Claude Opus 4.1, released on August 5, 2025, marks an important step forward in Anthropic’s large language model (LLM) lineup. While it isn’t designed to be a trading bot or financial advisor, it can serve as a powerful copilot for traders, quants, and analysts who want help with research, strategy coding, and workflow automation.

This post explores how to use Claude 4.1 for trading assistance, how to access it, and what risks to keep in mind.

Key Points on Using Claude Opus 4.1 for Trading Assistance

- Claude can assist with analyzing market data, generating Python or Pine scripts, and performing risk assessments.

- It is not a substitute for professional advice—human oversight is essential.

- Strong performance on coding and reasoning makes it well-suited for backtesting algorithms and workflow automation.

- To avoid pitfalls like overfitting or hallucinations, Claude should be paired with verified data sources.

- Anthropic’s guidelines classify financial applications as high risk, requiring safeguards such as human review before acting on results.

Accessing Claude Opus 4.1

Claude Opus 4.1 is accessible in several ways:

- Claude.ai – direct web interface for individuals.

- Anthropic API – model name:

claude-opus-4-1-20250805. - Amazon Bedrock – available as a managed service.

- Google Vertex AI – integrated into Google Cloud workflows.

- GitHub Copilot – for code generation tasks.

Pricing is unchanged from Claude Opus 4.0. See Anthropic’s pricing page for details.

Basic Applications in Trading

Claude’s coding ability makes it especially useful in algo-trading research. With structured prompts, you can offload repetitive analysis or generate working code quickly.

Example Uses:

- Market data analysis

Upload CSVs or pull from APIs (e.g., Yahoo Finance viayfinance) and have Claude compute moving averages, volatility, or correlation matrices. - Backtesting strategies

Ask Claude to write Python or Pine scripts for strategies like moving average crossovers, Bollinger bands, or pairs trading. - Sentiment analysis

Provide news headlines or social media feeds and have Claude generate sentiment scores and summary reports. - Risk modeling

Run simulations (e.g., Monte Carlo) to understand portfolio drawdowns or stress test different allocations. - Workflow automation

Connect Claude through Model-Compute-Platform (MCP) connectors to services like Alpaca, Morningstar, or Google Sheets.

Precautions and Best Practices

- Always verify outputs. AI can hallucinate prices, metrics, or trends. Cross-check with reliable data sources.

- Keep humans in the loop. Don’t let Claude place trades or execute strategies without oversight.

- Stay compliant. Regulatory frameworks require transparency and prohibit fully automated decision-making without intervention.

- Use enterprise-grade integrations. Protect sensitive financial data by using secured API or enterprise versions.

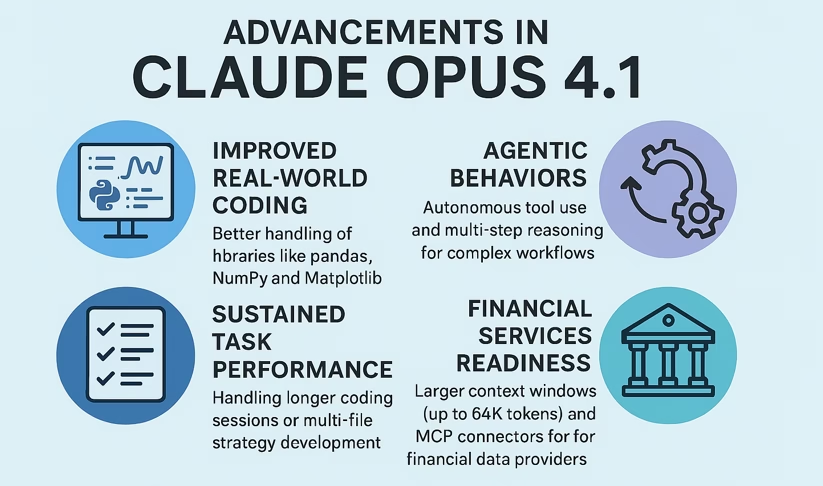

Advancements in Claude Opus 4.1

Compared to Claude Opus 4.0 (released May 22, 2025), the 4.1 upgrade focuses on:

- Improved real-world coding – better handling of libraries like pandas, NumPy, and Matplotlib.

- Agentic behaviors – autonomous tool use and multi-step reasoning for complex workflows.

- Sustained task performance – handling longer coding sessions or multi-file strategy development.

- Financial services readiness – larger context windows (up to 64K tokens) and MCP connectors for financial data providers.

Anthropic launched Claude for Financial Services in July 2025, providing tailored features like compliance automation, audit trails, and institutional support through partnerships with Deloitte and PwC.

