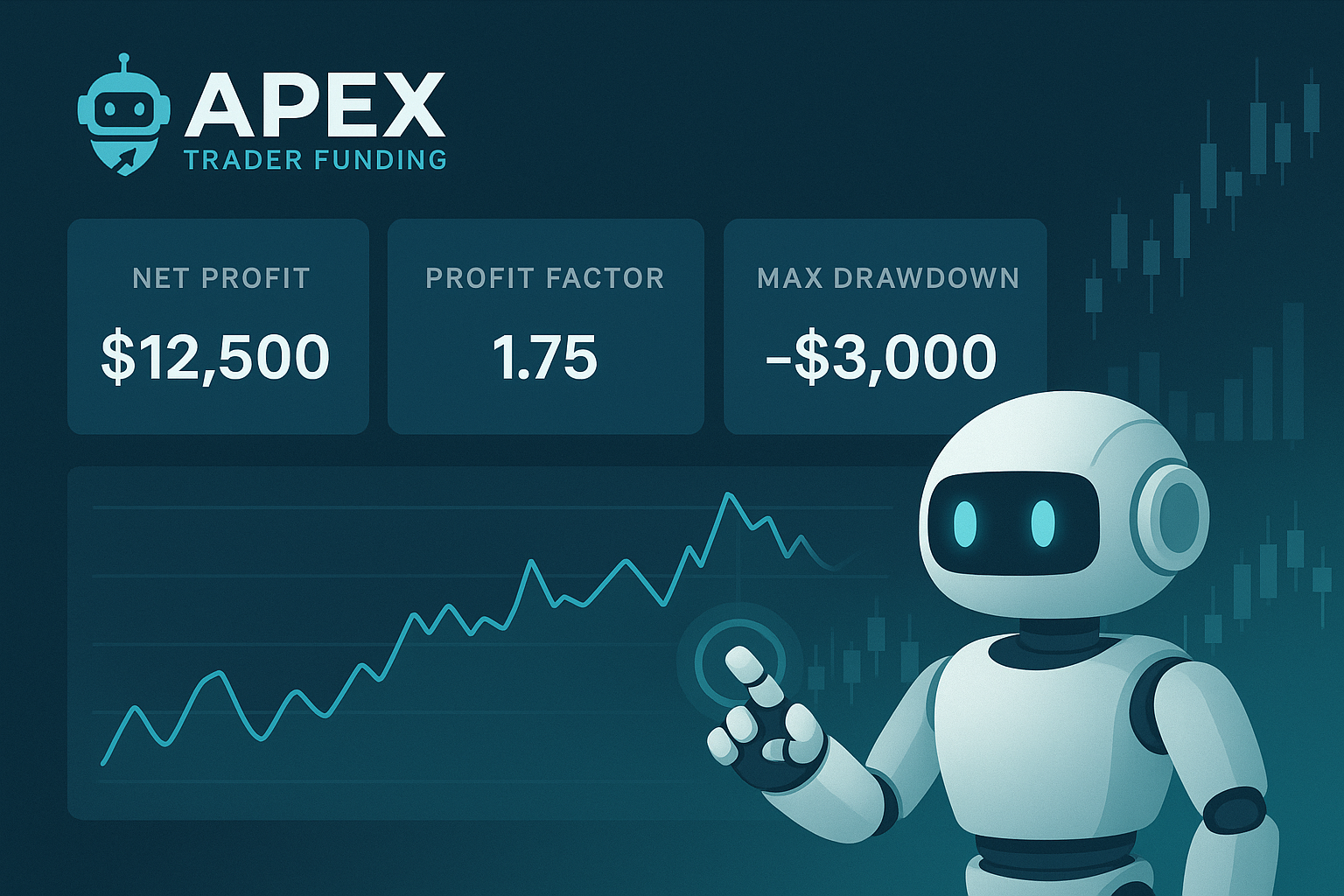

In the world of Apex Trader Funding automation, many traders obsess over win rates—but the truth is, that metric alone won’t tell you if your strategy is truly profitable or sustainable. If you’re automating trades using prop firm platforms like Apex, there are three key numbers you must focus on to evaluate your performance effectively.

Net Profit – Your Bottom Line in Apex Trader Funding Automation

The net profit tells you how much your automated strategy earned after all trades—wins and losses included. This is your true performance scorecard.

In Apex Trader Funding automation, where account evaluations are based on performance thresholds, net profit shows if your bot is hitting targets. A high win rate with low net profit means you’re spinning your wheels.

Profit Factor – Measure Your Trading Edge

The profit factor is the ratio of your total profits to total losses. For example:

- Profit Factor = 1.50 → you earn $1.50 for every $1 lost.

