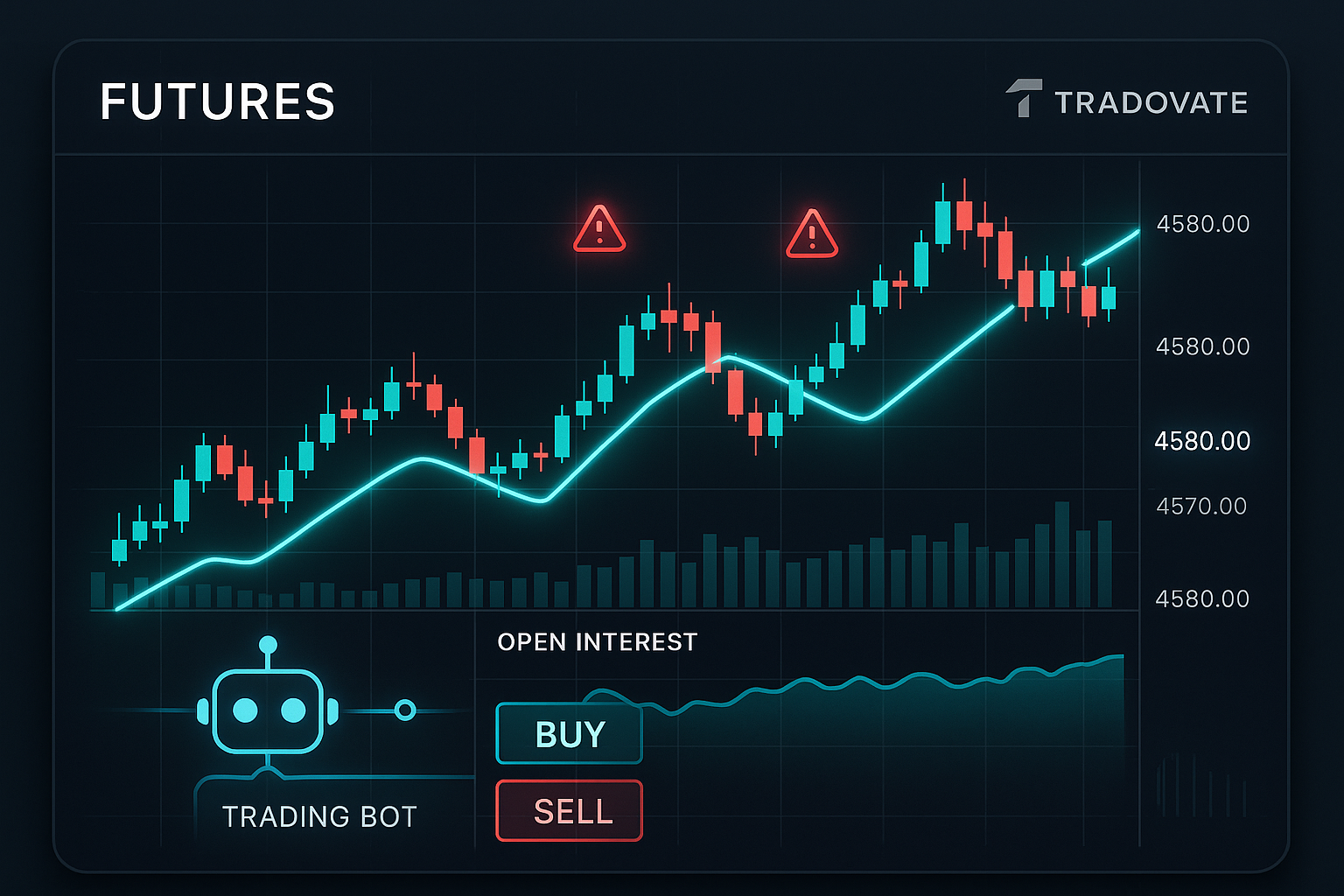

Want to make better decisions in futures markets? One powerful tool that many traders overlook is open interest. When paired with a futures Automation bot for trading, open interest can give you real-time insight into market momentum, sentiment, and potential traps. In this guide, we’ll explain how open interest works—and how to combine it with automation using platforms like Tradovate.

🤖 What is a Futures Trading Bot?

A futures trading bot is an automated system that executes trades based on pre-set conditions, such as technical indicators, price movements, or even open interest data. These bots work 24/7, remove emotional decision-making, and can be integrated with platforms like TradingView and Tradovate for seamless trading.

📊 What is Open Interest in Futures Trading?

Open interest is the total number of open contracts for a given futures asset. It measures market participation—how many traders are actively holding positions.

Think of it like a live scoreboard:

- More open interest = More participants

- Less open interest = Fewer players in the game

When paired with a futures trading bot, open interest becomes a key filter to validate trades automatically.

📈 Futures Trading Bot Strategy: Reading Open Interest Correctly

Here’s how to interpret open interest in your automated strategy:

✅ Rising Price + Rising Open Interest

Bullish Signal: New buyers are entering. Your futures trading bot can go long when these conditions are met.

