The Turtle Trading Strategy is renowned in trading circles for its systematic approach to trend following. In this blog post, we will delve into the S1 system, one of the key strategies from the Turtle Traders. This strategy focuses on capturing short-term market movements by utilizing specific entry and exit signals based on price action.

What is the S1 System?

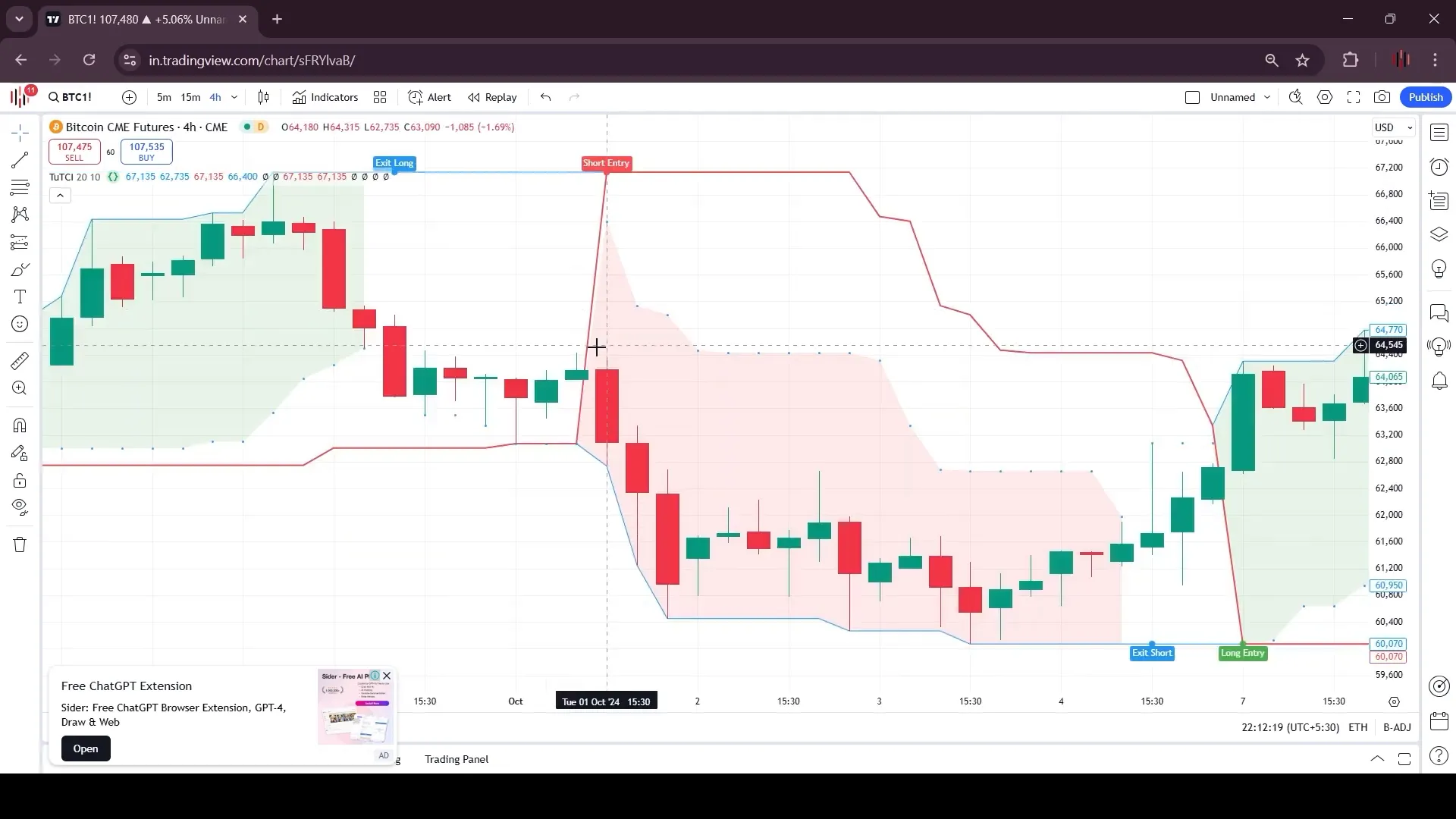

The S1 system is a straightforward trend-following strategy that relies on two primary rules: an entry rule and an exit rule. The entry rule dictates that you buy when the market reaches a new 4-week high, signaling the potential start of an upward trend. Conversely, the exit rule instructs traders to sell when the market drops to a two-week low, which helps lock in profits before a potential trend reversal.

