In today’s volatile markets, maintaining an optimal asset allocation is essential for long-term success. Portfolio rebalance bots have emerged as game-changing tools, automating the process of adjusting your holdings to match your target strategy—whether in stocks, bonds, ETFs, or cryptocurrencies. These intelligent systems monitor drifts, execute trades efficiently, and eliminate emotional decisions, helping investors stay disciplined amid 2026’s economic shifts.

As we enter 2026, advancements in AI and automation have made portfolio rebalance bots more sophisticated than ever. From real-time adjustments in robo-advisors to crypto-specific tools, these bots optimize risk, reduce costs, and potentially enhance returns through “buy low, sell high” mechanics.

Why Portfolio Rebalance Bots Are Essential in 2026

Portfolio rebalancing traditionally involves periodic manual reviews—often quarterly—to restore your desired asset mix. However, market swings can cause significant drifts, exposing you to unintended risk.

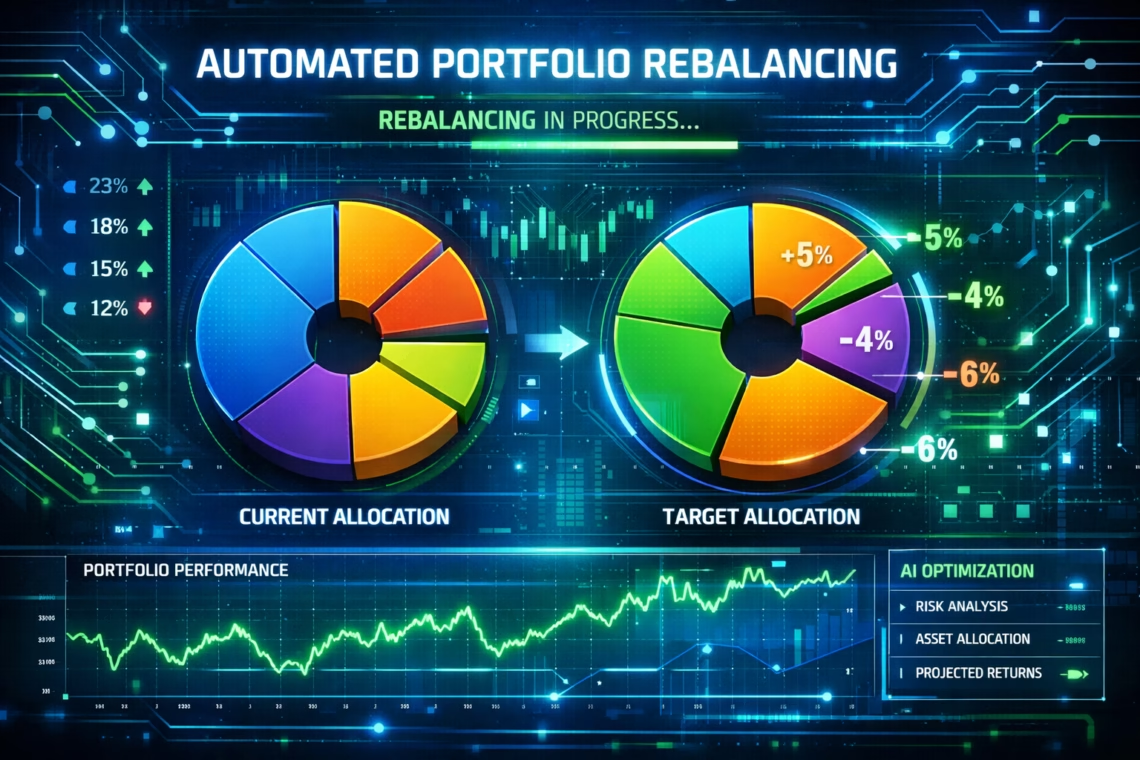

Portfolio rebalance bots solve this by continuously monitoring allocations and triggering automatic trades when deviations exceed thresholds (e.g., 5%). This disciplined approach follows modern portfolio theory principles, mitigating risk while capturing upside.

Recent trends show increased adoption: In crypto, where volatility is extreme, bots like those on Pionex and KuCoin maintain allocations (e.g., 50% BTC, 30% ETH). In traditional investing, robo-advisors like Wealthfront and Vanguard Digital Advisor now offer enhanced AI-driven rebalancing, including tax-loss harvesting and dynamic adjustments.

