Trading can often feel overwhelming, especially for beginners. The right tools can make a significant difference in simplifying decision-making. One such tool is the CBG Swing High Low MA Indicator. In this blog, we’ll explore how this unique indicator works, how to set it up, its rules for usage, and its strengths and weaknesses. By the end of this guide, you should have a clear understanding of how to leverage this tool in your trading strategy.

What is the CBG Swing High Low MA Indicator?

The CBG Swing High Low MA Indicator is designed to provide clear buy and sell signals through colour coding, making it particularly beginner-friendly. It helps traders identify market conditions quickly and effectively. The indicator operates on various time frames, but for our discussion, we will focus on its application in the Bitcoin Futures market.

Setting Up the Indicator

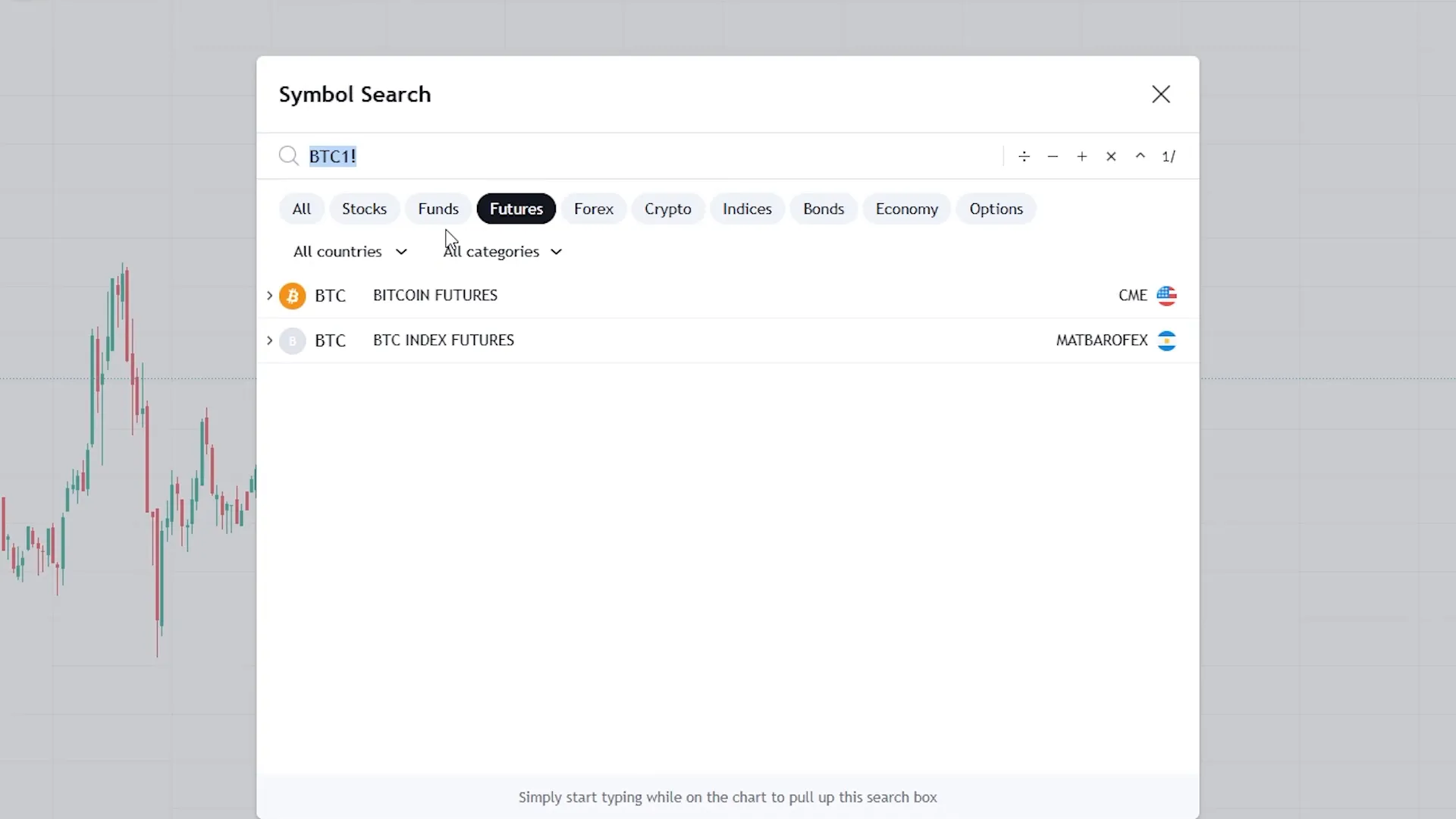

To set up the CBG Swing High Low MA Indicator, follow these steps:

- Open your trading platform and navigate to the Bitcoin Futures chart.

- Go to the indicator section and search for “CBG”.

- Select the “CBG Swing High Low MA” indicator from the list.

- If you prefer a cleaner look without the bars, you can disable them in the settings.

Once you have the indicator set up, it’s time to delve into how to interpret its signals.