Tables: Practical Uses and Risks

Table 1: Common Trading Use Cases for Claude Opus 4.1

| Use Case | Description | Example Prompt | Supporting Tools/Integrations |

|---|---|---|---|

| Market Sentiment Analysis | Process news/social feeds for bullish/bearish signals | “Analyze sentiment from these 10 TSLA articles and score trends.” | News APIs, yfinance |

| Strategy Backtesting | Generate Python/Pine code to test algorithms | “Write Python code to backtest a crossover strategy on SPY.” | Pandas, Matplotlib, Alpaca |

| Risk Management | Simulate scenarios and portfolio stress tests | “Run a Monte Carlo simulation for a 50/50 AAPL-bond portfolio.” | MCP data connectors |

| Portfolio Optimization | Suggest rebalancing based on Sharpe ratio | “Optimize this 10-stock portfolio for Sharpe ratio.” | FactSet, Morningstar |

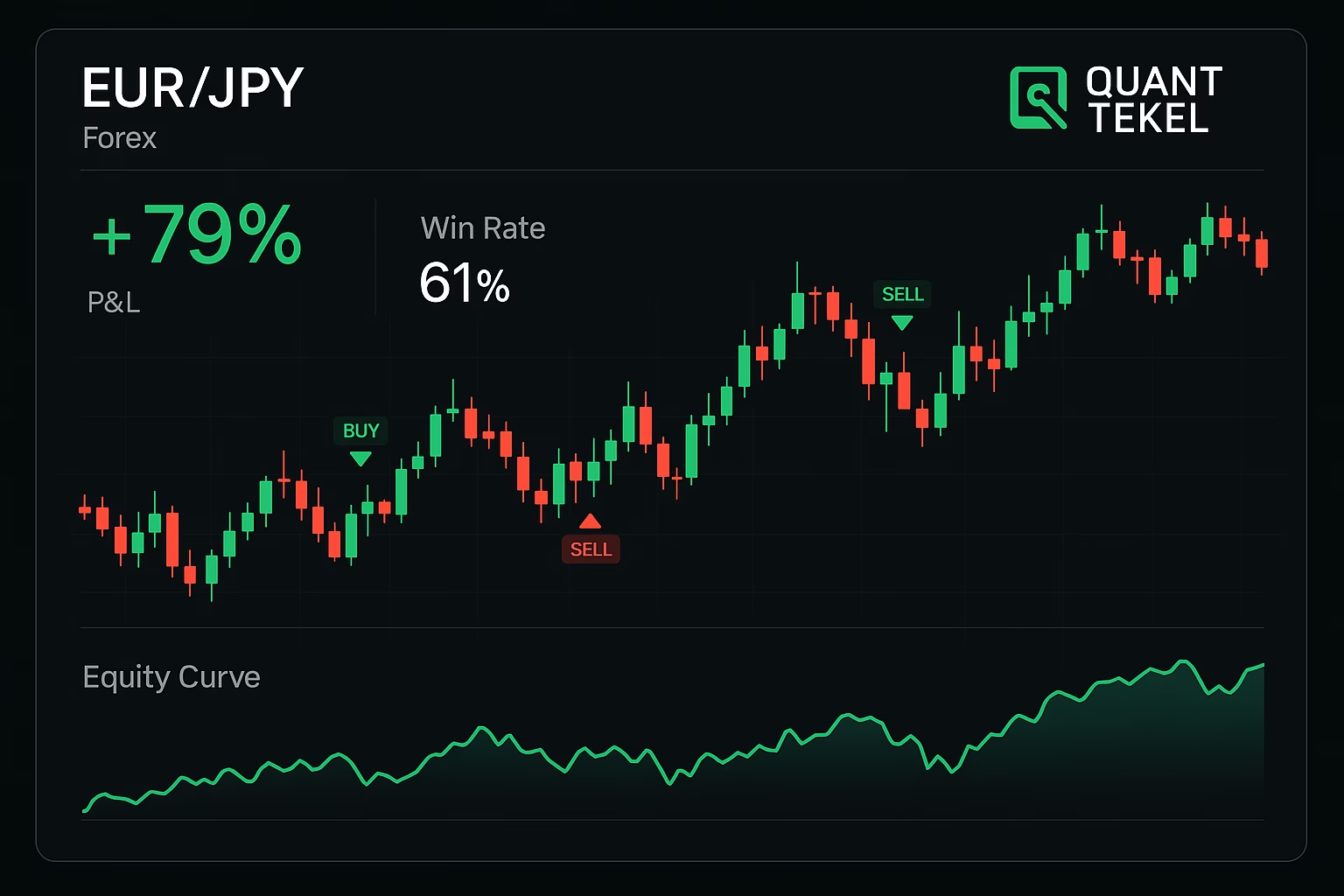

| Chart Interpretation | Explain candlestick or technical patterns | “Interpret this BTC candlestick chart for support/resistance.” | TradingView integrations |

