Maximize Your Trading Efficiency with Automation

Introduction to Automated Trading

Automated trading has revolutionized the way traders operate in the financial markets. With the right tools, traders can execute trades based on predefined criteria without the need for constant monitoring. This guide will explore how to utilize a powerful scanner tool with Interactive Brokers to automate your trading process effectively.

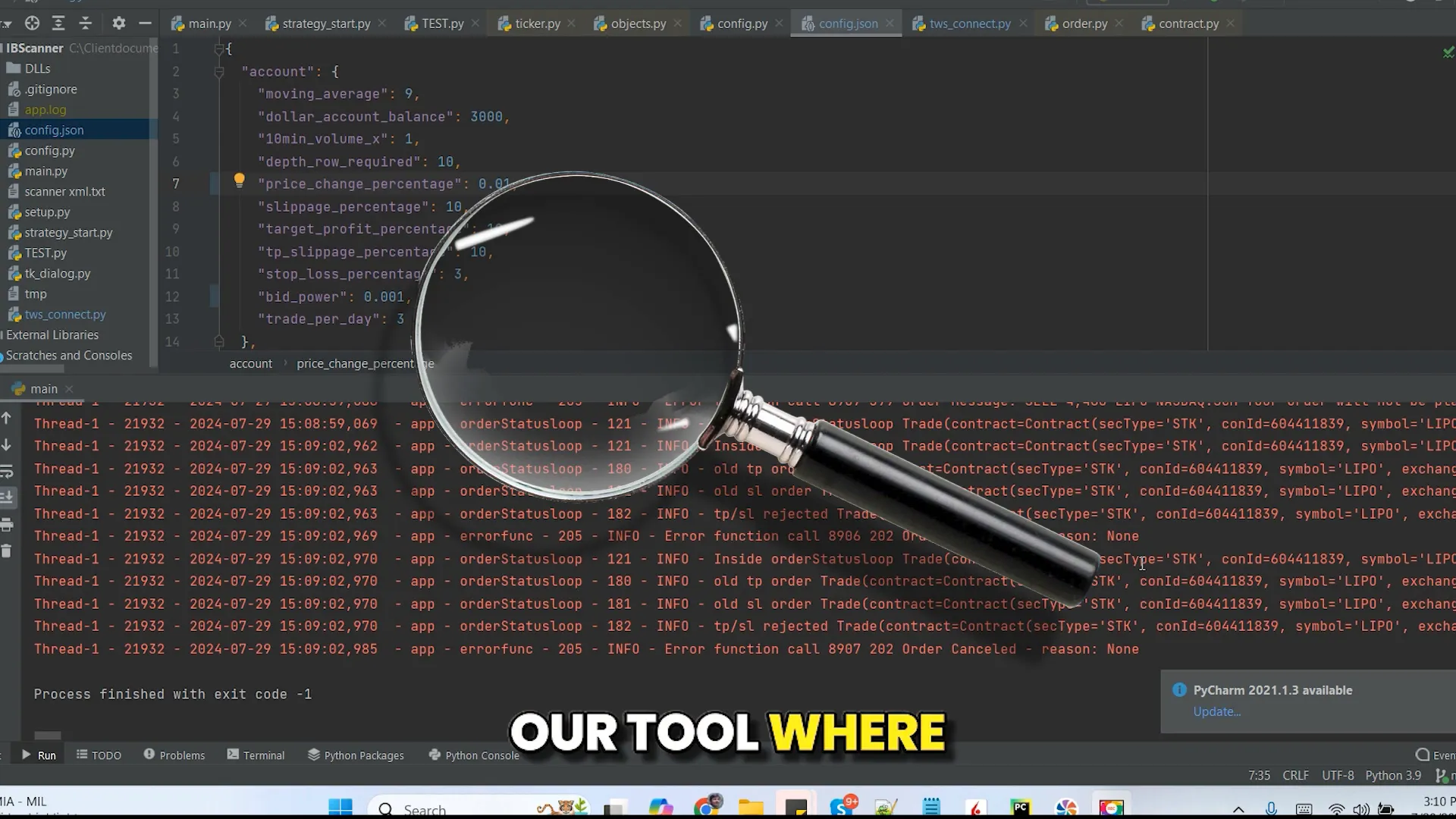

Understanding the Scanner Tool

The scanner tool allows traders to set specific criteria for their trades. Once these criteria are met, the scanner can automatically place trades on behalf of the trader. This feature is particularly beneficial in fast-moving markets where timing is crucial.

