Drawdown limits in prop trading are one of the most important rules every trader must understand. In the fast-paced world of proprietary trading, risk management is not optional—it’s essential. Prop firms enforce strict drawdown caps to protect their capital and ensure traders follow disciplined strategies. Knowing how these limits work, how they’re calculated, and what happens if you exceed them is critical for building a sustainable trading career.

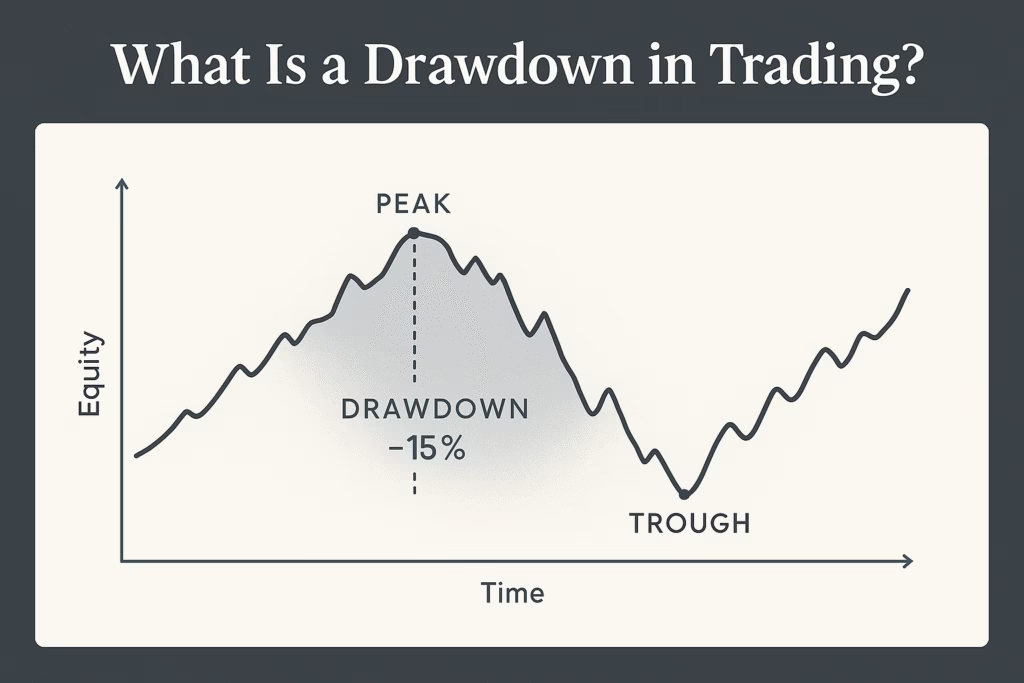

What is a Drawdown in Trading?

A drawdown measures the decline in a trading account’s value from a prior peak. It is a key metric used by prop firms to assess risk and strategy performance. There are two main types:

1. Maximum Drawdown (MDD)

Maximum Drawdown represents the largest drop in an account’s equity from a historical peak to the lowest subsequent trough. It is calculated as:

Maximum Drawdown (MDD) Formula:

MDD = (Peak Value – Trough Value) / Peak Value × 100%

Example:

If a trading account peaks at $50,000 and later drops to $30,000:

MDD = (50,000 – 30,000) / 50,000 × 100%

MDD = 20,000 / 50,000 × 100%

MDD = 40%

A lower MDD indicates a less risky strategy. Prop firms use MDD to gauge a trader’s risk profile and set firm-wide loss caps.

2. Daily Drawdown

Unlike MDD, daily drawdown measures losses within a single trading day. This limit resets each day, usually based on the opening balance. For instance, a $100,000 account with a 5% daily drawdown cannot lose more than $5,000 in one session. Once this cap is hit, trading typically stops for the day. Daily drawdown rules prevent one bad day from wiping out an account, even if equity later recovers.

