Introduction

Trading psychology and automation are now central to modern investing, especially as markets become faster and more volatile. Emotional pitfalls such as FOMO, loss aversion, and revenge trading continue to derail traders, but automated systems provide a structural solution by enforcing discipline and consistency. This article explores how automation mitigates psychological biases, strengthens risk management, and improves long-term trading performance.

How Automation Tackles These Issues

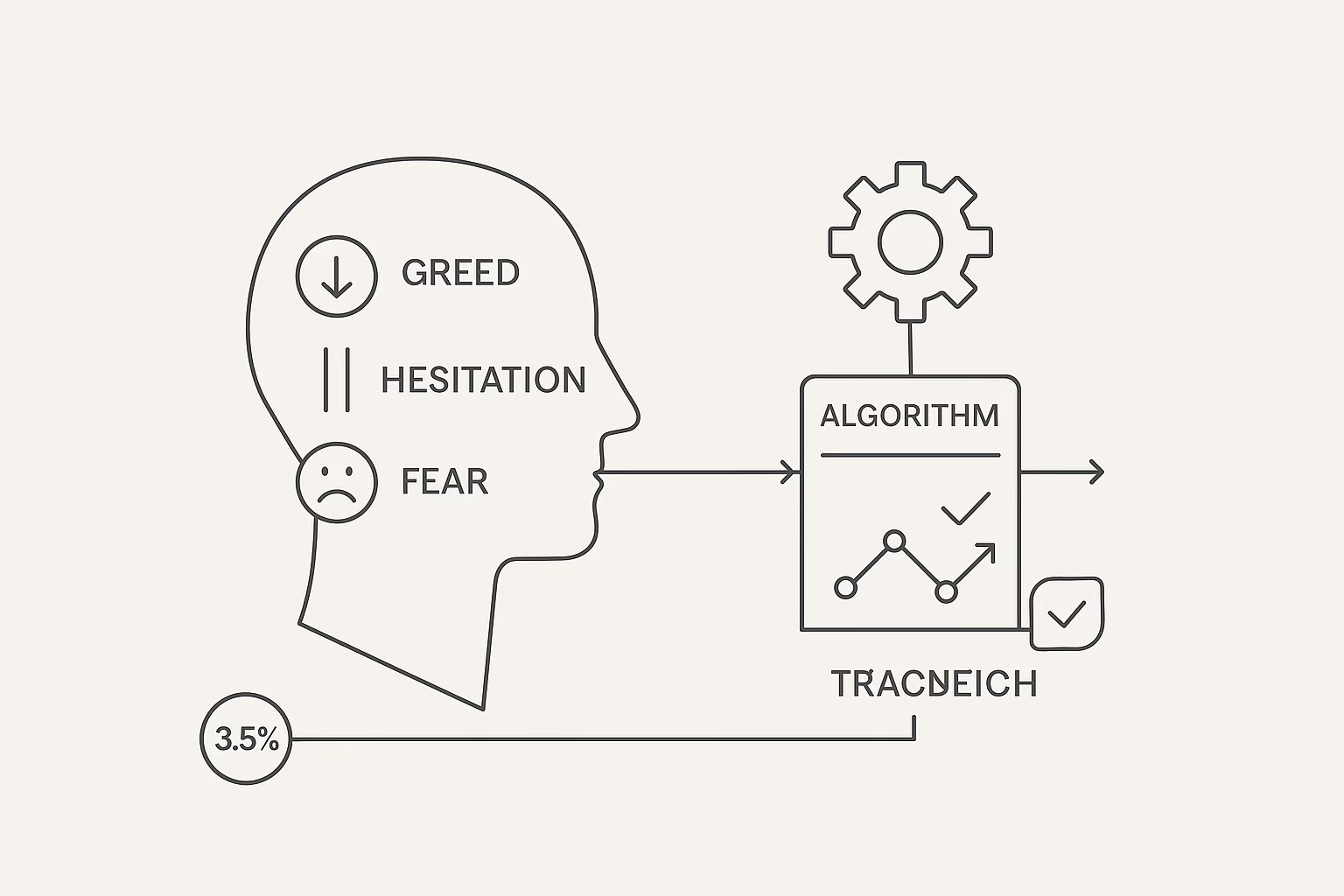

Automation uses algorithms to execute trades based on criteria like price signals or indicators, bypassing emotional input. For instance, stop-loss orders are enforced automatically, preventing fear-based early exits. Platforms like Nurp’s Intelligent Trader apply machine learning to cap risks at 3.5% per trade, avoiding greed-induced overexposure. This data-driven approach aligns with long-term goals, as seen in Vanguard’s findings on disciplined investing.