When using automation tools with Apex Trader Funding, a profit factor above 1.3 is often seen as solid, while above 2.0 is elite.

If your bot makes small profits but suffers big losses occasionally, the profit factor will expose that weakness—even if your win rate is high.

Max Drawdown – The Hidden Danger in Automation

The maximum drawdown reveals the biggest equity drop your account faced during the trading period. This is crucial for Apex-funded accounts where risk rules are strict.

For example:

A max drawdown of $41,000—even if you ended in profit—can cause disqualification from funding.

Automation helps remove emotion, but if not configured properly, your bot could breach drawdown limits quickly. Always test strategies with a focus on drawdown limits set by Apex Trader Funding.

Key Takeaways for Apex Trader Funding Automation

Forget win rate obsession. These three metrics are what truly matter:

- Net Profit: Are you making money overall?

- Profit Factor: Are you making more than you’re losing?

- Max Drawdown: Are you staying within Apex’s risk limits?

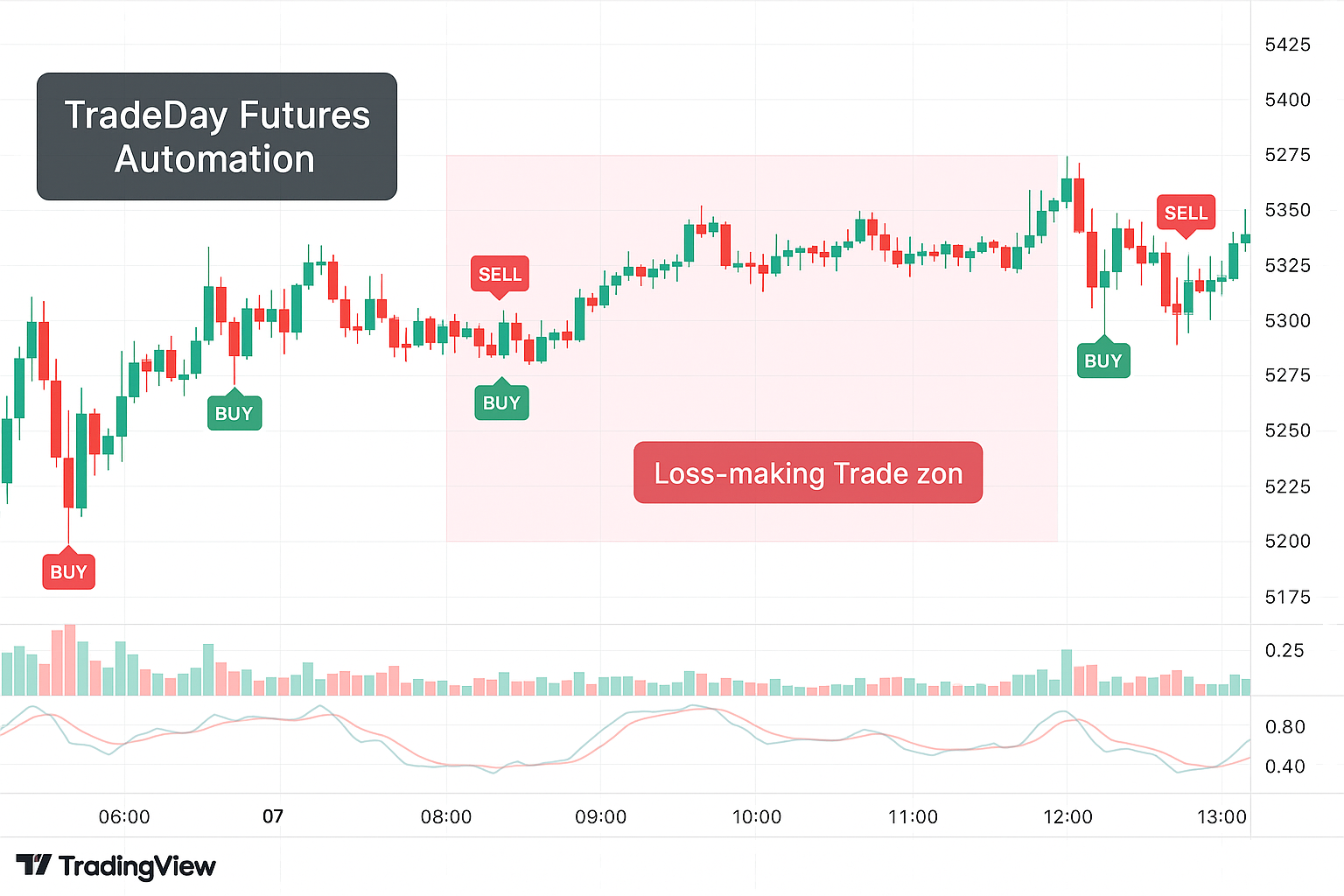

Before deploying your strategy, backtest it with these metrics in mind. Use TradingView’s Strategy Tester or forward-test with simulated Apex accounts.