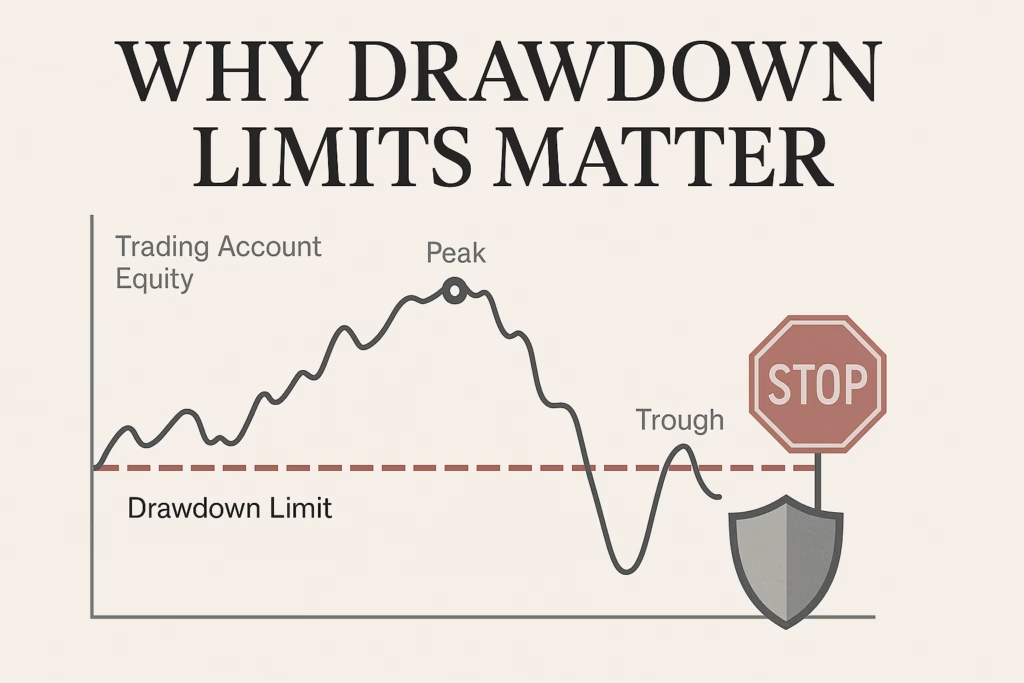

Why Drawdown Limits Matter

Drawdown limits act as guardrails for both the trader and the firm:

- For firms: Limits help allocate capital wisely, evaluate trading strategies, and minimize large-scale losses.

- For traders: They enforce discipline, protect capital, and prevent emotional decision-making.

As many prop firms emphasize: hitting a drawdown limit can result in permanent forfeiture of the account. Risk management, therefore, is not just a suggestion—it’s a requirement for sustainable success.

Consequences of Exceeding Drawdown Limits

Exceeding drawdown limits carries immediate consequences:

- Account Breach: All open positions are closed, and the account may be permanently forfeited.

- Loss of Funding: A funded account can be revoked, forcing the trader to restart evaluation challenges.

- Capital Reduction or Contract Termination: Firms may reduce allocation or terminate contracts to prevent further losses.

In short, prop trading drawdown limits are hard rules, designed to prevent catastrophic losses for both the trader and the firm.

Types of Drawdown Limits

Understanding the different types of drawdown limits can help traders choose a firm that aligns with their trading style:

- Static (Fixed) Drawdown: A predetermined cap based on the starting balance. For example, a 10% static limit on $100,000 allows a maximum $10,000 loss regardless of gains.

- Trailing (Relative) Drawdown: Moves with the account’s high-water mark, locking in profits while protecting against losses. A $100,000 account with a 10% trailing drawdown that grows to $110,000 would have a stop-loss at $99,000.

- Dynamic (Adaptive) Limits: Adjust based on market volatility or trader performance.

- Individualized Limits: Custom caps based on experience, strategy, or risk profile.

- Tiered Limits: Different drawdown thresholds at various stages, such as evaluation vs. funded account phases.

Calculating Drawdowns

Both daily and maximum drawdowns are expressed as a percentage of peak equity:

Drawdown % = (Peak Value – Trough Value) / Peak Value × 100%This metric helps traders quickly assess the severity of losses and ensure they remain within allowed limits.

Strategies to Avoid Drawdown Breaches

Professional prop traders adopt disciplined approaches to manage drawdowns effectively:

- Set Personal Loss Limits: Use half of the allowed daily drawdown as a self-imposed stop to avoid hitting hard limits.

- Conservative Position Sizing: Risk only 0.25–1% of capital per trade to minimize impact of losing streaks.

- Use Stop-Loss Orders: Automatic stop-losses help cap individual trade losses.

- Track and Review Trades: Maintain a trading journal to analyze mistakes and improve strategies.

- Follow a Solid Trading Plan: Stick to predefined rules for entries, exits, and risk, avoiding emotional trading. Diversify strategies to spread risk and protect capital.

Key Takeaways

- Maximum drawdown measures the worst historical loss; daily drawdown caps intraday losses.

- Exceeding drawdown limits can result in account forfeiture, funding loss, or contract termination.

- Prop firms use static, trailing, dynamic, and individualized drawdown limits to control risk.

- Effective drawdown management requires discipline, risk control, and adherence to a well-defined trading plan.

In the high-stakes environment of prop trading, respecting drawdown limits is essential. By proactively managing risk, traders not only protect their own capital but also build the credibility and consistency needed for a sustainable trading career.

Automate Your Trading with PickMyTrade

For traders looking to automate trading strategies, PickMyTrade offers seamless integrations with multiple platforms. You can connect Rithmic, Interactive Brokers, TradeStation, TradeLocker, or ProjectX through pickmytrade.io.

If your focus is Tradovate automation, use pickmytrade.trade for a dedicated, fully integrated experience. These integrations allow traders to execute strategies automatically, manage risk efficiently, and monitor trades with minimal manual intervention.

Related Articles

- How to Use GPT-5 with TradingView Strategies for Automated Trading

- Top Free Indicators and Strategies on TradingView

- Best TradingView Indicators and Strategies: Free and Premium Tools for All Traders

- Prop Firms Using Tradovate Broker: The 2025 Comparison Guide

- Instant Funding or Evaluation Challenge: The Better Path for Traders in 2025

- Prop Firm Payouts 2025

- Prop Firm Red Flags: 5 Warnings Traders Must Know