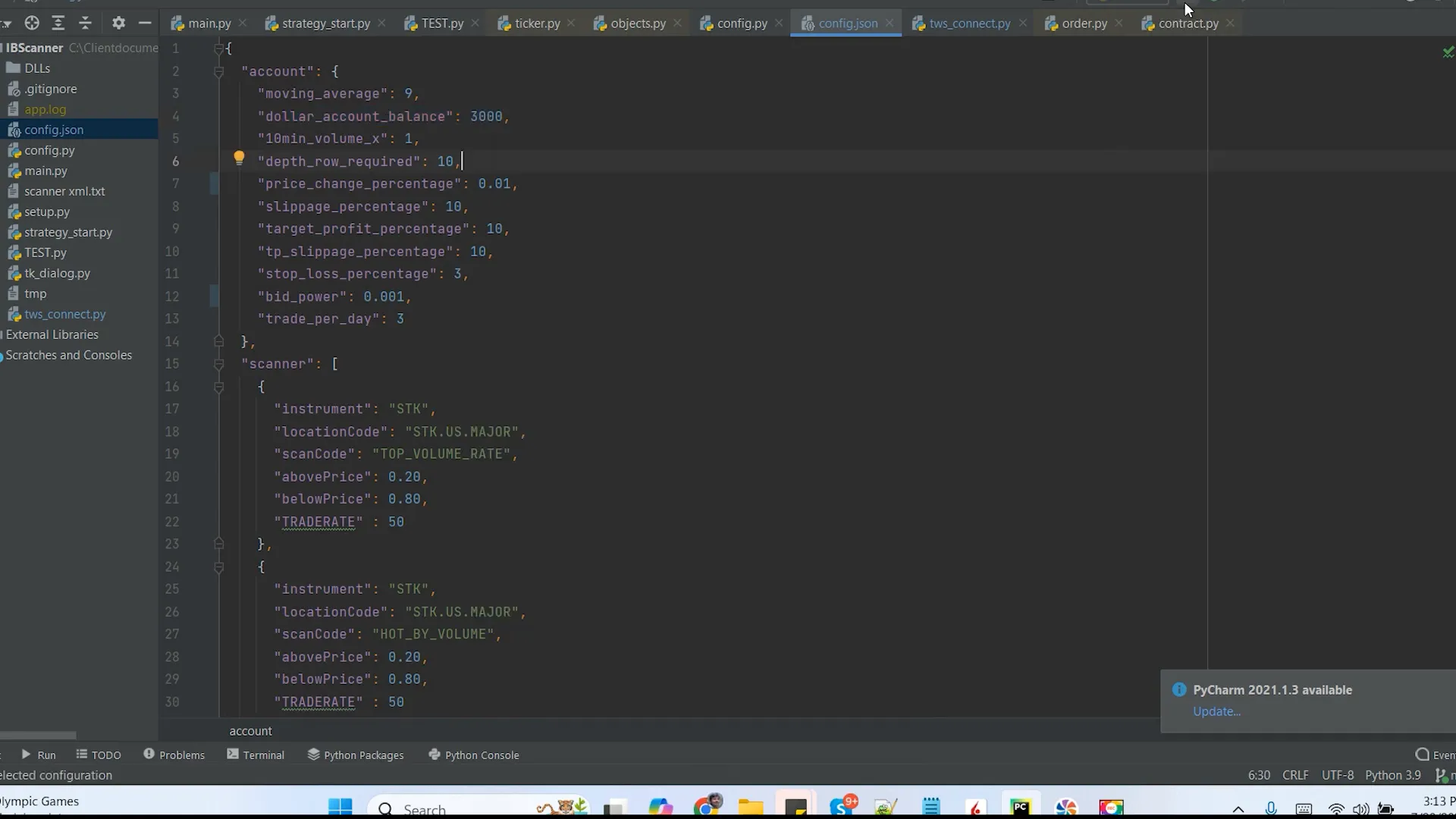

Setting Up Your Criteria

To start using the scanner, you need to define your trading criteria. This includes parameters such as price ranges, volume thresholds, and moving averages. For instance, you might set conditions like:

- Price should be between a specific range

- Volume should exceed a certain threshold

- Price movement percentage over a defined period

These criteria help in filtering stocks that meet your trading strategy.

