In the world of funded trading programs, Apex Trader Funding (often called “Apex”) and Topstep represent two of the most talked-about futures-prop-firm options.

When evaluating a “prop firm” path, it’s not just about scoring a funded account — it’s about matching your strategy, risk profile, tools, trading style and even automation readiness. And for those using an automation platform like PickMyTrade, understanding the subtle differences between the firms becomes critical.

Apex Prop Firm: Key Features, Strengths & Considerations

Key features of Apex

- Apex offers futures-based funded accounts (up to ~$300 k) and treats your first ~$25 000 in profits as 100 % yours, then a 90 / 10 split.

- It uses a one-step evaluation model, enabling a faster path to funding compared to multi-phase systems.

- Traders report strong reviews: e.g., 4.5/5 rating on Trustpilot across thousands of reviews.

- Frequent discounts/promos reduce evaluation cost.

- Good for automation-friendly traders: rule-sets are relatively flexible, which can allow bots or algorithmic strategies (but you must always check rules).

Considerations & caution

- Some traders cite slower customer support or rule changes in recent months.

- The model still relies on you passing evaluation conditions — risk of failure remains.

- If your automation strategy is stock-based or uses instruments outside of futures, Apex’s focus on futures may limit you.

Topstep: Overview, Strengths & What It Changes in the Comparison

Topstep’s profile

- Topstep is a long-standing name in the prop-firm space, primarily focused on futures.

- Their evaluation process is more structured, sometimes including two phases and stricter risk rules.

- Because of its structure and brand, Topstep may appeal to traders who prefer a well-known company with established history rather than a newer firm.

Potential drawbacks

- Relatively higher costs, stricter evaluation rules, fewer “trader perks” in terms of payout flexibility.

- Less “flex” for automation strategies if your style is non-standard or high frequency; you’ll need to ensure your automation platform adheres to their rule-set.

Click Here To Start Futures Trading Automation For Free

Apex vs Topstep: Side-by-Side Comparison for 2025

| Feature | Apex Trader Funding | Topstep |

|---|---|---|

| Evaluation style | One-step with flexible rules | One- or two-step, more structured |

| Profit split & payout | 100% first ~$25 000, then 90/10 | 100% first ~$10 000, then 90/10 |

| Account sizes | Up to ~$300 k for futures | Up to ~$150 k for futures |

| Rule flexibility | More flexible, more trader-friendly | More rigid risk rules, slower payout path |

| Cost & promos | Lower cost, frequent discounts | Higher cost baseline, fewer promos noted |

| Automation readiness* | Strong for futures traders with algorithmic setups | Suitable but stricter constraints may require adaptation |