Entry Rule Explained

When the market achieves a new 4-week high, it indicates a bullish sentiment. This is the moment when traders should consider entering the market. The rationale behind this rule is that breaking previous highs often leads to further upward momentum.

Exit Rule Explained

Once in a position, it’s crucial to monitor the market closely. The exit rule is triggered when the market hits a two-week low. This helps secure profits and minimize losses, as selling at this point can prevent a downturn from erasing gains.

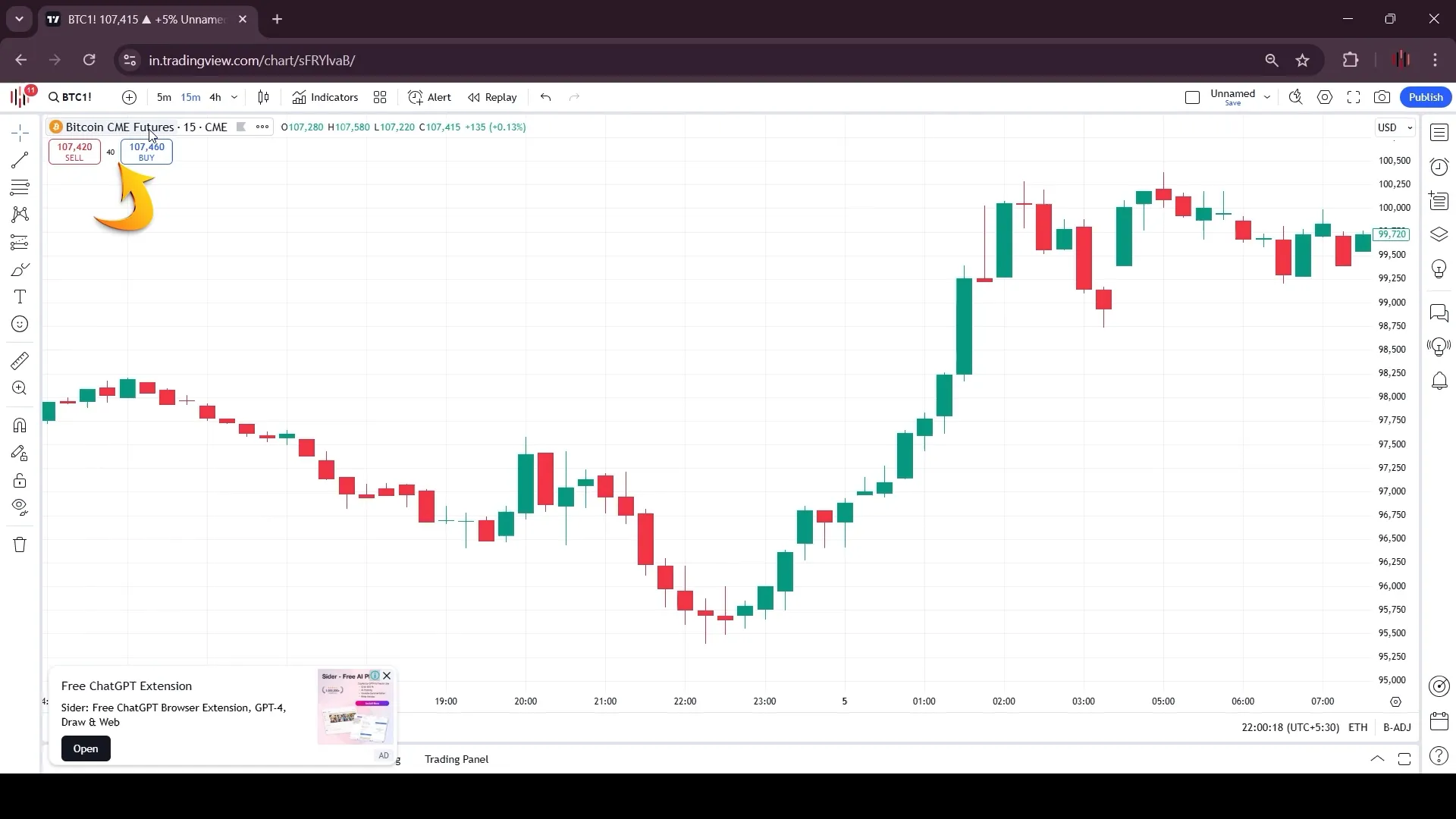

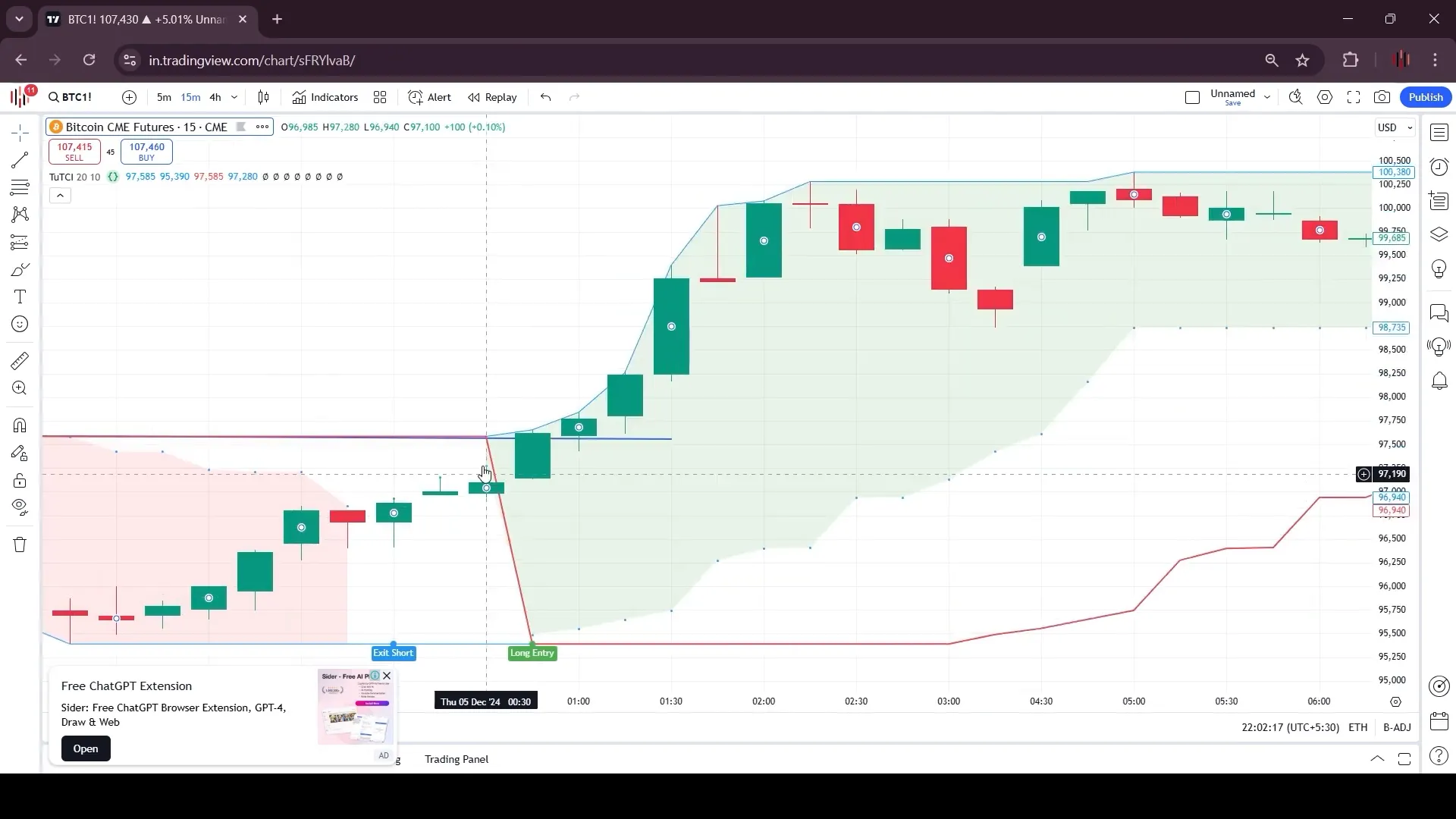

Using the Turtle Trader Indicator

To effectively implement the S1 system, traders can utilize the Turtle Trader indicator. This tool provides visual cues on the chart, making it easier to identify entry and exit points.

