Introduction

Are you considering joining a proprietary trading firm? Before you jump in, it’s crucial to understand the common proprietary trading mistakes that can cost you money and confidence. Many new traders rush into the game without preparation. This guide will help you avoid costly errors and start your prop trading journey the smart way.

1. Don’t Rush to Join a Prop Firm

Joining a prop trading firm too soon is a common proprietary trading mistake. Most beginners don’t yet understand how their system works or how to manage risk under pressure. Jumping into a prop challenge before building consistency usually leads to failure.

Tip: Spend time mastering your trading platform, testing your strategy, and developing discipline before attempting a funded challenge.

2. Practice With Low-Cost or Demo Accounts

Many new traders jump into prop firm evaluations without proper testing. Don’t mistake a few lucky wins for skill. One of the most common proprietary trading mistakes is risking too much too soon.

Start small:

Use a free demo or low-cost challenge account to test your strategy. Look for repeatable results before scaling up.

3. Don’t Get Fooled by Fast Wins

Social media is full of traders who “passed in one day.” What you don’t see is how many times they failed before that success.

Beginner tip:

Focus on getting your registration fee refunded first. Follow the rules. Trade safely. Consistency beats speed in proprietary trading.

4. Always Lock in Profits

One dangerous proprietary trading mistake is relying on unrealized profits. Most prop firms require a minimum hold time before withdrawals.

Tip:

Withdraw your gains regularly. Secure your profits. A single bad trade can erase days of effort.

5. Watch Out for Scams and Overhype

If it sounds too good to be true—it probably is. Stay away from:

- “Guaranteed profits”

- “Copy this signal and get rich”

- “Millionaire in a month”

Reality check:

Success in prop trading comes from gradual growth, disciplined execution, and consistent improvement. Focus on progress, not promises.

Final Thoughts

Prop trading offers access to significant capital, but only if you’re ready. Avoid the common proprietary trading mistakes that derail most beginners:

- Learn before you earn

- Test with low risk

- Lock in gains

- Ignore the hype

- Build long-term habits

Treat proprietary trading as a business, not a gamble.

Take the Next Step: Explore Prop Firm Automation

Want to build consistency and automation into your workflow? Explore our top guides for automating TradingView strategies with different platforms:

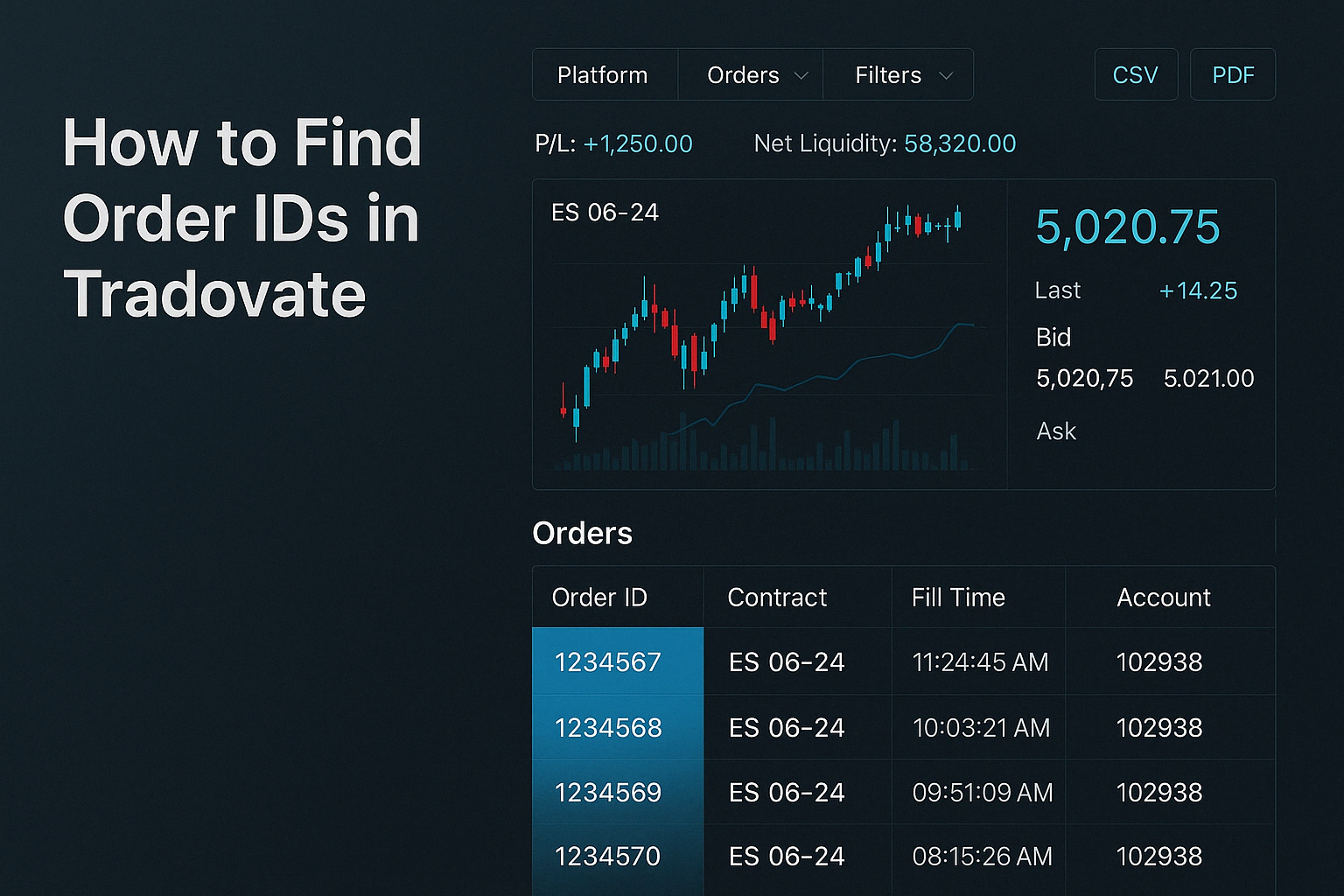

Automated Prop Firm Trading with Tradovate (2025 Guide)

Top Futures Prop Firms in 2025 with Automation Options

Proprietary Trading Explained: How to Automate and Scale

Why is proprietary trading risky?

Proprietary trading is risky because traders use firm capital to speculate in volatile markets. Without strict risk management, losses can be significant. Common risks include overleveraging, emotional decision-making, and strategy failure during unexpected market events.

Why is proprietary trading illegal in some contexts?

Proprietary trading is not illegal by itself. However, after the 2008 financial crisis, the Volcker Rule (under the Dodd-Frank Act) restricted U.S. banks from prop trading to reduce conflicts of interest and protect depositors. Independent prop firms and non-bank entities are still allowed to engage in proprietary trading.

Is proprietary trading profitable?

Yes, proprietary trading can be highly profitable but only with discipline, risk control, and consistent execution. Profits come from skill, not luck. Most successful traders develop a repeatable edge and follow strict rules to stay in the game long-term.

What are common prop trading techniques?

Common proprietary trading techniques include:

- Algorithmic trading – Automated strategies using code and signals

- Scalping – Quick trades for small profits using high frequency

- Momentum trading – Riding trends with price action and volume

- Mean reversion – Betting on price returning to average levels

- News-based trading – Reacting to economic or earnings releases