In this blog, we delve into effective trading strategies and explore how to automate them using PickMyTrade. By understanding various approaches, traders can enhance their profitability and streamline their trading process.

Table of Contents

- Exploring the Best Trailing Take Profit Strategy

- Replaying Signals to Validate Strategies

- Evaluating Returns for Different Symbols

- Comparing Results Across Various Futures

- Conclusion and Next Steps

- Frequently Asked Questions

Exploring the Best Trailing Take Profit Strategy

The concept of a trailing take profit strategy offers a unique twist to the conventional trailing stop-loss. Unlike the traditional method where the focus is solely on limiting losses, this strategy emphasises maximising profits by trailing the take profit level as the market moves favourably.

Understanding the Strategy

Developed by a trader named Devat, this strategy leverages the concept of dynamically adjusting the take profit points based on market movements. The idea is to lock in profits while still allowing room for further gains. This method can be particularly effective in volatile markets where price swings can be significant.

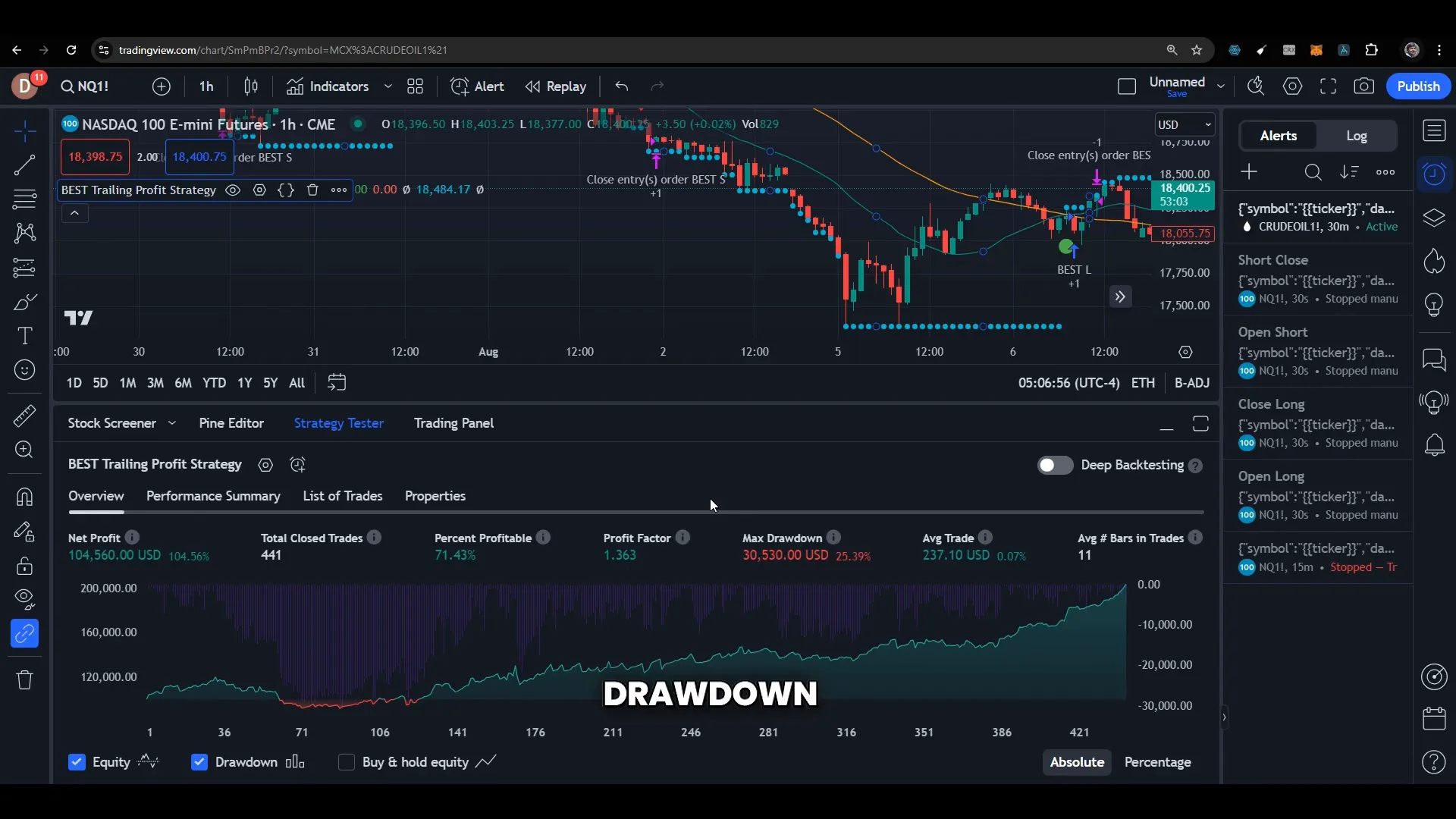

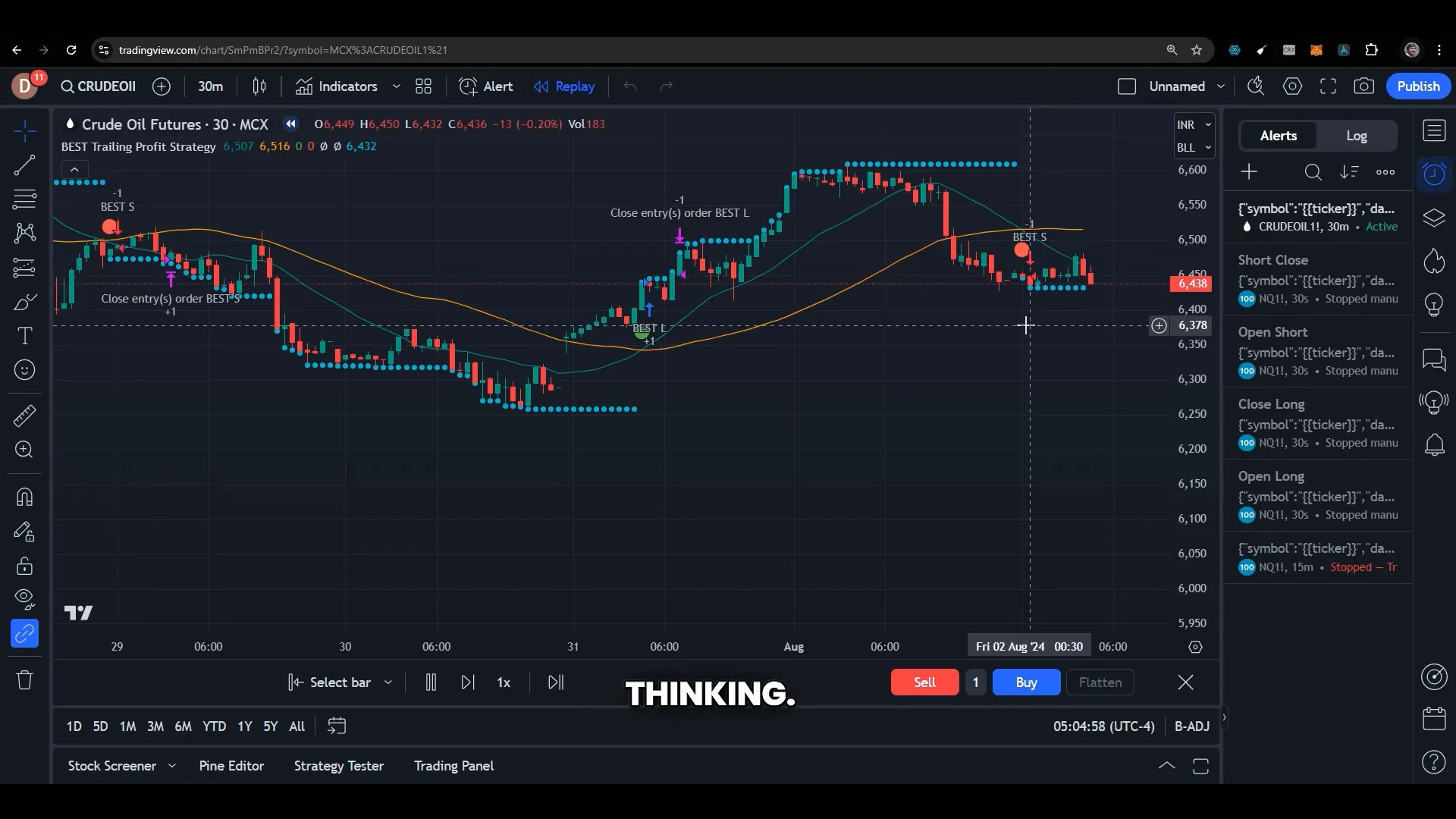

Applying Strategies to Crude Oil Trading

When applied to crude oil, the trailing take profit strategy has demonstrated promising results. On a one-hour chart, traders can see a substantial drawdown reduction, leading to improved net profits. This approach capitalises on the inherent volatility of crude oil, allowing traders to harness market movements effectively.