For instance, the upper blue line on the indicator denotes the highest high over the last 20 candles. When the price crosses above this line, a buy signal is generated. Conversely, the lower blue line marks the lowest low, serving as a support zone. If the price falls below this line, it triggers a sell signal.

Identifying Buy and Sell Opportunities

When applying the S1 strategy, it’s essential to look for specific patterns in the market. For example, when the market has been in a downward trend and begins to move sideways, this can be considered a resistance point. A bullish signal occurs when a green candle touches the blue line, indicating a potential long entry.

Similarly, once a sell signal is identified, traders can enter short positions. It’s important to watch for exit signals closely to ensure profits are secured before a reversal occurs.

Time Frames for the S1 System

The S1 system is versatile and can be applied across multiple time frames. However, to adhere closely to its rules, it is recommended to use the daily or 4-hour charts. These time frames allow for accurate tracking of the 4-week highs and 2-week lows without missing significant market movements.

Potential Drawbacks of the S1 System

While the S1 system can be effective, it is essential to recognize its limitations. One significant risk is the possibility of a false breakout. The market might reach a new 4-week high only to reverse shortly after, leading to losses on trades.

Additionally, in choppy or sideways markets, the S1 system may result in frequent entries and exits, leading to small losses known as whipsaw trades. This strategy excels in trending markets but may struggle in range-bound conditions.

Delayed Exits

Another concern is the potential for delayed exits. Sometimes, the system might hold onto a position longer than desired before hitting the two-week low, which can turn a profitable trade into a loss. It’s crucial to monitor exit signals closely and act promptly to maximize gains.

Discipline and Risk Management

As with any trading strategy, discipline is paramount. Following the rules without second-guessing is essential for success. Emotional decisions can lead to poor performance, so it’s vital to stick to the established guidelines.

Implementing Stop Losses

According to Turtle trading principles, it’s advisable to set stop losses at the previous candle’s low. This practice can help protect against unexpected market movements and limit potential losses.

Conclusion

The Turtle Trading S1 system is a robust strategy for capturing short-term market moves. By understanding the entry and exit rules, utilizing the Turtle Trader indicator, and maintaining discipline, traders can effectively navigate the markets. While there are risks associated with this strategy, such as false breakouts and delayed exits, careful planning and risk management can enhance its effectiveness.

Whether you’re a novice or an experienced trader, the Turtle Trading S1 system offers valuable insights into trend following and can be a useful addition to your trading toolkit.

PickMyTrade

PickMyTrade specializes in automating trading bots, enabling seamless strategy execution for futures from platforms like TradingView, across well-known brokers such as Tradovate. PickMyTrade

I always spent my half an hour to read this website’s articles or reviews every day along with a mug of coffee.

web page

Hello There. I found your blog using msn. This is a really neatly written article.

I’ll be sure to bookmark it and come back to learn more of your

helpful info. Thanks for the post. I’ll definitely comeback.

casino en ligne

Its like you read my thoughts! You seem to grasp

so much approximately this, like you wrote the book in it or something.

I feel that you simply could do with some % to drive

the message home a little bit, but other than that, this is

excellent blog. A great read. I will definitely be back.

casino en ligne

Hey very cool web site!! Guy .. Excellent .. Superb .. I will bookmark your website and take the feeds also?

I’m satisfied to search out so many helpful info here in the post, we need work out extra techniques on this regard, thank you for

sharing. . . . . .

casino en ligne

Spot on with this write-up, I honestly feel this site needs much more

attention. I’ll probably be returning to read through more, thanks for the advice!

casino en ligne

Hello, i read your blog from time to time and i own a similar one and

i was just curious if you get a lot of spam responses? If so how do you

prevent it, any plugin or anything you can suggest? I get so much lately it’s

driving me mad so any support is very much appreciated.

casino en ligne

Hello, Neat post. There’s a problem with your web site in internet explorer, would test this?

IE still is the market leader and a large component to folks will miss your wonderful writing due to this problem.

casino en ligne

Hi, yup this article is truly good and I have learned lot of things

from it about blogging. thanks.

casino en ligne

Very nice post. I definitely love this website.

Keep writing!

casino en ligne

You’ve made some really good points there. I looked on the web for more info about the issue and found most individuals

will go along with your views on this site.

casino en ligne