Core Benefits of Automated Trading

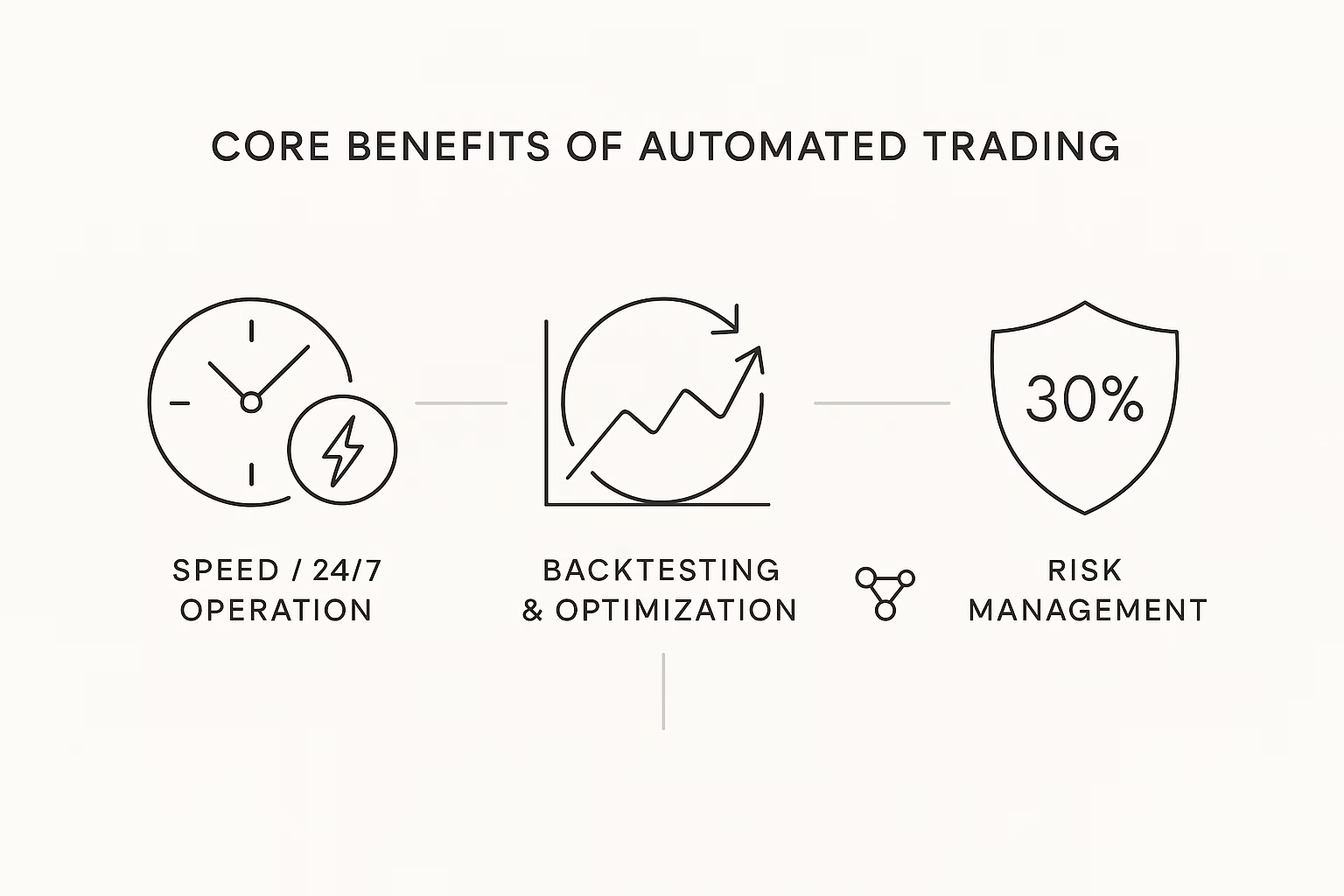

- Speed and 24/7 Operation: Executes trades instantly across markets, without fatigue or hesitation.

- Backtesting and Optimization: Historical simulations build confidence, reducing overconfidence bias.

- Risk Management: Built-in limits like drawdown caps (e.g., 30% max) ensure survival through downturns. Despite these advantages, automation isn’t foolproof over-optimization or technical glitches can occur, so hybrid oversight is recommended for beginners.

