Introduction to Automated Trading

Automated trading has revolutionised the way traders approach the financial markets. By leveraging technology, traders can execute strategies with precision and speed. This blog delves into effective automated trading strategies, particularly focusing on how to implement them using PickMyTrade. In this series, we will explore various strategies, their performance, and how to set them up for automated trading.

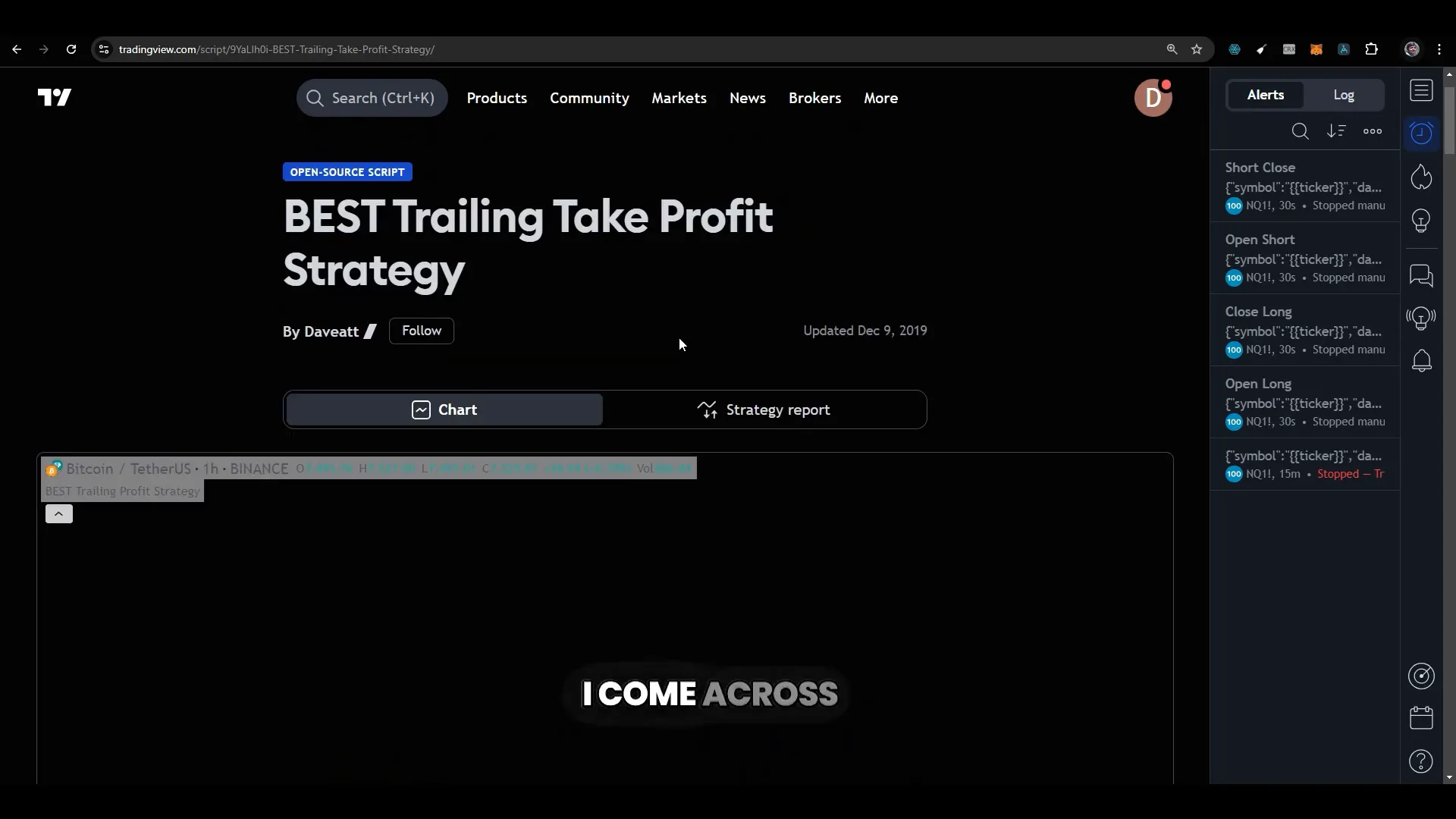

Understanding the Trailing Take Profit Strategy

The first strategy we will explore is the Trailing Take Profit strategy, which has been highlighted for its effectiveness. This strategy not only employs a trailing stop loss but also incorporates a trailing take profit mechanism. This dual approach allows traders to lock in profits while still benefiting from upward price movements.

Why Choose a Trailing Take Profit?

Using a trailing take profit strategy can significantly enhance your trading results. It allows you to capture more profits as the market moves in your favour, while also providing a safety net through the trailing stop loss. This strategy is particularly useful in volatile markets where prices can fluctuate rapidly.

Applying the Strategy to Crude Oil

In our testing, we applied the trailing take profit strategy to crude oil trading. The settings were minimal, focusing on the take profit trigger that could be adjusted according to the specific market conditions. The results were promising, with a reported accuracy of around 70% and a profit of 400k.