✅ Falling Price + Rising Open Interest

Bearish Signal: Sellers are gaining strength. Configure your bot to trigger short positions on these setups.

⚠️ Price Moves + Flat Open Interest

Caution: Likely a fake move. No new money is entering. A good bot will avoid entering trades in this condition.

🚀 Why Futures Traders Should Automate Open Interest Analysis

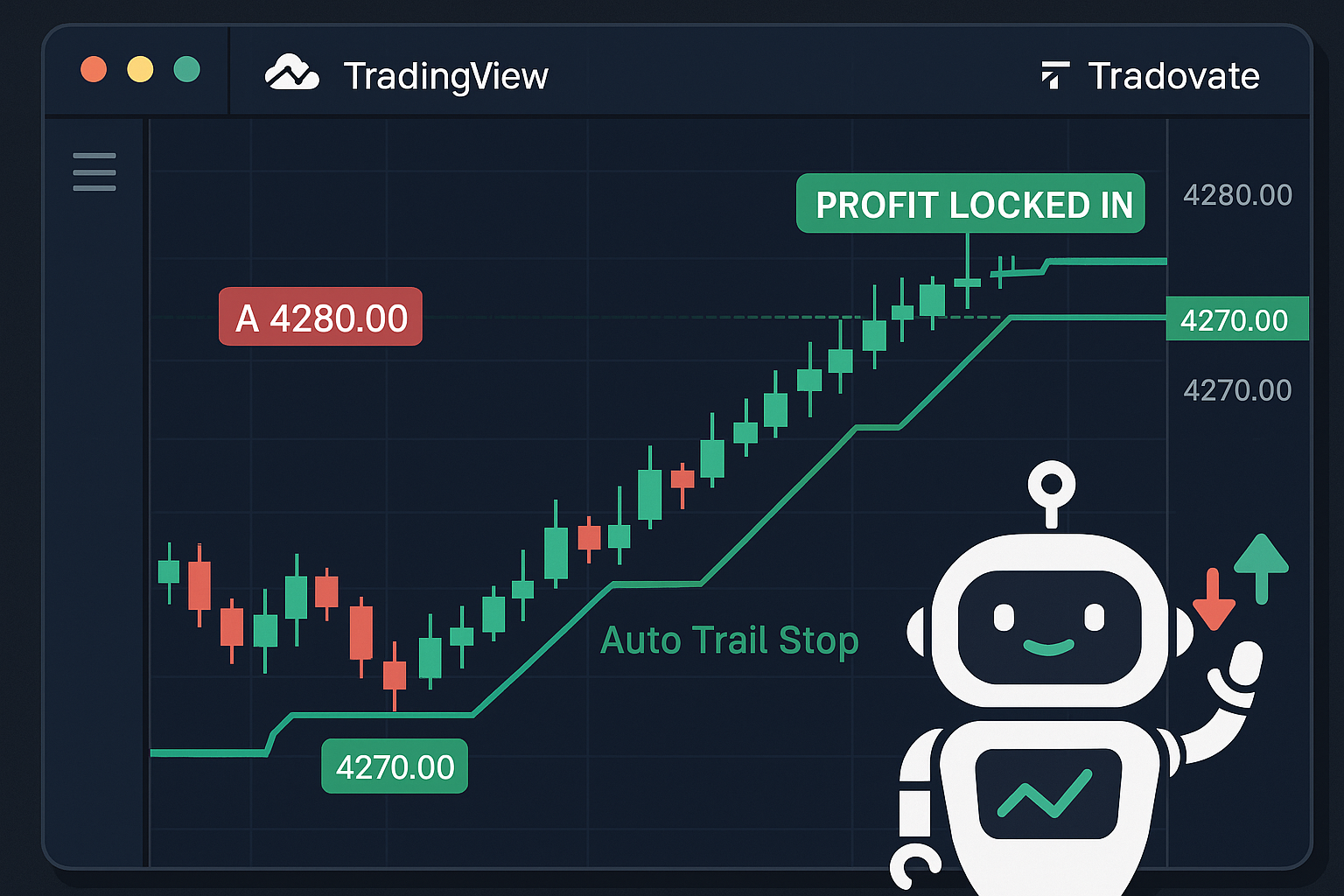

Using a futures trading bot gives you the edge to:

- React instantly to valid open interest changes

- Filter out weak trades based on fake breakouts

- Execute faster than human reaction time

- Maintain consistent trading logic without emotional errors

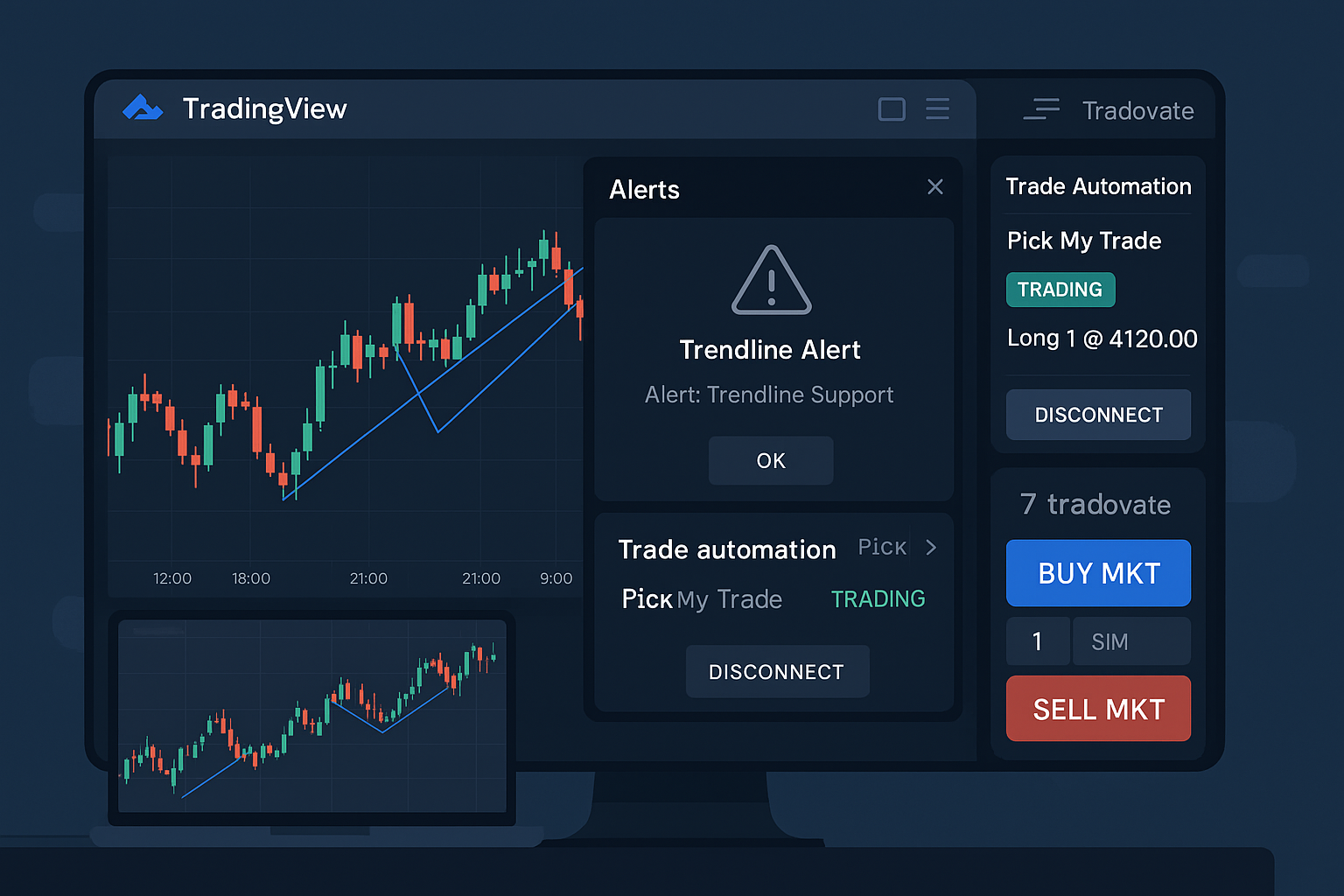

With tools like Pick My Trade, you can fully automate this logic through TradingView alerts, integrating directly with Tradovate for execution.

🔄 Example Scenarios for Bot Logic Using Open Interest

📌 Scenario 1:

- Price of NQ futures is rising

- Open interest also increasing

- Bot triggers a long trade on Tradovate

📌 Scenario 2:

- Gold futures price is falling

- Open interest increasing

- Bot opens a short trade with stop-loss placed automatically

📌 Scenario 3:

- EUR/USD futures spike up suddenly

- Open interest remains flat

- Bot ignores the move, avoiding a potential loss

🔍 Where to Find Open Interest Data for Your Bot

Most brokers, including Tradovate, provide open interest data in their contract or market data panels. You can also access it via TradingView, and feed that data into your futures trading bot logic using alerts.

⚙️ How to Automate Open Interest Strategies with Tradovate

- Use TradingView to analyze futures charts

- Add alerts based on open interest behavior

- Connect to Pick My Trade

- Execute trades via Tradovate with your futures trading bot

📈 Final Thoughts: Combine Open Interest with Futures Trading Bots for Better Results

Open interest is a powerful but underused indicator. When combined with a futures automation bot, it becomes a fully automated edge that can help confirm trends, avoid traps, and improve your trade timing.

Whether you’re trading commodities, indices, or currencies on Tradovate, using open interest in your bot logic can be the difference between success and inconsistency.

Ready to trade smarter? Start using open interest with your futures trading bot today.

Also Checkout: Tradovate Trade Copier: Trade Multiple Accounts with One Click