Understanding drawdown is essential in evaluating the risk of any trading strategy, especially when using Elite Trader Funding automation. Relative drawdown is one of the key metrics that shows how much your equity falls from its highest point during a trading cycle. This post explains what relative drawdown is, why it matters, and how to use it effectively when trading through Elite Trader Funding automation platforms.

What Is Relative Drawdown?

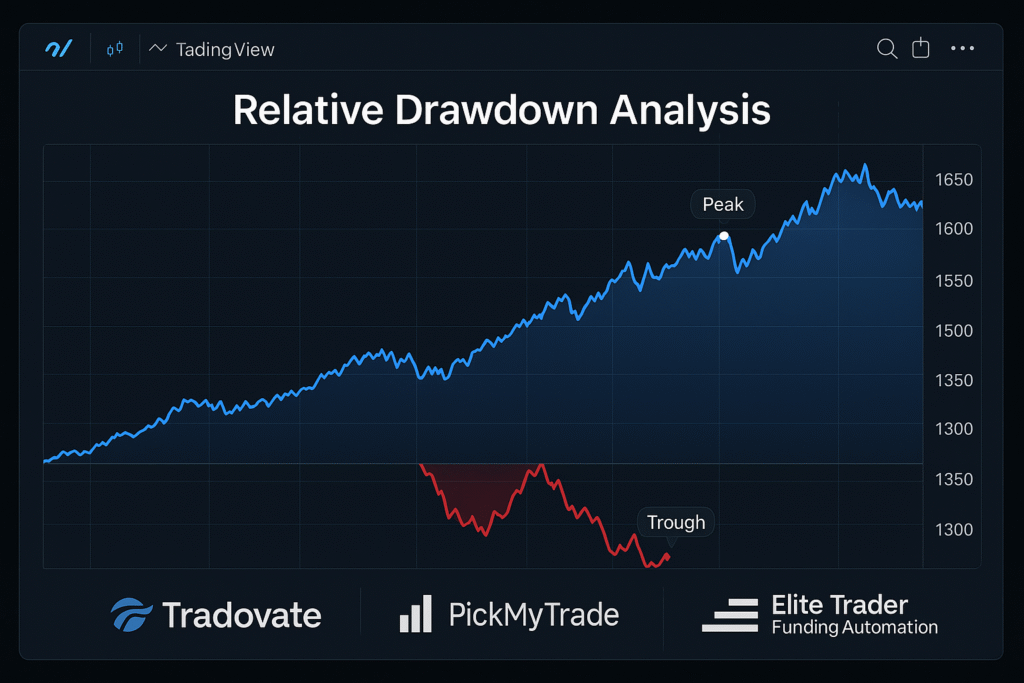

Relative drawdown measures the percentage drop from your peak equity value. Unlike absolute drawdown, which focuses on losses from your initial balance, relative drawdown focuses on losses from the highest point your trading account has reached.

Example:

If your account grows from $1,000,000 to $1,110,000 and then falls back to $1,000,000, the relative drawdown is 10%.

This helps traders understand how much of their earned profit was given back during a rough patch.

Why Relative Drawdown Matters in Funded Trading

When using platforms like Elite Trader Funding automation, managing risk is crucial. Funded accounts typically have strict drawdown limits. Knowing the relative drawdown helps:

- Spot risky strategies

- Maintain account compliance

- Avoid emotional decisions during pullbacks

Let’s compare two strategies:

- Strategy A: Peaks at $1,204,000 with a 15.43% drawdown

- Strategy B: Peaks at $1,110,000 with a 10% drawdown

Even though Strategy A might make more money, its higher drawdown could disqualify it under Elite Trader Funding risk parameters.

How to Use Relative Drawdown on TradingView

To analyze relative drawdown:

- Open Strategy Tester on TradingView.

- Enable the Drawdown Graph.

- Check for dips from the peak equity line.

This allows you to visually assess risk exposure.

Relative Drawdown vs. Other Metrics

While important, relative drawdown should not be your only metric. Combine it with:

- Profit Factor: How much you gain for every dollar you lose

- Win Rate: The percentage of successful trades

- Risk-Reward Ratio: The balance between risk taken and potential reward

- Max Drawdown: The deepest equity drop from peak to trough

By combining these insights, you get a full picture of strategy performance under Elite Trader Funding automation.

Avoiding the Drawdown Trap

A low relative drawdown doesn’t always mean a strategy is good. Some low-drawdown strategies might:

- Generate weak profits

- Suffer from low trading frequency

- Miss major moves due to tight stops

The goal is to find strategies that combine low drawdowns with high consistency and profitability.

Automate With Confidence

Platforms like PickMyTrade allow you to automate TradingView strategies across brokers such as Tradovate, Rithmic, Interactive Brokers, TradeLocker, and TradeStation.

Using Elite Trader Funding automation with well-tested, low-drawdown strategies can help you grow your capital safely within the rules.

Conclusion

Relative drawdown is a key risk metric every trader should understand. Especially in the world of Elite Trader Funding automation, it helps you manage performance expectations and stay within allowed risk parameters. Use it alongside profit factor and equity curves to choose smarter strategies and trade more confidently.

Take control of your trading with Elite Trader Funding automation – and start building a smarter risk profile today!

Also Checkout: Automate TradingView Indicators with Tradovate Using PickMyTrade