Interpreting the Indicator Signals

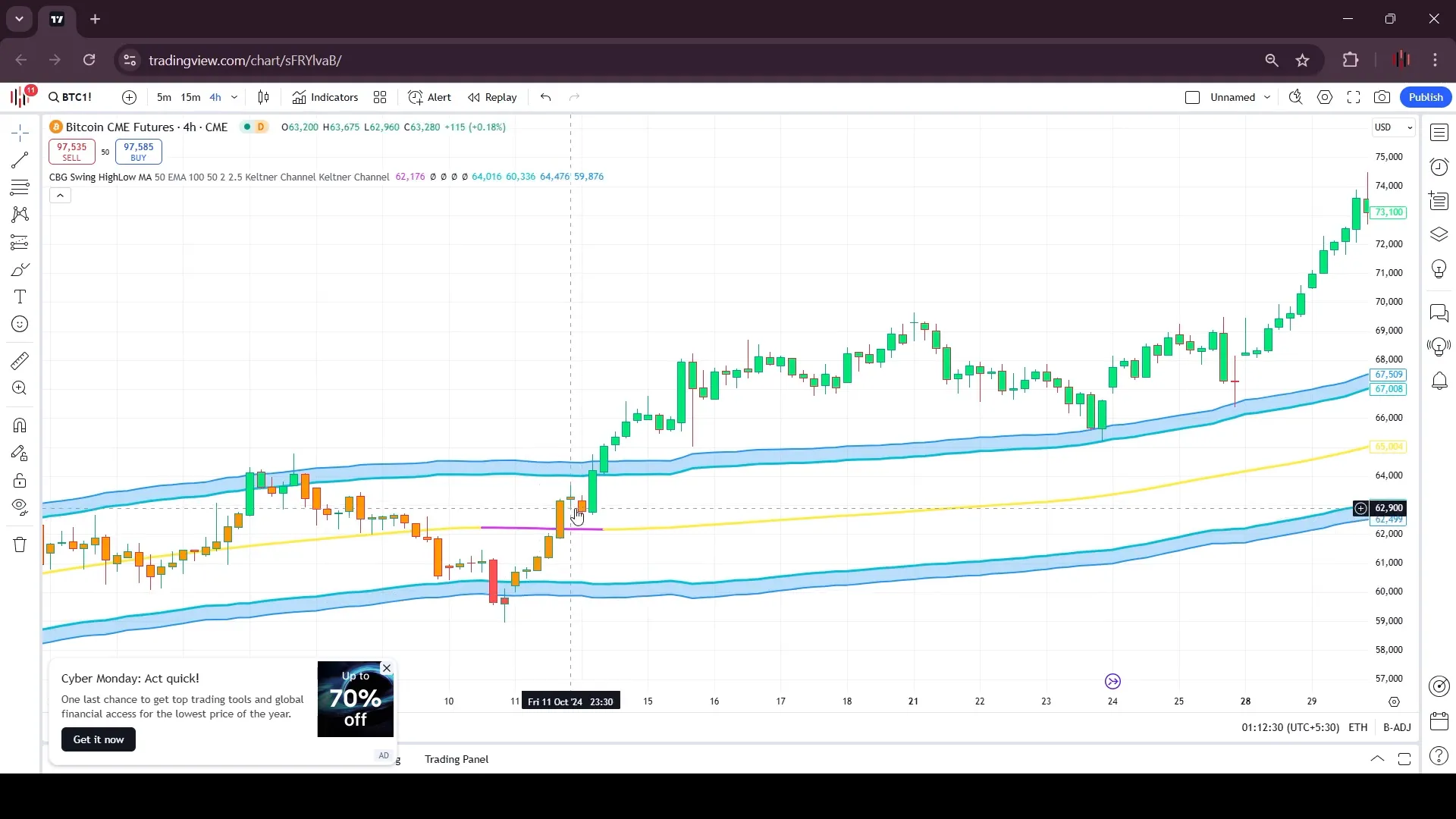

The CBG indicator displays three different colours, each signifying a specific market condition:

- Green Bars: Indicate buying opportunities.

- Red Bars: Signal selling opportunities.

- Orange Bars: Suggest that the market is moving sideways.

This colour coding simplifies decision-making and helps traders avoid choppy market conditions where many strategies may struggle.

Trading with the CBG Indicator

When trading using the CBG Swing High Low MA Indicator, the strategy is quite straightforward:

- For long trades, wait for a green bar to appear. This signals a buying opportunity. For instance, if you see an orange bar, refrain from placing a trade until a green bar appears.

- Once a green bar is present, take the position. Monitor the market closely; if it turns orange, close your trade.

