In the world of trading, efficiency and control are paramount. For traders managing multiple accounts, the ability to execute trades seamlessly across different platforms is a game-changer. This is where the Trade Copier feature of PickMyTrade comes into play. This innovative tool allows users to manage multiple accounts from a single interface, making it easier than ever to execute trades effectively. In this article, we will delve into the functionalities of this feature, how it operates, and why it stands out in the trading landscape.

Table of Contents

- What is PickMyTrade?

- The Need for a Trade Copier

- How to Use the Trade Copier

- Understanding Trade Execution

- Flexibility and Control

- Benefits of Using PickMyTrade

- Conclusion

What is PickMyTrade?

PickMyTrade is an advanced trading platform designed to simplify the trading process for both individual traders and those managing multiple accounts. The platform supports automated trading and offers features that enhance the trading experience, such as the Trade Copier. This tool is particularly beneficial for users who wish to execute trades across various accounts without the hassle of logging into each one individually.

The Need for a Trade Copier

Managing multiple trading accounts can be a daunting task. Traders often find themselves switching between different platforms, which can lead to delays and missed opportunities. The Trade Copier feature addresses this issue by allowing users to place trades in one account that automatically replicate across all managed accounts. This not only saves time but also ensures that all accounts are aligned in terms of trading strategy.

Key Features of the Trade Copier

The Trade Copier offered by PickMyTrade comes with several key features that enhance its usability:

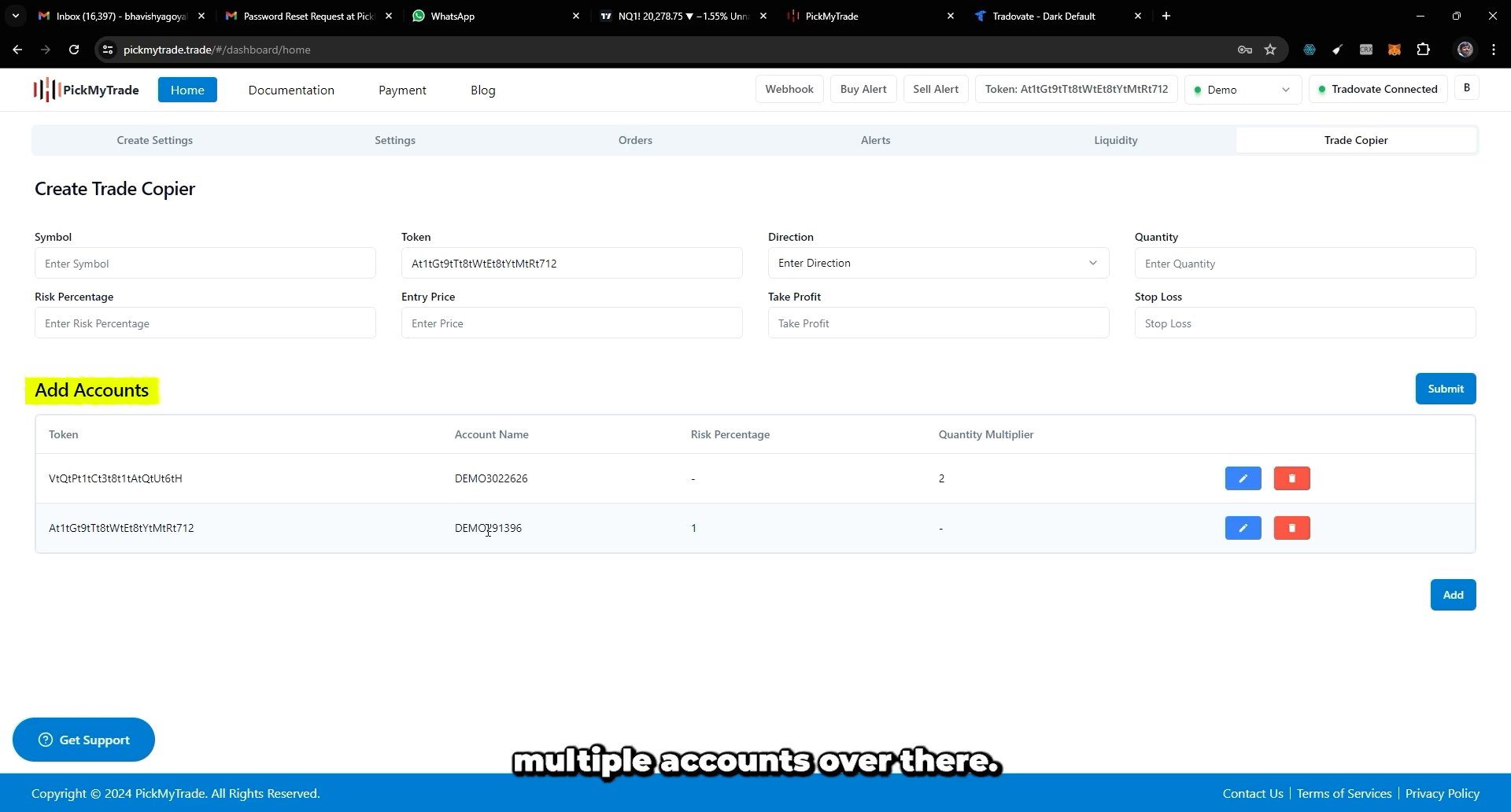

- Multi-Account Management: Users can manage multiple accounts from a single interface.

- Customizable Risk Settings: Traders can set different risk percentages for each account, tailoring their strategy to individual client needs.

- Quantity Multiplier: This feature allows users to specify a quantity multiplier for trades, enabling automated adjustments based on account size.

- Integration with TradingView: The Trade Copier can take trades directly from TradingView, streamlining the trading process.