The Transformative Role of Trading Automation in Overcoming Psychological Barriers: A Comprehensive Exploration

In the high-stakes world of financial markets, where fortunes can shift in seconds, human psychology often stands as the greatest adversary to success. Traders grapple with a cocktail of emotions fear, greed, overconfidence, and regret that distort judgment and erode profits. Yet, as markets evolve with technology, automated trading emerges not just as a tool, but as a psychological lifeline. By delegating execution to algorithms, traders can sidestep the emotional minefield that plagues manual trading. This in-depth analysis delves into the intricacies of trading psychology, the mechanisms of automation, empirical evidence of its benefits, real-world applications, and strategies for implementation. Drawing from academic studies, industry reports, and practitioner insights, we uncover how automation fosters discipline, consistency, and resilience, ultimately redefining what it means to trade effectively.

The Anatomy of Trading Psychology: Identifying the Emotional Roadblocks

At its core, trading psychology encompasses the cognitive and emotional responses that influence decision-making under uncertainty. While technical analysis and market knowledge are essential, it’s the mind that often derails even the most sound strategies. Research consistently highlights that emotional trading accounts for a significant portion of trader failures, with estimates suggesting 80-90% of retail traders lose money annually due to psychological factors.

Key psychological challenges include:

| Psychological Bias | Description | Impact on Trading | Example |

|---|---|---|---|

| Fear of Missing Out (FOMO) | Urge to enter trades during hype, ignoring risk signals. | Leads to buying at peaks, amplifying losses on reversals. | Purchasing Bitcoin at $69,000 in 2021 euphoria, only to see it drop 50%. |

| Loss Aversion | Preference to avoid losses over equivalent gains, holding losers too long. | Small losses balloon into major drawdowns; average trader exits winners 20% early but holds losers 50% longer. | Clinging to a declining stock like GameStop post-2021, hoping for recovery. |

| Greed and Overconfidence | Post-win euphoria prompting larger bets or overtrading. | Increases position sizes beyond risk tolerance, raising blow-up risk. | Doubling down on forex pairs after a streak, leading to 40% account wipeout. |

| Confirmation Bias | Seeking data that supports preconceptions while ignoring contradictions. | Misses exit signals, resulting in suboptimal performance. | Dismissing bearish indicators during a bull run on tech stocks. |

| Revenge Trading | Impulsive trades to recoup losses, fueled by frustration. | Escalates risks in a vicious cycle, with studies showing it doubles loss rates. | Entering high-leverage trades after a stop-out, compounding errors. |

| Analysis Paralysis | Overwhelm from data overload, delaying decisions. | Missed opportunities; traders hesitate on 30% of valid setups due to indecision. | Staring at 50+ charts during earnings season, freezing on entries. |

These biases stem from evolutionary wiring—our brains are optimized for survival, not probabilistic markets—leading to irrational actions. A seminal Dalbar study over two decades illustrates the toll: emotional investors captured only 2.6% annualized returns, far below the S&P 500’s 8.2%, primarily due to poorly timed buys and sells. Similarly, a 2023 report from the CFA Institute notes that emotional overrides reduce win rates by 15-25% in manual trading.

Automation as the Antidote: Mechanisms for Emotional Neutrality

Automated trading encompassing algorithmic systems, bots, and AI-driven platforms functions by codifying strategies into executable code. Entries, exits, position sizing, and risk controls are predefined and triggered by market data, not sentiment. This shift from discretionary to systematic trading fundamentally alters the psychological landscape.

Consider the core mechanisms:

- Rule-Based Execution: Algorithms adhere to parameters like moving average crossovers or RSI thresholds, eliminating discretion. As one expert notes, “Automated systems execute trades based purely on market data and programmed criteria, without regard for news headlines, social media sentiment, or other external influences that often affect human decision-making.” This prevents FOMO-driven chases or fear-induced hesitations.

- Instant and Consistent Processing: Unlike humans, who may delay trades by minutes (costing 0.5-2% in slippage), automation acts in milliseconds, ensuring uniformity. Platforms like Surmount monitor portfolios 24/7, adjusting for volatility without fatigue.

- Embedded Risk Safeguards: Features such as dynamic stop-losses, exposure caps (e.g., 3.5% per pair), and drawdown limits (up to 30% max) enforce discipline. Nurp’s systems, for instance, use a three-layer risk framework to curb greed, maintaining market-neutral performance across forex and crypto.