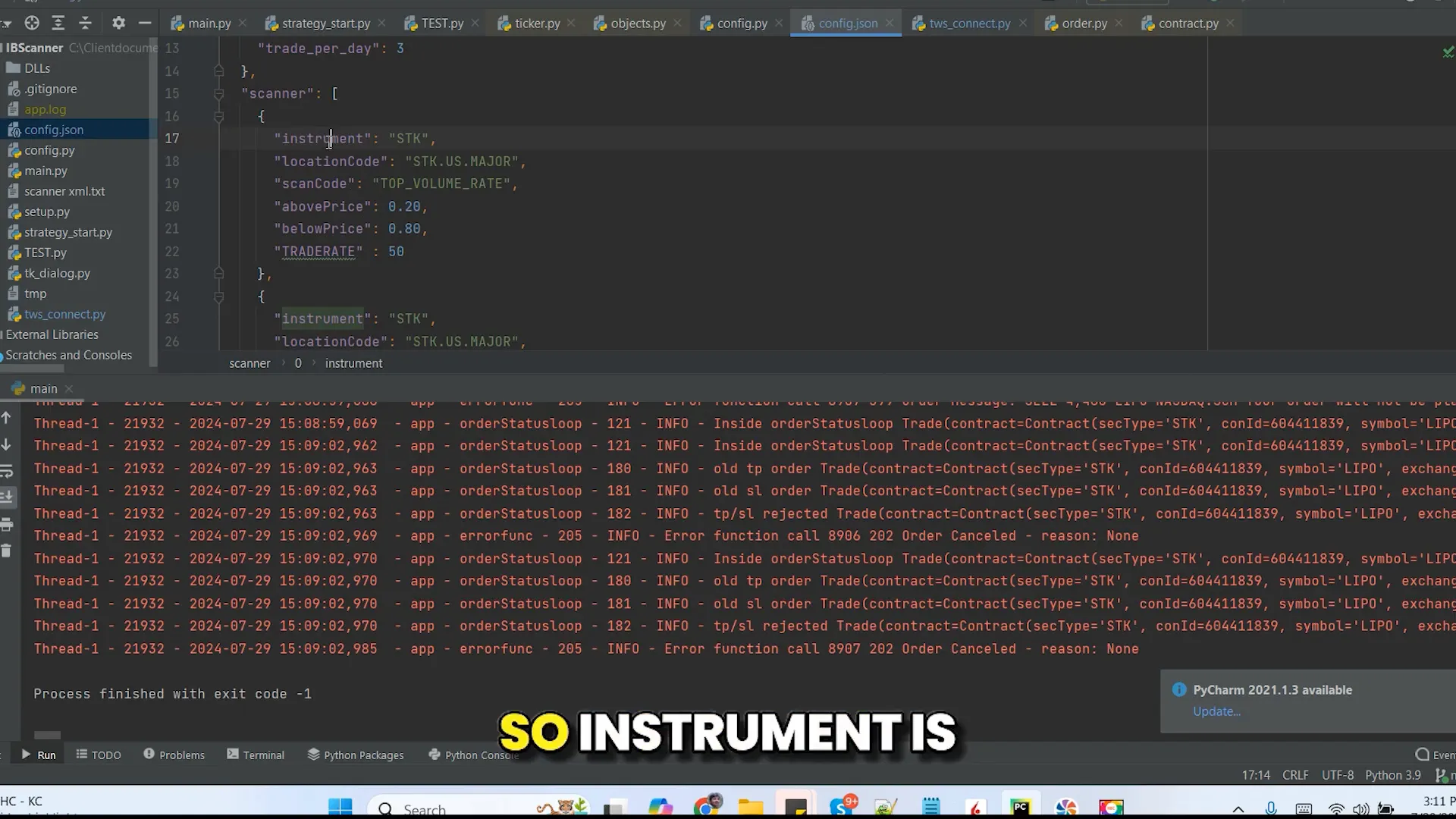

Types of Scanners Available

Interactive Brokers offers various scanners, including:

- Top Percentage Gainers: Stocks that have experienced the highest percentage increase.

- Top Percentage Losers: Stocks that have seen the most significant declines.

- Most Active Stocks: Stocks with the highest trading volume.

These scanners can be customized to suit your trading needs and preferences.

Customizing Your Scanner

Customization is key to making the most of the scanner tool. You can adjust the parameters based on your trading style. For example, you might want to focus on stocks that have a minimum price or a specific volume to ensure liquidity. This flexibility allows you to tailor the scanning process to fit your strategy perfectly.