How to Use the Trade Copier

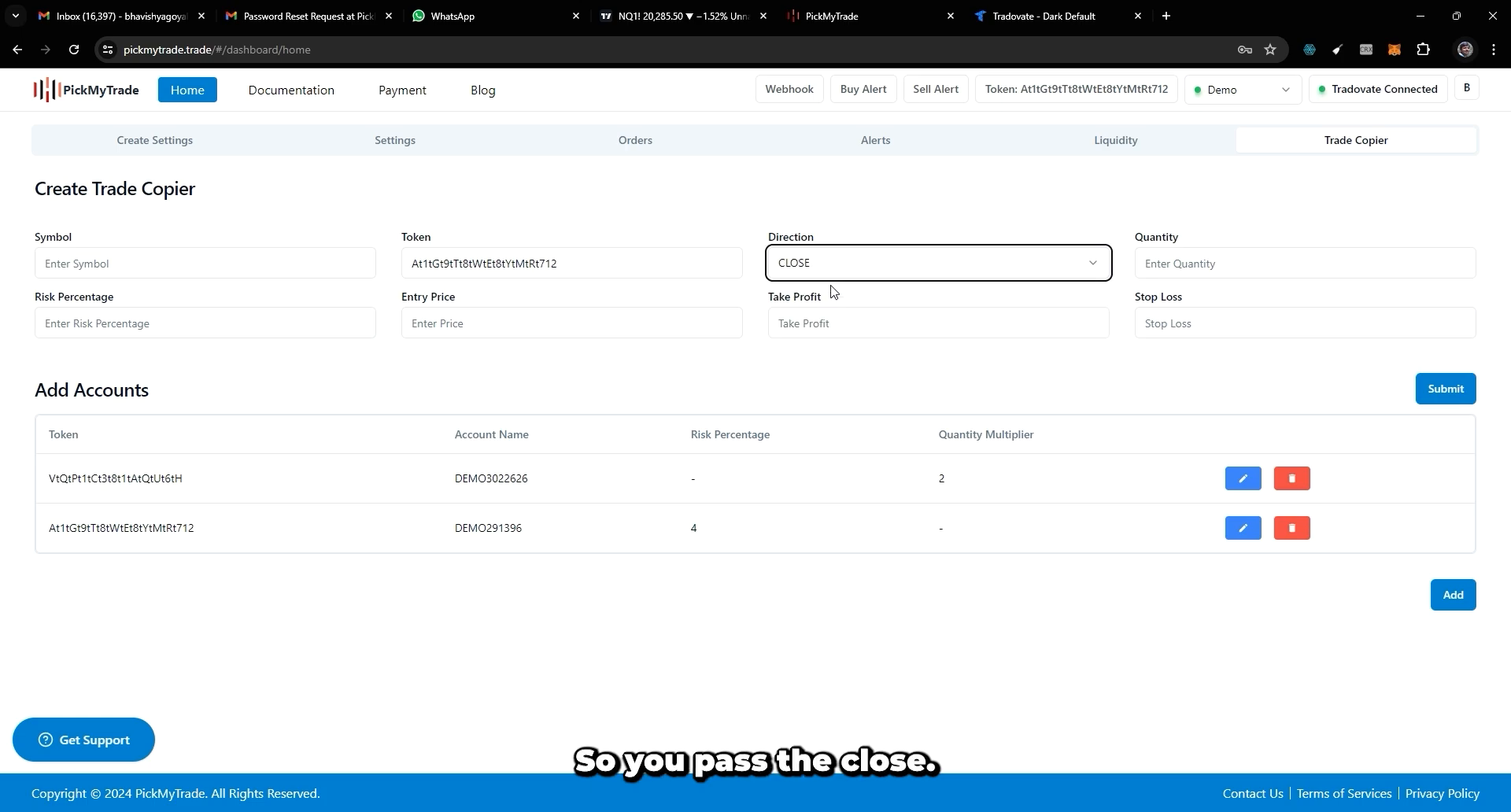

Using the Trade Copier is straightforward. Here’s a step-by-step guide on how to set it up:

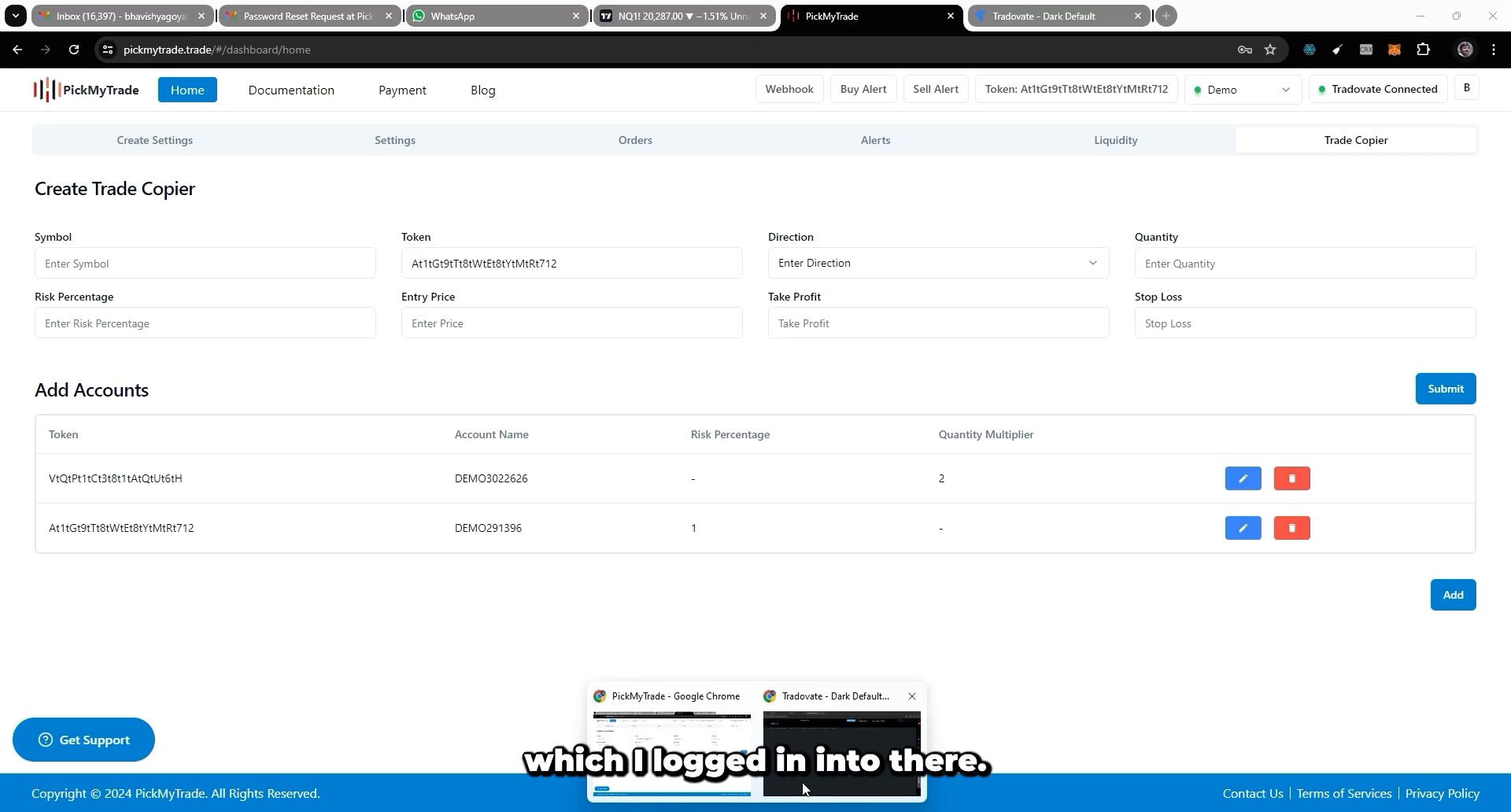

Step 1: Add Accounts

The first step involves adding the accounts you wish to manage. Users can input their own accounts and any additional accounts they are managing. This feature is particularly useful for traders who handle accounts for friends or clients.

Step 2: Set Risk Percentage and Quantity Multiplier

Once accounts are added, users can specify the risk percentage for each account. For example, one account might be set to a 1% risk, while another could be set to 2% or 3%. Additionally, users can choose to implement a quantity multiplier, which adjusts the trade quantity based on the specified multiplier. This flexibility allows for tailored trading strategies that align with individual risk appetites.

