Prop firms today offer two main funding paths: the instant funding model, where traders receive capital immediately, and traditional evaluation challenges (1-step or 2-step). Both approaches are real and legitimate, but they serve different trader needs. Instant funding programs let experienced traders “hit the ground running” with live capital, while challenge-based programs require you to prove your skills first. Each model has trade-offs in cost, rules and risk management, so most firms offer both options to accommodate different traders.

Why do prop firms use both? Evaluation challenges (like 1-step or 2-step programs) help firms manage risk and attract a wider pool of traders. They are generally cheaper for traders and provide a built-in vetting process, which many firms and traders value. Instant funding, on the other hand, caters to traders who can already demonstrate profitability and want immediate access to capital.

What Is Instant Funding in Prop Trading?

Instant funding means you pay a fee and get a funded account immediately, without any simulated evaluation phase. You trade live or in a live-simulated environment from day one. The appeal is clear: if you meet the profit targets and follow the rules, you can withdraw profits sooner without “waiting through” an evaluation.

However, “instant” often comes with asterisks. Many instant programs impose strict post-funding rules as soon as you start. In reality, even though there is no pre-funding demo test, the funded account behaves like a continuous evaluation.

Why Do Challenges Still Exist?

If instant funding is available, why do prop firms still sell evaluation challenges? The answer lies in risk and cost management. When you pay for an instant funding account, the firm is taking on immediate risk by letting you trade real money. To compensate, firms charge higher fees or enforce tighter controls. By contrast, challenges let the firm (and trader) vet performance first.

- Lower fees: Challenge programs are typically cheaper. You might pay $100–$300 for a 1-step demo challenge, whereas instant accounts often cost much more.

- Risk management: Traditional challenges usually use static drawdowns that do not move as you profit. Instant programs often use trailing drawdowns, where the loss limit moves upward as your equity grows, leaving a smaller cushion.

- Strict rules: Instant funding often comes with more restrictive rules to protect the firm, such as low leverage, maximum daily loss limits, banned strategies, or even mechanisms that force trades to close after a set drawdown.

Because of these factors, many traders and firms still prefer challenge-based paths. Established firms that charge lower fees can still attract traders who are willing to work for funding. For traders who want higher profit splits (often 90% or more after funding) and static drawdown cushions, the extra time spent on a demo can be worth it.

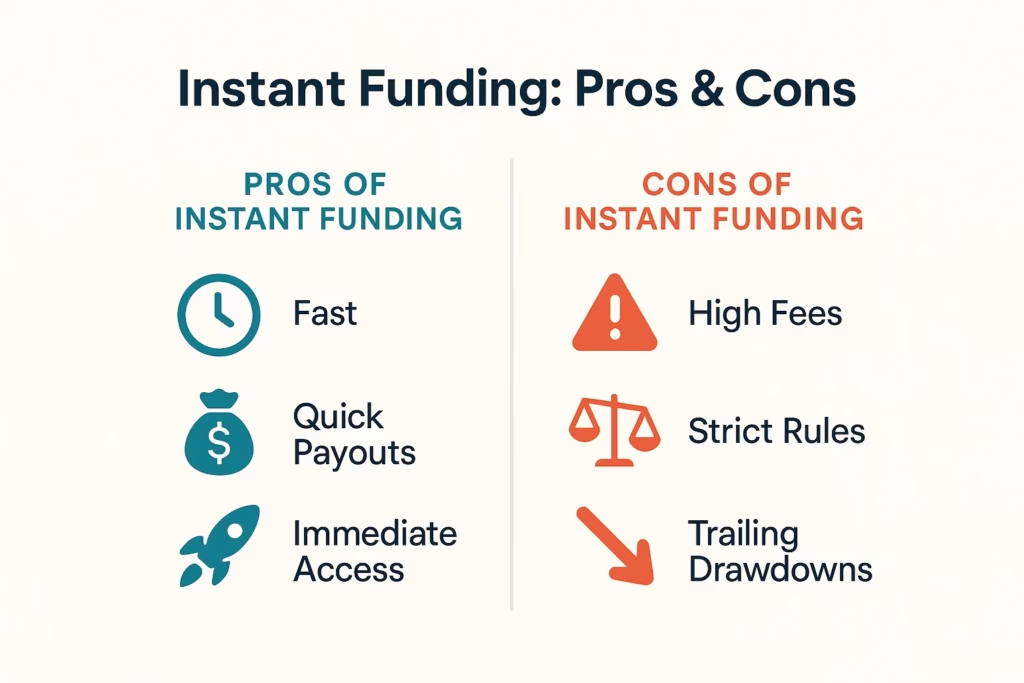

Pros and Cons of Instant Funding

Instant Funding Pros:

- Immediate Capital: Start trading live immediately with no waiting period.

- Fast Payouts: Many instant programs advertise quick withdrawals, sometimes within 24–48 hours once eligibility rules are met.

- Simplicity: No multiple evaluation phases or long profit targets before trading live.

Instant Funding Cons:

- Higher Fees: Instant programs typically charge significantly more than standard evaluation programs.