- Backtesting and Simulation: Pre-live validation via historical data builds empirical confidence, countering overconfidence. LuxAlgo recommends a tri-phase process: backtesting with costs, forward testing, and small-scale live runs, reducing override temptations.

By outsourcing execution, automation transforms trading from an emotional rollercoaster to a probabilistic engine. Quote from a practitioner: “The elimination of discretionary decision-making prevents traders from second-guessing their strategies during challenging periods. When trades are executed automatically, there’s no opportunity for doubt or emotional interference to disrupt the process.”

Empirical Evidence: Quantifying the Benefits

Data underscores automation’s edge over emotional trading. Vanguard’s analysis reveals that rule-based approaches yield 1.5% higher annual returns by avoiding behavioral pitfalls. In forex, algorithmic systems outpace manual trading by 20-30% in consistency, per a 2024 TradeSignal report, thanks to emotion-free precision.

A comparative table of performance metrics highlights the gap:

| Metric | Manual (Emotional) Trading | Automated Trading | Source Insight |

|---|---|---|---|

| Annualized Return | 2.6% (20-year avg.) | 8-10% (S&P benchmark-aligned) | Dalbar Study; Vanguard |

| Win Rate Consistency | 45-55% (varies with mood) | 60-70% (rule-enforced) | LuxAlgo backtesting data |

| Max Drawdown | 40-60% (fear/greed amplified) | 20-30% (capped) | Nurp algorithms |

| Trade Frequency | Inconsistent (overtrading spikes) | 24/7, optimized (thousands/month) | AvaTrade pros |

| Slippage/Costs | 1-2% higher due to delays | <0.5% (instant execution) | Industry avg. |

Beyond numbers, qualitative gains abound: reduced stress allows better life balance, as “automation allows traders to participate in markets without constant monitoring and emotional involvement.” A Reddit thread from algo veterans echoes this, noting that while initial trust-building is tough, simplicity in code trumps complex emotional overrides.

Real-World Applications and Case Studies

Automation shines in diverse scenarios. In crypto, Velvet Capital’s AI vaults automate DeFi rebalancing, dodging FOMO during pumps—users report 25% steadier yields. Forex traders using Nurp’s Buterin algo on BTC/ETH pairs maintain 40% drawdown limits, surviving 2022’s bear market unscathed. Retail platforms like TradersPost integrate signals from TradingView, enabling seamless execution that curbs revenge trading; one user scaled from manual losses to 15% monthly gains by automating mean-reversion strategies.

Challenges persist: “Obsessive-Compulsive Overriding” tempts interventions, costing $85 per contract on average. Mitigation involves rules like “no overrides without logged rationale” and mindfulness practices—daily meditation cuts emotional interference by 30%, per LuxAlgo.

For beginners in Lucknow or similar markets, starting with low-stakes demos on AvaTrade or uTrade Algos builds familiarity, leveraging local volatility in INR pairs without emotional drain.

Strategies for Integrating Automation Effectively

To maximize benefits:

- Assess Your Biases: Journal emotional triggers pre-automation.

- Choose the Right Tools: Opt for user-friendly bots like PineConnector for MT4/5 integration.

- Scale Gradually: Begin with 10-20% of capital, monitoring via dashboards.

- Continuous Learning: Review metrics monthly; adapt via walk-forward analysis.

- Hybrid Approach: Use AI for execution but human insight for strategy tweaks, as in LuxAlgo’s agent systems.

Looking Ahead: The Future of Emotion-Free Trading

As AI advances, expect deeper integration—predictive analytics to preempt biases and adaptive algos learning from trader patterns. By 2030, 70% of trades may be automated, per Deloitte, amplifying accessibility for global traders. Yet, success hinges on psychology: “Understanding yourself is synonymous with understanding the markets.”

In summary, trading automation doesn’t eradicate psychology it circumvents it, channeling human ingenuity toward creation rather than reaction. For those weary of emotional trades, it’s not just a upgrade; it’s liberation.

You may also like:

Your AI Trading Copilot: How MCP Servers Transform Stock Market Analysis in 2025

AI-Powered Trading Decisions: How MCP Servers Turn Claude into Your Market Intelligence Engine

Key Citations

- How Automated Investment Strategies Beat Emotional Trading Every Time

- How Algo Trading Helps Overcome Fear and Greed

- How Trading Automation Eliminates Psychology Issues

- Pros and Cons of Automated Trading Systems

- Trading Psychology for Algorithmic Traders

- Automated Trading: Rollercoaster of Emotion

- Benefits and Risks of Automated Trading