Introduction

If you’re trading with My Funded Futures in 2025, one of the first things you’ll need to do is connect your funded account to Tradovate. This ensures you can place trades on a reliable platform with real-time CME data.

Whether you’re on the Starter, Expert, or one of the newer Core, Scale, or Pro plans, this guide will walk you through connecting your account, activating market data, and enabling TradingView integration.

Quick Review: My Funded Futures in 2025

Founded in November 2023 and headquartered in the USA, My Funded Futures has quickly become one of the top proprietary futures trading firms. It has built a large trader base over 72,000 active traders and boasts a 4.9/5 Trustpilot rating based on thousands of reviews.

Key Strengths

- Generous Profit Split — Traders keep 100% of the first $10,000 in profits, then 90% thereafter.

- Fast Payouts — Starter plan payouts are often processed within 6–12 business hours; Expert plans typically within 1–3 business days.

- No Activation Fee — As of July 22, 2025, the $149 activation fee was removed for all new Core, Scale, and Pro plans.

- Flexible Trading Rules — Expert and new Core/Scale/Pro plans have no daily loss limits; news trading allowed in most cases.

- Platform Variety — Trade on Tradovate, NinjaTrader, TradingView, R Trader Pro, and more.

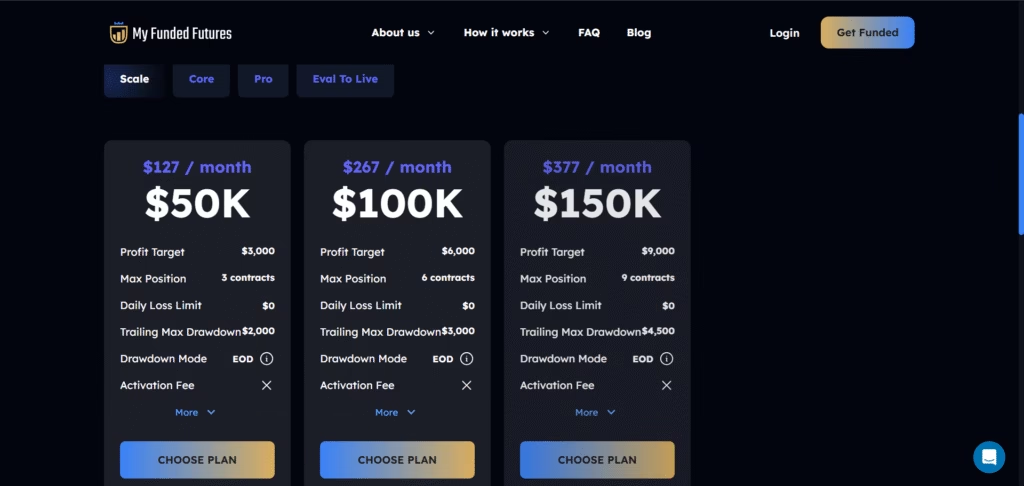

Account Sizes & Plan Options

MFFU offers a variety of account types, each with its own size tiers and pricing structure.

Starter & Expert Plans

These are the most common options, available in:

- $50K

- $100K

- $150K

Milestone / Static Plans

These are one-time funded accounts, available in:

- $25K

- $50K

- $100K

- $150K

Other Plan Types

MFFU also offers Eval-to-Live, Starter Plus, and 1-Step/2-Step evaluation plans, giving traders flexibility in how they qualify.

Note: While some sources mention scaling up to $600K, the most widely available limit for mainstream plans is $150K.

Contract Sizing (Leverage Limits)

Contract limits depend on your chosen plan and account size.

Starter / Starter Plus

- $50K: 3 E-Mini contracts

- $100K: 6 E-Mini contracts

- $150K: 9 E-Mini contracts

Expert Plan

- $50K: 5 E-Mini or 5 micros

- $100K: 10 contracts

- $150K: 15 contracts

Milestone Static Plan

- $25K: 1 E-Mini or 10 micros

- $50K: 3 E-Mini or 9 micros

- $100K: 6 E-Mini or 18 micros

- $150K: 9 E-Mini or 27 micros

Profit Sharing & Payout Rules

Profit Split

- Standard Plans: 100% of the first $10K in profits, then 90% to you / 10% to MFFU

- Eval-to-Live: 80/20 split from the start (no initial 100%)

Payout Frequency

- Starter: Withdraw after 5 profitable days, minimum $250, processed in 6–12 hours

- Expert: Withdraw every 14 days, minimum $1,000, processed in 1–3 days; ~60% withdrawal buffer

- Eval-to-Live: Daily withdrawals possible, minimum $200

Trading & Risk Rules

Consistency Rule

- Starter: No single day can make up more than 40% of total profits

- Starter Plus: No consistency rule in funded stage

- Expert: No consistency rule at all

Drawdown & Daily Loss

- Starter: May include a daily loss limit (~2.4%) plus End-of-Day (EOD) drawdown

- Expert & Milestone: EOD drawdown only (no daily loss limit)

Evaluation Requirements

- Profit targets vary by account size — e.g., $3K for $50K Starter, $4K for $50K Expert

- Minimum of 5 active trading days during evaluation

- No weekend holds allowed

Verdict: My Funded Futures offers one of the most trader-friendly futures funding programs in 2025—particularly strong for those who value fast payouts, high profit splits, and flexible trading conditions.