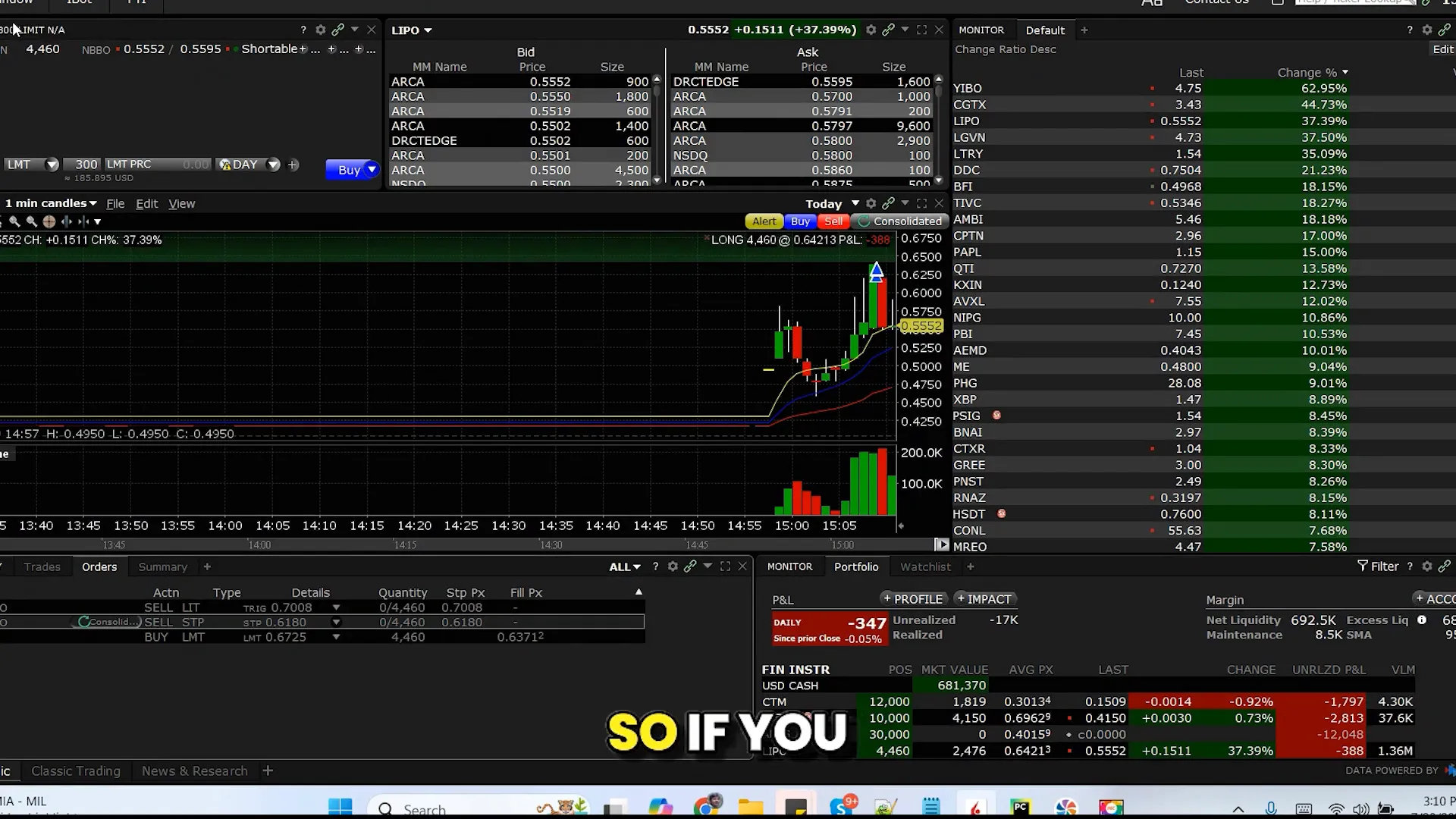

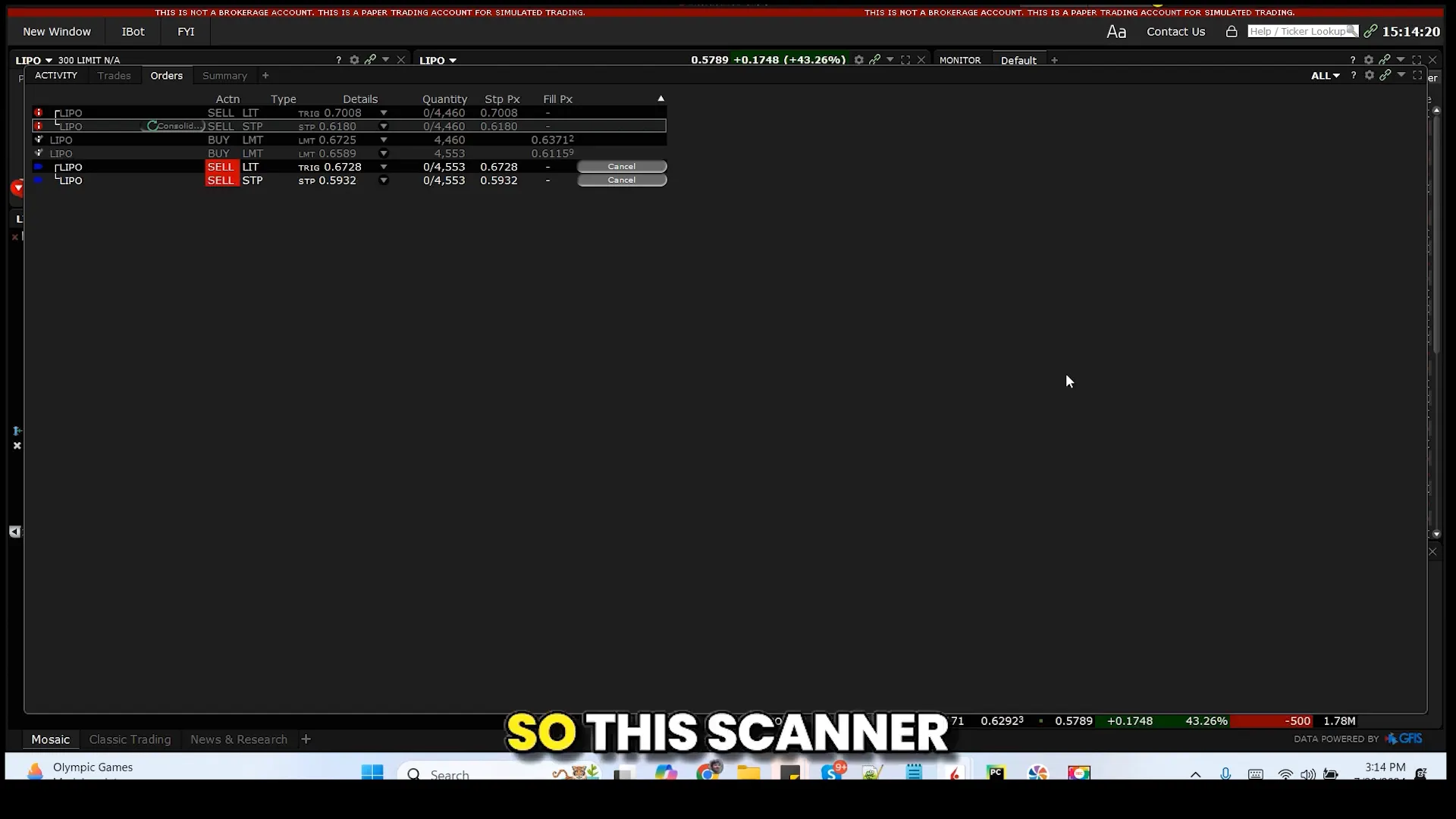

Placing Trades Automatically

Once the scanner identifies stocks that meet your criteria, it can automatically place trades. This process includes setting up take profit and stop loss orders to manage risk effectively. For instance, once a stock is purchased, you can specify:

- A take profit level to lock in gains

- A stop loss to limit potential losses

This automated approach not only saves time but also helps in executing trades more efficiently.