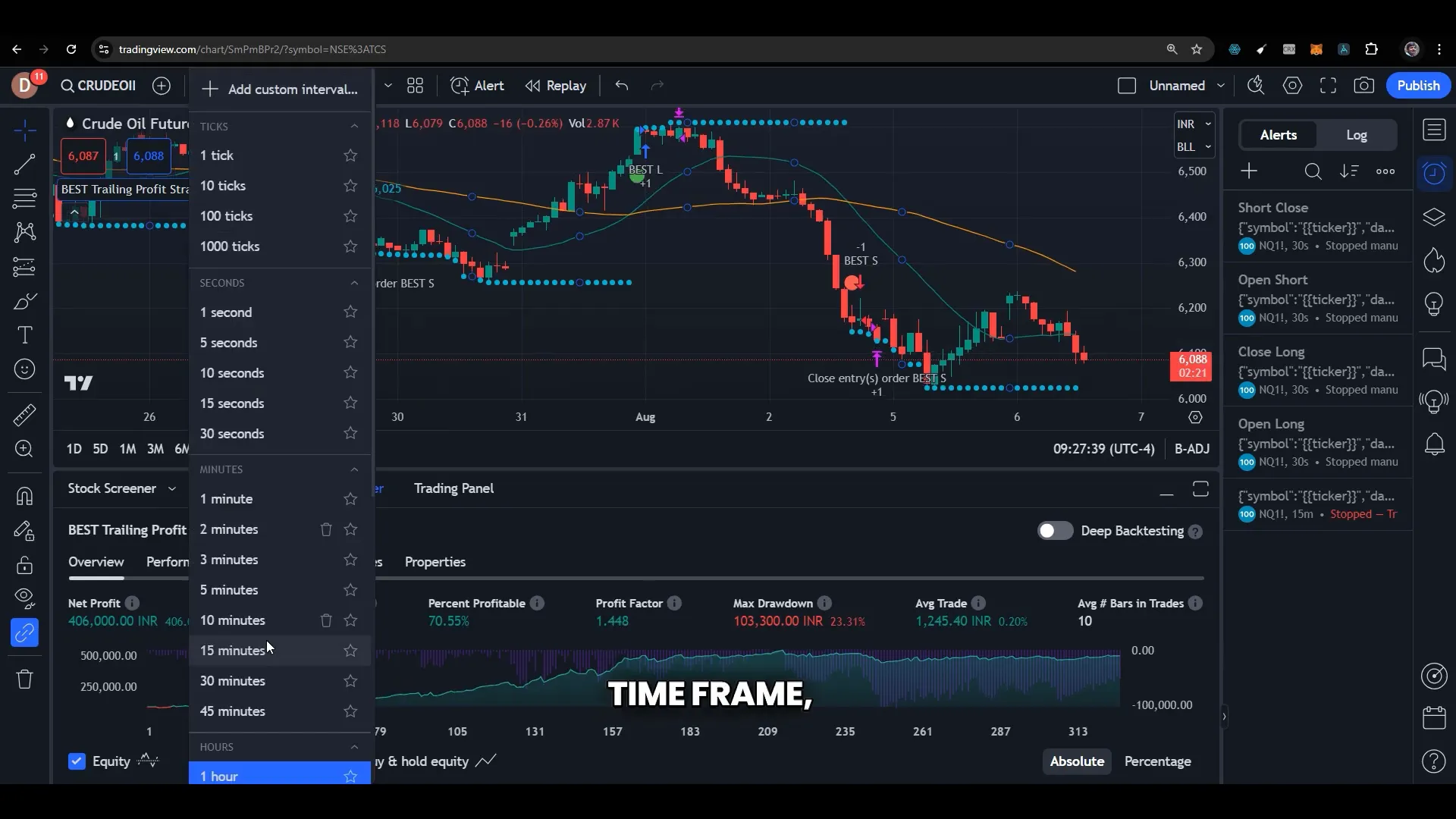

Optimising the Strategy

To optimise this strategy, we experimented with different time frames. Switching from a one-hour chart to a 30-minute chart yielded similar profit percentages but improved net profit and reduced drawdown. This flexibility allows traders to adapt to market conditions and choose the time frame that best suits their trading style.

Setting Up Alerts for Automation

One of the key advantages of using PickMyTrade is the ability to set up alerts for automated trading. To automate the trailing take profit strategy, traders simply need to create a single alert. This can be done by copying the specific alert format for the chosen strategy and pasting it into the alert creation section.

Creating Your Own Alerts

When creating alerts, it is crucial to use your own unique token. This ensures that trades are executed correctly on your account. PickMyTrade provides a seamless way to connect these alerts to your trading account, allowing for effective automation.