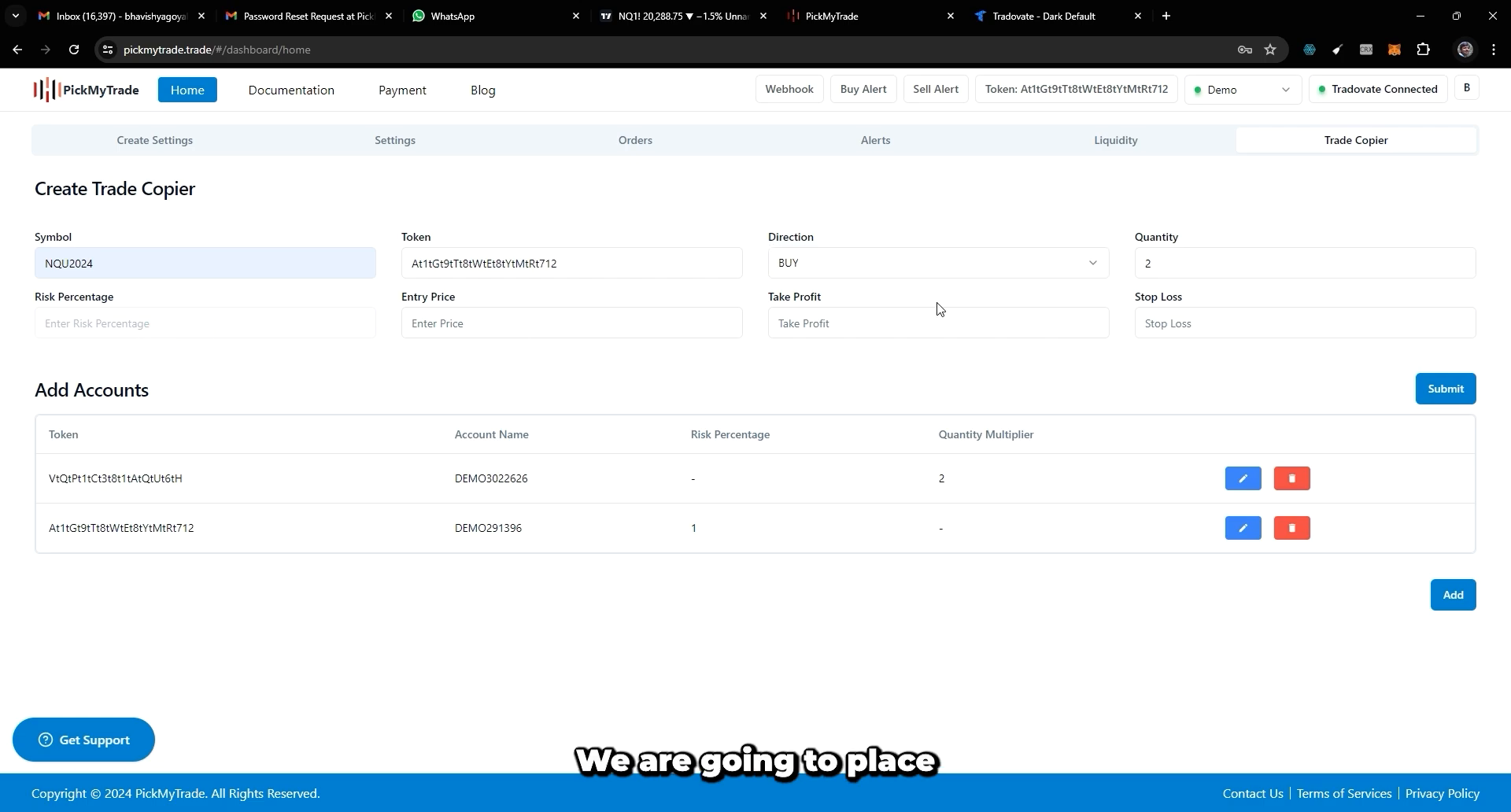

Step 3: Execute Trades

After setting up the accounts and risk parameters, users can start executing trades. The Trade Copier allows for easy placement of buy, sell, or close orders. Once a trade is executed from the primary account, it automatically replicates across all linked accounts.

Understanding Trade Execution

When placing a trade, users can specify various parameters such as entry price, take profit, and stop loss levels. The Trade Copier will then automatically place corresponding orders in all linked accounts based on the defined settings.

Example of a Trade Execution

For instance, if a trader decides to place a buy order for NQ (Nasdaq futures) at an entry price of 20,287 with a take profit at 20,300 and a stop loss at 20,250, the Trade Copier will ensure that the same parameters are applied to all other accounts linked to that trade.

Flexibility and Control

The Trade Copier not only simplifies the trading process but also provides users with flexibility and control over their trading strategies. Users can choose to close trades without opening new positions, which is particularly useful in volatile market conditions.

Closing Trades

If a trader is in a buy position and decides they want to close that position without opening a new one, the Trade Copier allows for this action to be executed effortlessly across all accounts. This level of control is essential for managing risk effectively.

Benefits of Using PickMyTrade

Utilizing the Trade Copier from PickMyTrade comes with several advantages:

- Time Efficiency: Save time by managing multiple accounts from a single platform.

- Reduced Errors: Minimize the chances of errors that can occur when manually executing trades across different accounts.

- Enhanced Strategy Implementation: Easily implement and adjust trading strategies across all accounts simultaneously.

- Real-Time Alerts: Receive real-time alerts for executed trades, ensuring you stay informed and can react promptly.

Conclusion

The Trade Copier feature of PickMyTrade is a powerful tool for traders managing multiple accounts. Its ability to streamline the trading process, combined with customizable risk settings and quantity multipliers, makes it a valuable asset for any trader looking to enhance their trading efficiency. By leveraging this feature, users can ensure that their trading strategies are executed consistently across all accounts, leading to better overall performance.

For those interested in optimizing their trading experience, consider exploring the capabilities of PickMyTrade. Whether you are a seasoned trader or just starting out, this platform offers the tools and features necessary to take your trading to the next level. You can sign up for more details at PickMyTrade.

PickMyTrade specializes in automating trading bots, enabling seamless strategy execution for futures from platforms like TradingView, across well-known brokers such as Tradovate.