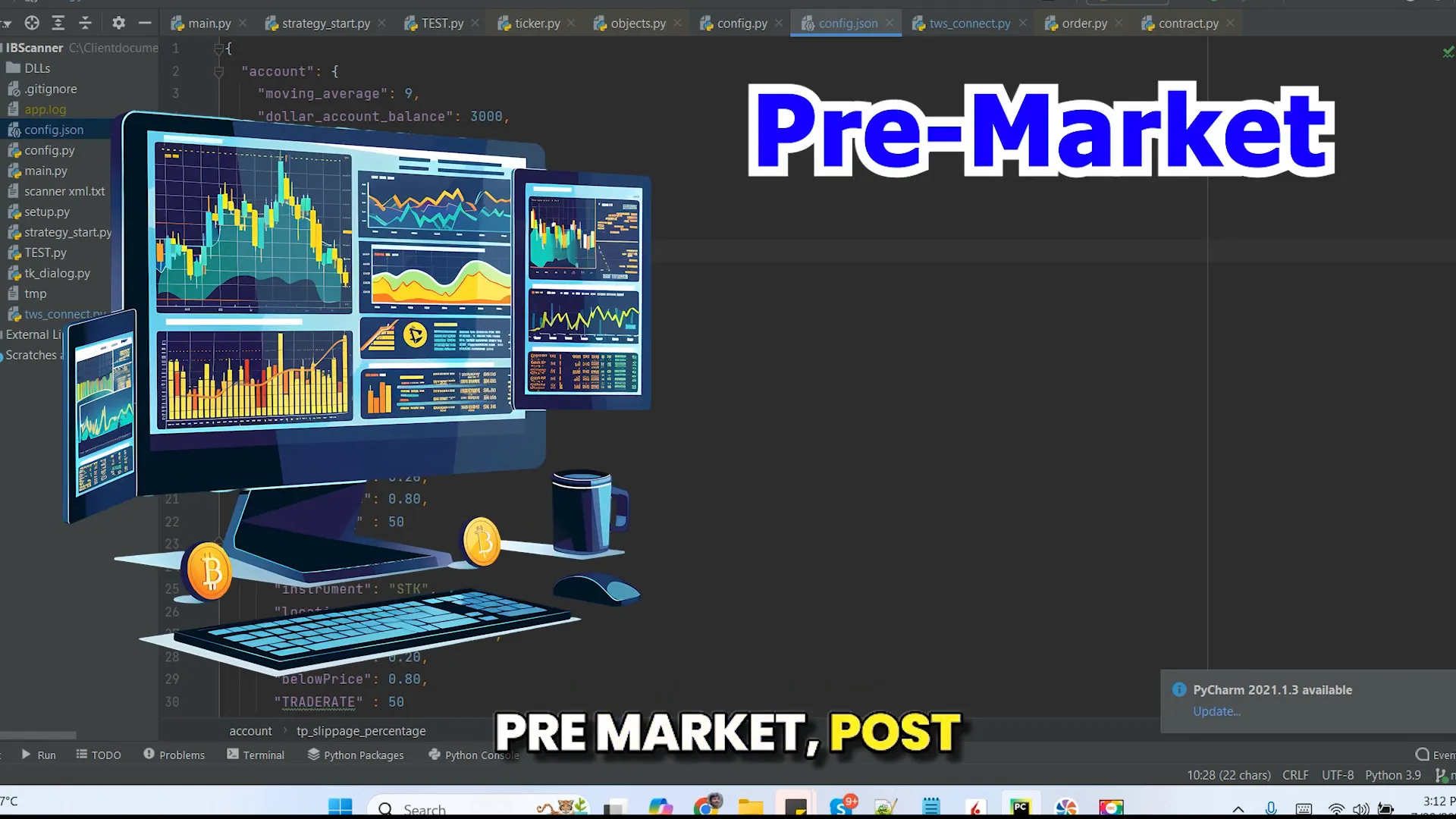

Working with Pre-Market and Post-Market Trading

The scanner tool is designed to work during regular market hours as well as in pre-market and post-market sessions. However, trading in pre-market can be challenging due to lower liquidity. To mitigate this risk, you can set a slippage percentage, which allows the scanner to place orders slightly above the current market price to ensure execution.

Maximizing Your Trade Volume

Another important aspect of automated trading is controlling your trading volume. You can specify the maximum number of trades to execute in a day and the dollar amount for each trade. This feature helps in managing your overall exposure and risk.

Running the Scanner Application

After configuring the scanner, you can run the application to start receiving alerts for stocks that meet your criteria. The application will continuously monitor the market and execute trades based on your specifications. For example, once a stock meets your criteria, the application will place the order and set the relevant stop loss and take profit levels automatically.

Conclusion: The Future of Trading

Automated trading through tools like the Interactive Brokers scanner can significantly enhance your trading efficiency. By setting precise criteria, placing trades automatically, and managing risks effectively, you can focus on developing your trading strategy without getting bogged down by the minutiae of daily trading activities. If you’re interested in implementing a similar solution, consider reaching out for customized development options.

For more information on automated trading solutions, check out PickMyTrade.

Contact Information

If you have any questions or need assistance in setting up your automated trading system, feel free to reach out via email or WhatsApp. We’re here to help you take your trading to the next level!

PickMyTrade

PickMyTrade specializes in automating trading bots, enabling seamless strategy execution for futures from platforms like TradingView, across well-known brokers such as Tradovate.

Hey! Quick question that’s totally off topic. Do you know how to make your site mobile friendly?

My site looks weird when viewing from my apple iphone. I’m trying to find a theme or plugin that might be able to correct this issue.

If you have any recommendations, please share. With thanks!

Hi there! Someone in my Myspace group shared this website with

us so I came to give it a look. I’m definitely loving the information. I’m bookmarking and will be

tweeting this to my followers! Excellent blog and superb design and style.