How Portfolio Rebalance Bots Work

These bots connect to your brokerage or exchange via APIs, analyze real-time data, and execute trades based on rules you set:

- Threshold-based — Rebalance when an asset deviates by X% (e.g., 3-5%).

- Periodic — Adjust at set intervals (daily, weekly, monthly).

- AI-enhanced — Use machine learning for predictive adjustments, factoring in volatility, trends, or sentiment.

For example, if stocks surge and push your 60/40 stock-bond portfolio to 70/30, the bot sells equities and buys bonds automatically—optimizing costs with limit orders and minimizing taxes.

In 2026, many bots incorporate AI for smarter decisions, such as widening bands in volatile periods or integrating on-chain data for crypto.

Top Portfolio Rebalance Bots and Tools in 2026

Here are leading options based on recent developments:

- Shrimpy — Ideal for crypto; automates rebalancing with social copying and smart indexing.

- Pionex Rebalancing Bot — Free built-in tool with dual/multi-coin modes; popular for long-term holders.

- KuCoin Smart Rebalance — AI-assisted for bull/bear markets; customizable parameters.

- HodlBot — Customizable crypto indexing with frequent rebalances and performance tracking.

- Wealthfront & Vanguard Digital Advisor — Top robo-advisors for traditional portfolios; automatic rebalancing, tax optimization, and low fees (updated with enhanced features in late 2025).

For active traders seeking custom automation, tools like PickMyTrade stand out. This platform automates TradingView strategies across brokers (Tradovate, Rithmic, Interactive Brokers, and more) with millisecond precision—no API needed. While focused on strategy execution, its multi-account support, risk-based sizing, and seamless trade copying make it powerful for portfolio automation. Traders use it to scale signals across accounts, enforce risk rules, and maintain disciplined execution in futures or stocks—perfect for those building automated rebalancing workflows.

Benefits

- Risk Management — Keeps your portfolio aligned with goals.

- Efficiency — 24/7 monitoring without constant oversight.

- Cost Savings — Reduces trading fees via optimized execution.

- Performance Edge — “Sell high, buy low” systematically.

- Tax Efficiency — Many include harvesting (especially robo-advisors).

In 2026’s environment—with AI maturation and broader adoption—these bots help investors navigate rotations from tech hype to diversified growth.

Getting Started with Portfolio Rebalance Bots

- Define your target allocation (e.g., risk tolerance, goals).

- Choose a bot/platform matching your assets (crypto vs. traditional).

- Connect accounts and set parameters.

- Monitor and refine—start small!

Tools like PickMyTrade offer quick setup for custom automation, ideal if you use TradingView signals.

Portfolio rebalance bots are no longer optional—they’re essential for smart, hands-off investing in 2026.

Most Asked FAQs

Are portfolio rebalance bots safe?

Yes, when using reputable platforms with secure API connections. Always enable two-factor authentication and start with small amounts.

What is a portfolio rebalance bot?

A portfolio rebalance bot is an automated tool that monitors your investments and adjusts asset allocations to match your target percentages, typically by buying/selling when drifts occur.

How often should a portfolio be rebalanced?

It depends on the bot’s settings—threshold-based (e.g., 5% drift) or periodic (monthly). In volatile markets like crypto, more frequent is common.

Do portfolio rebalance bots work for stocks and crypto?

Absolutely—tools like Wealthfront handle traditional assets, while Shrimpy and Pionex specialize in crypto.

Disclaimer:

This content is for informational purposes only and does not constitute financial, investment, or trading advice. Trading and investing in financial markets involve risk, and it is possible to lose some or all of your capital. Always perform your own research and consult with a licensed financial advisor before making any trading decisions. The mention of any proprietary trading firms, brokers, does not constitute an endorsement or partnership. Ensure you understand all terms, conditions, and compliance requirements of the firms and platforms you use.

Also Checkout: Automate TradingView Indicators with Tradovate Using PickMyTrade

I’m curious about how the bots adjust for different risk appetites. For example, if I’m more risk-averse, do the bots prioritize stable assets more, or do they strictly follow the set allocation percentages regardless of the market environment?