By adjusting the take profit trigger according to the specific trading symbol, such as crude oil, traders can tailor the strategy to suit their needs. The key is to find a balance between risk and reward, ensuring that the trigger value aligns with the trader’s risk tolerance and market conditions.

Exploring Various Time Frames

One of the notable aspects of this strategy is its adaptability across different time frames. When tested on a 30-minute chart, the strategy continued to yield positive results, maintaining a similar percentage profit and profit factor as observed with the one-hour chart.

This adaptability makes it a versatile tool for traders, enabling them to switch between time frames based on market conditions and personal preferences. The capacity to generate consistent returns across varying time frames underscores the robustness of the trailing take profit strategy.

Testing Different Time Frames

Experimentation with different time frames is crucial for optimising trading strategies. By testing the trailing take profit strategy on various time frames, traders can identify the optimal settings that align with their trading goals and market conditions. In the case of crude oil, both the 30-minute and one-hour frames have proven effective, offering traders flexibility in their approach.

Switching to a 15-minute frame, for instance, might reduce drawdown and increase net profit further, as observed in certain tests. This highlights the importance of adaptability and continuous evaluation to ensure the strategy remains effective in different market scenarios.

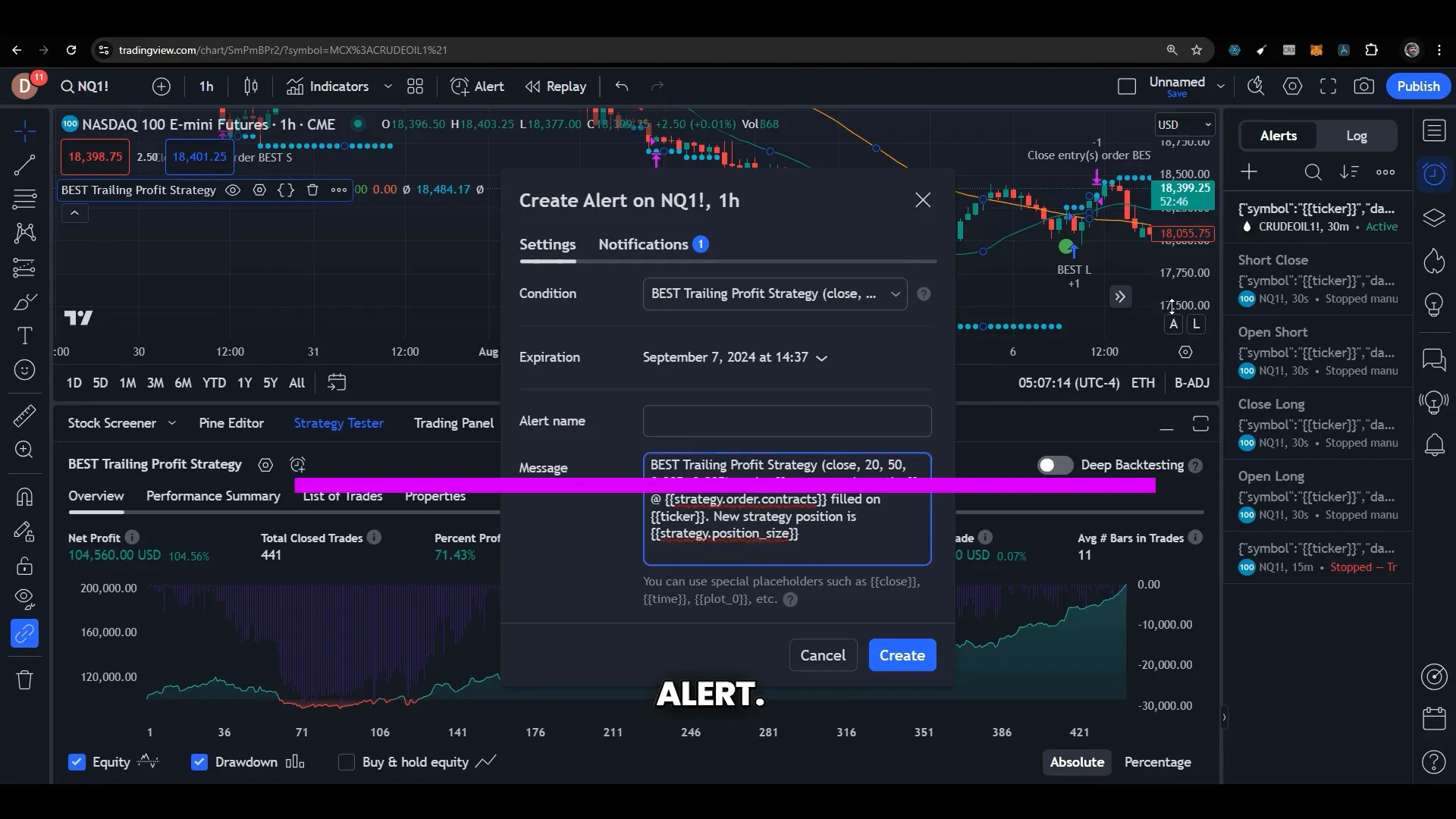

Creating Alerts for Automation

Automating the trailing take profit strategy through alert creation is a straightforward process. By setting up an alert, traders can receive notifications when specific market conditions are met, allowing for timely execution of trades. This automation streamlines the trading process, reducing the need for constant monitoring and enabling traders to focus on strategy optimisation.

The alert system is integral to the strategy’s success, ensuring that trades are executed precisely and efficiently. By leveraging this feature, traders can enhance their trading experience, maximising returns while minimising manual intervention.

