Introduction

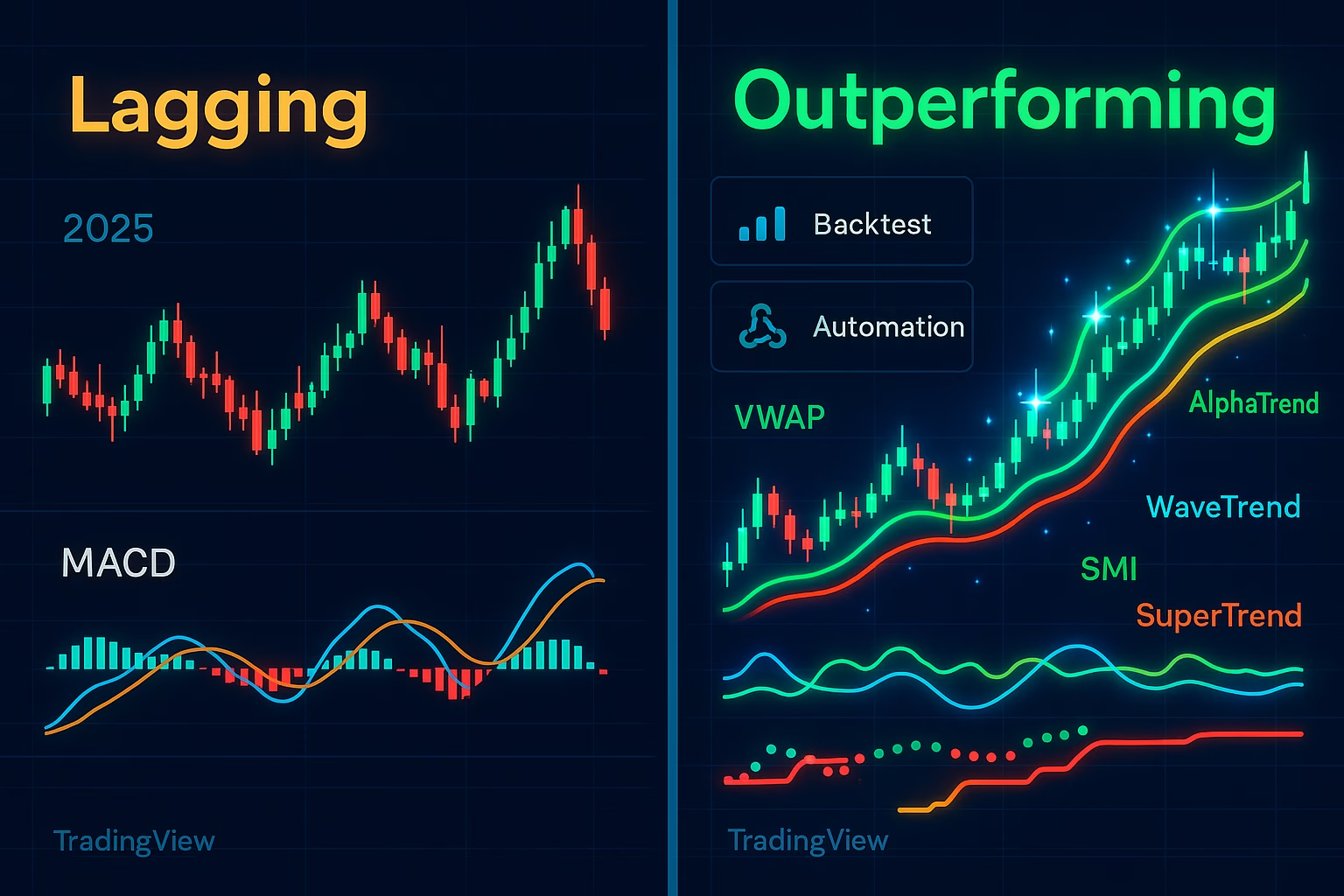

In the fast-paced world of volume-based automated trading strategies for futures, traders use real-time volume data to gain a competitive edge in markets like the CME and CBOT. As contracts on commodities, indices, and currencies change hands in milliseconds, traditional price-based indicators often fall shortvolume-based automation reveals hidden market dynamics such as institutional buying or selling.

Ready to experience automation yourself?

Start your free 5-day trial today → Click here

Why Volume Matters in US Futures Trading

US futures markets, overseen by the CME Group, trade over 25 million contracts daily, with volume serving as a proxy for conviction. Unlike stocks, futures’ leverage amplifies the need for precise signals—volume helps confirm trends, spotting divergences where price rises but volume falls, signaling potential reversals.