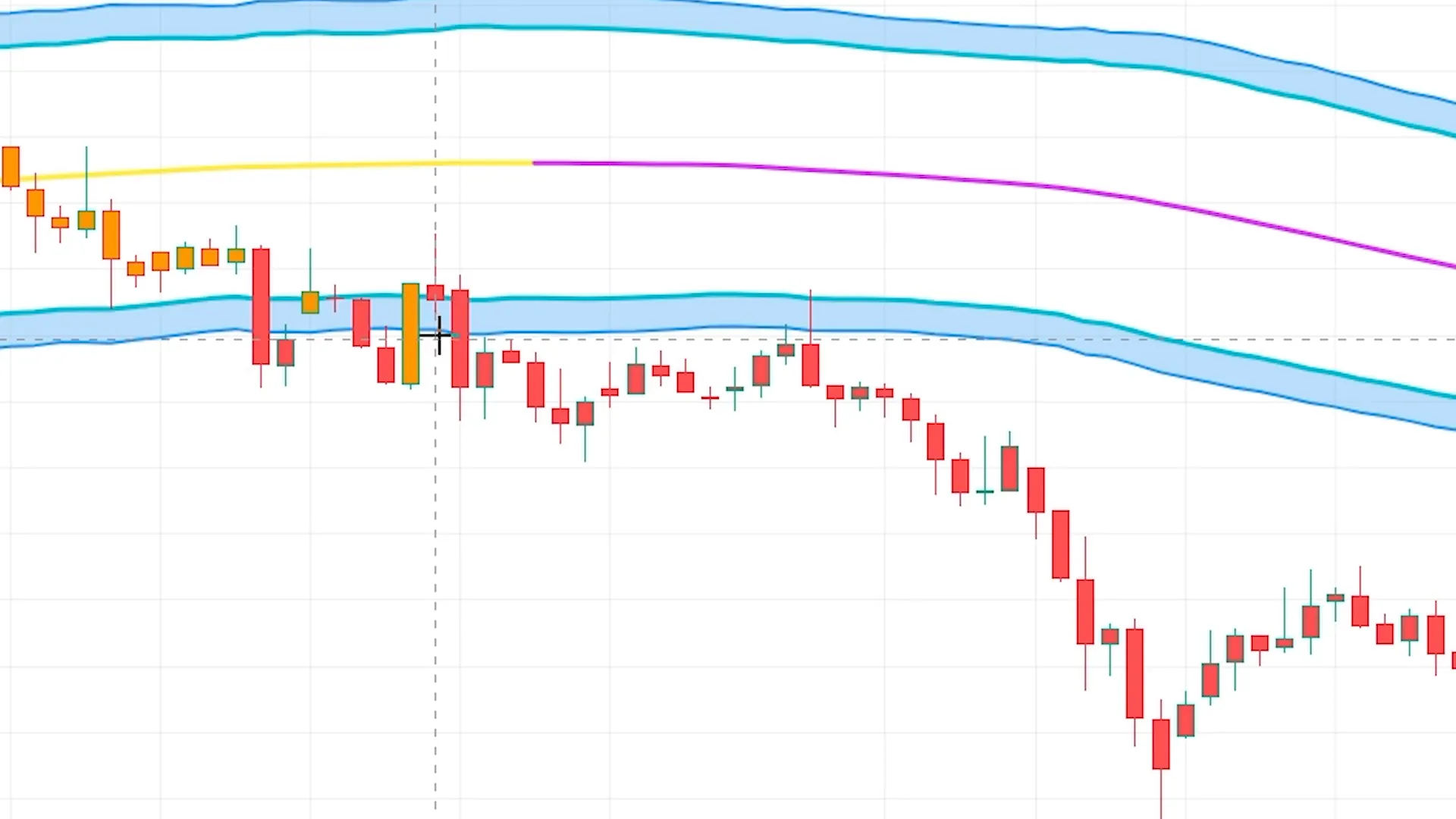

- For short positions, wait for red bars. If you see orange bars, avoid trading until a red bar appears.

- After entering a short position, you can exit when the market reverses.

Setting Stop-Loss Orders

Proper risk management is crucial in trading. Here’s how to set your stop-loss orders using the CBG indicator:

- For short positions, if taking a position after two red signals, set your stop-loss just above the last red bar.

- For long positions, place your stop-loss below the previous candle’s low to minimize potential losses.

Keeping your stop-loss nearby helps protect your capital, especially if the market doesn’t move in your favour.

Strengths of the CBG Indicator

The CBG Swing High Low MA Indicator has several strengths:

- Visual Clarity: The colour coding makes it easy to identify market conditions, particularly for beginners.

- Buffer Zone: The orange bars help traders avoid getting caught in choppy markets, which can be especially challenging with other indicators.

- Simple Strategy: The straightforward rules make it easy for beginners to grasp trading concepts without becoming overwhelmed.

Weaknesses of the CBG Indicator

While the indicator is beneficial, it is not without its limitations:

- Not a Standalone Strategy: The CBG indicator works best when used in conjunction with other tools or filters to refine signals.

- Delay in Signal Timing: As with many indicators, there can be a lag in signal generation, which may affect trade timing.

- Market Conditions: In highly volatile markets, the indicator may produce more false signals.

Conclusion

The CBG Swing High Low MA Indicator serves as a valuable tool for traders, especially those just starting out. Its clear visual cues and straightforward trading rules make it an excellent choice for simplifying trading decisions. However, it’s essential to remember that it should not be used as a standalone strategy. Pairing it with additional filters or indicators can significantly enhance its effectiveness.

For those interested in automated trading solutions, consider exploring PickMyTrade’s automated trading platform for expert strategies and real-time insights that can optimize your investments.

Happy trading!

PickMyTrade

PickMyTrade specializes in automating trading bots, enabling seamless strategy execution for futures from platforms like TradingView, across well-known brokers such as Tradovate.