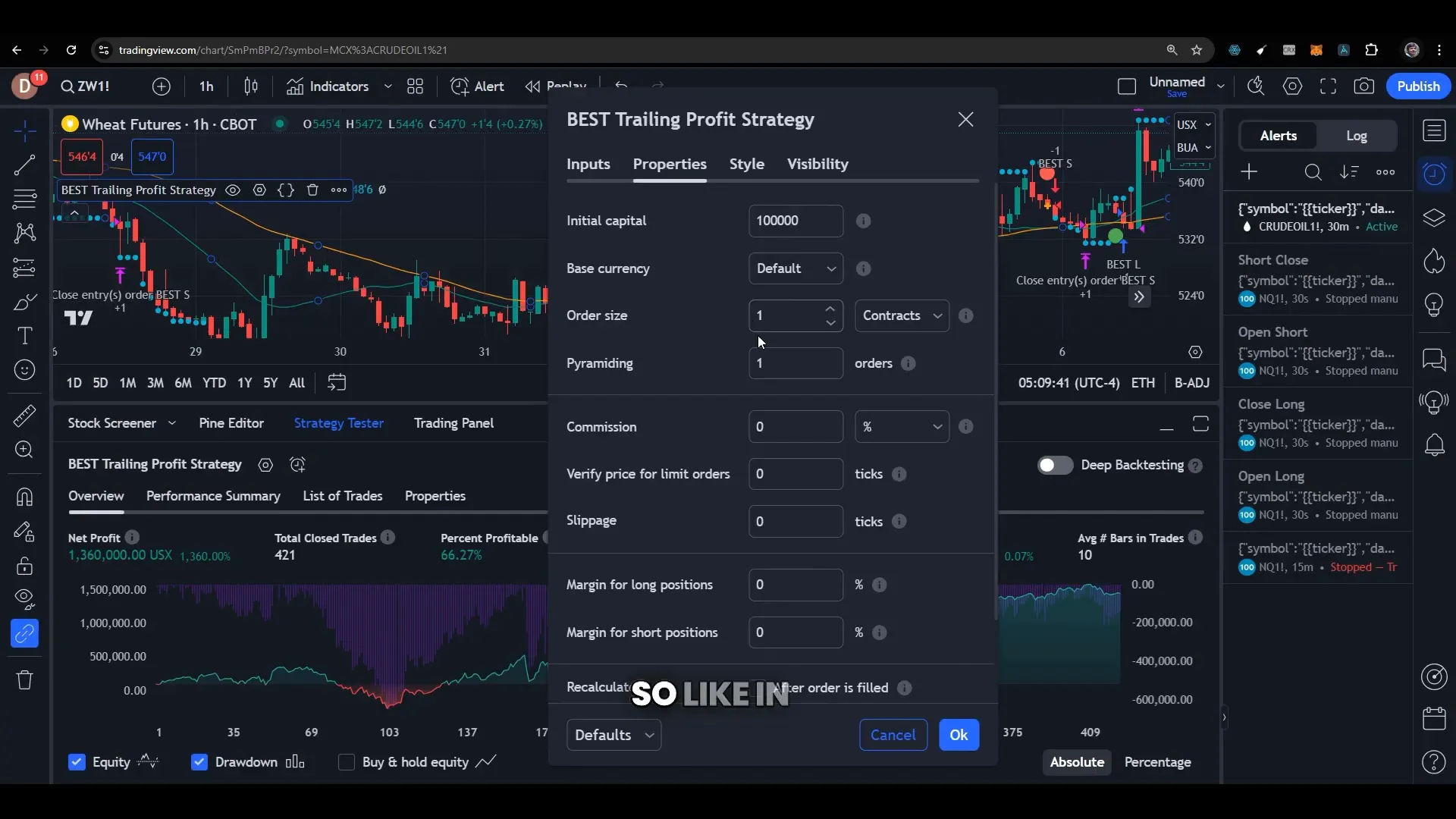

Evaluating Performance Across Different Markets

After successfully implementing the strategy on crude oil, we expanded our testing to other markets such as the INQ, wheat, and soybean. Each market displayed unique characteristics, with varying levels of drawdown and profitability. For instance, while the INQ showed decent returns, the wheat market yielded over a million in returns using the same strategy.

Testing Across Different Futures

Testing across different futures contracts is vital for identifying the most effective strategies. Each market can behave differently due to various factors, including supply and demand dynamics, geopolitical events, and economic data releases. By diversifying the assets you trade, you can enhance your overall portfolio performance.

Conclusion and Next Steps

In conclusion, the trailing take profit strategy offers a robust framework for automated trading. By leveraging PickMyTrade’s capabilities, traders can set up alerts and automate their strategies effectively. In the next part of our series, we will explore additional strategies and delve deeper into their mechanics.

Further Learning Resources

For those interested in diving deeper into automated trading, consider checking out the following resources:

- Complete Video Explained from TradingView to Tradovate – YouTube

- Complete Video Explained How to create alert message for TradingView Strategy – YouTube

- Complete Video Explained How to create alert message for TradingView Indicator – YouTube

- Automated Trading Algo Trading Platform in USA – Algo Trading Software – PickMyTrade

Disclaimer

Trading in the financial markets involves significant risk of loss. The strategies discussed in this blog are provided for educational purposes only and do not constitute trading or investment recommendations. It is advisable to consult with a qualified financial advisor before engaging in any trading activities.

PickMyTrade

PickMyTrade specializes in automating trading bots, enabling seamless strategy execution for futures from platforms like TradingView, across well-known brokers such as Tradovate.