Why Use Tradovate with My Funded Futures?

Tradovate is one of the primary platforms funded traders use at MFFU. In 2025, it’s favored for:

- Cloud-based access — Trade from anywhere without heavy software downloads.

- Multi-device support — Works on Windows, macOS, iOS, and Android.

- Advanced features — Market Replay, 40+ built-in indicators, plus custom community indicators.

- Low commissions — As low as $0.09 per micro contract (plan-dependent).

- Integration — Seamless link with TradingView for chart-based order placement.

Step-by-Step: Connecting My Funded Futures to Tradovate

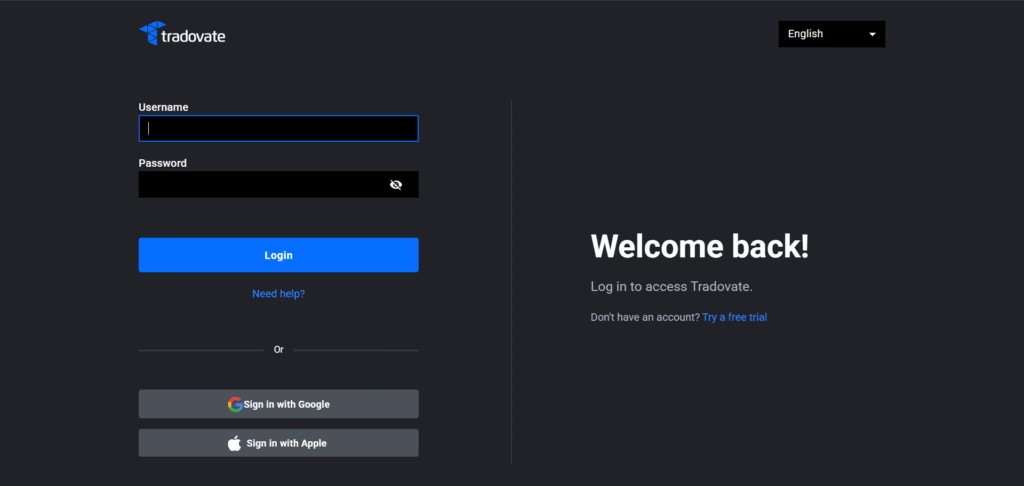

1. Log into Tradovate

- Visit https://trader.tradovate.com.

- Click Login and enter the username and password from your MFFU Dashboard (not your personal Tradovate account).

2. Sign the Market Data Agreement

- On first login, you’ll be prompted to sign the Market Data Agreement.

- Choose Non-Professional unless CME rules classify you otherwise.

- Sign and submit to activate your data feed.

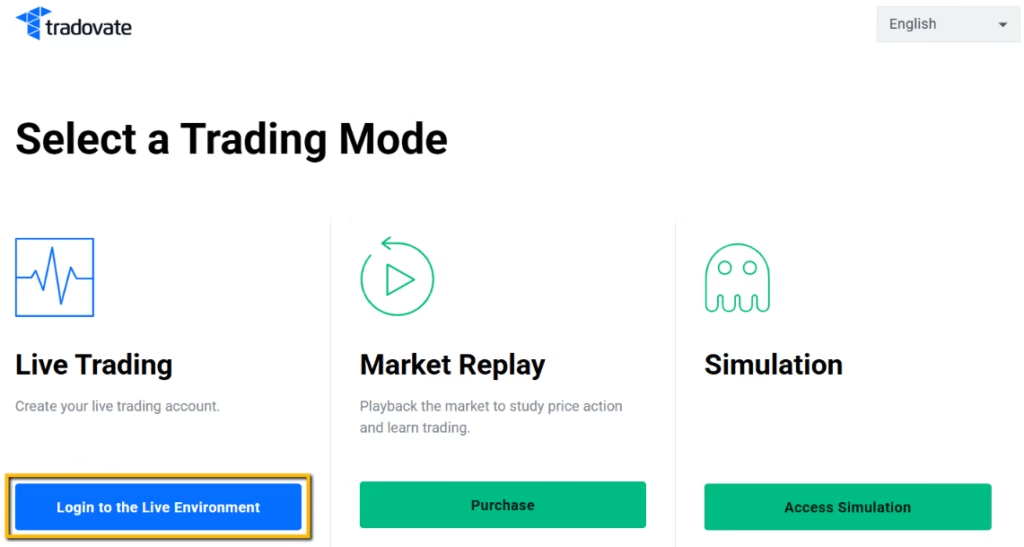

3. Choose Your Trading Mode

- Simulation Mode — For practice or while in the evaluation stage.