| PickMyTrade Supported Broker Automation | Tradovate | ProjectX |

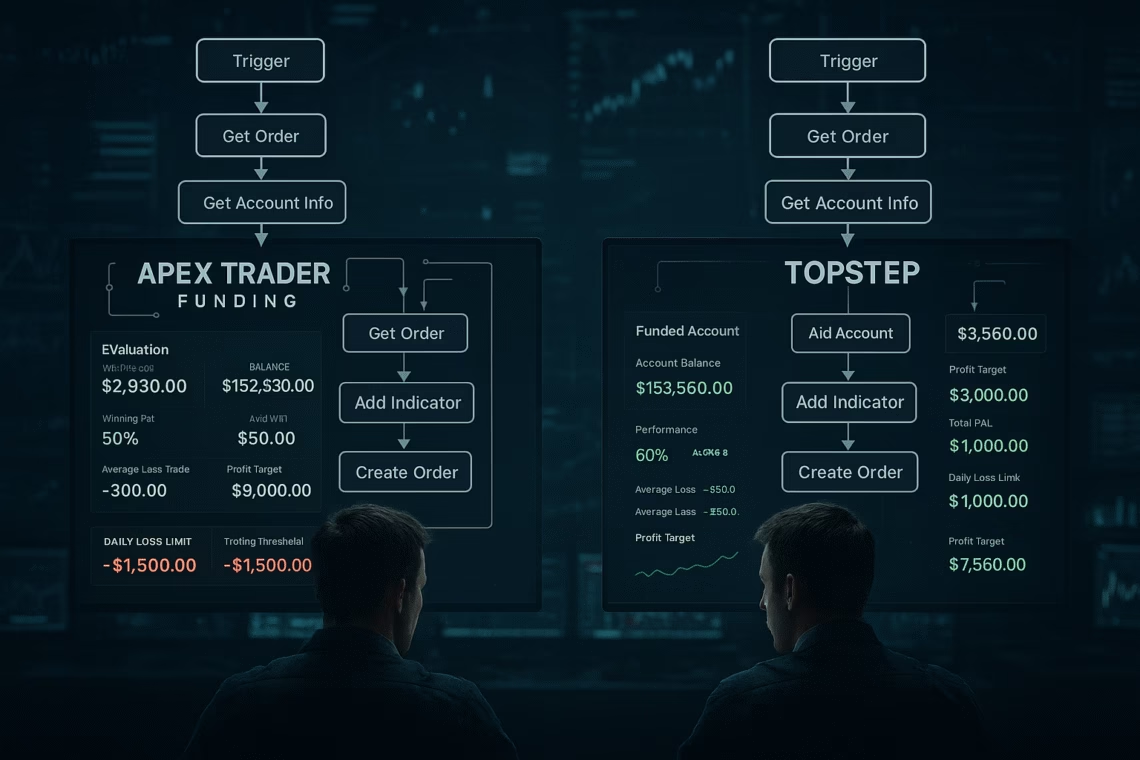

How PickMyTrade Automation Plays With Apex vs Topstep

If you’re using PickMyTrade as your automation engine, here’s how to consider each firm:

- Instrument compatibility: Cold check if the firm supports your automation instrument (futures contracts, timeframe, strategy) — Apex is clear on futures; Topstep likewise but with stricter rules.

- Rule automation: Program PickMyTrade to flag evaluation rules such as maximum daily loss, allowed holding time, contract size limits. For Apex you may have more freedom; Topstep may require tighter compliance.

- Payout trigger logic: Automation can alert you when you reach profit thresholds or handle risk when approaching drawdown limits ensuring you don’t trigger disqualification.

- Scalability: Once funded, schedule automation for live trading with capital allocation, risk rules, and logging — verify each firm’s live-account policies, trade size limits, and risk conditions.

- Trade timing and discipline: Because both firms judge behaviour (consistency, risk), automation systems (via PickMyTrade) may give you a priority edge by removing human error and maintaining discipline — assuming they’re built correctly and approved.

Which Firm Should You Choose—and When?

- If you are a futures-savvy trader, have an algorithmic/automation edge, prefer flexibility and want faster payout potential → Apex may be the stronger option.

- If you are newer, value structure, want coaching or educational resources, or prefer the brand reputation and don’t mind stricter rules → Topstep could be a better fit.

- Always evaluate your strategy’s instrument, frequency, automation compatibility, and ability to meet the prop-firm’s rule-set before committing.

- Use your automation engine (PickMyTrade) not just for execution, but for rules compliance, logging, alerting and scaling — whichever firm you choose.

Final Thoughts

Choosing between Apex Prop Firm (Apex Trader Funding) vs Topstep in 2025 isn’t just a matter of logo or hype — it requires analysing your trading style, automation capabilities, instrument focus, risk tolerance and cost structure.

With automation platforms like PickMyTrade integrated into your workflow, you can leverage funded accounts more effectively — but success depends on alignment: your automation logic + the firm’s rules = your performance.

Whichever route you take, make sure you trade with discipline, clarity of rules, risk management and a system that captures both your strategy and the prop-firm’s requirements.

FAQ – Most Asked Questions

Apex uses a one-step evaluation model (futures only) that often allows traders to qualify in as little as 7 trading days, subject to profit target and drawdown rules.

Topstep often uses a more structured two-phase challenge, stricter daily loss limits, and lower initial profit payout thresholds compared to Apex.

Yes — but you must verify the automation (via PickMyTrade or other) meets the firm’s rules (no banned strategies, contract size limits, no breaching drawdown) and the firm supports your instrument.

Apex is generally more generous: 100% of first ~$25 000 profits, then 90%; faster payout processes reported. Topstep gives 100% of first ~$10 000 then 90%, with stricter conditions.

Monitor evaluation cost, rule clarity, instrument support, payout terms, reputation, and how well your trading automation or style fits the firm’s model.

Also Checkout: Automate TradingView Indicators with Tradovate Using PickMyTrade