You actually make it seem so easy with your presentation but I find this topic

to be really something which I think I would never understand.

It seems too complicated and very broad for me. I am looking forward for your next post, I’ll try to get

the hang of it!

I’m impressed, I must say. Seldom do I come across a blog that’s both educative and interesting, and let me tell you, you’ve hit

the nail on the head. The problem is something that not enough people are speaking intelligently about.

I’m very happy that I found this in my search for something regarding this.

Does your blog have a contact page? I’m having problems locating it but,

I’d like to shoot you an email. I’ve got some suggestions for your blog you might be

interested in hearing. Either way, great blog and I look forward to seeing

it grow over time.

Thank you for some other informative site. The place else may I

get that kind of info written in such an ideal manner?

I’ve a project that I’m simply now operating on, and I have been on the glance out for such info.

Very good blog you have here but I was curious about if you knew of any message boards that cover the same topics discussed here?

I’d really love to be a part of online community

where I can get advice from other knowledgeable people that share the same interest.

If you have any suggestions, please let me know. Many thanks!

Asking questions are truly nice thing if you are not understanding

something fully, except this piece of writing provides

fastidious understanding yet.

Yes! Finally something about crypto casino.

Great information. Lucky me I ran across your site by accident (stumbleupon).

I have saved as a favorite for later!

Heya i am for the first time here. I came across this board and I find It truly useful & it helped me out much.

I hope to give something back and help others like you aided me.

Everything is very open with a clear clarification of the issues.

It was really informative. Your site is very useful. Thanks for

sharing!

Great post. I was checking continuously this

blog and I am impressed! Extremely helpful information specifically the last part 🙂 I care for such information a lot.

I was looking for this certain info for a very long

time. Thank you and good luck.

Woah! I’m really digging the template/theme of this site.

It’s simple, yet effective. A lot of times it’s very hard to get that “perfect balance” between usability and appearance.

I must say you’ve done a great job with this. Additionally, the blog loads very fast for me on Internet explorer.

Excellent Blog!

Excellent post. I was checking constantly this blog and I’m impressed!

Extremely useful information particularly the last part 🙂 I care for such

information a lot. I was looking for this particular

info for a very long time. Thank you and good luck.

Wow, awesome blog layout! How long have you been blogging for?

you made blogging look easy. The overall look of your website is fantastic, let alone the content!

site

Hi, its fastidious article concerning media print,

we all be familiar with media is a wonderful source of information.

casino en ligne

When some one searches for his required thing, thus he/she wants to be available that

in detail, so that thing is maintained over here.

casino en ligne

I do not even know how I ended up here, but I thought

this post was good. I don’t know who you are but definitely you’re

going to a famous blogger if you aren’t already 😉 Cheers!

casino en ligne

Hello, this weekend is nice in support of me, since this moment

i am reading this wonderful informative piece of writing here at my house.

casino en ligne

Thanks in support of sharing such a fastidious thinking, paragraph is good, thats why

i have read it entirely

casino en ligne

Hello i am kavin, its my first time to commenting anyplace, when i read this paragraph i thought i could also

create comment due to this good paragraph.

casino en ligne

Hello, i feel that i noticed you visited my website thus i came

to go back the choose?.I’m attempting to find issues to improve my

website!I guess its ok to make use of a few of your ideas!!

casino en ligne

Very nice post. I just stumbled upon your weblog and wished to say that I’ve truly

loved browsing your weblog posts. After all I’ll be subscribing for your feed and I’m

hoping you write once more very soon!

casino en ligne

It’s a shame you don’t have a donate button! I’d without

a doubt donate to this brilliant blog! I suppose for now

i’ll settle for book-marking and adding your RSS feed to my Google account.

I look forward to new updates and will talk about this site with my Facebook group.

Chat soon!

casino en ligne

Great blog right here! Also your site a lot up very fast! What host are you using?

Can I am getting your associate hyperlink in your host?

I desire my site loaded up as quickly as yours

lol