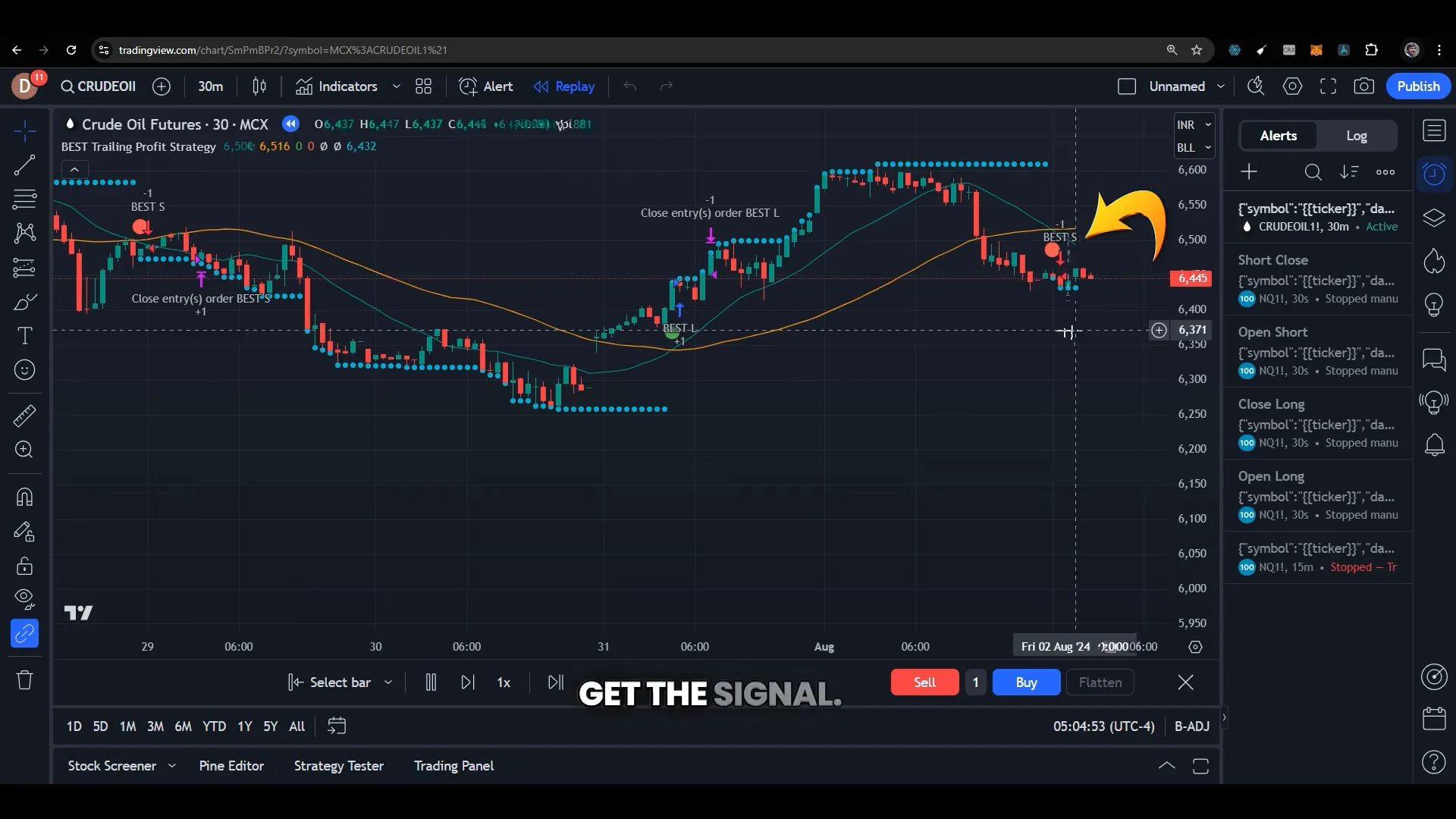

Replaying Signals to Validate Strategies

Replaying signals is a crucial step in validating the effectiveness of any trading strategy. By replaying market conditions, traders can confirm whether the signals generated by their strategy are consistent and reliable. This process helps in ensuring that the strategy is not subject to repainting, where signals change retrospectively, which can lead to inaccurate trading decisions.

To replay signals effectively, traders can utilise historical data and simulate trades using the same parameters as live trading. This allows them to observe how the strategy performs under different market conditions and time frames. Such validation helps in building confidence in the strategy’s ability to deliver consistent results.

Steps to Replay and Validate

- Identify key market periods to replay, focusing on volatile or trend-defining moments.

- Use the replay function to simulate trades and observe if signals align with expected outcomes.

- Analyse the consistency of the signals to ensure they are not subject to repainting.

- Adjust strategy parameters as needed based on insights gained during the replay.

By following these steps, traders can ascertain the robustness of their strategy and make informed decisions about its implementation in live markets.