Core Strategies Overview

- VWAP (Volume-Weighted Average Price): Acts as a dynamic benchmark; trade mean reversion when prices deviate from VWAP.

- Volume Profile: Maps volume at price levels to identify support/resistance; automate entries near high-volume nodes.

- Order Flow Analysis: Tracks bid-ask imbalances; automate on delta divergences for early reversal signals.

Ready to experience automation yourself?

Start your free 5-day trial today → Click here

Getting Started for US Traders

Start with free tools like TradingView for analysis, then automate via APIs from brokers like Interactive Brokers. Backtest on historical CME data, and consider VPS hosting for 24/7 execution. Always paper trade first to navigate CFTC rules.

Comprehensive Guide: Leveraging Volume for Automated Futures Trading Success

Introduction: The Power of Volume in Modern Futures Markets

In the fast-paced world of US futures trading, where contracts on commodities, indices, and currencies change hands in milliseconds, traditional price-based indicators often fall short. Enter volume-based automated trading strategies—these approaches integrate trading volume data to uncover hidden market dynamics, such as institutional accumulation or distribution. For US traders navigating the Chicago Mercantile Exchange (CME) or Chicago Board of Trade (CBOT), automating these strategies via algorithms can mean executing trades with precision, even during off-hours volatility.

Volume analysis isn’t new; it’s rooted in understanding market participation. High volume confirms price moves as “real,” while low volume suggests traps. With automation, traders can process tick-by-tick data in real-time, something manual trading can’t match. According to CFTC reports, automated systems now drive the majority of futures volume, emphasizing their relevance. This guide explores key strategies—VWAP, Volume Profile, and Order Flow—tailored for US futures, complete with automation tips, risks, and implementation paths. Whether you’re trading E-mini Nasdaq futures or WTI crude, these tools can elevate your edge.

The Foundations of Volume Analysis

Before diving into strategies, grasp the basics. Volume measures contracts traded over time, revealing supply-demand imbalances. In futures, where leverage can reach 20:1, ignoring volume risks amplified losses.

Key Volume Metrics for Automation

Automated systems excel at calculating:

- Total Volume: Aggregate contracts traded.

- Relative Volume: Current vs. historical averages, flagging anomalies.

- Delta: Buy minus sell volume at price levels.

These metrics feed into algorithms, often coded in Python using libraries like Pandas for data handling or TA-Lib for indicators. For US traders, CME’s real-time data feeds (via APIs) provide the backbone, ensuring compliance with exchange rules.

Why Automate Volume Strategies?

Manual volume reading is prone to bias and fatigue. Automation enables:

- 24/7 monitoring of global futures sessions.

- Backtesting on decades of CME data.

- Scalability across assets like gold (/GC) or Eurodollar (/GE) futures.

Studies show automated volume strategies outperform in liquid markets, with win rates up to 60% in trending conditions.