- Lower Profit Share (Sometimes): Some instant plans start with smaller profit splits, which may increase later.

- Trailing Drawdowns: The drawdown limit rises as your balance grows, reducing your loss buffer over time.

- Strict Rules & Caps: Tight daily loss limits, trading restrictions, or payout caps are common.

In short, instant funding is not a scam, but it is heavily marketed. It usually gives traders quick market access but under stricter conditions.

Instant Funding Programs: Examples

Some prop firms currently offering instant funding include:

- FundedNext (Instant Funding Plan): $5k–$25k accounts, with a relatively low initial profit share.

- Funded Trading Plus (Master Trader Program): Instant accounts starting at $5k, offering up to 90% profit splits after milestones.

- FXIFY: Low entry fees with profit splits up to 90% from day one, paired with trailing drawdowns.

- Instant Funding IO: Accounts ranging from $625 to $80k, with scaling opportunities up to $1.28M.

- FTUK: Offers accounts from $14k–$90k with standard profit splits and daily drawdown limits.

- Traders With Edge: Accounts up to $40k with flexible structures but relatively lower base profit splits.

- FundYourFX: Offers very large account sizes with variable splits depending on account tier.

- City Traders Imperium: Provides fixed drawdown instant accounts with up to 100% profit splits.

Each firm’s terms vary widely in pricing, profit splits, drawdown type, and rules. This is why careful comparison is essential.

Choosing Between Instant and Traditional Funding

So if you’re an experienced trader asking “Is instant funding worth it?”, consider your goals and strategy:

- Time vs Cost: If speed is your priority and you have a proven strategy, instant funding lets you access profits immediately. If you prefer to save money and maximize long-term payout potential, a traditional challenge is often better.

- Account Discipline: Challenges can help reinforce risk management and consistency, while instant accounts demand discipline right away.

- Trading Style: Day traders and scalpers may find instant funding more appealing, while swing traders may prefer challenge-based paths with higher profit splits and static drawdowns.

- Firm Reputation: Always check rules and terms closely before signing up.

Conclusion

Instant funding is real but restrictive. It provides immediate capital at a premium price and with tighter rules, while traditional challenges cost less and offer more flexibility but require a demo evaluation first. Instant funding hasn’t replaced challenges because many traders still value the lower costs and simpler rules of the 1-step or 2-step path.

Ultimately, the right choice depends on your priorities and trading style. By comparing terms like drawdowns, profit splits, and costs across prop firms, you can select the path — instant or traditional — that best aligns with your goals.

For traders looking to automate their strategies, you can connect Rithmic, Interactive Brokers, TradeStation, TradeLocker, or ProjectX with pickmytrade.io, and for Tradovate automation, use pickmytrade.trade

You May also Like:

How to Use GPT-5 with TradingView Strategies for Automated Trading

Top Free Indicators and Strategies on TradingView

Best TradingView Indicators and Strategies: Free and Premium Tools for All Traders

Prop Firms Using Tradovate Broker: The 2025 Comparison Guide

1. What is instant funding in prop trading?

Instant funding means a trader gets access to a funded account right away, without having to pass an evaluation challenge. The trader can start trading live and withdraw profits once payout rules are met.

2. Why do prop firms still offer 1-step and 2-step challenges if instant funding exists?

Challenges are cheaper for traders to join and less risky for the firm. Instant funding costs more upfront and often has stricter rules, while 1-step and 2-step challenges allow firms to test traders before giving them real capital.

3. Is instant funding a scam?

No, instant funding is a real model. But it’s not “free money.” The higher costs, trailing drawdowns, and stricter trading rules balance the risk firms take by skipping the evaluation phase. Traders should compare terms carefully before choosing.

4. Which is better: instant funding or a 2-step challenge?

It depends on your goals. Instant funding gives fast access to capital but is more expensive and restrictive. A 2-step challenge is cheaper and usually offers static drawdowns, but it takes longer to qualify.

5. Why is instant funding more expensive than challenges?

Because the firm takes on immediate risk by giving traders capital without testing them. Higher fees help cover that risk.

6. Do instant funding accounts use trailing drawdown?

Most do. This means as your balance grows, the loss limit moves upward, reducing your buffer. In contrast, many 2-step challenges use static drawdowns that don’t move once set.

7. Can I scale an instant funding account?

Yes, some firms allow scaling, but rules vary. Check the scaling policy before signing up, since limits may be stricter compared to traditional challenges.

8. Are payouts capped in instant funding accounts?

Some prop firms cap early payouts or limit withdrawal amounts in the beginning. Always review payout policies so there are no surprises.

9. Which option is better for beginner traders?

Usually, 1-step or 2-step challenges. They’re less expensive and give traders time to build consistency before managing real capital. Instant funding is better suited for experienced traders with proven strategies.

10. How can I compare prop firms offering instant funding?

The best way is to look at verified trader reviews and compare drawdown types, rules, fees, and payout policies side by side. That way, you can find a model that matches your trading style.