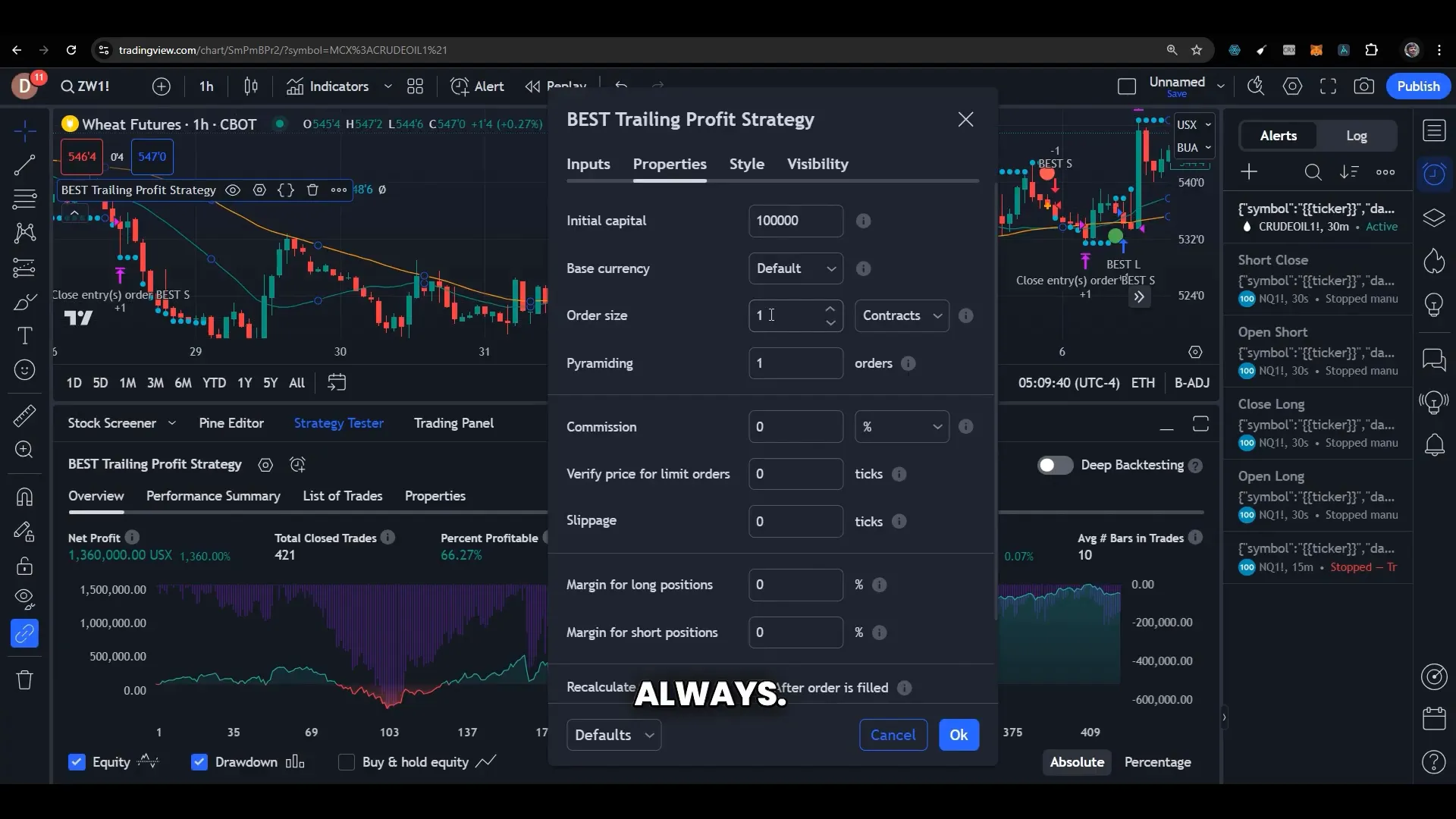

Evaluating Returns for Different Symbols

Evaluating a trading strategy across different symbols is essential to understanding its versatility and profitability. Each trading symbol, whether it’s crude oil, the Nasdaq (NQ), or wheat, presents unique characteristics and challenges. By testing the strategy on multiple symbols, traders can identify which assets are most compatible with their approach.

For instance, when applying the trailing take profit strategy to the Nasdaq (NQ), traders observed decent returns, albeit with a higher drawdown compared to crude oil. This indicates that while the strategy is effective, it may require adjustments to optimise performance for different symbols.

Key Considerations for Symbol Evaluation

- Analyse the historical performance of the strategy on each symbol to identify patterns.

- Adjust risk management settings, such as stop-loss and take profit levels, to suit the volatility of each symbol.

- Consider the liquidity and trading hours of each symbol, as these can impact strategy execution.

By thoroughly evaluating returns across different symbols, traders can refine their strategy to maximise profitability and minimise risk.