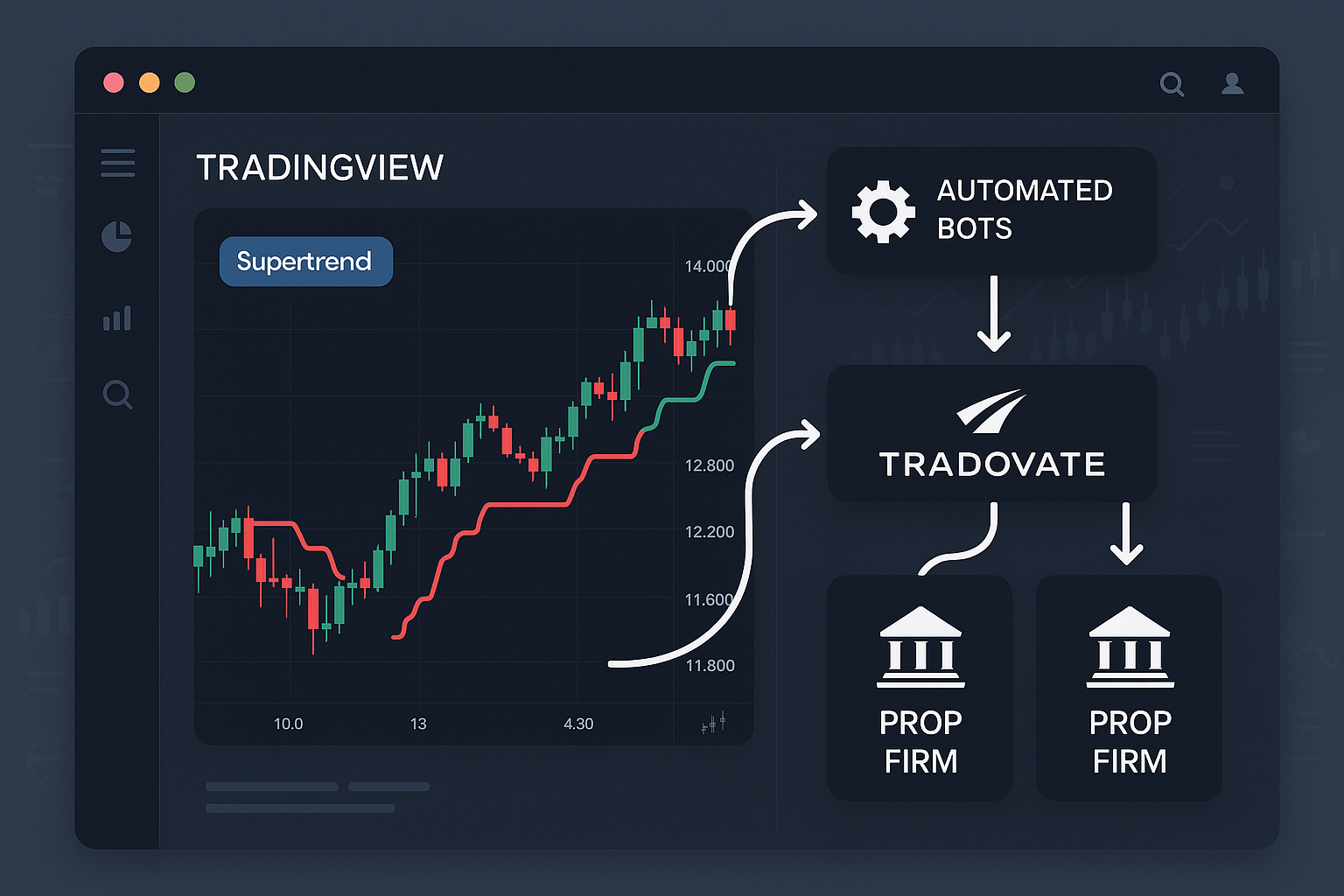

Automate with Apex + PickMyTrade

Platforms like PickMyTrade can automate your strategy for Apex Trader Funding using TradingView alerts. Focus on refining your strategy, and let automation handle execution.

Also Check Out: Automate TradingView Indicators with Tradovate Using PickMyTrade