- Live Mode — For trading funded capital once you’ve passed evaluation and received your funded account.

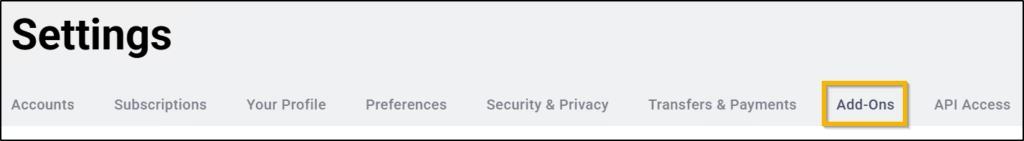

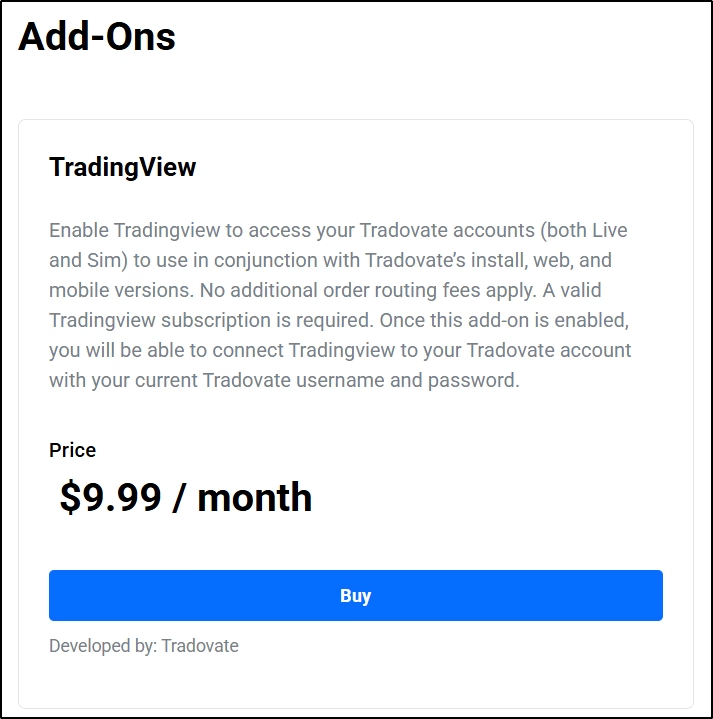

4. Enable TradingView (Optional but Recommended)

- In Tradovate, go to:

Application Settings → Add-Ons → TradingView → Enable. - Accept terms and confirm.

- This lets you place trades directly from TradingView charts.

5. Verify Connection in MFFU Dashboard

- Log into the My Funded Futures Dashboard.

- Go to Account Settings → Connected Platforms.

- Ensure Tradovate shows as “Active” and linked to your funded account.

Troubleshooting Tips

| Issue | Likely Cause | Fix |

|---|---|---|

| Can’t log in | Wrong credentials | Use login from MFFU Dashboard, not personal Tradovate account |

| No live data | Market Data Agreement not signed | Log back in and complete the agreement |

| TradingView orders not going through | Add-on not enabled | Enable TradingView add-on in Tradovate settings |

| Charts frozen | Market closed | Check CME trading hours—MFFU accounts follow CME/Rithmic schedules |

Final Thoughts

Connecting My Funded Futures to Tradovate is simple when you follow these steps: log in with your MFFU credentials, sign your market data agreement, choose the right mode, enable any add-ons, and confirm your connection.

Pairing MFFU’s high profit splits, fast payouts, and flexible rules with Tradovate’s low commissions and powerful tools makes for a strong trading setup in 2025 whether you’re just starting out or managing a larger funded account.

Automating Trades with PickMyTrade.trade

Tired of placing trades manually?

With PickMyTrade, you can fully automate your TradingView strategy — no coding required. Simply generate alerts from your TradingView strategy, connect your My Funded Futures or FundedNext Tradovate account, and let PickMyTrade handle entries, Stop Loss, and Take Profit for you.

- Supports Flat, Continuous, and Partial Exit strategies

- Automatically attaches SL/TP to entry orders

- Works seamlessly with My Funded Futures + Tradovate

- No need to create Tradovate API keys — just link your account via PickMyTrade’s broker integration

Start automating in minutes so you can focus on refining your strategy instead of executing every trade by hand.

You May Also Like:

Prop Firms Using Tradovate Broker: The 2025 Comparison Guide

How to Switch from Tradovate to TopstepX in 2025: A Comprehensive Guide

Rithmic vs Tradovate: Ultimate 2025 Comparison Guide for Traders

FundedNext Futures Tradovate Connection Guide (2025)