Comparing Results Across Various Futures

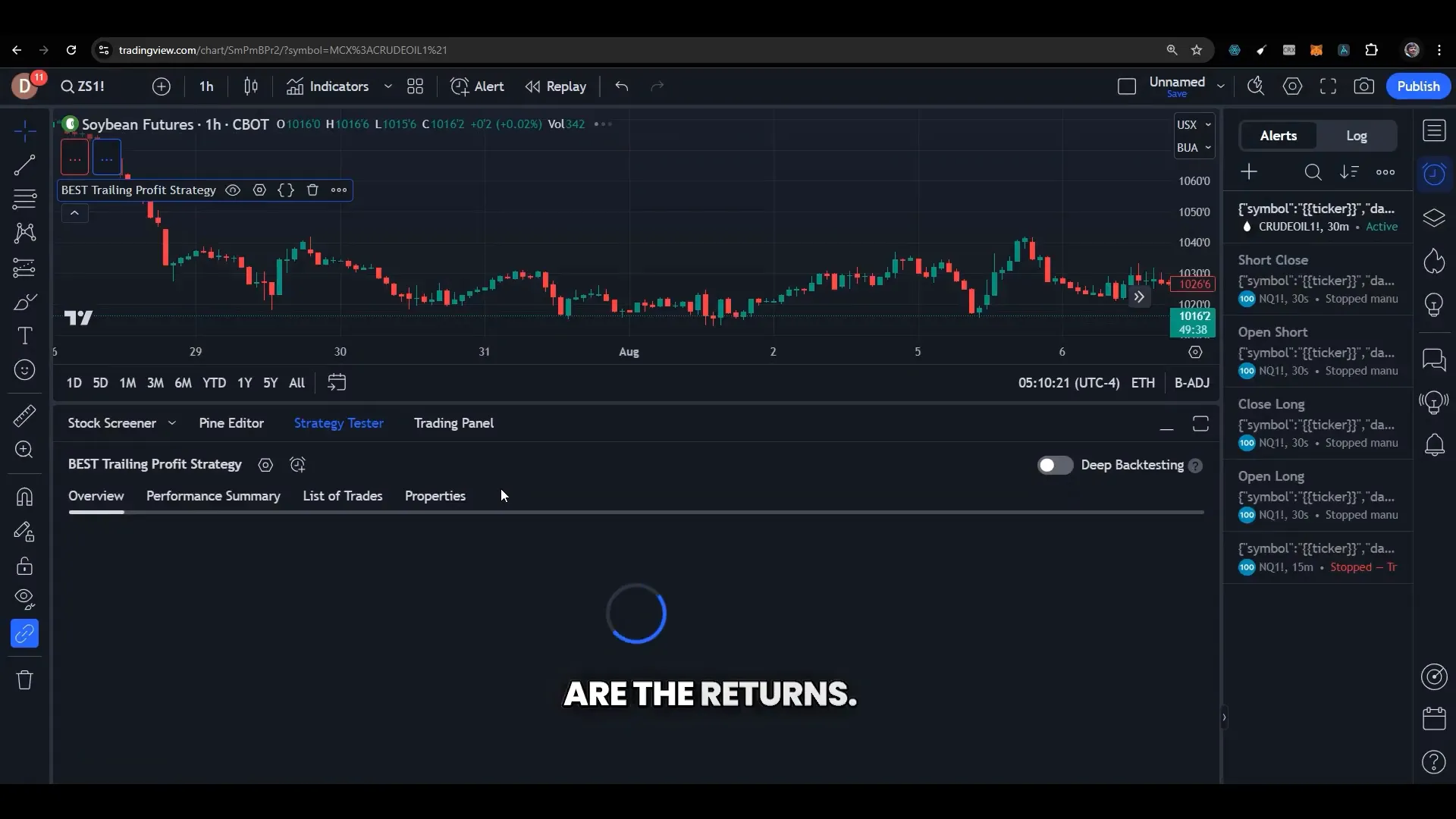

When it comes to futures trading, comparing results across different contracts is vital for strategy optimisation. Futures like wheat and soybean offer diverse opportunities, and understanding how a strategy performs with each can guide traders in choosing the right markets.

For example, while trading wheat with the trailing take profit strategy yielded impressive results, soybean trading showed a higher drawdown, albeit with decent returns. This comparison highlights the importance of tailoring strategies to suit the specific characteristics of each futures contract.

Optimising Strategy for Futures

- Evaluate the volatility and trend patterns of each futures contract to tailor strategy parameters.

- Consider seasonal factors that may affect the performance of agricultural futures like wheat and soybean.

- Use backtesting to simulate different market scenarios and fine-tune the strategy for each futures contract.

Through careful comparison and optimisation, traders can enhance their futures trading strategy, ensuring it aligns with their financial goals and market conditions.

Conclusion and Next Steps

In conclusion, the trailing take profit strategy offers a flexible and effective approach to trading across various symbols and futures. By replaying signals, evaluating returns, and comparing results, traders can fine-tune their strategies to maximise profitability and minimise risk.

As a next step, traders are encouraged to continue testing and refining their strategies using PickMyTrade, leveraging its automation capabilities to streamline the trading process. By staying informed and adaptable, traders can navigate the complexities of the market and achieve their trading objectives.

Frequently Asked Questions

What is the primary advantage of using a trailing take profit strategy?

The primary advantage is its ability to maximise profits by dynamically adjusting take profit levels as the market moves in a favourable direction, unlike traditional methods focused solely on limiting losses.

How can I ensure my strategy does not repaint?

By replaying signals and validating against historical data, traders can confirm the consistency and reliability of their strategy, ensuring it is not subject to repainting.

What should I consider when applying this strategy to different symbols?

Consider each symbol’s volatility, liquidity, and trading hours. Adjust strategy parameters like stop-loss and take profit levels to suit the unique characteristics of each symbol.

PickMyTrade specializes in automating trading bots, enabling seamless strategy execution for futures from platforms like TradingView, across well-known brokers such as Tradovate.

PickMyTrade

PickMyTrade specializes in automating trading bots, enabling seamless strategy execution for futures from platforms like TradingView, across well-known brokers such as Tradovate.