broad decline across equities. Meanwhile, international gold and oil prices surged, each gaining more than 3%.

U.S. Markets: Broad-Based Decline

- Dow Jones Industrial Average: ▼ 389.83 (–0.95%) to 40,829.00

- S&P 500 Index: ▼ 43.47 (–0.77%) to 5,606.91

- Nasdaq Composite: ▼ 154.58 (–0.87%) to 17,689.66

Sector Snapshot

- Meta: ▼ 2%

- Tesla, Intel, Apple: ▼ over 1%

- Microsoft, Google, Amazon, Netflix: ▼ slight losses

- Sarepta Therapeutics (SRPT): ▼ over 26%

- Eli Lilly (LLY): ▼ over 26%

- Palantir (PLTR): ▼ over 12% – worst in a year

- Constellation Energy (CEG): ▲ over 10% – best since Feb 21

Chinese Stocks: Gains on Strong Announcements

- Nasdaq Golden Dragon China Index: ▲ 0.42%

- Wofei (WRD): ▲ 31%

- Pony.ai: ▲ 47% after announcing a partnership with Uber

European Markets: Mixed Performance

- FTSE 100 (UK): ▲ 1.07 (+0.01%) to 8,597.42

- CAC 40 (France): ▼ 31.01 (–0.40%) to 7,696.92

- DAX (Germany): ▼ 94.89 (–0.41%) to 23,249.65

Commodity Markets: Strong Rally

Gold

- COMEX Gold Futures: ▲ $100.50 (+3.03%) to $3,422.80/oz

Oil

- NYMEX Crude (June): ▲ $1.96 (+3.43%) to $59.09/barrel

- Brent Crude (July): ▲ $1.92 (+3.19%) to $62.15/barrel

Conclusion

Global markets pulled back as U.S. equities declined across sectors, led by biotech and big tech weakness. However, commodities surged sharply, and Chinese stocks rallied on upbeat partnership news. Europe delivered a mixed performance.

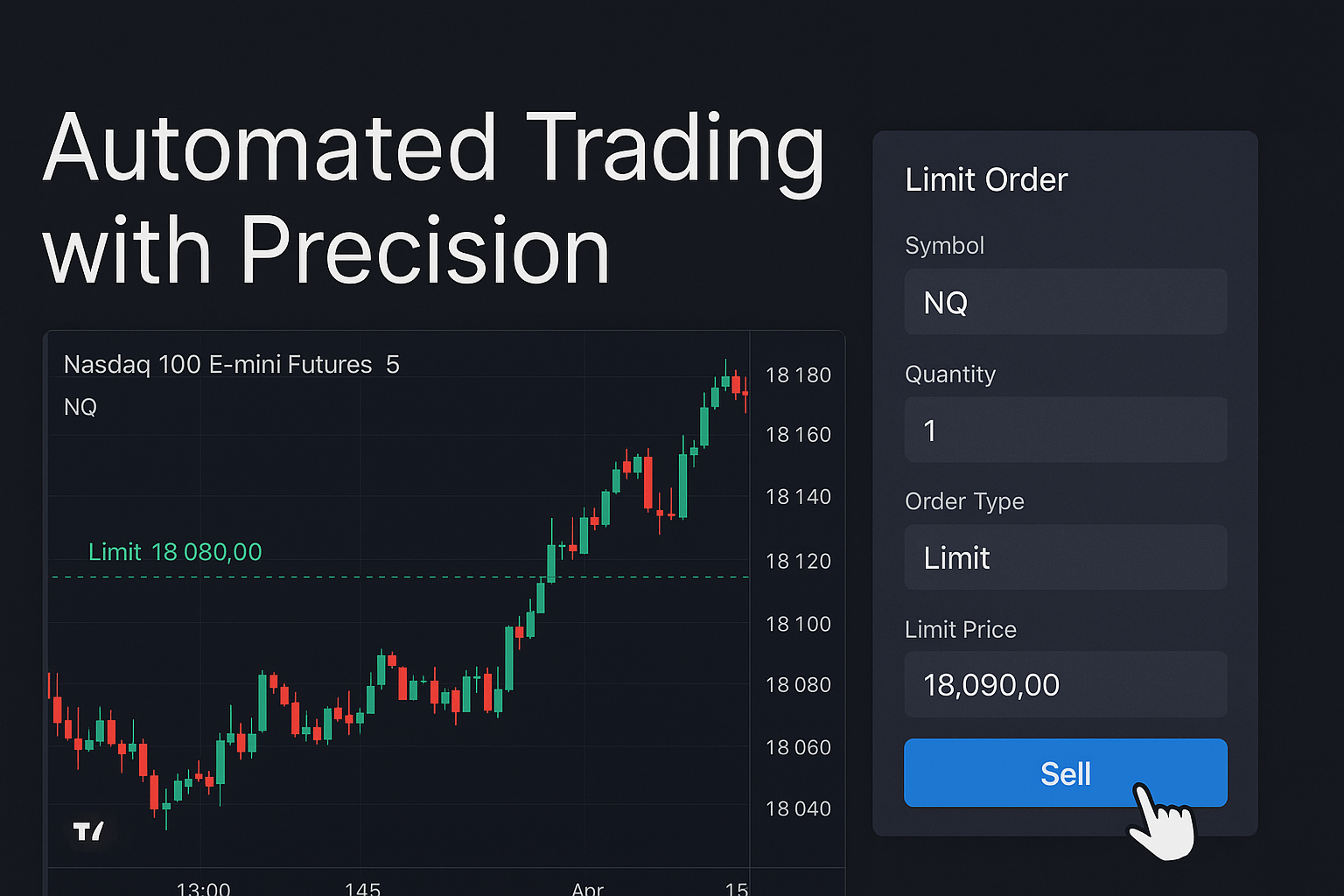

Brought to you by PickMyTrade — delivering smart tools, automation, and insights for the modern trader.