Introduction

Best AI Tools for Trading are transforming how traders make decisions, manage risk, and automate their strategies. From real-time signal generation to code-free strategy creation and portfolio automation, these tools offer a smarter, faster way to trade. In this article, we explore the top AI-powered platforms across every stage of the trading workflow.

AI Tools for Signal Generation

1. Trade Ideas (Holly AI)

Holly scans thousands of stocks in real time. It uses built-in algorithms to detect trade setups based on technical conditions like breakouts and pullbacks. Holly learns from the market each day, improves its recommendations, and allows you to backtest strategies or even send trades directly to your broker.

2. TrendSpider

TrendSpider applies machine learning to detect trendlines, patterns, and key levels automatically. Its AI Strategy Lab lets you define goals and train custom models on any asset or timeframe. These models can be applied to your charts or alerts without coding.

3. Kavout (Kai Score)

Kavout simplifies market screening with its Kai Score—a single predictive value based on technicals, fundamentals, and sentiment data. This score ranks stocks by their potential performance, ideal for quantitative traders and long-term investors.

4. BlackBox Stocks

BlackBox focuses on options and volatility analysis. It monitors unusual options activity, dark pool trades, and sentiment signals from social platforms. It provides alerts when large or unusual trades are detected, helping traders spot potential moves early.

5. Top AI Models for Trading Assistance

ChatGPT, Gemini, Grok, DeepSeek, and other advanced AI tools can help interpret financial news, analyze charts, or even write Pine Script code. While none of these models function as standalone trading platforms, they serve as flexible assistants—supporting idea generation, technical analysis, coding, and market commentary across various asset classes.

AI Tools for Strategy Development

6. AI Models for Pine Script Development

AI tools like ChatGPT, Gemini, Grok, and DeepSeek can generate Pine Script code for TradingView based on plain English descriptions. They handle the syntax, structure strategies or indicators, and add comments making it easier to focus on trading logic rather than code formatting.

7. TrendSpider AI Strategy Lab

This no-code solution lets you build trading models by selecting assets, timeframes, and performance targets. TrendSpider handles the machine learning behind the scenes and provides fully tested models that can be deployed directly to your chart or scanner.

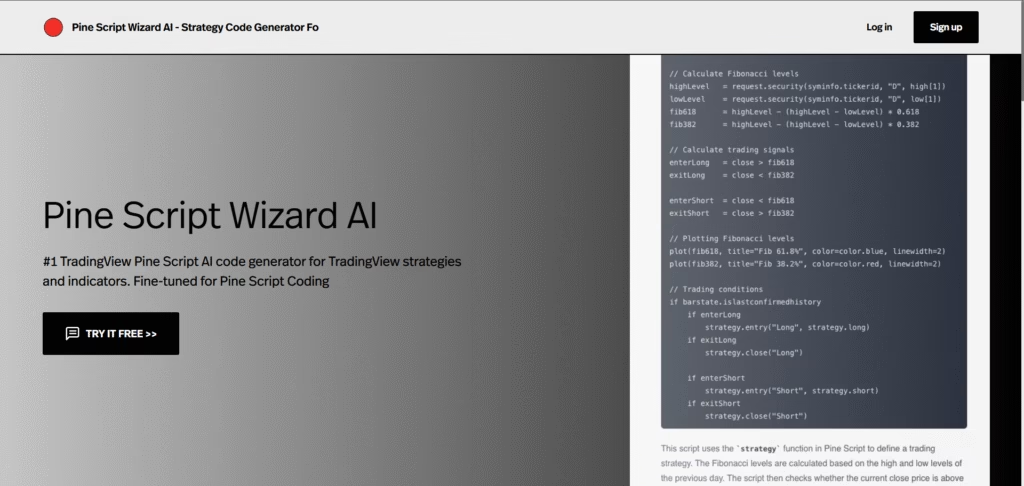

8. Pine Script Wizard

This AI assistant specializes in creating Pine Script. It asks clarifying questions, writes clean, well-commented code, and supports both indicators and strategies. Even if you’re new to scripting, it enables you to build robust TradingView tools.

AI Platforms for Portfolio Management and Automation

9. PickMyTrade

PickMyTrade connects TradingView alerts directly to your broker and includes a full portfolio and account management system. It allows you to:

- Track real-time profit and loss

- View asset allocation across all accounts

- Set global or strategy-specific position sizing rules

- Generate performance reports with drawdown, win/loss ratios, and exposure by symbol or sector

Once configured, PickMyTrade manages alerts, execution, and live account monitoring—providing an all-in-one automation solution.

10. QuantConnect

QuantConnect is a professional-grade platform for building and deploying algorithmic trading strategies in Python or C#. It includes a wide range of historical data and alternative datasets across stocks, crypto, forex, and futures. The platform connects directly to brokers and scales easily for live trading.

11. AlphaSense

AlphaSense supports research-focused investors by indexing millions of financial documents such as earnings calls, filings, and analyst reports. It uses AI to summarize insights and allows users to ask complex questions, helping portfolio managers uncover trends and hidden risks.

12. Numerai

Numerai is a crowdsourced hedge fund that accepts machine learning models from data scientists around the world. These models are trained on encrypted data and combined into one meta-model, which manages a market-neutral portfolio. It’s an innovative approach to collaborative AI trading.

Final Thoughts

AI is now deeply integrated into every stage of trading—from chart analysis and code writing to trade execution and risk management. Tools like Trade Ideas and TrendSpider identify opportunities. ChatGPT and Pine Script Wizard simplify strategy development. PickMyTrade and QuantConnect automate portfolio actions and trade management.

The key takeaway: AI is not a replacement for human traders. It’s a force multiplier. By using these tools, traders can make better decisions, reduce manual tasks, and compete at a higher level—regardless of the size of their account.

Take It Further: Automate Your TradingView Strategies with PickMyTrade

PickMyTrade connects directly to your TradingView strategies, enabling real-time, automated trade execution across supported brokers. No coding. No delays. Just reliable automation that keeps your strategy running exactly as intended.

Whether you’re scalping, swing trading, or running a fully automated system, PickMyTrade supports:

- Live and demo execution

- Multiple broker integrations including Rithmic, TradeStation, Interactive Brokers, and TradeLocker

- Lightning-fast strategy execution with zero lag from TradingView alerts

To start automating your TradingView strategies, visit PickMyTrade.io.

Using Tradovate? Head to PickMyTrade.trade for seamless Tradovate integration.

You May also Like:

Top Free Indicators and Strategies on TradingView

Best TradingView Indicators and Strategies: Free and Premium Tools for All Traders