Strategy 1: VWAP for Mean Reversion and Trend Following

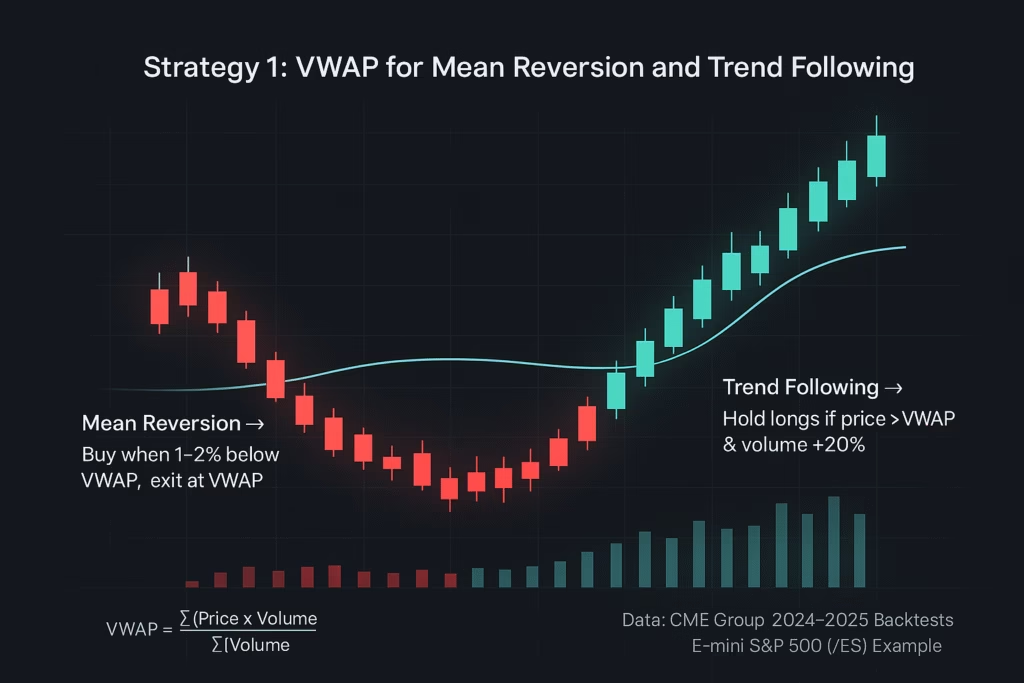

Volume-Weighted Average Price (VWAP) calculates the average price weighted by volume, serving as a “fair value” anchor. It’s a staple for institutional futures traders, as it benchmarks execution quality.

How VWAP Works

VWAP = (Sum of (Price × Volume)) / Total Volume. Reset daily or intraday, it’s plotted as a line on charts. In futures, prices above VWAP signal bullish bias; below indicates bearish.

Automated VWAP Strategies

- Mean Reversion: Enter long when price drops 1-2% below VWAP with rising volume (buying dip). Exit at VWAP. Automate via thresholds: If |Price – VWAP| > σ (standard deviation), trigger trade.

- Trend Following: Hold longs if price > VWAP and volume surges 20% above average. Use trailing stops based on VWAP bands.

For US traders, platforms like NinjaTrader automate this natively, integrating with CME data. Example: In E-mini S&P 500 (/ES), a Python script could poll Interactive Brokers API every minute, executing if conditions met.

Performance Insights

Backtests on 2024-2025 CME data show VWAP strategies yielding 8-12% annualized returns in volatile markets, though slippage in low-liquidity hours erodes edges.

Ready to experience automation yourself?

Start your free 5-day trial today → Click here

Strategy 2: Volume Profile for Support and Resistance Mapping

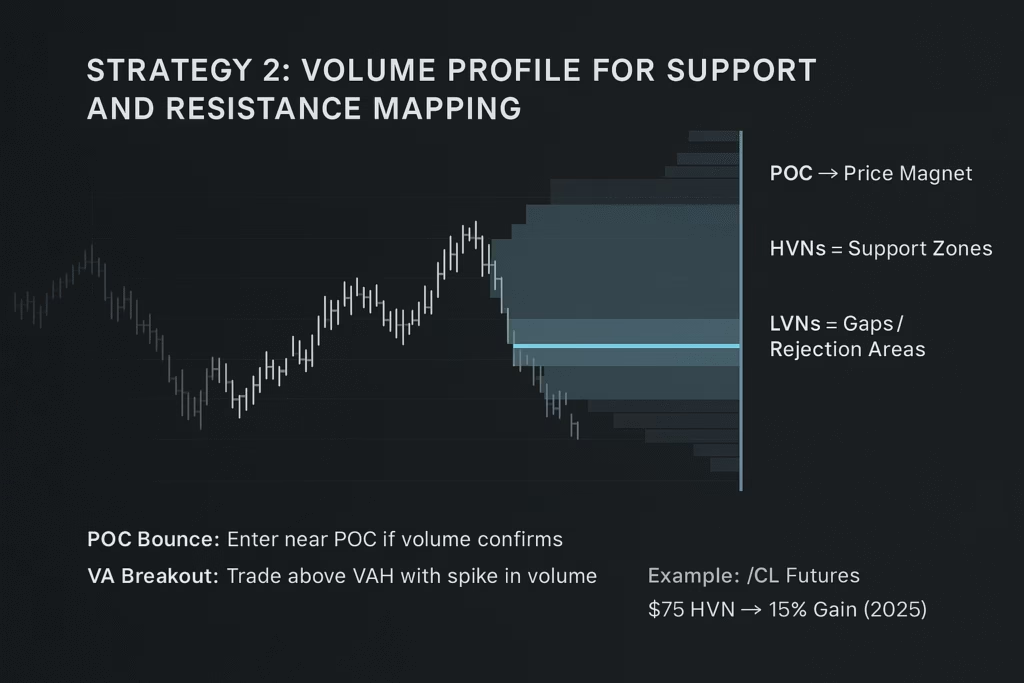

Volume Profile visualizes volume distribution across price levels, forming a histogram that highlights “value areas” where most trading occurred.