Table 2: Risks and Mitigation Strategies

| Risk | Description | Mitigation | Source Examples |

|---|---|---|---|

| Bias & Hallucinations | Fabricated or skewed outputs | Cross-verify with primary sources | Prompt leak analyses |

| Overfitting | Models tuned too tightly to past data | Use out-of-sample testing | Backtest failures |

| Regulatory Issues | AI-only execution not allowed | Human-in-the-loop review | Anthropic’s policy |

| Value Misalignment | AI behavior diverging from user goals | Define system prompts, monitor outputs | Agentic AI concerns |

| Data Privacy | Sensitive data exposure | Use enterprise-secured versions | Anthropic no-training policy |

Conclusion

Claude Opus 4.1 is not a trading autopilot but it is a capable copilot for anyone working in markets. With stronger coding, reasoning, and integration features, it can save time in research, strategy development, and workflow orchestration.

Success depends on using it responsibly: validate results, keep oversight in place, and align usage with regulatory standards. Traders who combine Claude’s capabilities with sound judgment and verified data may find it a valuable edge in 2025 and beyond.

If you’ve created a TradingView strategy, you can forward-test it using PickMyTrade’s 5-day free trial. It lets you automate execution with your broker while keeping full oversight—ideal for testing ideas before committing real capital.

Try Pickmytrade: Click here

References

- Anthropic – Claude Opus 4.1

- Anthropic – Claude for Financial Services

- GitHub – Claude Opus 4.1 in Copilot

- Google Cloud – Claude Opus 4.1 on Vertex AI

- CNBC – Anthropic AI for Financial Services

- Thoughtworks – Claude for Finance

- CFA Institute – AI Bias by Design

- Medium – AI for Alpha

You May also Like:

- Best AI Tools for Trading: Signal Generation, Strategy Building, and Automation

- Can Grok AI Really Trade?

- How to Use GPT-5 with TradingView Strategies for Automated Trading

- Using Generative AI for Trading: A Beginner’s Roadmap

Is Claude 4.1 a trading bot?

No. Claude 4.1 is an AI copilot for research, code generation, and workflow automation. It shouldn’t place trades directly keep a human in the loop and route any execution through reviewed, auditable steps.

How can I use Claude 4.1 for trading day to day?

Use it to analyze market data, draft Python/Pine code for backtests, summarize news sentiment, and document assumptions/risk. Pair every output with verified data before you act.

Does Claude 4.1 for trading support real-time prices?

The model doesn’t stream prices itself. It generates code or workflows that connect to your chosen data feed or API; you control data quality, latency, and costs.

Can Claude 4.1 write and backtest strategies for me?

It can generate clean starter code (Python/Pandas, Pine) and testing scaffolds. Run them locally or in your platform, include realistic costs/slippage, and validate out-of-sample before any deployment.

What are safe prompts for algo-trading with Claude 4.1?

Specify: objective, instruments, timeframe, data source, constraints (costs, leverage), risk metrics (Sharpe, max drawdown), and acceptance criteria. Example: “Write Python to backtest a daily MA crossover on SPY from 2010–2024 with 10 bps costs and walk-forward validation.”

How do I avoid overfitting and data leakage?

Use chronological splits, walk-forward validation, and feature freezes; only use information available at time t. Keep a holdout set, penalize complexity, and report confidence intervals not just headline returns.

Can Claude 4.1 place trades with my broker?

It shouldn’t autotrade. If you integrate with a broker API, require human review, position/LOSS limits, alerts, and start with paper trading.

Is Claude 4.1 for trading good for sentiment analysis?

Yes if you supply reliable headlines or transcripts. Have it score sentiment, extract entities, and summarize drivers, then cross-check with primary sources to curb hallucinations.

Which starter strategies work well with an AI copilot?

Moving-average crossovers, Bollinger mean reversion, momentum/trend filters, and pairs trading. Keep rules simple, costs modeled, and risk managed.

How do I evaluate a strategy fairly?

Track Sharpe/Sortino, max drawdown, PnL distribution, turnover, and slippage. Use robust backtests with transaction costs, then forward-test (paper) before any live trial.

Is my financial data safe with Claude?

Prefer enterprise/API setups with clear data-handling terms, key management, and audit logs. Avoid pasting secrets, mask IDs, and store credentials outside chat.

What compliance guardrails should I set?

Document prompts/versions, log every decision, enforce human approval, and add limits/alerts. Regulations vary by jurisdiction this isn’t legal advice.

How is Claude 4.1 different from other AI models for trading?

Models differ in coding strengths, context window, tool integrations, and cost. Choose based on your stack (APIs/cloud), data governance needs, and your own evaluation on representative tasks.

What tech stack do I need to get started?

Python 3.x with pandas/numpy, a backtesting library (vectorbt, backtrader), a data provider/API, and an IDE or notebooks. Optional: broker sandbox for paper trading.