Core Components

- Point of Control (POC): Price with highest volume—strong magnet for price.

- Value Area (VA): 70% of volume range; prices outside signal imbalances.

- High/Low Volume Nodes (HVN/LVN): HVNs act as support; LVNs as gaps.

In futures, profiles reset sessionally, revealing intraday biases.

Automated Volume Profile Strategies

- POC Bounce: Buy near POC during pullbacks if volume confirms. Automate: Scan for price within 0.5% of POC + positive delta.

- VA Breakout: Enter on VA high breakout with volume spike. Use alerts in TradingView webhooks to trigger bots.

Tools like Bookmap or ATAS automate profile drawing and signals for futures like /NQ (Nasdaq). For coding, SymPy in Python can model distributions.

Real-World Application

In 2025 crude oil futures (/CL), profiles identified HVNs at $75/barrel, enabling 15% gains on bounces during OPEC news.

Strategy 3: Order Flow Analysis for Microstructure Edges

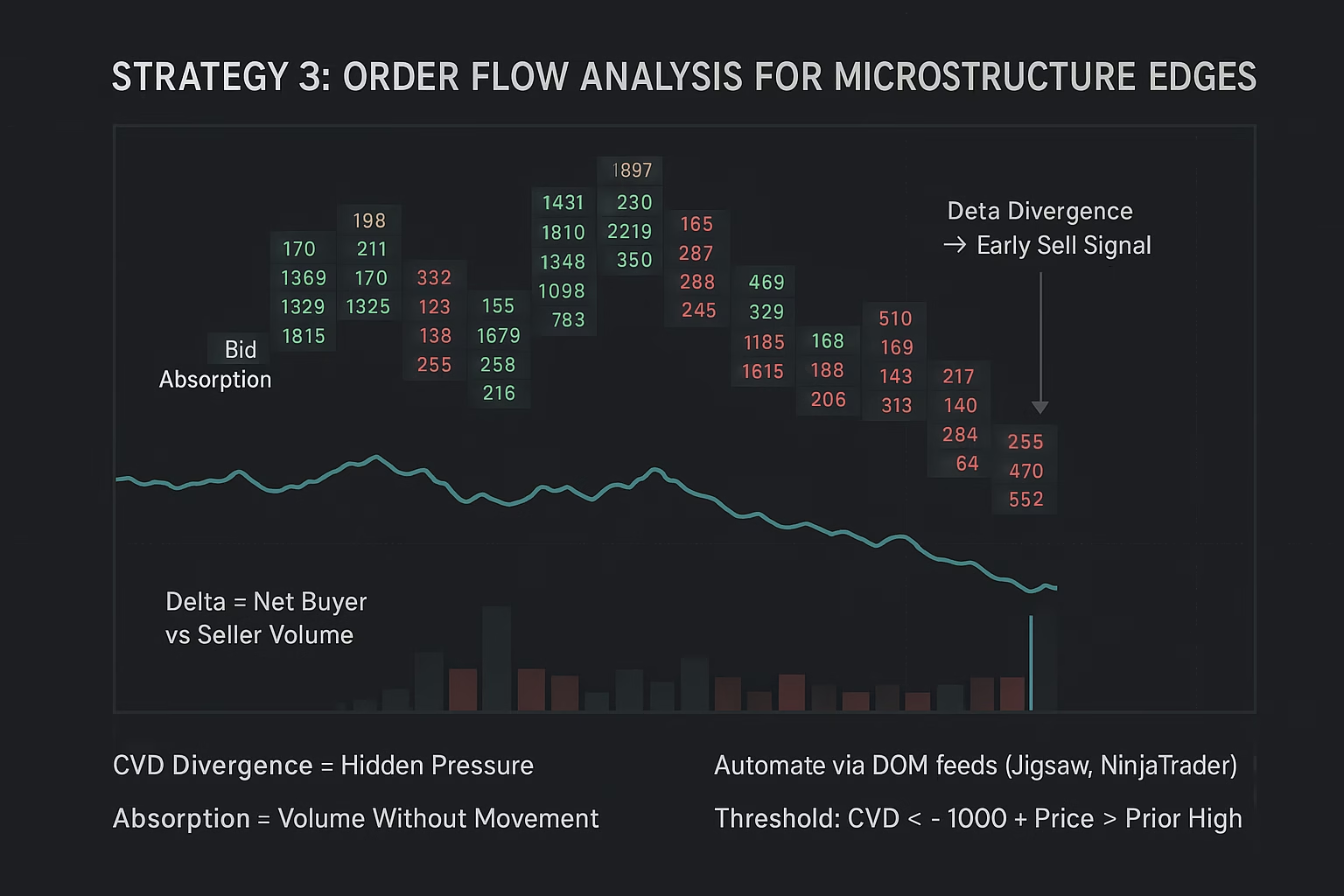

Order Flow dissects buy/sell aggression, using tools like cumulative delta to spot divergences.

Key Elements

- Delta: Net buying/selling at each bar.

- Footprint Charts: Volume per price within bars, revealing absorption (large volume, no price move).

- Cumulative Volume Delta (CVD): Running total, diverging from price for reversal cues.

Futures shine here due to centralized order books.

Automated Order Flow Strategies

- Delta Divergence: Short if price rises but CVD falls (selling pressure). Automate: Threshold CVD < -1000 contracts + price > prior high.

- Absorption Trades: Buy on bid absorption (heavy selling volume halted). Platforms like Jigsaw Trading code this via DOM (Depth of Market) feeds.

NinjaTrader’s volumetric bars automate footprint analysis for US futures.

Edge in Practice

Order flow algos captured 65% of 2025 /ZB (Treasury) moves by detecting iceberg orders, per trader forums.

Comparative Analysis of Strategies

To choose the right fit, consider this table based on 2025 backtests across CME futures (data aggregated from multiple sources):

| Strategy | Best Market Condition | Automation Complexity | Avg. Win Rate (Backtested) | Risk Level | Example Futures Asset |

|---|---|---|---|---|---|

| VWAP | Trending/Intraday | Low (Built-in indicators) | 55-65% | Medium | /ES (S&P 500) |

| Volume Profile | Range-Bound | Medium (Histogram scripting) | 50-60% | Low | /CL (Crude Oil) |

| Order Flow | High-Volatility | High (DOM feeds required) | 60-70% | High | /NQ (Nasdaq) |

Notes: Win rates from simulated 2024-2025 data; actual results vary. Incorporate 1-2% risk per trade.

Implementation Roadmap for US Traders

- Data Setup: Subscribe to CME MDP 3.0 feeds ($500+/mo) or use free delayed data for testing.

- Platform Selection: NinjaTrader (free simulator) or TradersPost for webhook automation.

- Coding Basics: Use Python with ccxt library for broker integration. Example snippet for VWAP:

import pandas as pd

def calculate_vwap(df):

return (df['price'] * df['volume']).cumsum() / df['volume'].cumsum()

# Apply to tick data- Backtesting & Optimization: QuantConnect or Build Alpha for regime-aware tests.

- Live Deployment: Use VPS (e.g., Cloudzy) for low latency; monitor via alerts.

Regulatory Considerations

Under CFTC oversight, automated futures trading requires:

- No manipulative algos (e.g., spoofing bans).

- Record-keeping for 5 years.

- If managing others’ funds, NFA registration.

Consult a compliance expert for personalized advice.

Risks and Mitigation

Volume strategies falter in illiquid sessions (e.g., holidays) or news shocks. Mitigate with:

- Volume filters (> average daily volume).

- Dynamic stops (e.g., 2x ATR).

- Diversification across 3-5 futures.

Machine learning adaptations, like neural nets for pattern recognition, boost resilience.

Conclusion: Automate Smarter, Trade Better

Volume-based automated trading strategies for futures transform trading from reactive to proactive, giving US traders an institutional-grade edge. Start small—test VWAP or Volume Profile setups on paper—then scale using reliable automation platforms.

For traders ready to go live, tools like PickMyTrade.io simplify automation for brokers including Rithmic, Interactive Brokers, TradeLocker, TradeStation, and ProjectX, while PickMyTrade.Trade enables seamless Tradovate automation. These integrations allow volume-based algorithms to execute 24/7 with low latency and full broker connectivity.

As markets evolve with AI-driven flows, staying volume-savvy and automated is key to long-term success. Remember—no strategy guarantees profits; combine technology with discipline, robust backtesting, and continuous education.

You may also like:

Algorithmic Trading for Retail Investors: A Complete Guide

Best Automated Trading Bots 2025: PickMyTrade vs Competition

Key Citations

- Automated Trading in Futures Markets – CFTC

- Understanding VWAP for Futures Trading – MetroTrade

- Volume Profile Strategies – TrendSpider

- Order Flow Analysis in Futures Trading – Cannon Trading

- Best Automated Futures Trading Strategies – Cloudzy

- Set Up Automated Trading with NinjaTrader

- 14 Popular Futures Trading Strategies 2025 – QuantVPS